Fill Out a Valid Auto Insurance Card Form

When it comes to driving legally and safely, having an Auto Insurance Card is essential for every vehicle owner. This important document serves as proof of insurance coverage and contains several key details that ensure compliance with state regulations. The card prominently displays the insurance company’s name, policy number, and the effective and expiration dates of the coverage. Additionally, it includes vital information about the insured vehicle, such as its make, model, and vehicle identification number (VIN). It is crucial for drivers to keep this card in their vehicle at all times, as it must be presented upon request in the event of an accident. Furthermore, in case of an incident, the card reminds the insured to report the accident to their insurance agent promptly and collect necessary information, including the names and addresses of all drivers, passengers, and witnesses involved. Lastly, a unique feature of the card is an artificial watermark, which can be viewed by holding the card at an angle, adding an extra layer of security. Understanding the components of the Auto Insurance Card is not just beneficial; it is a vital part of responsible vehicle ownership.

Common mistakes

-

Not including the effective date and expiration date correctly. These dates are crucial for ensuring your insurance coverage is valid. Double-check these fields to avoid any gaps in coverage.

-

Failing to provide the correct vehicle identification number (VIN). This number uniquely identifies your vehicle. An incorrect VIN can lead to issues with claims and coverage.

-

Omitting the insurance company policy number. This number is essential for identifying your specific policy. Without it, you may face delays when needing assistance.

-

Not keeping the card in the vehicle as required. The card must be present in your vehicle at all times. If you are stopped by law enforcement or involved in an accident, you need to show it immediately.

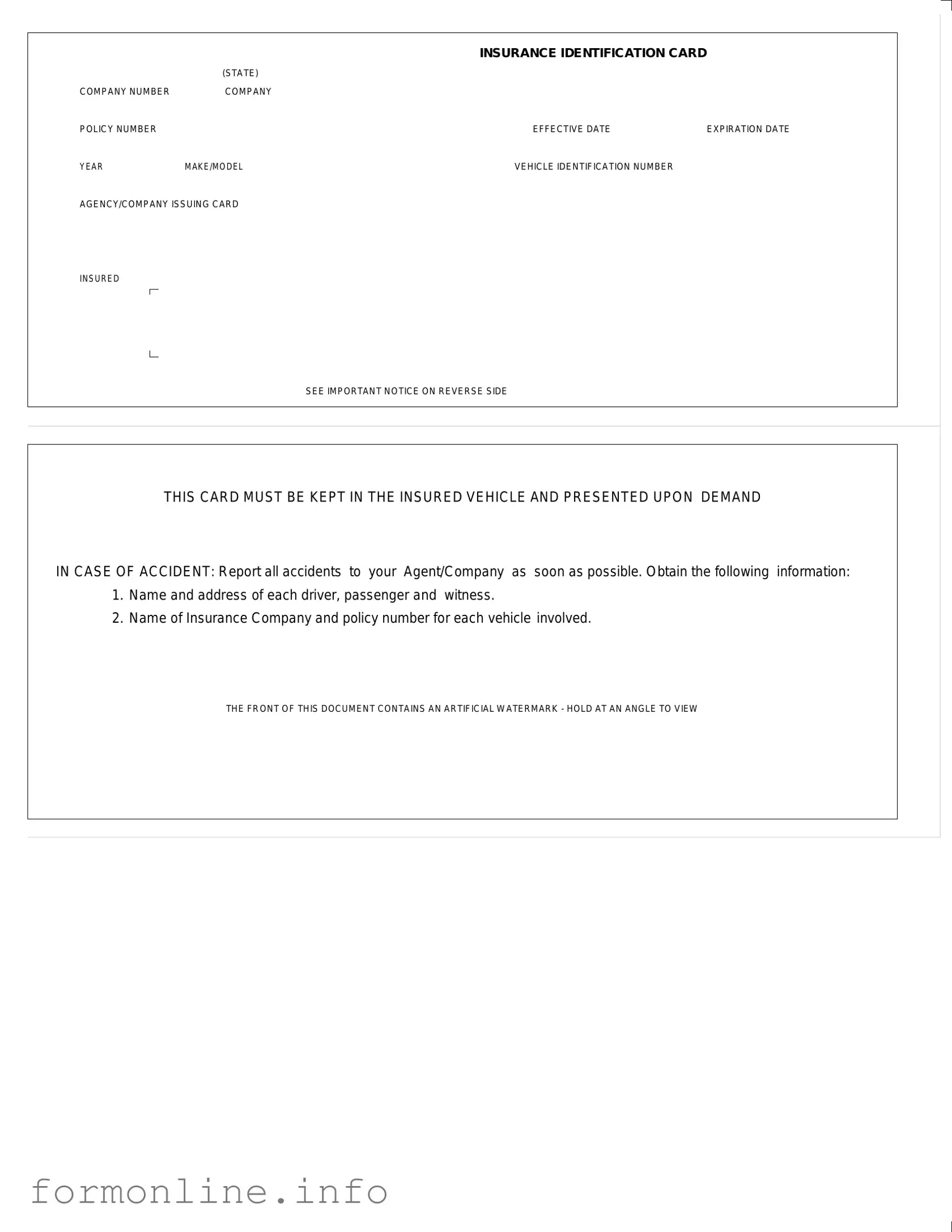

Preview - Auto Insurance Card Form

|

|

INSURANCE IDENTIFICATION CARD |

|

|

(STATE) |

|

|

COMPANY NUMBER |

COMPANY |

|

|

POLICY NUMBER |

|

EFFECTIVE DATE |

EXPIRATION DATE |

YEAR |

MAKE/MODEL |

VEHICLE IDENTIFICATION NUMBER |

|

AGENCY/COMPANY ISSUING CARD

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

THIS CARD MUST BE KEPT IN THE INSURED VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

Other PDF Templates

Roof Certification Template - Only covers visible elements of the roof during the inspection.

Cash Bill Format - A valuable tool for financial management and reporting.

To facilitate a successful transaction, parties involved in the sale of a mobile home should be familiar with the Texas Mobile Home Bill of Sale, a document that outlines vital information regarding the transfer of ownership. This form ensures that both the seller and buyer are accurately identified while providing detailed descriptions of the mobile home itself. For a complete understanding of this process, you can review the Mobile Home Bill of Sale.

Faa Aircraft Bill of Sale - This Bill of Sale can be essential for financing and insurance purposes.

Documents used along the form

When managing auto insurance, several key documents accompany the Auto Insurance Card. Each plays a vital role in ensuring you are adequately protected and prepared in case of an incident. Below is a list of commonly used forms and documents.

- Insurance Policy Document: This comprehensive document outlines the terms and conditions of your insurance coverage, including details about premiums, deductibles, and covered risks.

- Declaration Page: This page summarizes your insurance policy, listing coverage limits, deductibles, and the vehicles covered under the policy.

- Claim Form: In the event of an accident, this form is used to formally report the incident to your insurance company and initiate the claims process.

- Proof of Insurance Letter: This letter serves as an official statement from your insurer confirming your coverage. It may be required by law in some states.

- Vehicle Registration: This document proves ownership of your vehicle and must be kept updated with your state’s Department of Motor Vehicles.

- Accident Report Form: If an accident occurs, this form helps document the details of the incident, including the parties involved and any damages incurred.

- Trailer Bill of Sale Form: This document is crucial when transferring ownership of a trailer, serving as proof of the sale and required for registration in many states. For more information, visit https://autobillofsaleform.com/trailer-bill-of-sale-form.

- Medical Release Form: If injuries are sustained during an accident, this form allows your insurance company to access your medical records for claims processing.

- Endorsement Forms: These forms modify your existing policy by adding or removing coverage options, vehicles, or drivers.

Having these documents readily available can streamline the process of managing your auto insurance. They ensure you are prepared for any situation that may arise, providing peace of mind while on the road.

Similar forms

The first document similar to the Auto Insurance Card is the Vehicle Registration Certificate. Like the insurance card, this document is essential for vehicle operation. It contains vital information, such as the vehicle identification number (VIN), the owner's name, and the registration expiration date. Both documents serve as proof of compliance with state regulations, ensuring that the vehicle is legally registered and insured. Drivers must keep this certificate in their vehicle and present it when requested by law enforcement.

Another comparable document is the Driver's License. This identification card not only confirms a person's ability to operate a vehicle but also includes personal information like the driver's name, address, and date of birth. Similar to the insurance card, a driver's license must be presented during traffic stops or accidents. Both documents are crucial for verifying a driver's identity and legal capacity to drive, reinforcing public safety on the roads.

The Proof of Insurance document is also akin to the Auto Insurance Card. This document outlines the specifics of the insurance coverage, including policy limits and the names of covered drivers. While the insurance card serves as a quick reference for basic information, the Proof of Insurance provides a more detailed overview of the policy. Both documents are often required to be shown during vehicle inspections or in the event of an accident, ensuring that drivers have the necessary coverage.

In the context of vehicle operation and legal documentation, it is crucial to recognize the importance of a Hold Harmless Agreement form, particularly for activities associated with vehicle use. This form serves to mitigate risks and protect parties involved in various transactions, much like how essential documents such as insurance cards and registration proof serve specific purposes. For further understanding of its implications, refer to the details available at https://nypdfforms.com.

Additionally, the Title Certificate shares similarities with the Auto Insurance Card. This document establishes ownership of the vehicle and includes details such as the VIN and the owner's name. While the insurance card verifies that a vehicle is insured, the title certificate confirms who legally owns it. Both documents are critical in the context of vehicle transactions, as they provide essential information to buyers and sellers alike.

Finally, the Bill of Sale can be considered similar to the Auto Insurance Card in that it documents the transfer of ownership from one party to another. This document includes details about the vehicle, such as the VIN, make, model, and sale price. Like the insurance card, the Bill of Sale is important in establishing legal rights and responsibilities regarding the vehicle. It is often required during the registration process and can serve as proof of purchase in case of disputes.

Dos and Don'ts

When filling out the Auto Insurance Card form, it’s important to ensure that all information is accurate and complete. Here are some guidelines to follow:

- Do double-check all the information you enter, including names, addresses, and policy numbers.

- Do keep the card in your vehicle at all times, as it must be presented upon demand in case of an accident.

- Do report any accidents to your insurance agent or company as soon as possible.

- Do include the effective and expiration dates of your policy on the form.

- Don't leave any fields blank; incomplete forms can lead to issues later.

- Don't forget to check the back of the card for important notices and instructions.

Key takeaways

When filling out and using the Auto Insurance Card form, consider the following key takeaways:

- Keep it in the vehicle: Always store the insurance card in the insured vehicle. This ensures you have it on hand when needed.

- Present upon demand: Be prepared to show the card if requested during an accident or traffic stop.

- Report accidents promptly: Notify your insurance agent or company about any accidents as soon as possible.

- Gather information: In the event of an accident, collect names and addresses of all drivers, passengers, and witnesses involved.

- Insurance details: Record the name of the insurance company and the policy number for each vehicle involved in an accident.

- Check the card details: Ensure that the company number, policy number, effective date, and expiration date are all correctly filled out.

- Vehicle information: Include the year, make, and model of the vehicle, along with the Vehicle Identification Number (VIN).

- Agency information: Note the agency or company that issued the card for reference.

- Watermark feature: The front of the document contains an artificial watermark; hold it at an angle to view it clearly.

Understanding these points can help ensure that you are prepared and compliant while driving.

How to Use Auto Insurance Card

Filling out your Auto Insurance Card form is straightforward. Once completed, you'll have all the necessary information ready for your vehicle. This card must be kept in your car and shown if you're ever in an accident. Let’s get started on the steps to fill out the form.

- Locate the INSURANCE IDENTIFICATION CARD section at the top of the form.

- Fill in the COMPANY NUMBER. This number is provided by your insurance company.

- Next, enter your COMPANY POLICY NUMBER. This is unique to your insurance policy.

- Input the EFFECTIVE DATE of your policy. This is when your coverage begins.

- Fill in the EXPIRATION DATE. This indicates when your policy ends.

- Provide the YEAR of your vehicle.

- Enter the MAKE/MODEL of your vehicle. This identifies your car.

- Next, find the VEHICLE IDENTIFICATION NUMBER (VIN) and write it down. This number is unique to your vehicle.

- Fill in the AGENCY/COMPANY ISSUING CARD. This is the name of your insurance provider.

- Review all the information to ensure accuracy before finalizing.

Once you’ve completed these steps, keep the card in your vehicle. You’ll be prepared to show it if needed. Remember to report any accidents to your insurance agent promptly.