Fill Out a Valid Acord 50 WM Form

The Acord 50 WM form plays a crucial role in the world of insurance, particularly in the context of workers' compensation and general liability coverage. This standardized document serves as a vital communication tool between insurance agents and their clients, streamlining the process of obtaining coverage. By providing essential information about the insured entity, including its business operations and risk exposures, the form facilitates accurate underwriting and premium calculations. Additionally, the Acord 50 WM includes sections for detailing the types of coverage requested, limits, and any specific endorsements that may be necessary. Its structured format not only aids in clarity but also ensures compliance with industry standards, making it an indispensable resource for both insurers and policyholders. Understanding the intricacies of this form is essential for navigating the complexities of insurance applications and securing appropriate coverage for various business needs.

Common mistakes

-

Incomplete Information: Many people forget to fill in all required fields. Missing details can lead to delays or even rejection of the form.

-

Incorrect Policy Numbers: Entering wrong policy numbers is a common mistake. Double-checking these numbers is essential to ensure accuracy.

-

Neglecting Signatures: Some individuals forget to sign the form. Without a signature, the form is not valid and cannot be processed.

-

Using Outdated Versions: Submitting an outdated version of the form can cause confusion. Always ensure you are using the most current version available.

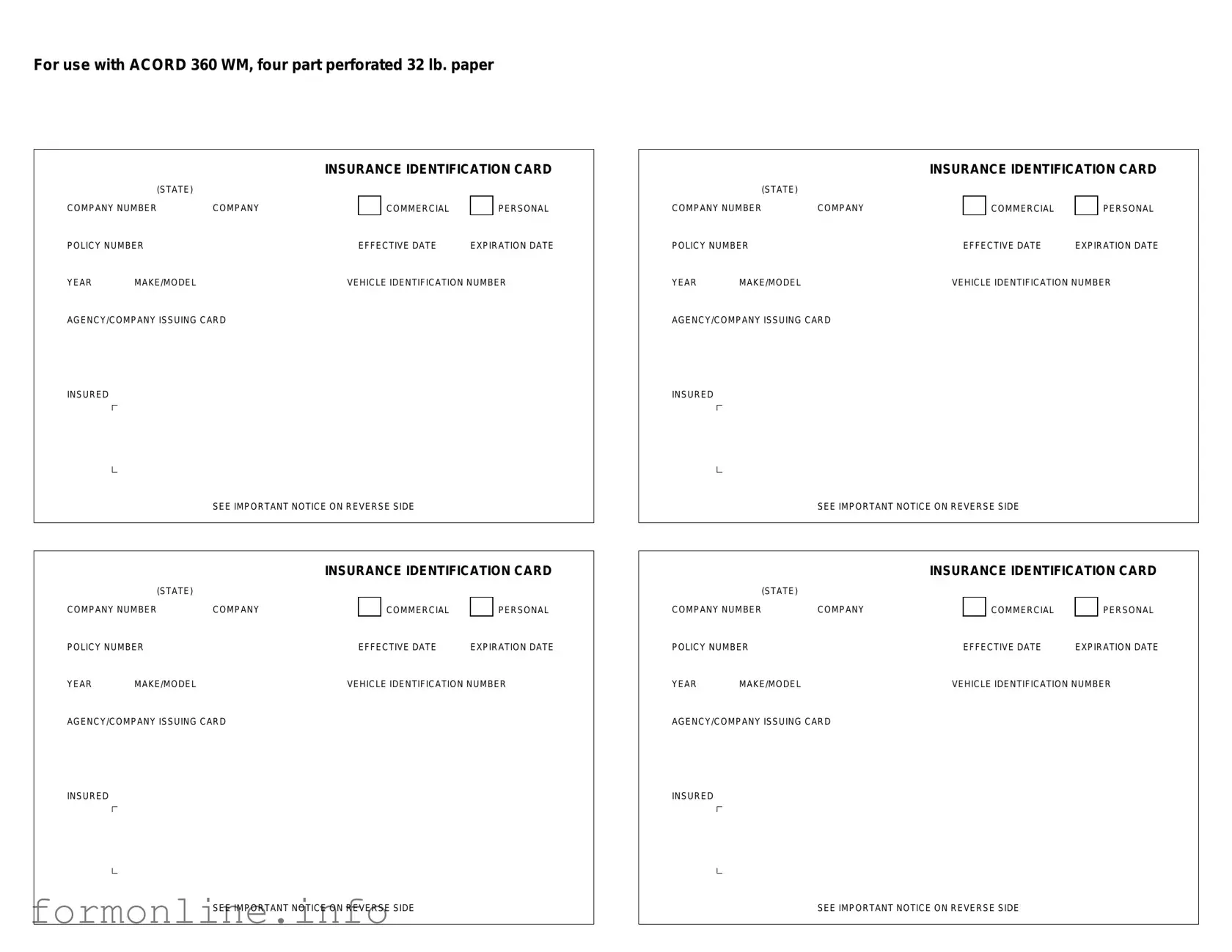

Preview - Acord 50 WM Form

For use with ACORD 360 WM, four part perforated 32 lb. paper

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

Other PDF Templates

What Income Is Used to Determine Medicare Premiums - This form provides an essential mechanism for recognizing and addressing financial hardships within Medicare.

Temporary Guardianship Form California Pdf - Guides individuals through the temporary custody process.

The process of launching a business in New York requires careful attention to documentation, particularly the New York Articles of Incorporation form, which is essential for establishing a corporation. This form not only delineates the corporation's name, purpose, and structure but can also be further explored at https://nypdfforms.com, making it an invaluable resource for new entrepreneurs.

Work Availability Form - Provide information on any part-time or full-time preference.

Documents used along the form

The Acord 50 WM form is a vital document in the insurance industry, particularly for those involved in workers' compensation coverage. However, it is often accompanied by several other forms and documents that help streamline the process and ensure comprehensive coverage. Below are four commonly used forms that you may encounter alongside the Acord 50 WM form.

- Acord 125: This is the standard application for commercial insurance. It provides essential information about the business seeking coverage, including details about its operations, risks, and previous insurance history. This form helps insurers assess the risk and determine appropriate premiums.

- Acord 140: Known as the Commercial General Liability Application, this document focuses specifically on liability coverage. It gathers information about the applicant’s business activities, locations, and any past claims. Insurers use this information to evaluate potential liabilities and coverage needs.

- Acord 130: This form is the Commercial Property Application. It collects data regarding the property to be insured, including its value, location, and any existing hazards. This information is crucial for underwriters to calculate the risk associated with insuring the property.

- Notice to Quit: For landlords needing to terminate a tenancy, the formal process of issuing a Notice to Quit is essential to legally notify tenants of their obligations to vacate the property.

- Acord 25: This is the Certificate of Liability Insurance. It serves as proof of insurance coverage and outlines the types of coverage in place, limits, and the policy period. This document is often requested by third parties, such as clients or vendors, to verify that a business has the necessary insurance protection.

Understanding these forms can significantly enhance your ability to navigate the insurance landscape effectively. Each document plays a unique role in the overall process, and being familiar with them will ensure that you are well-prepared to secure the coverage you need.

Similar forms

The Acord 50 WM form is similar to the Acord 25 form, which is commonly used for property and casualty insurance. Both documents serve to provide essential information about the insured entity, including details about coverage, limits, and the type of insurance being requested. The Acord 25 focuses more on commercial general liability, while the Acord 50 WM form is tailored for workers' compensation. However, both forms require similar data regarding the insured's business operations and risk exposure.

Another document that resembles the Acord 50 WM form is the Acord 130 form, which is used for commercial auto insurance. Like the Acord 50 WM, the Acord 130 collects information about the insured party, including details about vehicles, drivers, and coverage needs. Both forms aim to assess risk and determine appropriate premiums, although the Acord 130 specifically addresses auto-related coverage rather than workers' compensation.

The Acord 27 form is also comparable to the Acord 50 WM form. It is used for property insurance and gathers similar information about the insured's assets and coverage requirements. Both forms require detailed descriptions of the insured's operations and the nature of the risks involved. However, while the Acord 27 focuses on property, the Acord 50 WM is dedicated to the needs of workers' compensation insurance.

The Acord 126 form shares similarities with the Acord 50 WM form as well. This form is used for excess and surplus lines insurance. Both documents require comprehensive information about the insured’s business and potential liabilities. They help underwriters evaluate risks and set appropriate coverage limits. The main difference lies in the type of coverage being sought, with the Acord 126 focusing on excess coverage rather than workers' compensation.

When transferring ownership of a mobile home, it is essential to have the correct documentation in place, which includes the Mobile Home Bill of Sale. This document ensures the transaction proceeds smoothly, protecting the interests of both the buyer and the seller.

The Acord 151 form is another document that aligns closely with the Acord 50 WM form. It is designed for general liability insurance and collects information about the insured's operations, claims history, and coverage needs. Both forms aim to provide underwriters with a clear picture of the insured's risk profile, although the Acord 151 is specific to general liability rather than workers' compensation.

Lastly, the Acord 140 form is similar in purpose to the Acord 50 WM form. It is used for commercial package policies and collects information about various types of coverage, including property and liability. Both forms require detailed information about the insured's business activities and risk exposures. The Acord 140, however, addresses a broader range of coverage options, while the Acord 50 WM is focused specifically on workers' compensation needs.

Dos and Don'ts

When filling out the Acord 50 WM form, it’s important to follow certain guidelines to ensure accuracy and completeness. Here’s a helpful list of what to do and what to avoid:

- Do: Carefully read the instructions provided with the form.

- Do: Provide accurate and up-to-date information.

- Do: Double-check all entries for any typos or errors.

- Do: Sign and date the form where required.

- Don't: Leave any required fields blank.

- Don't: Use abbreviations or shorthand that may confuse the reader.

- Don't: Submit the form without reviewing it first.

- Don't: Ignore any specific instructions related to your situation.

Key takeaways

The Acord 50 WM form is essential for businesses seeking workers' compensation insurance. Understanding its components can facilitate a smoother application process.

- Accurate Information: Ensure all details are correct. This includes business name, address, and contact information.

- Coverage Needs: Clearly outline the types of coverage required for your business. This helps insurers provide appropriate options.

- Employee Details: Provide accurate employee counts and classifications. This information influences premium calculations.

- Prior Coverage: Disclose any previous workers' compensation insurance. Insurers often review past claims history.

- Signature Requirement: Ensure the form is signed by an authorized representative. An unsigned form may delay processing.

- Review and Submit: Double-check the completed form for accuracy before submission. Mistakes can lead to complications in coverage.

Filling out the Acord 50 WM form with care can lead to better insurance options and a smoother experience. Take the time to gather necessary information and review your submission for accuracy.

How to Use Acord 50 WM

Filling out the Acord 50 WM form is an important step in your process. This form is designed to gather specific information, and completing it accurately will help ensure that everything goes smoothly. Follow these steps to fill out the form correctly.

- Start by entering the name of the insured at the top of the form.

- Next, provide the address of the insured, including the city, state, and ZIP code.

- Fill in the policy number associated with the insurance.

- Indicate the effective date of the policy.

- In the section for coverage details, specify the types of coverage being requested.

- Complete the limits of liability section with the appropriate figures.

- Provide any additional information that may be relevant, such as special instructions or requests.

- Finally, review the entire form for accuracy and sign where indicated.