Fill Out a Valid 1099 Nec Form

The 1099-NEC form plays a crucial role in the landscape of tax reporting for independent contractors and nonemployees in the United States. This form is specifically designed to report nonemployee compensation, which includes payments made to individuals who are not classified as employees. For the calendar year, it captures essential information such as the total amount paid to the recipient and any federal or state taxes withheld. It is important to note that while Copy A of the form is provided for informational purposes and appears in red, it should not be printed from online sources for filing with the IRS, as penalties may be imposed for using non-scannable versions. Copies B and other applicable copies, however, can be downloaded and printed for distribution to recipients. The form also includes specific fields for identifying the payer and recipient, ensuring that both parties are accurately represented. In addition to paper filing, the IRS offers electronic filing options through its Filing Information Returns Electronically (FIRE) system, which can simplify the reporting process for many. Understanding the nuances of the 1099-NEC form is essential for compliance and to avoid potential penalties, making it a vital document for those engaged in freelance or contract work.

Common mistakes

-

Using the Wrong Copy: Many individuals mistakenly use Copy A of the 1099-NEC form for filing with the IRS. This copy is for informational purposes only and cannot be scanned. Always use the official printed version.

-

Incorrect Tax Identification Numbers (TIN): Entering the wrong TIN for either the payer or the recipient can lead to penalties. Ensure that you double-check these numbers before submitting the form.

-

Missing Recipient Information: Failing to include the recipient’s complete name and address can cause delays or issues with processing. Be thorough and accurate when filling out this section.

-

Omitting Nonemployee Compensation: Some filers forget to report all nonemployee compensation. This can result in discrepancies and potential penalties. Always ensure that the total amount is accurately reported in Box 1.

-

Incorrectly Reporting State Taxes: Mistakes in reporting state tax withheld can lead to complications. Verify that the amounts entered in Boxes 5-7 align with your records.

-

Not Filing Electronically When Required: If you are required to file electronically and fail to do so, you may incur penalties. Familiarize yourself with the IRS Filing Information Returns Electronically (FIRE) system.

-

Failing to Provide Recipient Copies: Not providing the recipient with their copy of the 1099-NEC can create issues. Ensure that you distribute the appropriate copies to recipients in a timely manner.

-

Incorrect Year Reporting: Some individuals mistakenly report the wrong calendar year on the form. Always double-check that you are reporting for the correct tax year.

-

Not Keeping Records: Failing to keep a copy of the filed 1099-NEC for your records can lead to problems if discrepancies arise. Maintain accurate records for your own protection.

Preview - 1099 Nec Form

Attention:

Copy A of this form is provided for informational purposes only. Copy A appears in red, similar to the official IRS form. The official printed version of Copy A of this IRS form is scannable, but the online version of it, printed from this website, is not. Do not print and file copy A downloaded from this website; a penalty may be imposed for filing with the IRS information return forms that can’t be scanned. See part O in the current General Instructions for Certain Information Returns, available at www.irs.gov/form1099, for more information about penalties.

Please note that Copy B and other copies of this form, which appear in black, may be downloaded and printed and used to satisfy the requirement to provide the information to the recipient.

To order official IRS information returns, which include a scannable Copy A for filing with the IRS and all other applicable copies of the form, visit www.IRS.gov/orderforms. Click on Employer and Information Returns, and we’ll mail you the forms you request and their instructions, as well as any publications you may order.

Information returns may also be filed electronically using the IRS Filing Information Returns Electronically (FIRE) system (visit www.IRS.gov/FIRE) or the IRS Affordable Care Act Information Returns (AIR) program (visit www.IRS.gov/AIR).

See IRS Publications 1141, 1167, and 1179 for more information about printing these tax forms.

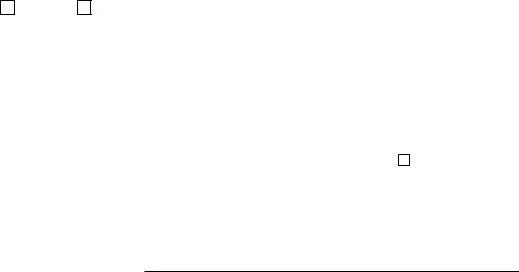

7171 |

VOID |

CORRECTED |

|

|

|

|

|

|

||||

PAYER’S name, street address, city or town, state or province, country, ZIP |

|

|

|

|

OMB No. |

|

|

|||||

or foreign postal code, and telephone no. |

|

|

|

|

|

|

Form |

|

|

|||

|

|

|

|

|

|

|

|

|

Nonemployee |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Rev. January 2022) |

|

Compensation |

||

|

|

|

|

|

|

|

|

For calendar year |

|

|

||

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAYER’S TIN |

RECIPIENT’S TIN |

|

|

1 |

Nonemployee compensation |

|

Copy A |

|||||

|

|

|

|

$ |

|

|

|

|

|

|

|

For Internal Revenue |

RECIPIENT’S name |

|

|

|

2 |

Payer made direct sales totaling $5,000 or more of |

|

Service Center |

|||||

|

|

|

|

|

consumer products to recipient for resale |

|

File with Form 1096. |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

For Privacy Act and |

|

|

|

|

|

|

|

|

|

|

|

|

Paperwork Reduction Act |

Street address (including apt. no.) |

|

|

|

|

|

|

|

|

|

|

|

Notice, see the current |

|

|

|

|

4 |

Federal income tax withheld |

|

General Instructions for |

|||||

|

|

|

|

|

Certain Information |

|||||||

|

|

|

|

$ |

|

|

|

|

|

|

|

|

City or town, state or province, country, and ZIP or foreign postal code |

|

|

|

|

|

|

|

|

Returns. |

|||

|

|

|

|

5 |

State tax withheld |

6 State/Payer’s state no. |

|

7 State income |

||||

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

Account number (see instructions) |

|

2nd TIN not. |

|

|

|

|

|

|

||||

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

Form |

Cat. No. 72590N |

|

www.irs.gov/Form1099NEC |

|

Department of the Treasury - Internal Revenue Service |

|||||||

Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page

|

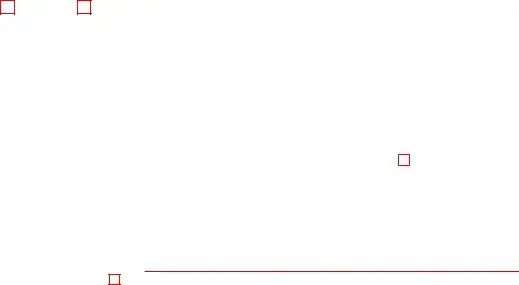

VOID |

CORRECTED |

|

|

|

|

|

|

|||

PAYER’S name, street address, city or town, state or province, country, ZIP |

|

|

|

|

OMB No. |

|

|

||||

or foreign postal code, and telephone no. |

|

|

|

|

|

Form |

|

|

|||

|

|

|

|

|

|

|

|

Nonemployee |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Rev. January 2022) |

|

Compensation |

||

|

|

|

|

|

|

|

For calendar year |

|

|

||

|

|

|

|

|

|

|

20 |

|

|

|

|

PAYER’S TIN |

RECIPIENT’S TIN |

|

1 |

Nonemployee compensation |

|

Copy 1 |

|||||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For State Tax |

|

RECIPIENT’S name |

|

|

2 |

Payer made direct sales totaling $5,000 or more of |

|

||||||

|

|

|

|

consumer products to recipient for resale |

|

Department |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

Street address (including apt. no.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Federal income tax withheld |

|

|

|||||

City or town, state or province, country, and ZIP or foreign postal code |

$ |

|

|

|

|

|

|

|

|

||

|

|

|

5 |

State tax withheld |

6 State/Payer’s state no. |

|

7 State income |

||||

|

|

|

$ |

|

|

|

|

|

|

|

$ |

Account number (see instructions) |

|

|

|

|

|

|

|

|

|||

|

|

|

$ |

|

|

|

|

|

|

|

$ |

Form |

|

www.irs.gov/Form1099NEC |

|

Department of the Treasury - Internal Revenue Service |

|||||||

CORRECTED (if checked)

CORRECTED (if checked)

PAYER’S name, street address, city or town, state or province, country, ZIP |

|

|

|

OMB No. |

|

|

|||

or foreign postal code, and telephone no. |

|

|

|

Form |

|

|

|||

|

|

|

|

|

|

Nonemployee |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Rev. January 2022) |

|

Compensation |

||

|

|

|

|

|

For calendar year |

|

|

||

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAYER’S TIN |

RECIPIENT’S TIN |

1 Nonemployee compensation |

|

|

|

|

Copy B |

||

|

|

$ |

|

|

|

|

|

|

For Recipient |

RECIPIENT’S name |

|

2 Payer made direct sales totaling $5,000 or more of |

|

This is important tax |

|||||

|

|

information and is being |

|||||||

|

|

consumer products to recipient for resale |

|

||||||

|

|

|

furnished to the IRS. If you are |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

required to file a return, a |

|

|

|

|

|

|

|

|

negligence penalty or other |

|

Street address (including apt. no.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

sanction may be imposed on |

|

|

|

4 Federal income tax withheld |

|

you if this income is taxable |

|||||

|

|

|

and the IRS determines that it |

||||||

City or town, state or province, country, and ZIP or foreign postal code |

$ |

|

|

|

|

|

|

||

|

|

|

|

|

|

has not been reported. |

|||

|

|

5 State tax withheld |

6 State/Payer’s state no. |

|

7 State income |

||||

|

|

$ |

|

|

|

|

|

|

$ |

Account number (see instructions) |

|

|

|

|

|

||||

|

|

$ |

|

|

|

|

|

|

$ |

Form |

(keep for your records) |

www.irs.gov/Form1099NEC |

Department of the Treasury - Internal Revenue Service |

||||||

Instructions for Recipient

You received this form instead of Form

If you believe you are an employee and cannot get the payer to correct this form, report the amount shown in box 1 on the line for “Wages, salaries, tips, etc.” of Form 1040,

If you are not an employee but the amount in box 1 is not self- employment (SE) income (for example, it is income from a sporadic activity or a hobby), report the amount shown in box 1 on the “Other income” line (on Schedule 1 (Form 1040)).

Recipient’s taxpayer identification number (TIN). For your protection, this form may show only the last four digits of your TIN (social security number (SSN), individual taxpayer identification number (ITIN), adoption taxpayer identification number (ATIN), or employer identification number (EIN)). However, the issuer has reported your complete TIN to the IRS.

Account number. May show an account or other unique number the payer assigned to distinguish your account.

Box 1. Shows nonemployee compensation. If the amount in this box is SE income, report it on Schedule C or F (Form 1040) if a sole proprietor, or on Form 1065 and Schedule

Note: If you are receiving payments on which no income, social security, and Medicare taxes are withheld, you should make estimated tax payments. See Form

Box 2. If checked, consumer products totaling $5,000 or more were sold to you for resale, on a

Box 3. Reserved for future use.

Box 4. Shows backup withholding. A payer must backup withhold on certain payments if you did not give your TIN to the payer. See Form

Boxes

Future developments. For the latest information about developments related to Form

Free File Program. Go to www.irs.gov/FreeFile to see if you qualify for

|

VOID |

CORRECTED |

|

|

|

|

|

|

|||

PAYER’S name, street address, city or town, state or province, country, ZIP |

|

|

|

|

OMB No. |

|

|

||||

or foreign postal code, and telephone no. |

|

|

|

|

|

Form |

|

|

|||

|

|

|

|

|

|

|

|

Nonemployee |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Rev. January 2022) |

|

Compensation |

||

|

|

|

|

|

|

|

For calendar year |

|

|

||

|

|

|

|

|

|

|

20 |

|

|

|

|

PAYER’S TIN |

RECIPIENT’S TIN |

|

1 |

Nonemployee compensation |

|

Copy 2 |

|||||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To be filed with |

|

RECIPIENT’S name |

|

|

2 |

Payer made direct sales totaling $5,000 or more of |

|

||||||

|

|

|

|

consumer products to recipient for resale |

|

recipient’s state |

|||||

|

|

|

|

|

|

|

|

|

|

|

income tax |

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

return, when |

|

Street address (including apt. no.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

required. |

|

|

|

|

4 |

Federal income tax withheld |

|

|

|||||

City or town, state or province, country, and ZIP or foreign postal code |

$ |

|

|

|

|

|

|

|

|

||

|

|

|

5 |

State tax withheld |

6 State/Payer’s state no. |

|

7 State income |

||||

|

|

|

$ |

|

|

|

|

|

|

|

$ |

Account number (see instructions) |

|

|

|

|

|

|

|

|

|||

|

|

|

$ |

|

|

|

|

|

|

|

$ |

Form |

|

www.irs.gov/Form1099NEC |

|

Department of the Treasury - Internal Revenue Service |

|||||||

|

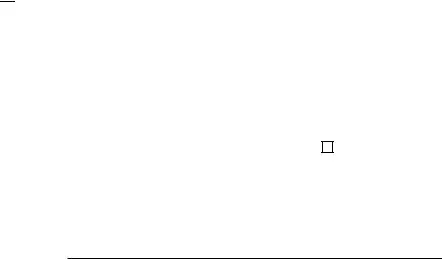

VOID |

|

CORRECTED |

|

|

|

|

|

|

||

PAYER’S name, street address, city or town, state or province, country, ZIP |

|

|

|

OMB No. |

|

|

|||||

or foreign postal code, and telephone no. |

|

|

|

|

|

Form |

|

|

|||

|

|

|

|

|

|

|

|

Nonemployee |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Rev. January 2022) |

|

Compensation |

||

|

|

|

|

|

|

|

For calendar year |

|

|

||

|

|

|

|

|

|

|

20 |

|

|

|

|

PAYER’S TIN |

RECIPIENT’S TIN |

|

|

1 Nonemployee compensation |

|

Copy C |

|||||

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Payer |

|

RECIPIENT’S name |

|

|

|

2 Payer made direct sales totaling $5,000 or more of |

|

||||||

|

|

|

|

|

|||||||

|

|

|

|

consumer products to recipient for resale |

|

For Privacy Act and |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

Paperwork Reduction |

|

|

|

|

|

|

|

|

|

|

Act Notice, see the |

|

|

|

|

|

|

|

|

|

|

|

|

|

Street address (including apt. no.) |

|

|

|

|

|

|

|

|

|

|

current General |

|

|

|

|

|

|

|

|

|

|

|

Instructions for Certain |

|

|

|

|

4 Federal income tax withheld |

|

||||||

|

|

|

|

|

Information Returns. |

||||||

City or town, state or province, country, and ZIP or foreign postal code |

$ |

|

|

|

|

|

|

|

|||

|

|

|

|

5 State tax withheld |

6 State/Payer’s state no. |

|

7 State income |

||||

|

|

|

|

$ |

|

|

|

|

|

|

$ |

Account number (see instructions) |

|

|

2nd TIN not. |

|

|

|

|

||||

|

|

|

|

$ |

|

|

|

|

|

|

$ |

Form |

|

www.irs.gov/Form1099NEC |

|

Department of the Treasury - Internal Revenue Service |

|||||||

Instructions for Payer

To complete Form

•The current General Instructions for Certain Information Returns, and

•The current Instructions for Forms

To order these instructions and additional forms, go to www.irs.gov/EmployerForms.

Caution: Because paper forms are scanned during processing, you cannot file certain Forms 1096, 1097, 1098, 1099, 3921, or 5498 that you print from the IRS website.

Filing and furnishing. For filing and furnishing instructions, including due dates, and to request filing or furnishing extensions, see the current General Instructions for Certain Information Returns.

Need help? If you have questions about reporting on Form

Other PDF Templates

Dd 214 - Receiving a DD 214 can be a significant milestone for service members as they move forward from active duty.

Us Passport Form - The DS-11 form is for first-time applicants seeking a U.S. passport.

Establishing a Medical Power of Attorney is essential for ensuring your healthcare decisions align with your personal wishes, especially during critical times when you may be unable to communicate. By completing this important document, individuals can appoint a trusted person to make decisions on their behalf, reinforcing the need for clear directives in healthcare planning. For more information, consider exploring the Healthcare POA resources available.

How to Set Up Direct Deposit - It can be a valuable tool for employees seeking immediate payment access.

Documents used along the form

The 1099-NEC form is essential for reporting nonemployee compensation, but it often works in conjunction with several other important documents. These forms help ensure that all tax obligations are met and that both payers and recipients have the necessary information for accurate reporting. Below is a list of forms commonly associated with the 1099-NEC.

- Form W-9: This form is used by the payer to request the taxpayer identification number (TIN) from the recipient. It helps ensure that the correct information is reported to the IRS and is essential for backup withholding purposes.

- Mobile Home Bill of Sale: This document is essential for transferring ownership and protecting the rights of both parties involved in a mobile home sale, as detailed in the Mobile Home Bill of Sale.

- Form 1096: This is a summary form that accompanies certain information returns, including the 1099-NEC, when filed by paper. It provides the IRS with a summary of the information returns being submitted.

- Form 1040: This is the individual income tax return form used by recipients to report their income, including any amounts reported on the 1099-NEC. It is crucial for ensuring that all income is accurately reported to the IRS.

- Form 8919: This form is used by individuals who believe they should have been classified as employees rather than independent contractors. It helps report uncollected Social Security and Medicare taxes on income reported from the 1099-NEC.

- Schedule C: This form is used by sole proprietors to report income or loss from a business. If the recipient of a 1099-NEC is self-employed, they will typically report this income on Schedule C along with any associated business expenses.

Understanding these additional forms can greatly simplify the tax filing process for both payers and recipients. Proper use of these documents ensures compliance with tax regulations and helps avoid potential penalties. Always keep these forms organized and accessible to facilitate a smooth tax season.

Similar forms

The 1099-MISC form is similar to the 1099-NEC form in that both are used to report income paid to non-employees. The 1099-MISC is primarily used for various types of payments, including rents, prizes, and awards, while the 1099-NEC specifically focuses on nonemployee compensation. Each form requires the payer to provide details such as the recipient's taxpayer identification number (TIN) and the amount paid. However, the distinction lies in the fact that the 1099-NEC was reintroduced in 2020 specifically to streamline reporting of nonemployee compensation, which was previously reported on the 1099-MISC.

The 1099-K form is another document that shares similarities with the 1099-NEC. This form is used to report payment card and third-party network transactions. Like the 1099-NEC, it is issued to recipients who have received payments totaling over a certain threshold, typically $20,000 and 200 transactions. The 1099-K also requires the reporting of TINs and payment amounts, making it essential for tracking income from electronic payment platforms. Both forms aim to ensure that the IRS receives accurate information about income earned outside of traditional employment.

The W-2 form is similar in that it also reports income, but it is specifically for employees rather than independent contractors. Employers use the W-2 to report wages, tips, and other compensation paid to employees, along with the taxes withheld. In contrast, the 1099-NEC does not involve tax withholding, as it is intended for nonemployee compensation. Both forms require the payer to report the recipient's TIN and provide a summary of earnings, but the W-2 includes additional information regarding Social Security and Medicare taxes.

The 1099-INT form is used to report interest income, which can also be similar to the 1099-NEC in terms of providing information to the IRS about income earned. Financial institutions use the 1099-INT to report interest payments made to individuals, while the 1099-NEC reports payments made to independent contractors. Both forms require the inclusion of the recipient's TIN and the amount paid, but they serve different purposes in terms of the type of income being reported.

When dealing with property transfers, understanding the implications of a quitclaim deed can be vital. For a comprehensive overview of the legal framework, you can explore our detailed guide about the Quitclaim Deed options and requirements in Florida.

The 1099-DIV form is used to report dividends and distributions from investments, which makes it similar to the 1099-NEC in that both forms track income received by individuals. Corporations issue the 1099-DIV to shareholders who have received dividends, while the 1099-NEC is issued to nonemployees for compensation. Each form necessitates the reporting of the recipient's TIN and the amounts received, but they cater to different types of income sources.

The 1099-R form reports distributions from retirement accounts, making it another document akin to the 1099-NEC. This form is issued to individuals who have received distributions from pensions, annuities, or retirement plans. Similar to the 1099-NEC, the 1099-R requires the reporting of the recipient's TIN and the amount distributed. However, the 1099-R focuses specifically on retirement income, while the 1099-NEC is concerned with payments made for services rendered by nonemployees.

The 1099-G form is used to report certain government payments, including unemployment compensation and state tax refunds. Like the 1099-NEC, it is issued to individuals who have received payments, requiring the inclusion of the recipient's TIN and the payment amount. Both forms serve to inform the IRS about income received by individuals, but the 1099-G is specifically focused on government-related payments.

The 1099-C form reports cancellation of debt, which can be similar to the 1099-NEC in that both forms track income that may not be immediately apparent to the taxpayer. Creditors issue the 1099-C when a debt of $600 or more is forgiven, requiring the reporting of the debtor's TIN and the amount of debt canceled. While the 1099-NEC focuses on payments for services, the 1099-C highlights financial relief that may have tax implications for the recipient.

The 1099-S form is used to report proceeds from real estate transactions, which can also relate to the 1099-NEC in terms of reporting income generated from business activities. The 1099-S is issued when real estate is sold, requiring the reporting of the seller's TIN and the gross proceeds. Both forms are crucial for ensuring accurate income reporting to the IRS, but they pertain to different types of transactions.

The 1099-LTC form reports long-term care benefits, which can be similar to the 1099-NEC in that both forms are used to report payments made to individuals. The 1099-LTC is issued to individuals who receive payments from long-term care insurance policies. While both forms require the reporting of the recipient's TIN and the amount received, the 1099-LTC specifically focuses on insurance benefits, whereas the 1099-NEC pertains to compensation for services rendered.

Dos and Don'ts

When filling out the 1099-NEC form, here are four important dos and don'ts:

- Do: Use the official IRS version of Copy A for filing to avoid penalties.

- Do: Ensure that you provide accurate taxpayer identification numbers (TINs) for both the payer and recipient.

- Do: Report all nonemployee compensation accurately in Box 1 to prevent issues with the IRS.

- Do: Keep a copy of the completed form for your records.

- Don't: Print and file a downloaded Copy A from the IRS website, as it is not scannable.

- Don't: Forget to check the box for direct sales if applicable, as this could affect tax reporting.

- Don't: Leave any required fields blank, as this can lead to processing delays or penalties.

- Don't: Ignore deadlines for filing the form with the IRS to avoid late penalties.

Key takeaways

Understanding the 1099-NEC form is crucial for both payers and recipients. Here are key takeaways to keep in mind when filling out and using this form:

- Copy A is for informational purposes only. It appears in red and is not suitable for filing if downloaded from the IRS website.

- Do not print and file the online version of Copy A. A penalty may apply for using non-scannable forms.

- Copies B and other versions can be printed. These copies, which appear in black, can be used to provide information to the recipient.

- Order official forms directly from the IRS for scannable copies. Visit the IRS website to request these forms.

- Electronic filing is an option. Use the IRS FIRE system or the AIR program for submitting information returns online.

- Ensure the recipient's taxpayer identification number (TIN) is accurate. This protects both the payer and the recipient.

- Report any nonemployee compensation accurately. This income must be included on the appropriate tax return.

- Stay informed about updates. Check the IRS website for the latest information regarding the 1099-NEC and related instructions.

Filling out the 1099-NEC correctly is essential for compliance and avoiding penalties. Take these points seriously to ensure smooth processing of tax information.

How to Use 1099 Nec

Completing the 1099-NEC form requires careful attention to detail. After filling out the form, ensure all information is accurate before submission. This form must be provided to the recipient and filed with the IRS. Follow these steps to fill out the form correctly.

- Obtain the official IRS 1099-NEC form. Do not use a downloaded version of Copy A, as it is not scannable.

- Enter the Payer's Name, Street Address, City, State, ZIP Code, and Telephone Number in the designated fields.

- Provide the Payer's TIN (Tax Identification Number) in the appropriate box.

- Fill in the Recipient's Name and Street Address, including any apartment number.

- Enter the Recipient's TIN in the designated box.

- In Box 1, report the total Nonemployee Compensation paid to the recipient during the calendar year.

- If applicable, check Box 2 if the payer made direct sales totaling $5,000 or more of consumer products to the recipient for resale.

- Complete Box 4 if any federal income tax was withheld from the payments made to the recipient.

- Fill in Boxes 5 through 7 if any state income tax was withheld. Include the state tax withheld, state payer's state number, and state income.

- If you have an account number for the recipient, include it in the designated field.

- Review all entries for accuracy. Make sure there are no errors or omissions.

- Distribute the appropriate copies of the form to the recipient and file Copy A with the IRS.