Printable Articles of Incorporation Form

The Articles of Incorporation form serves as a foundational document for establishing a corporation in the United States. This essential form outlines critical information about the corporation, including its name, purpose, and the address of its principal office. Additionally, it specifies the number of shares the corporation is authorized to issue and the names and addresses of the initial directors. By filing this document with the appropriate state authority, individuals can legally create a separate entity that protects personal assets from business liabilities. Furthermore, the Articles of Incorporation may include provisions regarding the management structure and any specific rules governing the corporation. Understanding the significance of each section of this form is crucial for entrepreneurs and business owners who seek to navigate the complexities of corporate formation successfully.

State-specific Tips for Articles of Incorporation Templates

Common mistakes

-

Inaccurate Business Name: One of the most common mistakes is not ensuring the business name is unique. Before filing, check that your desired name isn’t already taken by another entity in your state.

-

Missing Purpose Statement: Failing to clearly define the purpose of the corporation can lead to confusion. A vague or overly broad purpose may not meet state requirements.

-

Incorrect Registered Agent Information: The registered agent must be a person or business authorized to receive legal documents. Providing incorrect information can result in missed notifications.

-

Omitting the Number of Shares: Not specifying the number of shares the corporation is authorized to issue can create complications. This detail is crucial for ownership and investment purposes.

-

Failure to Include Incorporator Details: The incorporator’s name and address must be included. Omitting this information can delay the filing process.

-

Ignoring State-Specific Requirements: Each state has its own rules regarding Articles of Incorporation. Ignoring these can lead to rejection of the application.

-

Not Signing the Document: A signature is often required. Forgetting to sign can result in the document being deemed incomplete.

-

Inadequate Review Before Submission: Rushing through the form without careful review can lead to errors. Taking time to double-check details can save you from potential setbacks.

-

Overlooking Filing Fees: Each state requires a filing fee. Failing to include this payment can delay the incorporation process significantly.

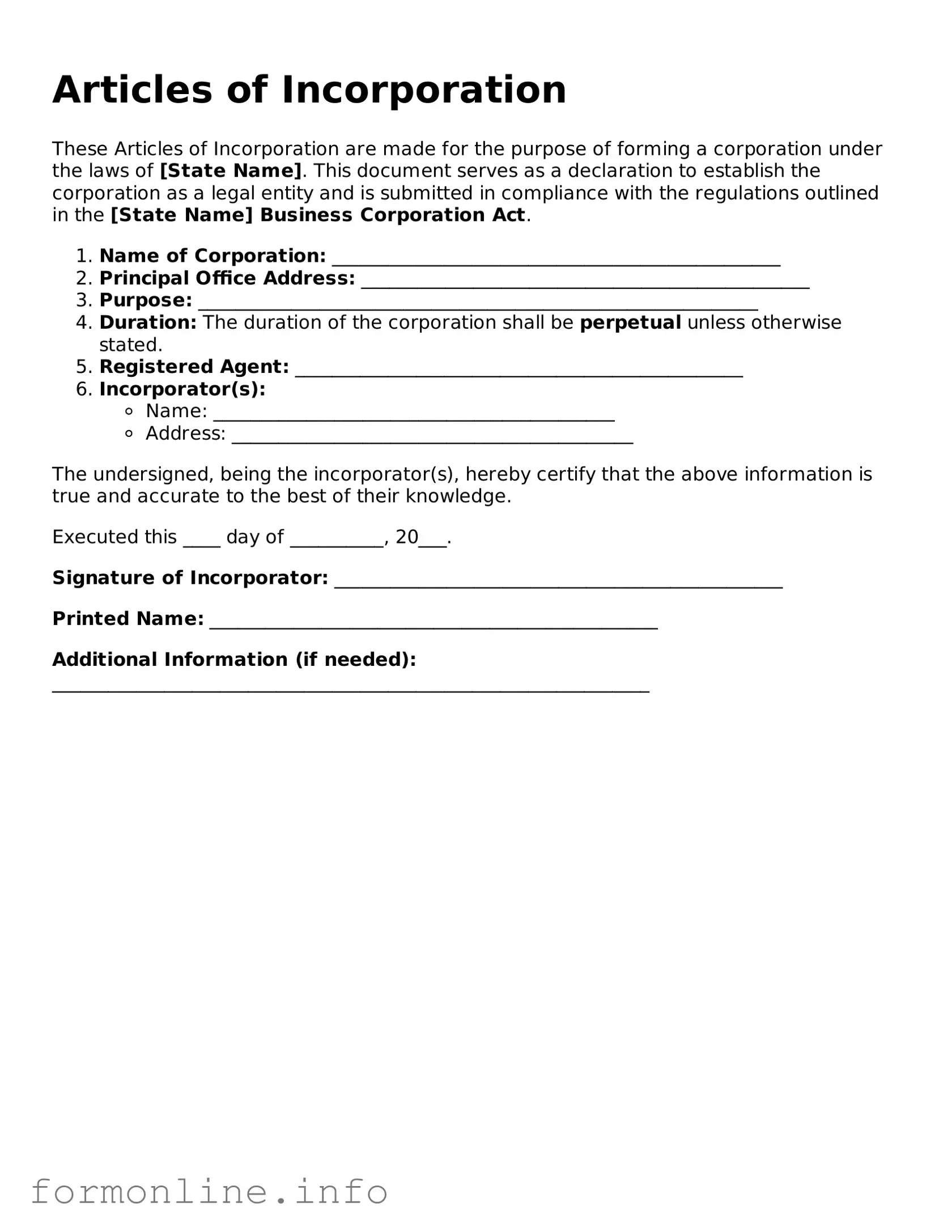

Preview - Articles of Incorporation Form

Articles of Incorporation

These Articles of Incorporation are made for the purpose of forming a corporation under the laws of [State Name]. This document serves as a declaration to establish the corporation as a legal entity and is submitted in compliance with the regulations outlined in the [State Name] Business Corporation Act.

- Name of Corporation: ________________________________________________

- Principal Office Address: ________________________________________________

- Purpose: ____________________________________________________________

- Duration: The duration of the corporation shall be perpetual unless otherwise stated.

- Registered Agent: ________________________________________________

- Incorporator(s):

- Name: ___________________________________________

- Address: ___________________________________________

The undersigned, being the incorporator(s), hereby certify that the above information is true and accurate to the best of their knowledge.

Executed this ____ day of __________, 20___.

Signature of Incorporator: ________________________________________________

Printed Name: ________________________________________________

Additional Information (if needed): ________________________________________________________________

Common Forms:

How to Write a Purchase Agreement - It specifies the buyer and seller’s information.

The process of homeschooling in Virginia begins with the submission of the Virginia Homeschool Letter of Intent, which is a crucial step for parents wishing to educate their children at home. This formal document serves to inform the local school division of the family's educational intentions, ensuring clear communication and adherence to state guidelines. For those seeking guidance on completing this important form, resources such as the Homeschool Letter of Intent can be invaluable in navigating the requirements and facilitating a positive homeschooling experience.

Wh-60 - It summarizes the transaction clearly to prevent confusion later on.

Certapet Letter - Emotional Support Animal Letters are unique to each individual and their specific needs.

Documents used along the form

The Articles of Incorporation serve as a foundational document for establishing a corporation. Alongside this form, several other documents may be required or beneficial during the incorporation process. Each of these documents plays a specific role in ensuring compliance with legal requirements and facilitating smooth operations for the new entity.

- Bylaws: This document outlines the internal rules and procedures for the corporation. It typically includes information about the governance structure, roles of officers, and the process for holding meetings.

- Initial Board of Directors Resolutions: These resolutions are used to appoint the initial board of directors. They may also cover important decisions such as opening bank accounts and designating the corporation's official address.

- Motorcycle Bill of Sale Form: This document is vital for any motorcycle transaction in Minnesota, providing proof of ownership transfer. For more details, visit autobillofsaleform.com/motorcycle-bill-of-sale-form/minnesota-motorcycle-bill-of-sale-form.

- Employer Identification Number (EIN) Application: The EIN is a unique identifier for the corporation, used for tax purposes. This application is submitted to the IRS to obtain the number, which is essential for hiring employees and filing taxes.

- State Business License Application: Depending on the state and type of business, a license may be required to legally operate. This application ensures compliance with local regulations and permits.

- Shareholder Agreements: This document outlines the rights and responsibilities of shareholders. It can address issues such as share transfers, voting rights, and how to handle disputes among shareholders.

- Statement of Information: Many states require corporations to file this document periodically. It provides updated information about the corporation, including its address, officers, and registered agent.

- Registered Agent Appointment Form: A registered agent is a designated individual or business entity responsible for receiving legal documents on behalf of the corporation. This form officially appoints the agent and provides their contact information.

- Stock Certificates: If the corporation issues stock, stock certificates serve as proof of ownership. These documents detail the number of shares owned and may include the corporation’s seal and signatures of officers.

- Annual Report: This report is often required by states to provide a snapshot of the corporation’s financial health and operations. It typically includes information about revenues, expenses, and any changes in the corporation's structure.

Each of these documents contributes to the successful formation and operation of a corporation. Understanding their purposes and requirements can help ensure that all necessary steps are taken during the incorporation process.

Similar forms

The Articles of Incorporation is often compared to the Certificate of Incorporation. Both documents serve as foundational legal paperwork that establishes a corporation's existence. While the Articles of Incorporation typically detail the corporation's name, purpose, and structure, the Certificate of Incorporation may also include similar information but is often used interchangeably in certain states. The key takeaway is that both documents are essential for legally forming a corporation and ensuring compliance with state laws.

Another document that shares similarities with the Articles of Incorporation is the Bylaws. Bylaws outline the internal rules and procedures for the corporation's operation. While the Articles of Incorporation provide a high-level overview of the corporation's structure, the Bylaws delve into the specifics of governance, including how meetings are conducted and how officers are elected. Both documents are crucial for the functioning of a corporation, yet they serve different purposes within the corporate framework.

The Operating Agreement is akin to the Articles of Incorporation but is specific to Limited Liability Companies (LLCs). This document outlines the management structure and operational procedures of an LLC, much like how the Articles define a corporation's structure. While Articles of Incorporation are required for corporations, an Operating Agreement is not always mandatory for LLCs, yet it is highly recommended to clarify ownership and management roles.

The Partnership Agreement is another document that bears resemblance to the Articles of Incorporation. This agreement is used to outline the terms and conditions of a partnership, including the roles and responsibilities of each partner. Just as the Articles of Incorporation define a corporation's structure and purpose, the Partnership Agreement establishes the framework for how partners will work together and share profits and losses. Both documents are vital for ensuring clarity and reducing conflicts among parties involved.

When establishing a business entity, it's important to ensure that all legal documentation is properly handled to avoid future conflicts. For those involved in the sale or transfer of motor vehicles, having a properly completed Motor Vehicle Bill of Sale is vital. This form not only proves ownership transfer but also provides clarity and security in the transaction. To learn more about the necessary documentation and to access the relevant forms, visit billofsaleforvehicles.com.

Lastly, the Business License can be seen as related to the Articles of Incorporation, as both are essential for legal compliance when starting a business. While the Articles of Incorporation establish the legal entity of a corporation, the Business License grants permission from local or state authorities to operate a business within a specific jurisdiction. Without both, a business may face legal challenges and fines, underscoring the importance of completing these documents in tandem.

Dos and Don'ts

When filling out the Articles of Incorporation form, it’s important to follow certain guidelines to ensure the process goes smoothly. Here are five things you should and shouldn't do:

- Do provide accurate information about your business name and address.

- Don't use a name that is too similar to an existing corporation.

- Do include the purpose of your corporation clearly and concisely.

- Don't leave any required fields blank; incomplete forms can lead to delays.

- Do sign and date the form before submitting it.

Following these steps can help you avoid common pitfalls and ensure that your incorporation process is successful.

Key takeaways

Filling out and utilizing the Articles of Incorporation form is a crucial step in establishing a corporation. Below are key takeaways to consider:

- The Articles of Incorporation serve as the foundational document for your corporation.

- Ensure that the name of the corporation is unique and complies with state regulations.

- Include the purpose of the corporation clearly; this defines what your business will do.

- Designate a registered agent who will receive legal documents on behalf of the corporation.

- Specify the number of shares the corporation is authorized to issue, if applicable.

- Provide the names and addresses of the initial directors; this information is vital for governance.

- Be mindful of the filing fees, which vary by state and must be paid at the time of submission.

- Consider seeking legal advice to ensure compliance with state laws and regulations.

- After filing, keep a copy of the Articles of Incorporation for your records, as it is an important legal document.

How to Use Articles of Incorporation

After gathering the necessary information, you will proceed to fill out the Articles of Incorporation form. This document is essential for establishing your corporation legally. Careful attention to detail is crucial, as inaccuracies may delay the incorporation process.

- Begin by providing the name of your corporation. Ensure that the name complies with state regulations and is not already in use.

- Next, include the principal office address. This should be a physical location where your corporation will conduct business.

- Specify the purpose of your corporation. Be clear and concise about the business activities you intend to engage in.

- List the names and addresses of the initial directors. Typically, a minimum number of directors is required, depending on state law.

- Indicate the duration of your corporation. Most corporations are established to exist perpetually, but you can specify a limited duration if desired.

- Include information about the registered agent. This individual or entity will receive legal documents on behalf of the corporation.

- Provide the total number of shares the corporation is authorized to issue, along with the par value of those shares, if applicable.

- Finally, sign and date the form. Ensure that the person signing has the authority to do so on behalf of the corporation.

Once you have completed the form, review it for accuracy before submitting it to the appropriate state agency. This step is vital to ensure a smooth incorporation process.