Fill Out a Valid Act 221 Disclosure Form

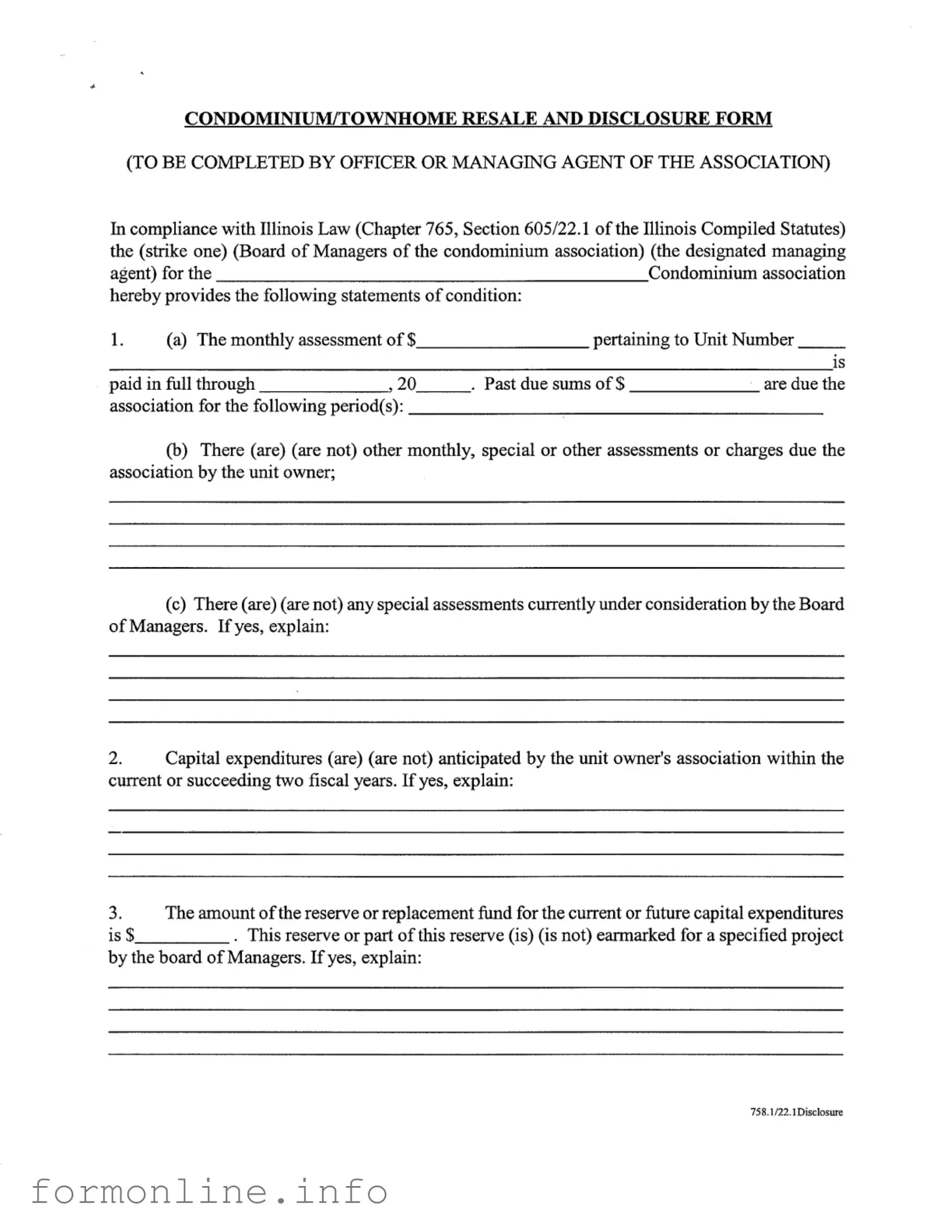

The Act 221 Disclosure form serves as a crucial tool for prospective buyers of condominiums or townhomes in Illinois, ensuring transparency regarding the financial and legal status of the property. This form is completed by an officer or managing agent of the condominium association and provides essential information about the unit in question. Key aspects include the status of monthly assessments, any past due sums, and whether additional charges or special assessments are pending. The form also outlines anticipated capital expenditures, the status of reserve funds, and any pending lawsuits involving the association. Additionally, it includes details about the association's insurance carrier and confirms compliance with condominium regulations concerning improvements or alterations made to the unit. By requiring this disclosure, Illinois law aims to protect buyers and promote informed decision-making in the real estate market.

Common mistakes

-

Incomplete Information: Failing to provide complete details about the unit, such as the unit number and the current monthly assessment status, can lead to confusion and potential legal issues.

-

Incorrect Dates: Entering incorrect dates for payment periods or assessments can misrepresent the financial status of the unit, affecting both the seller and buyer.

-

Missing Signatures: Not obtaining the required signatures from the board of managers or managing agent can render the form invalid.

-

Neglecting Special Assessments: Failing to disclose any pending special assessments or charges can lead to unexpected costs for the buyer.

-

Omitting Insurance Information: Not providing the name and contact details of the insurance carrier may leave potential buyers uninformed about coverage.

-

Ignoring Capital Expenditures: Not mentioning anticipated capital expenditures can mislead buyers about the future financial obligations of the association.

-

Failure to Attach Required Documents: Not including the most recent approved budget or financial statement can create distrust and hinder the sale process.

Preview - Act 221 Disclosure Form

Other PDF Templates

Netspend Direct Deposit Time - It’s essential to be prompt when dealing with lost or stolen cards.

A Release of Liability form is a legal document where one party agrees not to hold another party responsible for any risks, injuries, or losses that may occur. This form is commonly used in events or activities that involve a certain level of risk. It ensures that individuals or entities are aware of and accept the potential dangers involved, and you can download the document in pdf to facilitate this process.

Xpo Bol - Each section of the form is designed to efficiently capture all necessary shipping information.

Documents used along the form

The Act 221 Disclosure form is an essential document for those involved in the resale of condominium or townhome units in Illinois. It provides vital information regarding the financial and legal status of the homeowners' association. Alongside this form, several other documents can help prospective buyers gain a comprehensive understanding of the property and its management. Below is a list of commonly used forms and documents that are often associated with the Act 221 Disclosure form.

- Condominium Bylaws: These are the rules and regulations governing the operation of the condominium association. They outline the rights and responsibilities of unit owners and the association.

- Declaration of Condominium: This document establishes the condominium as a legal entity. It includes details about the property, the common elements, and the percentage of ownership for each unit.

- Virginia Homeschool Letter of Intent: This essential form is crucial for parents intending to educate their children at home, formally notifying the local school division of their decision. For more information, you can refer to the Homeschool Letter of Intent.

- Current Budget: The most recent budget of the condominium association provides insights into the financial health of the association, including anticipated income and expenses.

- Meeting Minutes: These records of past association meetings can reveal discussions about important decisions, ongoing issues, and future plans affecting the community.

- Reserve Study: A reserve study assesses the condition of common elements and estimates the funds needed for future repairs and replacements. It helps ensure the association can meet long-term financial obligations.

- Insurance Certificate: This document verifies the type and amount of insurance coverage held by the association, protecting both the association and unit owners from potential liabilities.

- Special Assessments Disclosure: If there are any special assessments planned or in effect, this document provides details about the amounts and purposes of these assessments.

- Rules and Regulations: This document outlines the specific rules that unit owners and residents must follow, covering everything from noise restrictions to pet policies.

- Property Management Agreement: If a management company oversees the condominium, this agreement details the responsibilities and terms of service between the association and the management firm.

- Owner Occupancy Rates: This document provides information about the percentage of units that are owner-occupied versus rented, which can affect the community's stability and financing options.

These documents collectively provide a clearer picture of the condominium's operational and financial landscape. Understanding them can help prospective buyers make informed decisions and ensure that they are aware of any potential issues before finalizing a purchase.

Similar forms

The Seller's Disclosure Statement serves a similar purpose to the Act 221 Disclosure form by providing essential information about a property being sold. In this document, the seller outlines any known issues, repairs, or conditions that may affect the property’s value or desirability. Like the Act 221 form, it aims to inform potential buyers of any liabilities or concerns before the sale is finalized. This transparency helps prevent disputes after the transaction and ensures that buyers can make informed decisions.

The Homeowners Association (HOA) Disclosure Statement is another document that shares similarities with the Act 221 Disclosure form. This statement provides information about the rules, regulations, and financial health of the HOA governing a community. It details assessments, special fees, and any pending litigation involving the HOA. Just as the Act 221 form informs buyers about the financial status and potential liabilities of a condominium association, the HOA Disclosure Statement serves to educate buyers about the community’s governance and obligations.

The Property Condition Disclosure Statement is also akin to the Act 221 Disclosure form. This document is often required in real estate transactions and outlines the physical condition of the property. Sellers must disclose known defects or issues with the property, similar to how the Act 221 form addresses the financial and legal conditions of a condominium. Both documents protect buyers by ensuring they are aware of any significant concerns that could impact their investment.

The Real Estate Purchase Agreement includes clauses that are reminiscent of the Act 221 Disclosure form. This agreement outlines the terms and conditions of the sale, including disclosures about the property’s condition and any associated fees. While the Act 221 form focuses on the financial and legal aspects of a condominium association, the Purchase Agreement encompasses a broader range of information, ensuring that both parties understand their rights and obligations during the transaction.

In the realm of education, families seeking to inform their local school district about their plans to withdraw their child from traditional schooling can utilize the Intent to Homeschool Letter, a crucial document that aligns with state regulations and ensures proper communication with educational authorities.

Finally, the Lead-Based Paint Disclosure is similar in that it serves to inform buyers about potential hazards associated with a property. Required for homes built before 1978, this document requires sellers to disclose any known lead-based paint hazards. Like the Act 221 Disclosure form, it emphasizes transparency and the importance of informing buyers about issues that could affect their safety and investment. Both documents aim to protect consumers by ensuring they are aware of significant risks before making a purchase.

Dos and Don'ts

When filling out the Act 221 Disclosure form, it's essential to be thorough and accurate. Here are some guidelines to help you navigate the process effectively:

- Do ensure that all information provided is complete and accurate. This includes details about assessments, pending lawsuits, and the association's financial condition.

- Do attach any required documents, such as the most recent approved budget, to support the information provided in the form.

- Don't leave any sections blank unless specifically instructed. Incomplete forms can lead to delays or misunderstandings.

- Don't provide misleading information. Honesty is crucial, as inaccuracies can have legal implications for both the seller and the association.

Key takeaways

Filling out the Act 221 Disclosure form is an essential step for anyone involved in the sale of a condominium or townhome. This form provides crucial information about the property and the association, ensuring transparency for potential buyers. Here are some key takeaways to keep in mind:

- Understanding Financial Obligations: The form clearly outlines the financial status of the unit, including any outstanding assessments or charges. This information is vital for prospective buyers to gauge their financial responsibilities.

- Capital Expenditures: The form addresses whether any capital expenditures are anticipated in the near future. Knowing about potential large expenses can help buyers prepare for future costs and make informed decisions.

- Reserve Funds: The disclosure includes details about the reserve or replacement fund. Buyers should pay attention to whether these funds are earmarked for specific projects, as this can impact future financial stability.

- Legal Considerations: The form also mentions any pending lawsuits or judgments involving the association. This information is crucial, as it can affect the overall health of the community and the buyer's investment.

By carefully reviewing and understanding the contents of the Act 221 Disclosure form, both buyers and sellers can navigate the condominium resale process with greater confidence.

How to Use Act 221 Disclosure

Filling out the Act 221 Disclosure form is an important step for ensuring transparency in condominium or townhome transactions. By completing this form, you provide essential information about the financial health and legal status of the association. Here’s how to fill it out step by step.

- Identify the Association: At the top of the form, indicate whether you are representing the Board of Managers of the condominium association or the designated managing agent.

- Unit Information: Fill in the Unit Number and the name of the owner. Specify if the monthly assessment is paid in full through a specific date.

- Past Due Sums: State any past due amounts owed to the association and the corresponding periods.

- Assessments: Check whether there are any other monthly, special, or additional assessments due from the unit owner. If applicable, explain.

- Special Assessments: Indicate if any special assessments are under consideration by the Board of Managers. Provide details if necessary.

- Capital Expenditures: Note if any capital expenditures are anticipated within the current or next two fiscal years. If so, explain further.

- Reserve Fund: State the amount of the reserve or replacement fund and whether it is earmarked for a specific project. Provide explanations if needed.

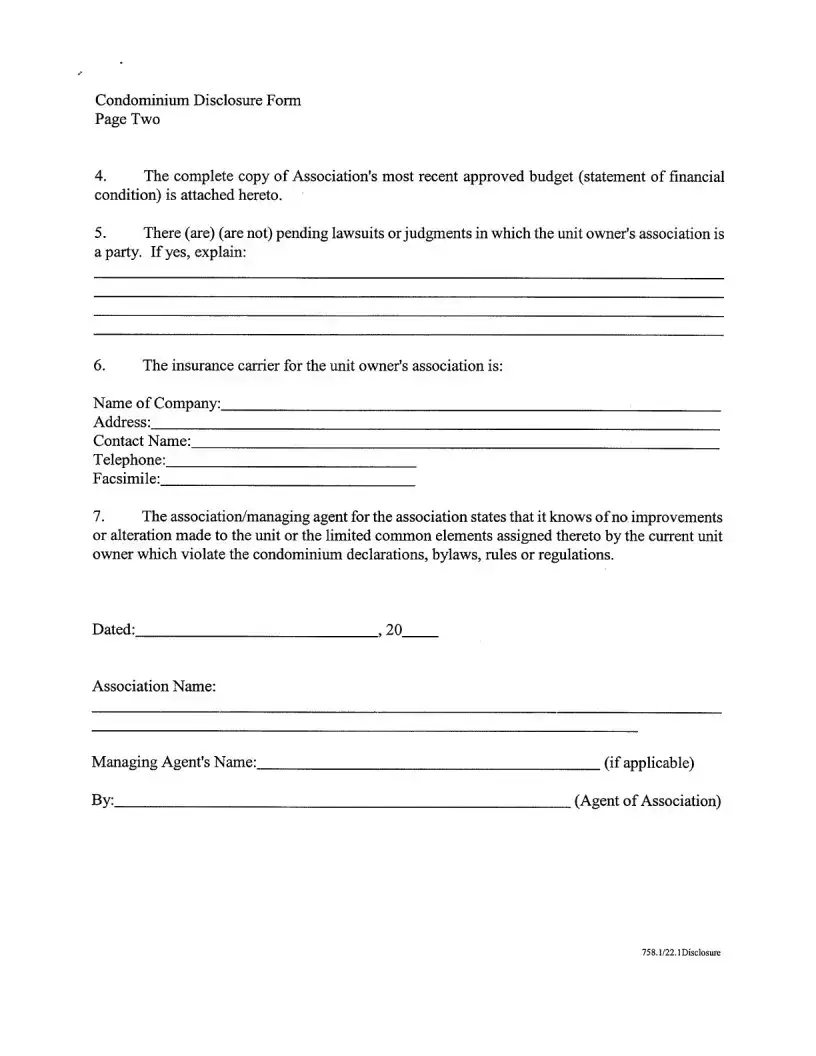

- Attach Budget: Include a complete copy of the association's most recent approved budget or statement of financial condition.

- Pending Lawsuits: Indicate if there are any pending lawsuits or judgments involving the unit owner's association. Provide explanations if applicable.

- Insurance Information: Fill in the name, address, contact name, telephone, and facsimile of the insurance carrier for the association.

- Improvements or Alterations: State that you know of no improvements or alterations made to the unit that violate the condominium declarations, bylaws, rules, or regulations.

- Signature: Sign the form as the agent of the association, including the name of the association and managing agent (if applicable).

Once you have completed the form, ensure that all information is accurate and up to date. It is crucial to provide this information to potential buyers, as it helps them understand the financial and legal standing of the condominium association.