Printable Affidavit of Gift Form

The Affidavit of Gift form serves as a crucial document for individuals wishing to formally declare a gift transfer of property or assets. This form is typically used when one party, the donor, intends to give property to another party, the recipient, without any expectation of payment or compensation in return. The affidavit must include essential details such as the description of the gifted property, the identities of both the donor and recipient, and the intent behind the gift. Additionally, the donor must affirm that the gift is made voluntarily and without coercion. This document often requires notarization to ensure its authenticity and can be vital in legal situations, such as tax implications or disputes over ownership. Understanding the significance of the Affidavit of Gift is essential for both parties involved, as it provides legal clarity and protection, ensuring that the intentions of the donor are respected and upheld.

State-specific Tips for Affidavit of Gift Templates

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all required information. This includes not filling out names, addresses, or other essential details. Each section of the form must be thoroughly completed to avoid delays in processing.

-

Incorrect Signatures: Signatures are crucial for validating the Affidavit of Gift. Often, individuals forget to sign the form or use an incorrect signature. Ensure that the person making the gift and any witnesses sign where required.

-

Failure to Notarize: Many people overlook the need for notarization. The Affidavit of Gift typically requires a notary public to verify the identities of the signers. Without this step, the form may be deemed invalid.

-

Missing Supporting Documents: It’s essential to attach any necessary supporting documents that may be required with the Affidavit of Gift. This could include proof of ownership or identification. Neglecting to include these can lead to complications or rejection of the form.

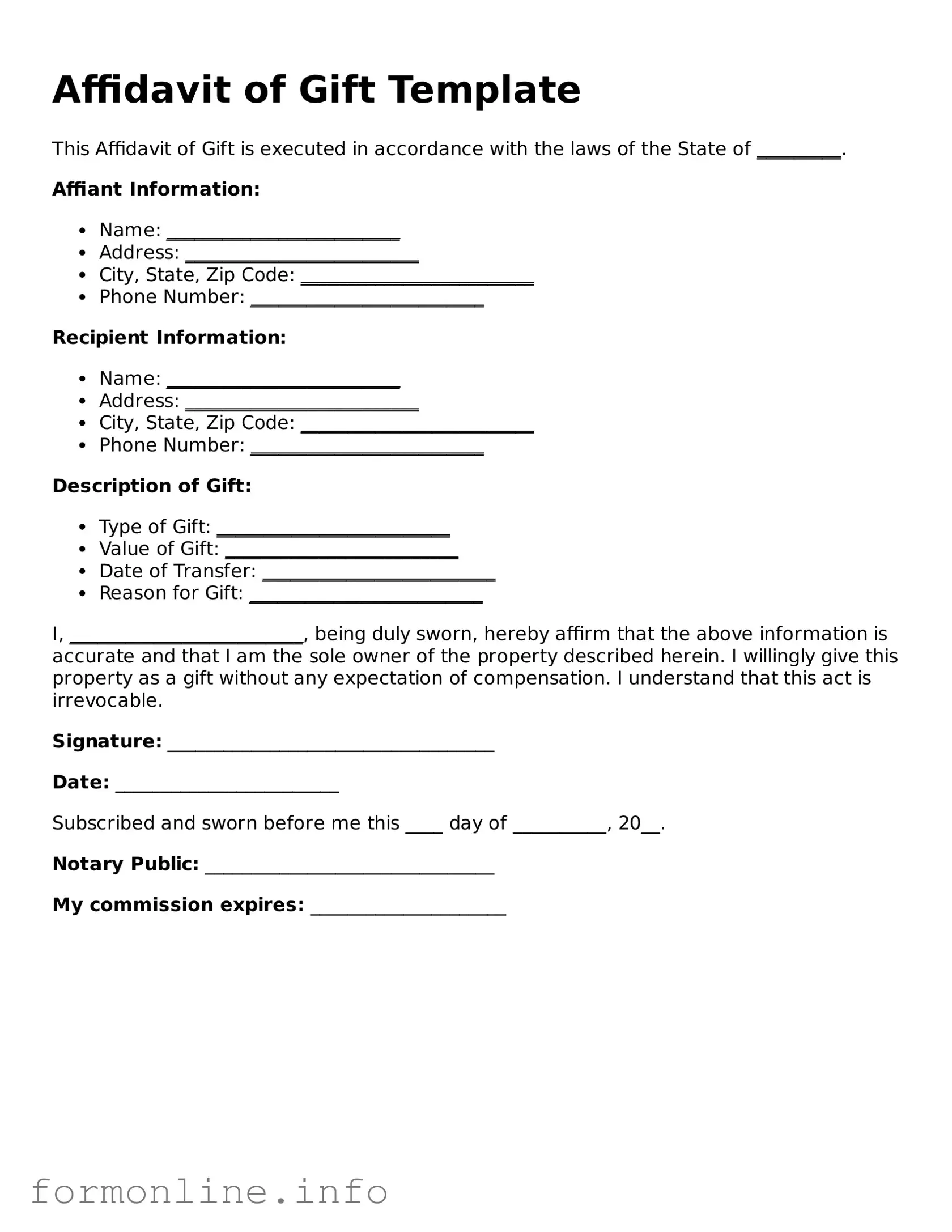

Preview - Affidavit of Gift Form

Affidavit of Gift Template

This Affidavit of Gift is executed in accordance with the laws of the State of _________.

Affiant Information:

- Name: _________________________

- Address: _________________________

- City, State, Zip Code: _________________________

- Phone Number: _________________________

Recipient Information:

- Name: _________________________

- Address: _________________________

- City, State, Zip Code: _________________________

- Phone Number: _________________________

Description of Gift:

- Type of Gift: _________________________

- Value of Gift: _________________________

- Date of Transfer: _________________________

- Reason for Gift: _________________________

I, _________________________, being duly sworn, hereby affirm that the above information is accurate and that I am the sole owner of the property described herein. I willingly give this property as a gift without any expectation of compensation. I understand that this act is irrevocable.

Signature: ___________________________________

Date: ________________________

Subscribed and sworn before me this ____ day of __________, 20__.

Notary Public: _______________________________

My commission expires: _____________________

More Types of Affidavit of Gift Templates:

Affidavit of Death Form California - Professional assistance may be beneficial in preparing an affidavit of death.

The importance of having a properly filled Texas RV Bill of Sale form cannot be overstated, as it lays the groundwork for a transparent and legally binding transaction. This document ensures that all details are meticulously recorded and can help avoid disputes between the parties. For more information on how to complete this process, you can visit autobillofsaleform.com/rv-bill-of-sale-form/texas-rv-bill-of-sale-form/.

Documents used along the form

When preparing an Affidavit of Gift, several additional forms and documents may be necessary to ensure the process is smooth and legally sound. Below is a list of commonly used documents that accompany the Affidavit of Gift.

- Gift Tax Return (Form 709): This form is used to report gifts that exceed the annual exclusion limit. It helps the IRS track large gifts and ensures compliance with tax laws.

- Deed of Gift: This document formally transfers ownership of property or assets from the donor to the recipient. It serves as a legal record of the gift.

- Letter of Intent: This letter outlines the donor's wishes regarding the gift, including any specific conditions or purposes for which the gift is intended.

- Title Transfer Document: For gifts involving vehicles or real estate, this document is necessary to officially change the title from the donor to the recipient.

- Valuation Appraisal: An appraisal provides an estimated value of the gift, which may be required for tax purposes or to establish the worth of the gift for the recipient.

- Bill of Sale: This document serves as proof of sale for personal property. While not mandatory for gifts, it can help record the details of the transaction, including the description of the item and the transfer date. You can access a Bill of Sale form for your needs.

- Proof of Identity: Both the donor and recipient may need to provide identification to verify their identities and ensure the legitimacy of the transaction.

- Consent Form: If the gift involves a minor or is subject to any legal restrictions, a consent form may be required from a guardian or other responsible party.

- Bank Statements or Financial Records: These documents can demonstrate the source of funds or assets being gifted, which may be important for transparency and tax purposes.

Having these documents ready can simplify the gifting process and help avoid potential legal complications. Always consider consulting a professional to ensure that everything is completed correctly.

Similar forms

The Affidavit of Gift form shares similarities with the Bill of Sale. Both documents serve as proof of a transfer of ownership. A Bill of Sale is often used in transactions involving personal property, such as vehicles or furniture. It outlines the details of the sale, including the buyer and seller's information, a description of the item, and the sale price. In contrast, the Affidavit of Gift is specifically designed for gifts, emphasizing that no payment has been exchanged. Both documents require signatures to validate the transfer, ensuring that all parties acknowledge the agreement.

The Indiana Mobile Home Bill of Sale form is a critical document in the realm of mobile home ownership transfers, as it provides a clear record of the sale and protects the interests of both the buyer and the seller. To ensure compliance and clarity in such transactions, one should consider utilizing a Mobile Home Bill of Sale form, which outlines the necessary details pertinent to the ownership change.

Another document that resembles the Affidavit of Gift is the Deed of Gift. This legal instrument is used to formally transfer ownership of property or assets without any exchange of money. Like the Affidavit of Gift, a Deed of Gift requires the donor to declare their intent to give the property to the recipient. It often includes details about the property, the parties involved, and any conditions tied to the gift. Both documents aim to provide clarity and legal recognition of the transfer, reinforcing the donor's intention to give without expectation of compensation.

The Gift Tax Return, also known as IRS Form 709, is another document that bears resemblance to the Affidavit of Gift. While the Affidavit of Gift serves as a declaration of intent to give, the Gift Tax Return is a tax-related document that reports gifts exceeding a certain value. Both documents are linked by their focus on gifts, but the Gift Tax Return is concerned with tax implications and compliance with federal tax laws. Individuals may need to file this return when they make substantial gifts, ensuring they adhere to tax regulations while documenting their generosity.

Lastly, the Trust Agreement can be compared to the Affidavit of Gift. A Trust Agreement outlines how assets will be managed and distributed, often involving a trustee and beneficiaries. While the Affidavit of Gift focuses on the immediate transfer of ownership, a Trust Agreement may include provisions for future distributions and conditions for the beneficiaries. Both documents serve to clarify the intentions of the giver, ensuring that their wishes are legally recognized and upheld. They provide a framework for the transfer of assets, whether immediately or over time.

Dos and Don'ts

When filling out the Affidavit of Gift form, attention to detail is crucial. Here are some important do's and don'ts to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate information about the gift and the donor.

- Do sign and date the form where indicated.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't use incorrect names or spellings for the donor or recipient.

- Don't forget to check for any additional documentation that may be required.

By following these guidelines, you can ensure that your Affidavit of Gift form is filled out correctly and efficiently.

Key takeaways

When filling out and using the Affidavit of Gift form, consider the following key takeaways:

- Purpose of the Affidavit: This form serves to document the transfer of property or assets as a gift.

- Accurate Information: Ensure that all information provided is accurate and complete to avoid any potential issues.

- Signatures Required: The form must be signed by both the donor and the recipient to validate the gift.

- Notarization: Some jurisdictions may require notarization of the Affidavit to confirm the identities of the parties involved.

- Record Keeping: Keep a copy of the completed form for personal records and future reference.

- Tax Implications: Be aware of any tax implications that may arise from gifting property or assets.

- Consultation Recommended: It may be beneficial to consult with a legal professional if there are questions about the process or requirements.

How to Use Affidavit of Gift

After gathering the necessary information, you are ready to fill out the Affidavit of Gift form. This form is important for documenting the transfer of a gift, ensuring that all details are clear and accurate. Follow the steps below to complete the form correctly.

- Begin by entering the date at the top of the form.

- Fill in the name of the donor (the person giving the gift).

- Provide the donor's address, including city, state, and ZIP code.

- Next, enter the name of the recipient (the person receiving the gift).

- Fill in the recipient's address, including city, state, and ZIP code.

- Specify the nature of the gift. Describe what is being given (e.g., cash, property, etc.).

- Indicate the value of the gift. Be honest and accurate in your estimation.

- Sign the form where indicated. The donor must sign to validate the gift.

- Have the signature notarized. This step may be required to ensure the form's authenticity.

Once the form is completed and notarized, keep a copy for your records. You may need to provide this documentation for tax purposes or other legal matters in the future.