Printable Business Bill of Sale Form

The Business Bill of Sale form serves as a crucial document in the transfer of ownership for a business or its assets. This form outlines essential details such as the names and addresses of the buyer and seller, a description of the business being sold, and the agreed purchase price. It also specifies the terms of the sale, including any warranties or representations made by the seller regarding the condition of the business assets. By documenting these key aspects, the form helps protect both parties in the transaction and provides a clear record of the sale. Additionally, it may include provisions for the transfer of licenses, permits, and other necessary documentation, ensuring a smooth transition of ownership. Understanding the components of this form is vital for anyone involved in buying or selling a business, as it lays the foundation for a legally binding agreement.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all necessary details. This includes not only the names and addresses of the buyer and seller but also the specific business assets being sold. Leaving out crucial information can lead to disputes later on.

-

Incorrect Asset Valuation: Accurately valuing the business assets is essential. Underestimating or overestimating their worth can affect the sale price and lead to tax complications. It's important to conduct a thorough assessment before filling out the form.

-

Missing Signatures: Both parties must sign the Bill of Sale for it to be legally binding. Forgetting to obtain a signature from either the buyer or the seller can render the document invalid, resulting in potential legal issues down the line.

-

Failure to Include Terms of Sale: The Bill of Sale should clearly outline the terms of the sale, including payment methods and any contingencies. Omitting these details can lead to misunderstandings and disputes, particularly if the sale does not go as planned.

-

Not Consulting Legal Advice: Many individuals attempt to fill out the form without seeking legal guidance. This can lead to mistakes that may have been avoided with professional input. Consulting an attorney can provide clarity on the legal implications of the sale.

-

Ignoring State Requirements: Each state has specific requirements for a Bill of Sale. Failing to adhere to these regulations can invalidate the document. It’s crucial to check local laws to ensure compliance and avoid future complications.

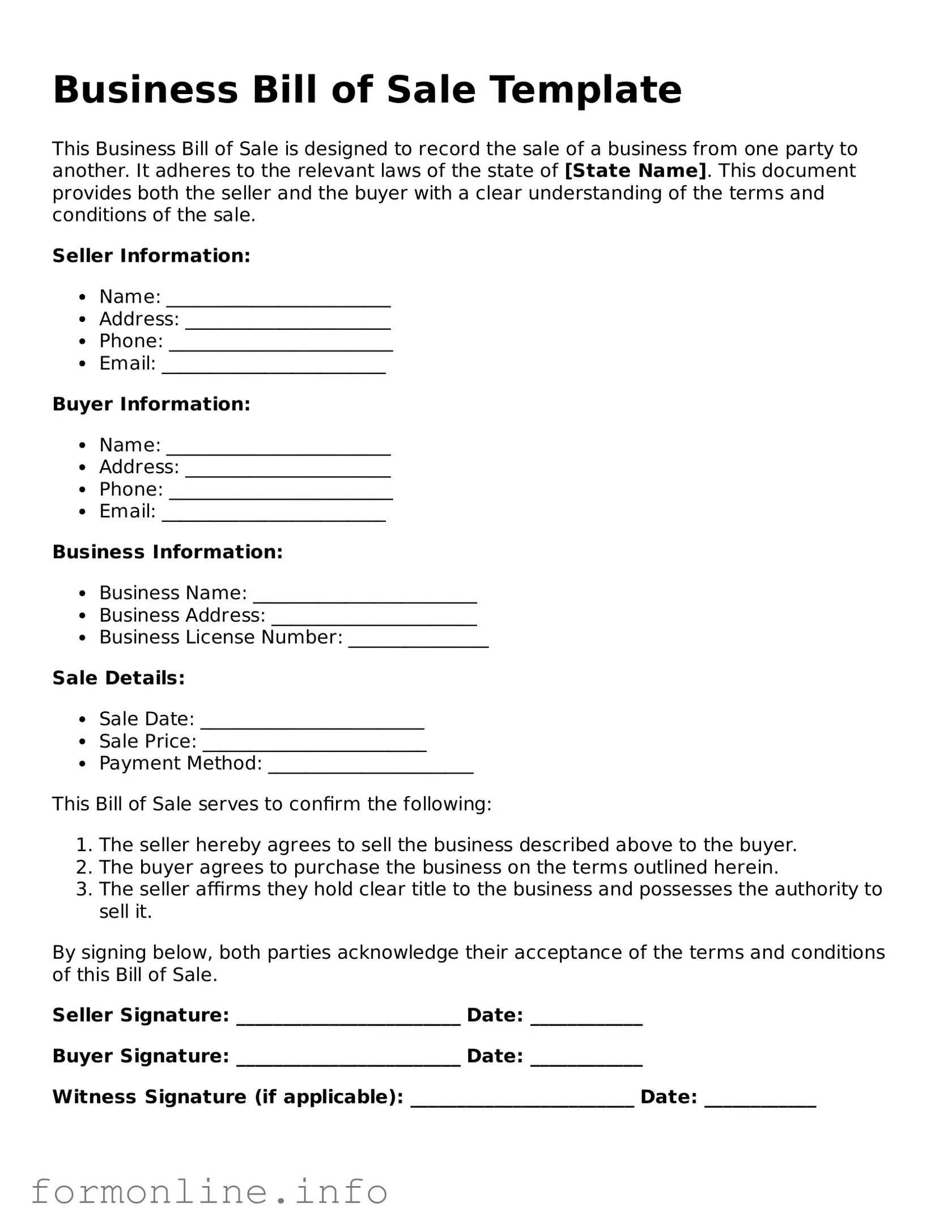

Preview - Business Bill of Sale Form

Business Bill of Sale Template

This Business Bill of Sale is designed to record the sale of a business from one party to another. It adheres to the relevant laws of the state of [State Name]. This document provides both the seller and the buyer with a clear understanding of the terms and conditions of the sale.

Seller Information:

- Name: ________________________

- Address: ______________________

- Phone: ________________________

- Email: ________________________

Buyer Information:

- Name: ________________________

- Address: ______________________

- Phone: ________________________

- Email: ________________________

Business Information:

- Business Name: ________________________

- Business Address: ______________________

- Business License Number: _______________

Sale Details:

- Sale Date: ________________________

- Sale Price: ________________________

- Payment Method: ______________________

This Bill of Sale serves to confirm the following:

- The seller hereby agrees to sell the business described above to the buyer.

- The buyer agrees to purchase the business on the terms outlined herein.

- The seller affirms they hold clear title to the business and possesses the authority to sell it.

By signing below, both parties acknowledge their acceptance of the terms and conditions of this Bill of Sale.

Seller Signature: ________________________ Date: ____________

Buyer Signature: ________________________ Date: ____________

Witness Signature (if applicable): ________________________ Date: ____________

More Types of Business Bill of Sale Templates:

Golf Cart Bill of Sale Pdf - Ensures clarity in the sale of a golf cart.

For those navigating personal sales, a crucial resource is the detailed New York bill of sale document, which can help clarify the transaction process. You can find valuable information at a reliable New York bill of sale guide.

Handgun Bill of Sale - Encourages accurate reporting of firearm characteristics.

Documents used along the form

A Business Bill of Sale form is a document that records the transfer of ownership of a business or its assets from one party to another. Along with this form, several other documents are commonly used to ensure a smooth transaction. Below is a list of such documents, each described briefly.

- Asset Purchase Agreement: This document outlines the terms and conditions of the sale, including the specific assets being sold, the purchase price, and any warranties or representations made by the seller.

- Non-Disclosure Agreement (NDA): An NDA protects sensitive information shared between the buyer and seller during the negotiation process. It ensures that confidential business information remains private.

- Bill of Sale for Equipment: If the business includes equipment, this document details the transfer of ownership for specific items. It includes descriptions and serial numbers to identify the equipment being sold.

- Assignment of Contracts: This document transfers existing contracts from the seller to the buyer. It ensures that the buyer can continue to operate the business under the same agreements previously held by the seller.

- RV Bill of Sale: Essential for the transfer of ownership of a recreational vehicle, this document serves as proof of purchase and details the transaction between parties. For more information, visit autobillofsaleform.com/rv-bill-of-sale-form/arizona-rv-bill-of-sale-form.

- Closing Statement: A closing statement summarizes the financial aspects of the transaction. It includes details such as the purchase price, any adjustments, and the final amounts due at closing.

These documents play a crucial role in facilitating the sale and protecting the interests of both parties involved. Each serves a specific purpose in the overall transaction process.

Similar forms

The Business Purchase Agreement is a document that outlines the terms and conditions under which a business is sold. Similar to the Business Bill of Sale, it details the assets being transferred, the purchase price, and the responsibilities of both the buyer and the seller. This agreement is more comprehensive, often including warranties and representations about the business, which helps protect both parties involved in the transaction.

The Asset Purchase Agreement is another document closely related to the Business Bill of Sale. This agreement specifically focuses on the sale of individual assets rather than the entire business entity. It provides clarity on which assets are being sold, such as equipment, inventory, and intellectual property. Like the Business Bill of Sale, it requires both parties to agree on the purchase price and the terms of the sale.

In addition to the various agreements outlined, it is important to recognize that the Virginia Mobile Home Bill of Sale serves a vital role in the realm of mobile home ownership, providing necessary legal documentation for the transfer of ownership. This form not only includes the buyer's and seller's details but also entails a description of the mobile home and the sale price, thus ensuring clarity in the transaction. For more information and to access the form, you can visit the Mobile Home Bill of Sale website.

The Uniform Commercial Code (UCC) Financing Statement serves a different purpose but is often used in conjunction with a Business Bill of Sale. This document is filed to provide public notice of a secured party's interest in the assets of a business. It protects the seller's rights in the event that the buyer defaults on payment. Both documents work together to ensure that the seller retains a claim to the assets until the purchase price is fully paid.

A Lease Agreement can also be similar to a Business Bill of Sale when it involves the transfer of business property. While a Bill of Sale transfers ownership, a Lease Agreement allows a buyer to use property without full ownership. Both documents outline the terms of use, payment obligations, and responsibilities of each party. They provide essential information to protect the interests of both the lessor and lessee.

The Non-Disclosure Agreement (NDA) is another document that can accompany a Business Bill of Sale, particularly during the sale process. While the Bill of Sale focuses on the transfer of ownership, the NDA protects sensitive information shared between the buyer and seller. This agreement ensures that proprietary information remains confidential, fostering trust and safeguarding business interests during negotiations.

Finally, the Operating Agreement is relevant for businesses structured as limited liability companies (LLCs). While the Business Bill of Sale deals with the sale of the business, the Operating Agreement outlines the management structure and operational procedures of the LLC. Both documents are crucial for ensuring a smooth transition of ownership and clarifying the roles and responsibilities of the new owner.

Dos and Don'ts

When filling out the Business Bill of Sale form, it is crucial to follow specific guidelines to ensure accuracy and legality. Here’s a list of things you should and shouldn’t do:

- Do: Provide complete and accurate information about the business being sold.

- Do: Include the names and contact information of both the buyer and seller.

- Do: Clearly describe the assets being sold, including any equipment or inventory.

- Do: Specify the purchase price and payment terms in detail.

- Do: Sign and date the document to validate the agreement.

- Don't: Leave any sections blank; incomplete forms can lead to disputes.

- Don't: Use vague language; clarity is essential to avoid misunderstandings.

- Don't: Forget to check for typos or errors before submitting the form.

- Don't: Neglect to consult with a legal professional if you have questions.

Key takeaways

When filling out and using the Business Bill of Sale form, keep the following key points in mind:

- Understand the Purpose: The Business Bill of Sale serves as a legal document that records the transfer of ownership of a business or its assets.

- Gather Necessary Information: Collect all relevant details about the business, including the names of the buyer and seller, business name, and description of assets being sold.

- Be Clear and Specific: Clearly outline what is included in the sale. This may consist of equipment, inventory, or intellectual property.

- Include Purchase Price: Clearly state the agreed-upon purchase price for the business or its assets to avoid any misunderstandings.

- Document Payment Terms: Specify how and when the payment will be made. This can include upfront payments or installment plans.

- Consider Legal Requirements: Check local and state regulations to ensure compliance with any legal requirements related to the sale.

- Signatures Matter: Both the buyer and seller should sign the document to make it legally binding. Consider having a witness or notary if necessary.

- Keep Copies: After signing, both parties should keep copies of the Business Bill of Sale for their records.

- Consult Professionals: If unsure about any part of the process, consult with a legal or financial professional for guidance.

By following these takeaways, individuals can navigate the process of completing a Business Bill of Sale more effectively.

How to Use Business Bill of Sale

Completing the Business Bill of Sale form is a crucial step in transferring ownership of a business. Once you have gathered the necessary information, you can proceed with filling out the form accurately to ensure a smooth transaction.

- Identify the Seller: Enter the full legal name of the seller, including any business entity details if applicable.

- Identify the Buyer: Fill in the full legal name of the buyer, ensuring that any business information is included.

- Describe the Business: Provide a detailed description of the business being sold. Include its name, location, and any relevant identifiers.

- List Assets Included: Clearly outline all assets being transferred in the sale. This may include equipment, inventory, and intellectual property.

- State the Sale Price: Write the total purchase price agreed upon for the business. Be clear and precise.

- Payment Terms: Specify the payment method and any terms regarding payment plans or deposits.

- Signatures: Ensure both the seller and buyer sign the document. Include the date of signing for record-keeping.

- Witness or Notary: If required, have a witness or notary public sign the document to validate the transaction.

After completing the form, make sure to keep copies for both parties. This documentation is vital for future reference and legal protection.