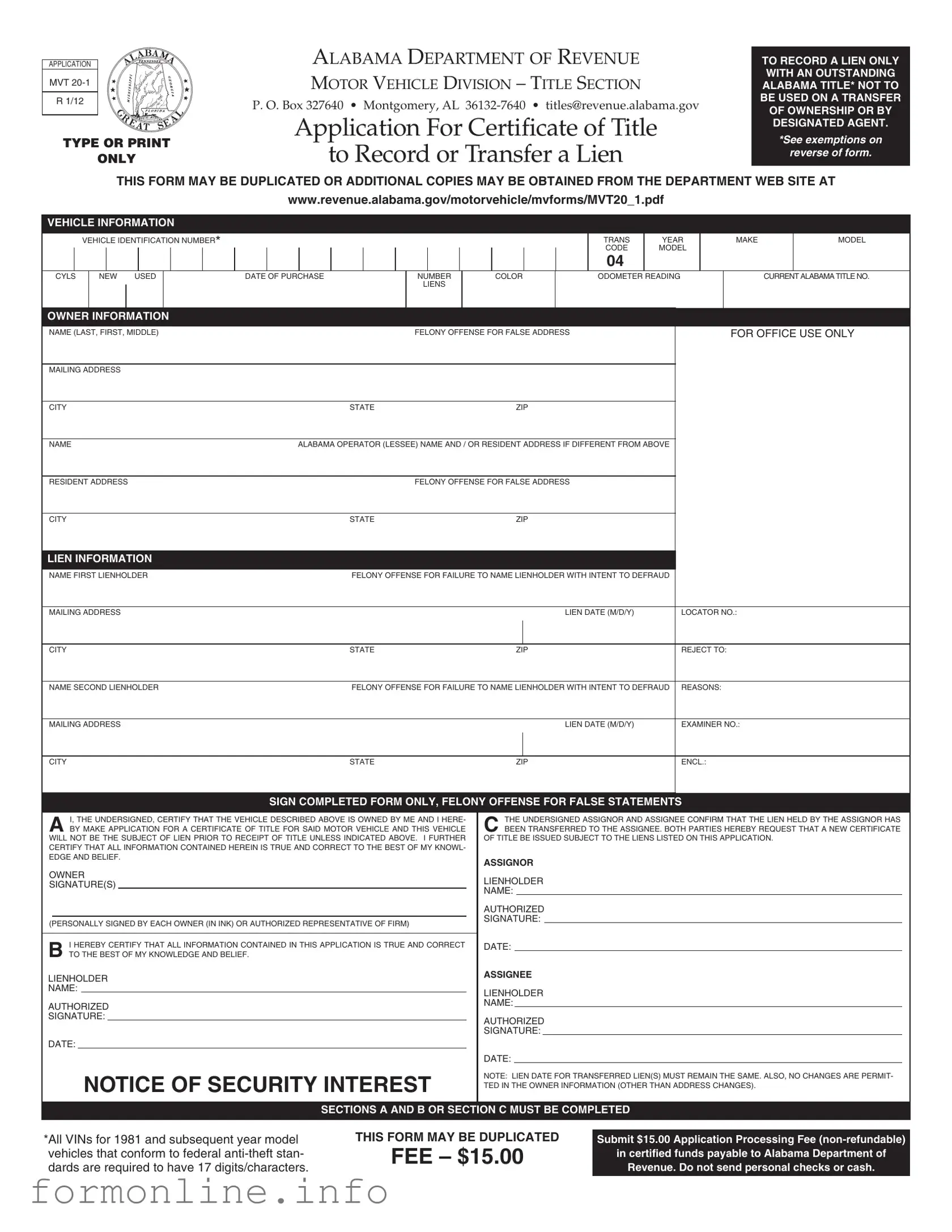

Fill Out a Valid Alabama Mvt 20 1 Form

The Alabama Mvt 20 1 form serves a crucial role in the state’s motor vehicle title management system. Specifically designed for lienholders, this application facilitates the recording or transfer of a lien on a vehicle that holds an outstanding Alabama title. It is essential to understand that this form is not intended for ownership transfers or use by designated agents. The application requires detailed vehicle information, including the Vehicle Identification Number (VIN), make, model, and current title number. Additionally, it captures owner information, ensuring that all data aligns with the existing Alabama title, except for updated mailing addresses. Lienholder details are equally important, as the form mandates the inclusion of both first and second lienholders, if applicable. To process the application, a non-refundable fee of $15 must be submitted alongside the current Alabama title. It is vital to note that specific exemptions apply, particularly for vehicles over certain age thresholds, which may not require titling. By adhering to the guidelines outlined in this form, vehicle owners and lienholders can ensure compliance with Alabama's motor vehicle laws, thereby safeguarding their interests in the transaction.

Common mistakes

-

Illegible Information: One of the most common mistakes is submitting a form that is difficult to read. The instructions clearly state that the form must be typed or printed legibly. Illegible forms will be returned, which can delay the processing of your lien.

-

Incorrect Vehicle Information: Failing to ensure that the vehicle information matches the existing Alabama title is another frequent error. All details, including the Vehicle Identification Number (VIN), must be identical to what appears on the surrendered title, except for the current mailing address and resident address.

-

Missing Signature: Not signing the completed form can lead to rejection. Both the assignor and assignee must personally sign the application. Ensure that all required signatures are present before submission.

-

Improper Payment Method: Submitting the application fee in an incorrect format is a common oversight. The fee must be in certified funds made payable to the Alabama Department of Revenue. Personal checks and cash are not acceptable.

-

Ignoring Exemptions: Many applicants overlook the exemptions related to the title application. For instance, vehicles older than 35 years or certain types of trailers may not require a title. Familiarizing yourself with these exemptions can save time and resources.

Preview - Alabama Mvt 20 1 Form

|

ALABAMA DEPARTMENT OF REVENUE |

||

APPLICATION |

|

||

MVT |

|

MOTOR VEHICLE DIVISION – TITLE SECTION |

|

|

|

|

|

R 1/12 |

|

P. O. Box 327640 • Montgomery, AL |

|

|

|

||

TYPE OR PRINT |

Application For Certificate of Title |

||

to Record or Transfer a Lien |

|||

|

ONLY |

||

TO RECORD A LIEN ONLY WITH AN OUTSTANDING ALABAMA TITLE* NOT TO BE USED ON A TRANSFER OF OWNERSHIP OR BY DESIGNATED AGENT.

*See exemptions on reverse of form.

THIS FORM MAY BE DUPLICATED OR ADDITIONAL COPIES MAY BE OBTAINED FROM THE DEPARTMENT WEB SITE AT

www.revenue.alabama.gov/motorvehicle/mvforms/MVT20_1.pdf

VEHICLE INFORMATION

|

|

|

|

|

VEHICLE IDENTIFICATION NUMBER* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TRANS |

YEAR |

|

|

MAKE |

|

MODEL |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CODE |

MODEL |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

04 |

|

|

|

|

|

|

|

|

|

|

|

CYLS |

|

NEW USED |

|

|

|

DATE OF PURCHASE |

|

|

|

NUMBER |

|

|

|

COLOR |

|

|

ODOMETER READING |

|

|

|

|

CURRENT ALABAMA TITLE NO. |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIENS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OWNER INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME (LAST, FIRST, MIDDLE) |

|

|

|

|

|

|

FELONY OFFENSE FOR FALSE ADDRESS |

|

|

|

|

|

FOR OFFICE USE ONLY |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAILING ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

|

|

|

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

NAME |

|

|

|

|

|

|

|

|

|

|

ALABAMA OPERATOR (LESSEE) NAME AND / OR RESIDENT ADDRESS IF DIFFERENT FROM ABOVE |

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

RESIDENT ADDRESS |

|

|

|

|

|

|

FELONY OFFENSE FOR FALSE ADDRESS |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

|

|

|

ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIEN INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

NAME FIRST LIENHOLDER |

|

|

|

FELONY OFFENSE FOR FAILURE TO NAME LIENHOLDER WITH INTENT TO DEFRAUD |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

MAILING ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIEN DATE (M/D/Y) |

|

|

LOCATOR NO.: |

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

|

|

|

ZIP |

|

|

|

|

|

REJECT TO: |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

NAME SECOND LIENHOLDER |

|

|

|

FELONY OFFENSE FOR FAILURE TO NAME LIENHOLDER WITH INTENT TO DEFRAUD |

|

REASONS: |

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

MAILING ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIEN DATE (M/D/Y) |

|

|

EXAMINER NO.: |

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

|

|

|

|

|

|

|

|

|

|

STATE |

|

|

|

ZIP |

|

|

|

|

|

ENCL.: |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGN COMPLETED FORM ONLY, FELONY OFFENSE FOR FALSE STATEMENTS |

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I, THE UNDERSIGNED, CERTIFY THAT THE VEHICLE DESCRIBED ABOVE IS OWNED BY ME AND I HERE- |

|

|

THE UNDERSIGNED ASSIGNOR AND ASSIGNEE CONFIRM THAT THE LIEN HELD BY THE ASSIGNOR HAS |

||||||||||||||||||||||||||||||||||||

|

A BY MAKE APPLICATION FOR A CERTIFICATE OF TITLE FOR SAID MOTOR VEHICLE AND THIS VEHICLE |

|

C BEEN TRANSFERRED TO THE ASSIGNEE. BOTH PARTIES HEREBY REQUEST THAT A NEW CERTIFICATE |

||||||||||||||||||||||||||||||||||||||

|

WILL NOT BE THE SUBJECT OF LIEN PRIOR TO RECEIPT OF TITLE UNLESS INDICATED ABOVE. I FURTHER |

|

OF TITLE BE ISSUED SUBJECT TO THE LIENS LISTED ON THIS APPLICATION. |

||||||||||||||||||||||||||||||||||||||

|

CERTIFY THAT ALL INFORMATION CONTAINED HEREIN IS TRUE AND CORRECT TO THE BEST OF MY KNOWL- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

EDGE AND BELIEF. |

|

|

|

|

|

|

|

|

|

|

ASSIGNOR |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

OWNER |

|

|

|

|

|

|

|

|

|

|

LIENHOLDER |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

SIGNATURE(S) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

NAME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AUTHORIZED |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

(PERSONALLY SIGNED BY EACH OWNER (IN INK) OR AUTHORIZED REPRESENTATIVE OF FIRM) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

I HEREBY CERTIFY THAT ALL INFORMATION CONTAINED IN THIS APPLICATION IS TRUE AND CORRECT |

|

DATE: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

B TO THE BEST OF MY KNOWLEDGE AND BELIEF. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

ASSIGNEE |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

LIENHOLDER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

NAME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIENHOLDER |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

AUTHORIZED |

|

|

|

|

|

|

|

|

|

|

NAME: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

SIGNATURE: |

|

|

|

|

|

|

|

|

|

|

AUTHORIZED |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

DATE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DATE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

NOTICE OF SECURITY INTEREST |

|

NOTE: LIEN DATE FOR TRANSFERRED LIEN(S) MUST REMAIN THE SAME. ALSO, NO CHANGES ARE PERMIT- |

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

TED IN THE OWNER INFORMATION (OTHER THAN ADDRESS CHANGES). |

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*All VINs for 1981 and subsequent year model vehicles that conform to federal

SECTIONS A AND B OR SECTION C MUST BE COMPLETED

THIS FORM MAY BE DUPLICATED |

Submit $15.00 Application Processing Fee |

FEE – $15.00 |

in certified funds payable to Alabama Department of |

|

|

|

Revenue. Do not send personal checks or cash. |

|

|

Instructions

This form shall be typed or printed legibly.

Illegible forms will be returned.

This form is designed for use by a lienholder in order for an owner of a vehicle to comply with section

This form may not be used on a transfer of ownership or by designated agents. Designated agents shall use form MVT

NOTE: Vehicle information and owner information shall be identical to information appearing on surrendered alabama title except for current mailing address and current alabama resident address.

SUPPORTING DOCUMENTS – This application shall be accompanied by the current Alabama title to this vehicle and the title fee (certified funds only) payable to the Alabama Department of Revenue.

Exemptions

(1)Effective January 1, 2012, no certificate of title shall be issued for any manufactured homes, trail- er,

Example: As of January 1, 2012, all 1991 and prior year model manufactured homes, trailers,

(2)Effective January 1, 2012, no certificate of title shall be issued for any motor vehicle more than

Example: As of January 1, 2012, all 1976 and prior year model motor vehicles are exempt from the titling provisions of Chapter 8, Title 32, Code of Alabama 1975.

(3)Effective January 1, 2012, no certificate of title shall be issued for a low speed vehicle. A low speed vehicle is defined as a

NOTE: The exemption from titling does not invalidate any Alabama certificate of title that is currently in effect. However, no subsequent title, including a certificate of title to record or transfer a lien, can be issued if the vehicle is exempt from titling.

Other PDF Templates

Download Leap Application - This form is essential for service members to receive legal clearance for international missions.

When buying or selling a mobile home in Connecticut, it is essential to utilize the appropriate legal documentation to facilitate the transaction. The Connecticut Mobile Home Bill of Sale serves as the formal agreement between the buyer and seller, detailing important information about the parties involved and the mobile home itself. To ensure a smooth transfer of ownership, it is advisable to refer to a comprehensive resource such as the Mobile Home Bill of Sale for guidance on proper completion and legal requirements.

Bbb Review - Advertised benefits were misleading and unrealistic.

Documents used along the form

When dealing with the Alabama MVT 20 1 form, several other documents are commonly required to ensure a smooth process for recording or transferring a lien. These documents help clarify ownership and lien details, providing necessary information to the Alabama Department of Revenue. Below is a list of related forms and documents that are often used alongside the MVT 20 1 form.

- Current Alabama Title: This document is essential as it serves as proof of ownership for the vehicle. The current title must be submitted with the MVT 20 1 form to validate the lien being recorded.

- MVT 5-1E Form: This form is specifically designed for designated agents who are acting on behalf of the owner. It is used to record liens and must be completed when the MVT 20 1 form cannot be used.

- Proof of Identity: Lienholders may need to provide documentation that verifies their identity. This can include a government-issued ID or other forms of identification to confirm the lienholder's legitimacy.

- Florida Lease Agreement: For those entering rental agreements, it's crucial to understand the detailed Florida lease agreement guidelines that outline tenant and landlord responsibilities.

- Bill of Sale: If applicable, a bill of sale can serve as evidence of the transaction between the buyer and seller. This document may be required to establish the chain of ownership prior to the lien being recorded.

- Payment Receipt: A receipt for the application processing fee is necessary to confirm that the required fee has been paid. This fee must be submitted in certified funds and is non-refundable.

These documents work together to provide a complete picture of the vehicle's ownership and any liens associated with it. Ensuring that all required forms are accurately completed and submitted can help prevent delays in processing and facilitate a smoother experience when dealing with vehicle titles in Alabama.

Similar forms

The Alabama MVT 20 1 form is similar to the MVT 5-1E form, which is used by designated agents to record liens. While the MVT 20 1 is specifically for lienholders and focuses on recording or transferring a lien, the MVT 5-1E is intended for agents acting on behalf of vehicle owners. Both forms require accurate vehicle and owner information, but the MVT 5-1E allows for the involvement of third-party agents, making it essential for situations where an agent is managing the lien process.

Another document comparable to the MVT 20 1 is the MVT 5-1 form, which is used for the application of a certificate of title. This form is essential when a vehicle's ownership is being transferred. Like the MVT 20 1, it requires detailed information about the vehicle and its owner. However, the MVT 5-1 focuses on transferring ownership rather than just recording a lien, making it crucial for buyers and sellers in vehicle transactions.

The MVT 10 form serves as an application for a duplicate title. This document is similar to the MVT 20 1 in that it also requires vehicle and owner information. However, the MVT 10 is specifically designed for situations where the original title has been lost or damaged. Both forms aim to ensure that the correct information is recorded, but they cater to different circumstances regarding vehicle ownership documentation.

In navigating the complexities of vehicle ownership and lien documentation, one might find it beneficial to also consider related documents such as the Mobile Home Bill of Sale, which serves to formalize the transfer of ownership for mobile homes, ensuring that all parties' rights are recognized and upheld during the transaction.

Similar to the MVT 20 1, the MVT 5-1C form is utilized for the transfer of a lien. This form is specifically for situations where a lien is being transferred from one lienholder to another. While both forms deal with liens, the MVT 5-1C focuses on the movement of lien responsibilities rather than the initial recording of a lien, which is the primary purpose of the MVT 20 1.

The MVT 4 form is an application for a certificate of title for a vehicle that was not previously titled. This document is similar to the MVT 20 1 in that it requires comprehensive vehicle information. However, the MVT 4 is focused on establishing a title for vehicles that may have been previously untitled, rather than simply recording or transferring a lien on an existing title.

The MVT 1 form is used for registering a vehicle in Alabama. This document shares similarities with the MVT 20 1, as both require detailed vehicle and owner information. However, the MVT 1 is primarily focused on the initial registration of a vehicle, while the MVT 20 1 is specifically for lien recording, making them applicable in different stages of vehicle ownership.

The MVT 7 form is utilized for the application of a title for a vehicle purchased from a dealer. Like the MVT 20 1, it requires similar information regarding the vehicle and the owner. The key difference lies in the context; the MVT 7 is tailored for dealer transactions, whereas the MVT 20 1 is specifically for lienholders, highlighting the distinction in the nature of the transaction.

Another relevant document is the MVT 6 form, which is an application for a title for a vehicle that has been inherited. This form is similar to the MVT 20 1 in that it requires specific details about the vehicle and the new owner. However, the MVT 6 is focused on transferring ownership due to inheritance, while the MVT 20 1 is concerned solely with lien recording.

The MVT 8 form is used for the application for a title for a vehicle that has been rebuilt or reconstructed. This document shares similarities with the MVT 20 1, as both require information about the vehicle and the owner. However, the MVT 8 focuses on vehicles that have undergone significant changes, while the MVT 20 1 is strictly for lien purposes.

Finally, the MVT 3 form is an application for a title for a vehicle that has been abandoned. This document is similar to the MVT 20 1 in that it requires detailed vehicle and owner information. However, the MVT 3 is specifically for addressing the ownership of abandoned vehicles, while the MVT 20 1 is focused solely on the recording or transfer of liens, highlighting the different contexts in which these forms are used.

Dos and Don'ts

When filling out the Alabama MVT 20 1 form, there are important guidelines to follow. Here are six things to do and not do:

- Do type or print the application legibly to avoid delays.

- Do ensure that the vehicle and owner information matches the current Alabama title.

- Do submit the application with the required $15.00 processing fee in certified funds.

- Do include the current Alabama title with your application.

- Don't use this form for transferring ownership or by designated agents.

- Don't send personal checks or cash; only certified funds are accepted.

Key takeaways

Filling out and using the Alabama MVT 20 1 form requires attention to detail. Here are some key takeaways to keep in mind:

- Purpose of the Form: This form is specifically for recording or transferring a lien on a vehicle with an outstanding Alabama title.

- Eligibility: It cannot be used for transferring ownership or by designated agents. Ensure you meet the criteria before proceeding.

- Vehicle Information: Provide accurate details such as the vehicle identification number (VIN), make, model, and year. This information must match the existing Alabama title.

- Owner Information: Include your name and address. If there are multiple owners, all must sign the form.

- Liens: Clearly list any lienholders. If there are multiple liens, provide details for each. This ensures proper record-keeping.

- Fees: A non-refundable application processing fee of $15 must be submitted in certified funds. Avoid personal checks or cash.

- Supporting Documents: Attach the current Alabama title to the application. Missing documents may delay processing.

- Exemptions: Be aware of exemptions for certain vehicles. For example, vehicles over 35 years old may not require a title.

By following these guidelines, you can navigate the MVT 20 1 form process more smoothly and ensure compliance with Alabama regulations.

How to Use Alabama Mvt 20 1

Filling out the Alabama MVT 20 1 form is an important step for those looking to record or transfer a lien on a vehicle. After completing this form, you will need to submit it along with the required fee and any supporting documents to the Alabama Department of Revenue. Make sure to follow the instructions carefully to avoid delays.

- Obtain the Form: You can download the MVT 20 1 form from the Alabama Department of Revenue website or make copies of the form.

- Fill Out Vehicle Information: Enter the Vehicle Identification Number (VIN), year, make, model, color, odometer reading, and current Alabama title number. Indicate whether the vehicle is new or used.

- Provide Owner Information: Fill in your name (last, first, middle), mailing address, city, state, and ZIP code. If the owner is a business, include the authorized representative's name.

- Complete Lien Information: List the first lienholder's name, mailing address, and lien date. If there is a second lienholder, provide their information as well.

- Certify the Information: Sign and date the form, certifying that all information is true and correct. Each owner or authorized representative must sign.

- Prepare Supporting Documents: Include the current Alabama title for the vehicle with your application. Ensure that the title matches the information provided in the form.

- Submit the Application: Send the completed form, supporting documents, and a $15.00 application processing fee in certified funds to the Alabama Department of Revenue.