Fill Out a Valid Adp Pay Stub Form

The ADP Pay Stub form is an essential document for employees and employers alike, serving as a detailed record of earnings and deductions for each pay period. This form provides a clear breakdown of gross pay, taxes withheld, and various deductions, such as retirement contributions and health insurance premiums. Employees can easily track their earnings, ensuring transparency in their compensation. Additionally, the pay stub includes important information like the pay period dates, year-to-date totals, and employer details, which can be crucial for personal budgeting and tax preparation. Understanding the components of this form can empower employees to make informed financial decisions and help employers maintain accurate payroll records.

Common mistakes

-

Incorrect Personal Information: Many individuals fail to verify their name, address, and Social Security number. Even a small typo can lead to significant issues, such as delays in processing or problems with tax reporting.

-

Misreporting Hours Worked: Employees often underestimate or overestimate their hours. This mistake can result in underpayment or overpayment, leading to complications with payroll adjustments.

-

Ignoring Deductions: Some people overlook the importance of checking deductions for taxes, benefits, and other withholdings. Not understanding these deductions can affect take-home pay and tax liabilities.

-

Failure to Update Changes: When individuals experience changes in their employment status, such as a promotion or change in benefits, they sometimes forget to update their information on the pay stub. This oversight can lead to inaccuracies in pay and benefits.

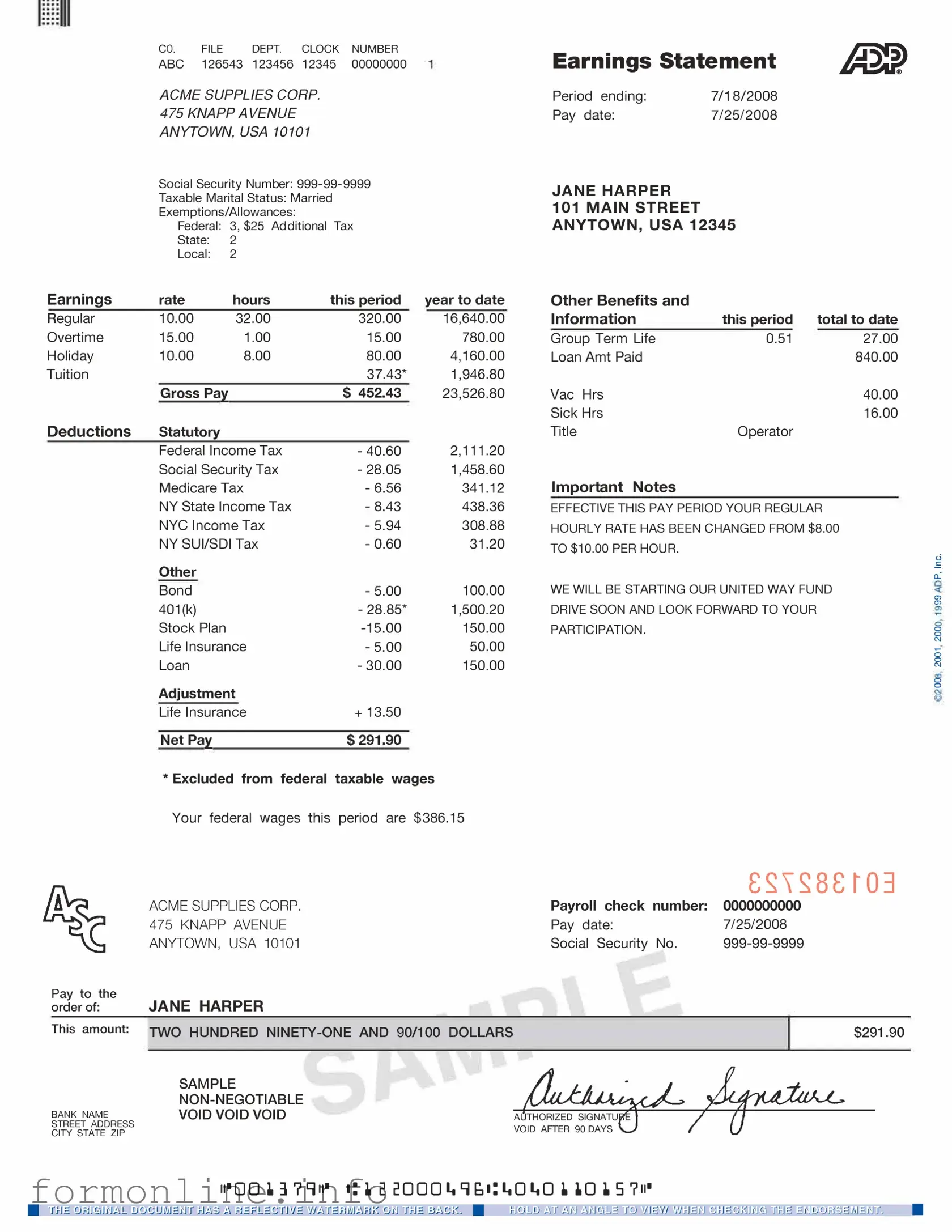

Preview - Adp Pay Stub Form

|

CO. |

FILE |

DEPT. |

CLOCK |

NUMBER |

|

|

ABC |

126543 123456 |

12345 |

00000000 |

|

|

|

ACME SUPPLIES CORP. |

|

|

|||

|

475 KNAPP AVENUE |

|

|

|

||

|

ANYTOWN, USA 10101 |

|

|

|||

|

Social Security Number: |

|

||||

|

Taxable Marital Status: Married |

|

|

|||

|

Exemptions/Allowances: |

|

|

|

||

|

Federal: 3, $25 Additional Tax |

|

||||

|

State: |

2 |

|

|

|

|

|

Local: |

2 |

|

|

|

|

Earnings |

rate |

|

hours |

this period |

year to date |

|

Regular |

10.00 |

|

32.00 |

|

320.00 |

16,640.00 |

Overtime |

15.00 |

|

1.00 |

|

15.00 |

780.00 |

Holiday |

10.00 |

|

8.00 |

|

80.00 |

4,160.00 |

Tuition |

|

|

|

|

37.43* |

1,946.80 |

|

Gross Pa� |

|

|

$ 452.43 |

23,526.80 |

|

Deductions |

Statutory |

|

|

|

2,111.20 |

|

|

Federal Income Tax |

|

- 40.60 |

|||

|

Social Security Tax |

|

- 28.05 |

1,458.60 |

||

|

Medicare Tax |

|

- 6.56 |

341.12 |

||

|

NY State Income Tax |

|

- 8.43 |

438.36 |

||

|

NYC Income Tax |

|

- 5.94 |

308.88 |

||

|

NY SUI/SDI Tax |

|

- 0.60 |

31.20 |

||

|

Other |

|

|

|

|

|

|

Bond |

|

|

|

- 5.00 |

100.00 |

|

401(k) |

|

|

|

- 28.85* |

1,500.20 |

|

Stock Plan |

|

|

150.00 |

||

|

Life Insurance |

|

- 5.00 |

50.00 |

||

|

Loan |

|

|

|

- 30.00 |

150.00 |

|

Adjustment |

|

|

|

||

|

Life Insurance |

|

+ 13.50 |

|

||

|

Net Pa� |

|

|

$291.90 |

|

|

*Excluded from federal taxable wages Your federal wages this period are $386.15

ACME SUPPLIES CORP. 475 KNAPP AVENUE ANYTOWN, USA 10101

Pay to the

order of: JANE HARPER

This amount: TWO HUNDRED

SAMPLE

BANK NAMEVOID VOID VOID

STREET ADDRESS

CITY STATE ZIP

Earnings Statement

Period ending: |

7/18/2008 |

Pay date: |

7/25/2008 |

JANE HARPER

101MAIN STREET

ANYTOWN, USA 12345

Other Benefits and

Information |

this period |

total to date |

|

|

Group Term Life |

0.51 |

27.00 |

|

|

Loan Amt Paid |

|

840.00 |

|

|

Vac Hrs |

|

40.00 |

|

|

Sick Hrs |

|

16.00 |

|

|

Title |

Operator |

|

|

|

Important Notes |

|

|

|

|

EFFECTIVE THIS PAY PERIOD YOUR REGULAR |

|

|||

HOURLY RATE HAS BEEN CHANGED FROM $8.00 |

|

|||

TO $10.00 PER HOUR. |

|

|

0 |

|

|

|

|

||

|

|

|

.!: |

|

WE WILL BE STARTING OUR UNITED WAY FUND |

0: |

|||

"' |

||||

DRIVE SOON AND LOOK FORWARD TO YOUR |

|

|||

|

|

|||

PARTICIPATION. |

|

|

0 |

|

|

|

|

0 |

|

C\J

0

0

C\J

0

0

|

£�,�8£�03 |

Payroll check number: |

0000000000 |

Pay date: |

7/25/2008 |

Social Security No. |

$291.90

Other PDF Templates

Rochdale Village Application - Residents receive information on local resources and services through community boards.

The Employment Application PDF form is a standardized document used by job seekers to provide their personal information, work history, and qualifications to potential employers. This form serves as a crucial first step in the hiring process, allowing candidates to showcase their skills and experiences. For those interested in finding a suitable template, Top Forms Online offers resources that can enhance their chances of securing job interviews.

Pay Rate Form - Monitoring employee pay rates is essential for maintaining morale and motivation.

Nc-4p - Married couples should discuss how to complete their NC-4 based on their filing status.

Documents used along the form

The ADP Pay Stub form is an essential document for employees, providing a detailed breakdown of their earnings, deductions, and net pay for each pay period. Alongside this form, there are several other documents that employees may encounter, each serving a unique purpose in the payroll and employment process. Below is a list of commonly used forms and documents that complement the ADP Pay Stub.

- W-2 Form: This form is issued annually by employers to report an employee's total earnings and the amount of taxes withheld throughout the year. It is crucial for filing income tax returns.

- Pay Schedule: This document outlines the frequency of pay periods (weekly, bi-weekly, monthly) and provides employees with important dates for when they can expect their paychecks.

- Direct Deposit Authorization Form: Employees use this form to authorize their employer to deposit their pay directly into their bank account, ensuring timely access to funds without the need for physical checks.

- Employee Handbook: This handbook contains important policies, procedures, and guidelines regarding workplace conduct, benefits, and employee rights, serving as a reference for employees throughout their employment.

- Tax Withholding Certificate (W-4): Employees fill out this form to indicate their tax withholding preferences. The information provided helps employers determine the appropriate amount of federal income tax to withhold from each paycheck.

- Emotional Support Animal Letter Form: To understand the advantages of having an emotional support animal, refer to the essential guidelines for obtaining an Emotional Support Animal Letter to improve mental well-being.

- Time Sheets: These records document the hours worked by employees, including overtime and leave taken. Time sheets are essential for calculating accurate pay and ensuring compliance with labor laws.

Understanding these documents can empower employees to manage their finances effectively and ensure compliance with tax regulations. Each form plays a vital role in the overall employment experience, providing clarity and support for both employees and employers alike.

Similar forms

The W-2 form is a crucial document for employees in the United States. Like the ADP Pay Stub, it provides a summary of earnings over the year. Employees receive a W-2 from their employer, which details wages, tips, and other compensation, as well as the taxes withheld. Both documents serve as essential tools for understanding income and tax obligations, making them important for financial planning and filing tax returns.

The paycheck is another document that shares similarities with the ADP Pay Stub. A paycheck typically includes information about the employee’s earnings for a specific pay period. Like the pay stub, it outlines gross pay, deductions, and net pay. However, while a paycheck is a physical form of payment, the pay stub serves as a record of the transaction, providing a breakdown of earnings and deductions for the employee’s reference.

In the context of employment documentation, an essential component is the Income Verification Letter, which serves to verify an individual's income for various purposes, including loan applications and job offers. This letter can complement other documents such as the W-2 form, Paycheck Stub, and Earnings Statement, providing an official confirmation of income details that may enhance the credibility of an employee's financial claims.

The 1099 form is relevant for independent contractors and freelancers, akin to the ADP Pay Stub for employees. This form reports income received outside of traditional employment, detailing how much was earned and any taxes withheld. Similar to the pay stub, the 1099 provides a clear record of income, helping individuals track their earnings and prepare for tax season.

The pay statement, often issued by employers, resembles the ADP Pay Stub in its purpose and content. It includes information about the employee's pay for a specific period, detailing gross pay, deductions, and net pay. While the pay statement may be less formal than a pay stub, both documents serve the same function of informing employees about their earnings and deductions.

The direct deposit receipt is another document that shares characteristics with the ADP Pay Stub. When employees opt for direct deposit, they receive a receipt that confirms the transfer of funds to their bank account. This receipt typically includes information about the amount deposited, similar to what is found on a pay stub. Both documents provide a record of payment and help employees track their earnings.

The payroll summary report is a comprehensive document that provides an overview of all employees’ earnings and deductions within a specific pay period. Like the ADP Pay Stub, it includes details such as gross pay, taxes withheld, and net pay. While the payroll summary is more extensive and may not be provided to individual employees, it serves a similar purpose in tracking and summarizing payroll information.

Dos and Don'ts

When filling out the ADP Pay Stub form, it's important to follow certain guidelines to ensure accuracy and efficiency. Here’s a list of things to do and not to do:

- Do double-check your personal information for accuracy.

- Do ensure your pay period dates are correct.

- Do include all relevant deductions and contributions.

- Do review your hours worked before submission.

- Do keep a copy for your records.

- Don't leave any sections blank unless instructed.

- Don't use incorrect or outdated forms.

- Don't ignore discrepancies in your pay.

- Don't rush through the process; take your time.

- Don't forget to sign and date the form if required.

Key takeaways

Understanding how to fill out and use the ADP Pay Stub form can make managing your finances easier. Here are some key takeaways to keep in mind:

- Accuracy is crucial: Double-check all entries to ensure the information is correct. Mistakes can lead to issues with payroll or tax reporting.

- Know your deductions: Familiarize yourself with the various deductions listed on the pay stub, such as taxes, health insurance, and retirement contributions.

- Keep it for records: Save your pay stubs for personal records. They can be useful for budgeting and verifying income when applying for loans or housing.

- Understand your earnings: Pay attention to the breakdown of your gross pay, net pay, and any overtime or bonuses. This helps you understand your total compensation.

- Review regularly: Make it a habit to review your pay stubs regularly. This ensures you catch any discrepancies early on.

- Seek help if needed: If you have questions or concerns about your pay stub, don’t hesitate to reach out to your HR department or payroll administrator.

How to Use Adp Pay Stub

When you're ready to fill out the ADP Pay Stub form, it's important to gather all necessary information beforehand. This will ensure a smooth process and help avoid any mistakes. Follow the steps below to complete the form accurately.

- Start with your personal information. Fill in your name, address, and employee ID at the top of the form.

- Next, provide your employer's details. This includes the company name and address.

- Indicate the pay period by entering the start and end dates for the pay period you are reporting.

- List your total hours worked during that pay period. Be sure to include regular hours, overtime, and any other relevant categories.

- Enter your gross pay. This is the total amount earned before any deductions.

- Detail any deductions. This might include taxes, health insurance, retirement contributions, or any other withholdings.

- Calculate your net pay. This is the amount you will receive after all deductions have been made.

- Review the completed form for accuracy. Make sure all information is correct and legible.

- Finally, sign and date the form at the bottom to certify that the information provided is true and complete.