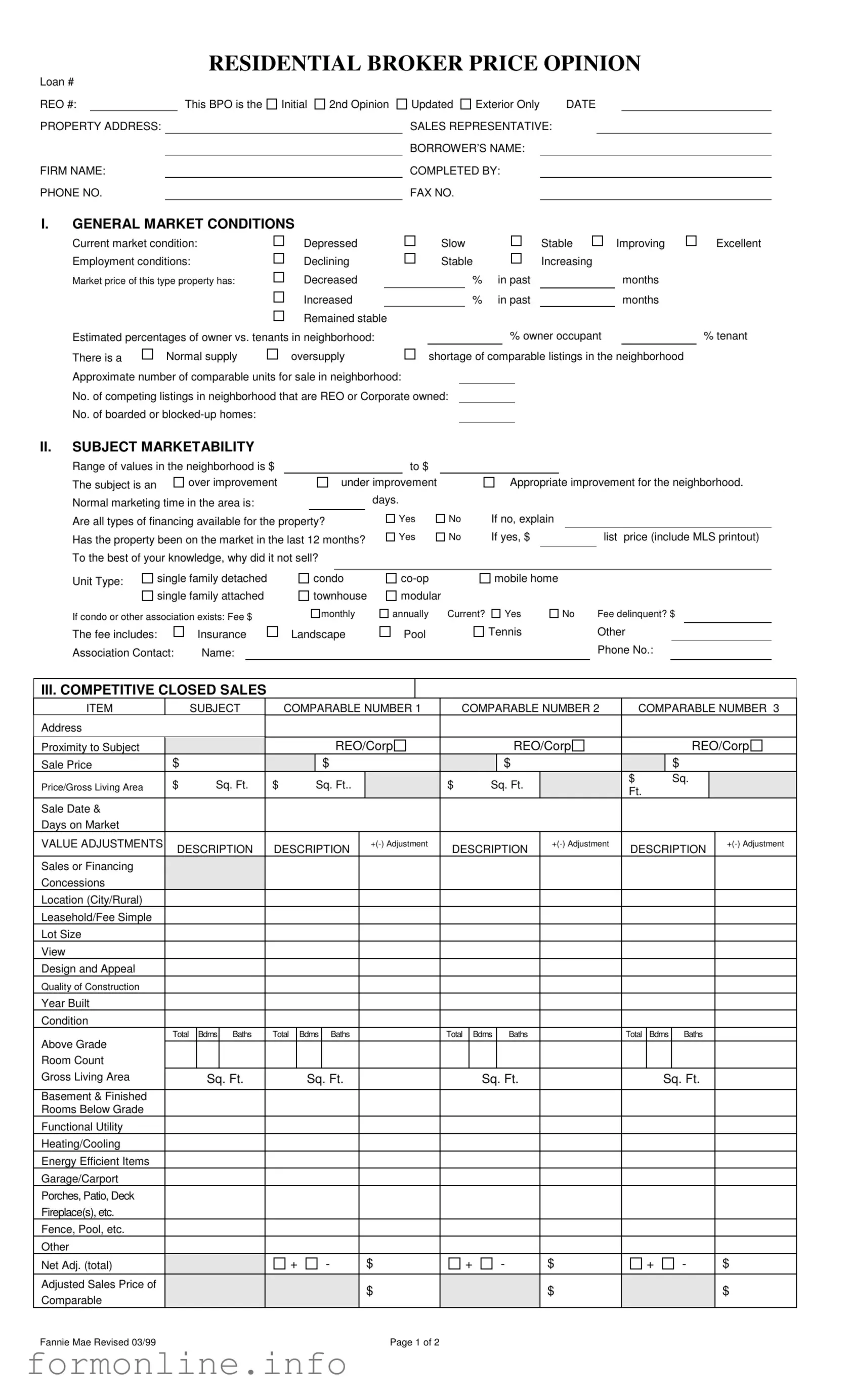

Fill Out a Valid Broker Price Opinion Form

The Broker Price Opinion (BPO) form is an essential tool used in the real estate industry to assess property values. This form provides a structured way for real estate professionals to evaluate market conditions and the specific characteristics of a property. Key sections of the BPO include general market conditions, which outline the current state of the market, employment trends, and the supply of comparable listings. Additionally, the form addresses the marketability of the subject property, detailing its range of values and the types of financing available. It also includes information about competitive closed sales, allowing for a comparison with similar properties in the area. Another important aspect is the marketing strategy, which may involve recommendations for repairs to enhance the property’s appeal. The BPO culminates in a suggested market value and list price, taking into account various adjustments based on comparable sales. Overall, the BPO form serves as a comprehensive resource for determining property value and guiding sales strategies.

Common mistakes

-

Neglecting to Provide Accurate Property Address: Failing to fill in the correct property address can lead to confusion and miscommunication regarding the property being evaluated.

-

Ignoring Market Conditions: Not adequately assessing current market conditions can result in an inaccurate property valuation. The form requires a clear understanding of whether the market is depressed, stable, or improving.

-

Inaccurate Owner vs. Tenant Percentage: Misestimating the percentage of owner-occupants versus tenants in the neighborhood can skew the analysis of market demand and property value.

-

Omitting Comparable Sales: Failing to include relevant comparable sales can undermine the credibility of the Broker Price Opinion. It is essential to provide accurate data on nearby properties.

-

Neglecting to Document Repairs: Not itemizing necessary repairs can lead to an inflated or deflated property value. A clear list of repairs helps establish a more accurate marketable condition.

-

Forgetting to Include Financing Options: Indicating whether all types of financing are available is critical. Omitting this information can mislead potential buyers about their purchasing options.

-

Failure to Explain Reasons for Non-Sale: If the property has been on the market previously, not providing reasons for its failure to sell can hinder the evaluation process.

-

Incorrectly Assessing Marketing Time: Misjudging the normal marketing time in the area can affect the pricing strategy. Accurate estimates help in setting realistic expectations.

-

Not Updating the Form: Using outdated information or failing to update the form can lead to inaccuracies in the Broker Price Opinion. Regular updates are essential for reliable evaluations.

-

Overlooking Special Concerns: Ignoring specific issues like encroachments, easements, or environmental concerns can lead to significant valuation errors. These factors can greatly affect property value.

Preview - Broker Price Opinion Form

RESIDENTIAL BROKER PRICE OPINION

Loan #

REO #:This BPO is the

PROPERTY ADDRESS:

FIRM NAME:

PHONE NO.

Initial

2nd Opinion

Updated Exterior Only |

DATE |

|||

SALES REPRESENTATIVE: |

|

|

|

|

BORROWER’S NAME: |

|

|

|

|

COMPLETED BY: |

|

|

|

|

FAX NO. |

|

|

|

|

I.GENERAL MARKET CONDITIONS

Current market condition: |

Depressed |

Slow |

|

Stable |

Improving |

||

Employment conditions: |

Declining |

Stable |

|

Increasing |

|

||

Market price of this type property has: |

Decreased |

|

|

% |

in past |

|

months |

|

Increased |

|

|

% |

in past |

|

months |

|

Remained stable |

|

|

|

|

|

|

Estimated percentages of owner vs. tenants in neighborhood: |

|

|

% owner occupant |

|

|||

There is a |

Normal supply |

oversupply |

shortage of comparable listings in the neighborhood |

||||

Approximate number of comparable units for sale in neighborhood: |

|

|

|

|

|

||

No. of competing listings in neighborhood that are REO or Corporate owned:

No. of boarded or

Excellent

% tenant

II.SUBJECT MARKETABILITY

Range of values in the neighborhood is $ |

|

|

|

|

|

to $ |

|

|

|

|

|

|

|

|

The subject is an |

over improvement |

|

|

under improvement |

|

Appropriate improvement for the neighborhood. |

||||||||

Normal marketing time in the area is: |

|

|

|

|

days. |

|

|

|

|

|

|

|||

Are all types of financing available for the property? |

Yes |

No |

If no, explain |

|

|

|

||||||||

Has the property been on the market in the last 12 months? |

Yes |

No |

If yes, $ |

|

|

list price (include MLS printout) |

||||||||

To the best of your knowledge, why did it not sell? |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||||

Unit Type: |

single family detached |

|

condo |

|

mobile home |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

single family attached |

|

townhouse |

modular |

|

|

|

|

|

|

||||

If condo or other association exists: Fee $

monthly

annually Current?

Yes

No |

Fee delinquent? $ |

The fee includes:

Association Contact:

Insurance

Name:

Landscape

Pool

Tennis |

Other |

|

Phone No.: |

III. COMPETITIVE CLOSED SALES

ITEM |

|

|

SUBJECT |

|

COMPARABLE NUMBER 1 |

|

COMPARABLE NUMBER 2 |

|

COMPARABLE NUMBER 3 |

|||||||||||||||||||||||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proximity to Subject |

|

|

|

|

|

|

|

|

|

|

REO/Corp |

|

|

|

|

|

|

REO/Corp |

|

|

|

|

|

REO/Corp |

||||||||

Sale Price |

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|||

Price/Gross Living Area |

$ |

|

Sq. Ft. |

$ |

|

Sq. Ft.. |

|

|

$ |

|

|

Sq. Ft. |

|

|

$ |

|

|

|

Sq. |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

Ft. |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Sale Date & |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Days on Market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VALUE ADJUSTMENTS |

|

DESCRIPTION |

|

DESCRIPTION |

|

|

DESCRIPTION |

|

DESCRIPTION |

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

Sales or Financing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Concessions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location (City/Rural) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leasehold/Fee Simple |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lot Size |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

View |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Design and Appeal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quality of Construction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Built |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condition |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

Bdms |

Baths |

|

Total |

Bdms |

|

Baths |

|

|

|

Total |

|

Bdms |

|

Baths |

|

|

Total |

Bdms |

Baths |

|

|

|

||||||

Above Grade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Room Count |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Living Area |

|

|

|

Sq. Ft. |

|

|

Sq. Ft. |

|

|

|

|

|

|

Sq. Ft. |

|

|

|

|

|

Sq. Ft. |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basement & Finished |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rooms Below Grade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Functional Utility |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Heating/Cooling |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Efficient Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Garage/Carport |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Porches, Patio, Deck |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fireplace(s), etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fence, Pool, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Adj. (total) |

|

|

|

|

|

+ |

- |

|

|

$ |

|

+ |

- |

|

$ |

|

+ |

|

|

- |

|

$ |

|

|||||||||

Adjusted Sales Price of |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

Comparable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fannie Mae Revised 03/99 |

|

|

|

|

|

|

|

|

|

|

|

|

Page 1 of 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REO# |

Loan # |

IV. MARKETING STRATEGY

Minimal Lender Required Repairs |

V. REPAIRS

Occupancy Status: Occupied

Repaired Most Likely Buyer:

Vacant

Unknown

Unknown

Owner occupant

Investor

Investor

Itemize ALL repairs needed to bring property from its present “as is” condition to average marketable condition for the neighborhood. Check those repairs you recommend that we perform for most successful marketing of the property.

$

$

$

$

$

$

$

$

$

$

|

|

|

|

GRAND TOTAL FOR ALL REPAIRS $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VI. COMPETITIVE LISTINGS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

ITEM |

|

|

SUBJECT |

COMPARABLE NUMBER 1 |

COMPARABLE NUMBER. 2 |

COMPARABLE NUMBER. 3 |

|||||||||||||||||||||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proximity to Subject |

|

|

|

|

|

REO/Corp |

|

|

|

|

|

REO/Corp |

|

|

REO/Corp |

||||||||||||

List Price |

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

||

Price/Gross Living Area |

$ |

|

Sq.Ft. |

$ |

Sq.Ft. |

|

|

|

$ |

Sq.Ft. |

|

|

|

$ |

Sq.Ft. |

|

|

||||||||||

Data and/or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Verification Sources |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VALUE ADJUSTMENTS |

|

DESCRIPTION |

DESCRIPTION |

|

+ |

DESCRIPTION |

|

DESCRIPTION |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales or Financing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Concessions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Days on Market and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date on Market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location (City/Rural) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leasehold/Fee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Simple |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lot Size |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

View |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Design and Appeal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quality of Construction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Built |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condition |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Above Grade |

Total |

Bdms |

Baths |

Total |

Bdms |

Baths |

|

|

|

Total |

Bdms |

|

Baths |

|

Total |

Bdms |

|

Baths |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Room Count |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Living Area |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Sq. Ft. |

|

Sq. Ft. |

|

|

|

Sq. Ft. |

|

|

|

Sq. Ft. |

|

|

|||||||||||||

Basement & Finished |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rooms Below Grade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Functional Utility |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Heating/Cooling |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Efficient Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Garage/Carport |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Porches, Patio, Deck |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fireplace(s), etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fence, Pool, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Net Adj. (total) |

|

|

|

|

+ |

- |

|

|

|

$ |

|

|

+ |

- |

- |

|

$ |

|

|

+ |

- |

|

$ |

|

|

||

Adjusted Sales Price |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

of Comparable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VI. THE MARKET VALUE (The value must fall within the indicated value of the Competitive Closed Sales).

Market Value |

Suggested List Price |

AS IS REPAIRED

30 Quick Sale Value

Last Sale of Subject, Price |

Date |

COMMENTS (Include specific positives/negatives, special concerns, encroachments, easements, water rights, environmental concerns, flood zones, etc. Attach addendum if additional space is needed.)

Signature: |

|

Date: |

Fannie Mae Revised 03/99 |

Page 2 of 2 |

CMS Publishing Company 1 800 |

Other PDF Templates

How to Fill Out a Bill of Lading - It serves as both a receipt for the goods and a shipping contract.

A Georgia Non-disclosure Agreement (NDA) is a legally binding contract designed to protect confidential information shared between parties. This agreement ensures that sensitive data remains private and is not disclosed to unauthorized individuals. To safeguard your interests, consider filling out the form by clicking the button below or visiting https://georgiapdf.com for more information.

Miscarriage Bleeding at 8 Weeks - This form encompasses medical, legal, and emotional aspects of a miscarriage.

Documents used along the form

The Broker Price Opinion (BPO) form is a crucial document in real estate transactions, especially for assessing property values. Along with the BPO, several other forms and documents are often utilized to provide a comprehensive overview of the property and its market conditions. Here are five common documents that accompany the BPO.

- Comparative Market Analysis (CMA): A CMA provides a detailed analysis of similar properties that have recently sold in the area. It helps in determining a fair market value for the property by comparing it with others that have similar features, sizes, and locations.

- North Carolina Motor Vehicle Bill of Sale: This legal document is essential for the transfer of ownership of a vehicle in North Carolina, providing necessary details about the transaction. For more information, you can visit https://autobillofsaleform.com/north-carolina-motor-vehicle-bill-of-sale-form/.

- Property Inspection Report: This report outlines the condition of the property. It includes details about any repairs needed and highlights any potential issues that could affect the property's value. This information is vital for both buyers and sellers.

- Listing Agreement: A listing agreement is a contract between the property owner and a real estate broker. It outlines the terms under which the broker will market the property and the commission structure. This document is essential for formalizing the relationship between the seller and the broker.

- Seller Disclosure Statement: This document requires the seller to disclose any known issues or defects with the property. It protects buyers by ensuring they are aware of any problems before making a purchase decision.

- Appraisal Report: An appraisal report is conducted by a licensed appraiser to determine the property's market value. It includes an in-depth analysis of the property and the local market, providing a professional opinion on its worth.

These documents, when used alongside the Broker Price Opinion form, create a more complete picture of the property's marketability and value. Understanding each document's role can help all parties involved make informed decisions.

Similar forms

The Comparative Market Analysis (CMA) is a document often used by real estate agents to determine the value of a property based on the sale prices of similar properties in the area. Like the Broker Price Opinion (BPO), a CMA evaluates market conditions and comparable sales, providing insights into pricing strategies. However, a CMA is typically more detailed and may include a broader range of properties, making it a valuable tool for both buyers and sellers to understand the market landscape.

The Appraisal Report is another document that shares similarities with the BPO. An appraisal is conducted by a licensed appraiser and provides a professional opinion of a property's value. Both documents assess property conditions and market trends. However, an appraisal is more formal and often required by lenders for financing, while a BPO is generally used for internal purposes by banks or real estate professionals.

The Property Condition Report (PCR) focuses specifically on the physical aspects of a property. It details the condition of various components, such as the roof, plumbing, and electrical systems. While a BPO includes some evaluation of property condition, the PCR is more comprehensive in identifying needed repairs and maintenance issues, which can significantly impact marketability and pricing.

The Listing Agreement is a contract between a seller and a real estate agent that outlines the terms of the property listing. Similar to the BPO, it considers market conditions and pricing strategies. However, the Listing Agreement formalizes the relationship between the seller and agent, whereas a BPO is more of an informal assessment of value without establishing such a contract.

The Seller's Disclosure Statement is a document that sellers complete to disclose known issues with the property. This statement complements the BPO by providing additional context about the property's condition and any potential problems. While the BPO offers a market value estimate, the Seller's Disclosure focuses on transparency regarding the property's physical state, which can influence buyer decisions.

The Lease Agreement is a document that outlines the terms under which a property is rented. While it serves a different purpose than a BPO, both documents consider market conditions. A Lease Agreement may reflect current rental prices based on market analysis, similar to how a BPO assesses property values for sale. Understanding rental trends can also inform pricing strategies for properties on the market.

The Market Analysis Report (MAR) provides a broader overview of market trends, including supply and demand dynamics, economic indicators, and demographic data. While a BPO focuses on a specific property, the MAR takes a wider lens to assess market conditions. Both documents aim to inform stakeholders, but the MAR is more comprehensive in its analysis of market forces affecting property values.

In the realm of mobile home transactions, one essential document to be aware of is the Mobile Home Bill of Sale, which serves as a formal agreement detailing the transfer of ownership. This document is crucial for outlining the specifics of the mobile home in question, ensuring that both the buyer and seller have a clear understanding of the terms and conditions surrounding the sale. Properly utilizing this bill of sale helps in minimizing disputes and providing legal protection for both parties involved in the transaction.

The Investment Property Analysis Report is geared toward investors looking to evaluate the potential return on investment for a property. Similar to a BPO, it assesses market conditions and comparable sales. However, this report delves deeper into financial metrics, such as cash flow and capitalization rates, providing investors with the necessary data to make informed decisions about property acquisitions.

The Title Report outlines the legal ownership and any encumbrances on a property. While it does not directly assess market value, it complements the BPO by ensuring that the property is free from legal issues that could affect its sale. Both documents work together to provide a complete picture of the property, with the BPO focusing on value and the Title Report addressing ownership clarity.

The Rent Roll is a document that lists all rental properties owned by an investor, detailing the rental income generated. While it serves a different purpose than a BPO, both documents can inform decisions about property value. The Rent Roll provides insights into income potential, which can influence how a property is priced for sale, particularly in investment scenarios.

Dos and Don'ts

When filling out the Broker Price Opinion (BPO) form, it is crucial to approach the task with care and attention to detail. Here’s a list of things you should and shouldn’t do to ensure the form is completed accurately and effectively.

- Do provide accurate and complete information.

- Do check the current market conditions and employment status before making assessments.

- Do ensure that all comparable sales data is up to date and relevant to the property in question.

- Do clearly indicate the condition of the property and any necessary repairs.

- Do include all necessary contact information for follow-up questions.

- Don’t make assumptions without supporting data.

- Don’t overlook the importance of providing a thorough market analysis.

By following these guidelines, you can help ensure that the Broker Price Opinion form is filled out correctly, which can lead to a more accurate valuation of the property.

Key takeaways

Filling out and using a Broker Price Opinion (BPO) form is a crucial task for real estate professionals. Here are key takeaways to consider:

- Understand Market Conditions: Assess current market conditions, including employment trends and supply-demand dynamics.

- Evaluate Property Marketability: Determine the range of values for similar properties in the neighborhood and identify any over or under improvements.

- Analyze Comparable Sales: Use comparable properties to establish a fair market value, adjusting for differences in features and conditions.

- Document Repairs Needed: Clearly itemize necessary repairs to bring the property to marketable condition, and estimate associated costs.

- Consider Financing Options: Identify available financing types for the property and note any limitations that may affect buyer interest.

- Review Marketing Strategy: Choose an appropriate marketing strategy, whether selling as-is or after repairs.

- Include Relevant Comments: Provide detailed notes on the property, including any special concerns or issues that may impact its value.

- Keep Records Accurate: Ensure all data entered is precise, as inaccuracies can lead to mispricing and lost opportunities.

- Signature and Date: Always sign and date the BPO to validate the report and establish accountability.

How to Use Broker Price Opinion

Completing the Broker Price Opinion (BPO) form is an essential step in assessing the value of a property. This process requires careful attention to detail to ensure accurate information is provided. Follow these steps to fill out the form correctly.

- Enter the Loan # and REO # at the top of the form.

- Fill in the PROPERTY ADDRESS.

- Provide your FIRM NAME and PHONE NO..

- Indicate if this is an Initial, 2nd Opinion, or Updated BPO, and whether it is Exterior Only.

- Write the DATE of completion.

- List the SALES REPRESENTATIVE and BORROWER’S NAME.

- Include your name in the COMPLETED BY section and provide your FAX NO..

Next, move to the GENERAL MARKET CONDITIONS section. Here, you will assess the current market conditions and provide relevant details.

- Choose the current market condition: Depressed, Slow, Stable, or Improving.

- Indicate the Employment conditions as Declining, Stable, or Increasing.

- State the market price change: Decreased, Increased, or Remained stable.

- Estimate the percentage of owner occupants in the neighborhood.

- Describe the supply of comparable listings as Normal, Oversupply, or Shortage.

- Provide the approximate number of comparable units for sale in the neighborhood.

- List the number of competing listings that are REO or Corporate owned.

- Indicate the number of boarded or blocked-up homes.

- Assess the percentage of tenants in the area.

Proceed to the SUBJECT MARKETABILITY section. Here, you will evaluate the specific property.

- Provide the range of values in the neighborhood.

- Determine if the subject property is an over improvement, under improvement, or appropriate improvement.

- Estimate the normal marketing time in days.

- Specify if all types of financing are available for the property. Answer Yes or No.

- If financing is not available, explain why.

- Indicate if the property has been on the market in the last 12 months. Answer Yes or No.

- If it has been on the market, provide the list price.

- To the best of your knowledge, explain why it did not sell.

- Select the Unit Type from the options provided.

- If applicable, provide the association fee and whether it is current or delinquent.

Next, move to the COMPETITIVE CLOSED SALES section. This part requires detailed comparisons with similar properties.

- Fill in the details for COMPARABLE NUMBER 1, COMPARABLE NUMBER 2, and COMPARABLE NUMBER 3.

- Provide the address and proximity to the subject for each comparable.

- Indicate if each comparable is REO/Corp.

- Fill in the sale price and price per gross living area for each comparable.

- Note the sale date and days on market for each comparable.

- Make any necessary value adjustments based on the provided criteria.

- Calculate the adjusted sales price for each comparable.

Continue to the MARKETING STRATEGY section. Here, you will outline the approach for selling the property.

- Select the marketing strategy: As-is or Minimal Lender Required Repairs.

In the REPAIRS section, you will detail any necessary repairs.

- Indicate the occupancy status of the property.

- Identify the most likely buyer type.

- Itemize all repairs needed to bring the property to average marketable condition.

- Check the repairs you recommend for successful marketing.

- Calculate the grand total for all repairs.

Next, fill out the COMPETITIVE LISTINGS section, comparing the subject property to similar listings.

- Fill in details for COMPARABLE NUMBER 1, COMPARABLE NUMBER 2, and COMPARABLE NUMBER 3.

- Provide the list price and price per gross living area for each comparable.

- Make any necessary value adjustments.

- Note the days on market and location for each comparable.

- Provide details on the condition, room count, and gross living area.

- Calculate the adjusted sales price for each comparable.

Finally, complete the MARKET VALUE section. Here, you will summarize your assessment.

- Provide the market value and suggested list price for both AS IS and REPAIRED.

- Indicate the quick sale value and details of the last sale of the subject property.

- Include any comments regarding positives, negatives, or concerns related to the property.

- Sign and date the form.