Fill Out a Valid Business Credit Application Form

When embarking on the journey of establishing or expanding a business, securing credit can be a pivotal step toward achieving financial stability and growth. A Business Credit Application form serves as a crucial tool in this process, allowing businesses to present their financial health and creditworthiness to potential lenders or suppliers. This form typically encompasses several key components, including the business's legal name, address, and structure, as well as details about ownership and management. Financial information is also vital; applicants usually need to provide insights into their revenue, expenses, and existing debts. Additionally, references from other creditors or suppliers may be requested to further bolster the application. By thoroughly completing this form, businesses not only demonstrate their professionalism but also set the stage for building lasting relationships with financial partners. Understanding each section of the application can empower business owners to present their best case for credit, ultimately paving the way for future opportunities.

Common mistakes

-

Incomplete Information: Many applicants fail to provide all required details. Leaving sections blank can lead to delays or outright rejection.

-

Incorrect Business Name: Using an incorrect or informal name can cause confusion. Always use the legal name of the business as registered.

-

Wrong Tax Identification Number: Entering an incorrect tax ID can result in verification issues. Double-check this number for accuracy.

-

Inconsistent Financial Information: Providing conflicting data about income or debts can raise red flags. Ensure that all financial figures are consistent throughout the application.

-

Failure to Sign: Neglecting to sign the application can lead to immediate rejection. Always review the form for required signatures before submission.

-

Ignoring Terms and Conditions: Not reading the terms can lead to misunderstandings later. Applicants should understand the implications of the credit terms they are agreeing to.

-

Providing Outdated Information: Using old data, such as outdated contact information or financial statements, can misrepresent the current status of the business.

-

Not Disclosing Additional Owners: Failing to list all business owners can create trust issues. Full disclosure is important for transparency.

-

Overlooking Personal Guarantees: Some lenders may require personal guarantees. Not addressing this can complicate the approval process.

-

Neglecting to Review the Application: Submitting the application without a final review can lead to simple mistakes. Always proofread for errors before sending it off.

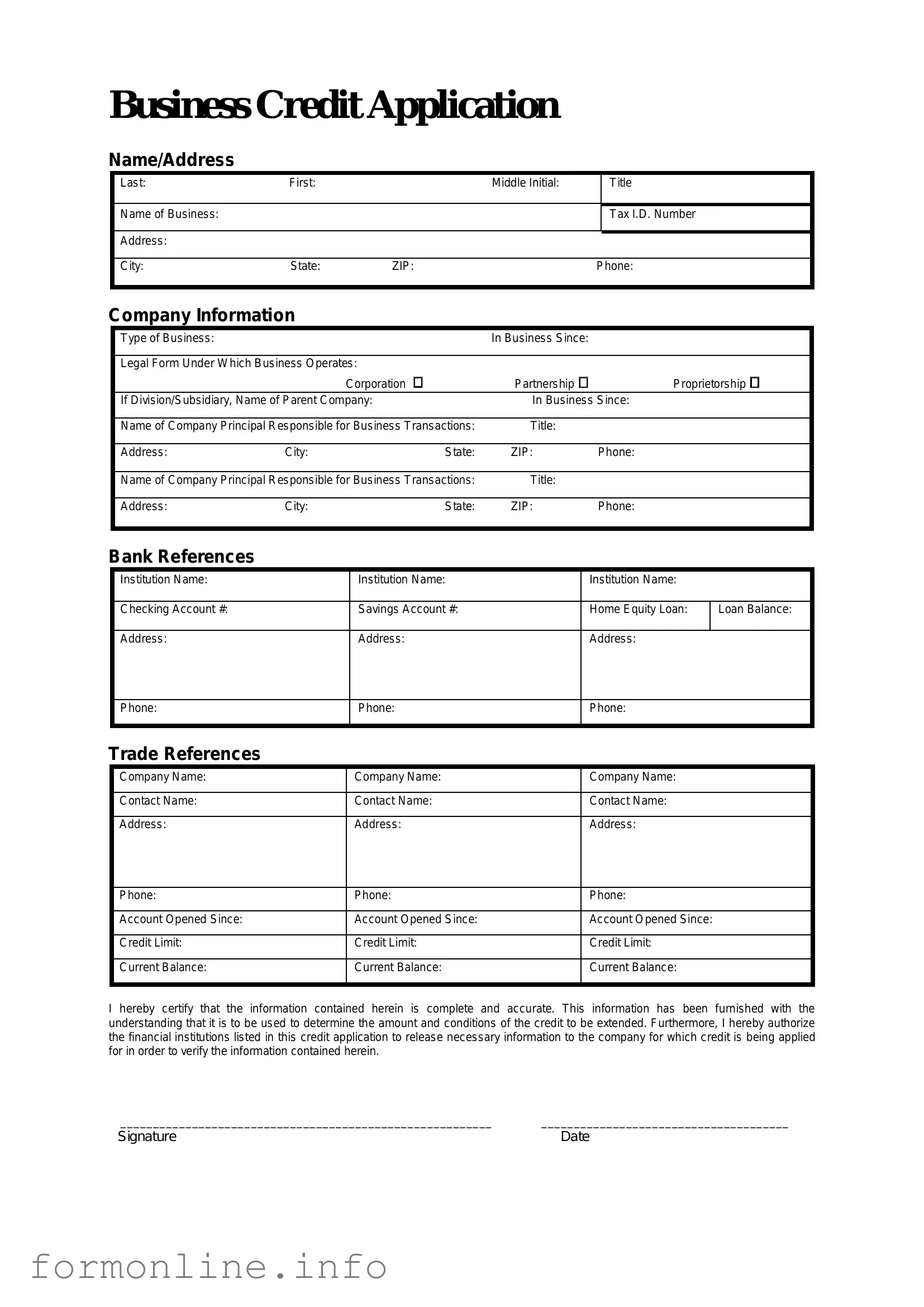

Preview - Business Credit Application Form

Business Credit Application

Name/Address

Last: |

First: |

|

Middle Initial: |

|

Title |

|

|

|

|

|

|

Name of Business: |

|

|

|

|

Tax I.D. Number |

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

City: |

State: |

ZIP: |

|

Phone: |

|

|

|

|

|

|

|

Company Information

|

Type of Business: |

|

|

|

In Business Since: |

|

|

|

|

|

|

|

|

|

|

||

|

Legal Form Under Which Business Operates: |

|

|

|

|

|||

|

|

|

Corporation |

Partnership |

Proprietorship |

|

||

|

If Division/Subsidiary, Name of Parent Company: |

In Business Since: |

|

|||||

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

|

|

Bank References |

|

|

|

|

|

|

|

|

|

Institution Name: |

|

|

Institution Name: |

|

Institution Name: |

||

|

|

|

|

|

|

|

|

|

|

Checking Account #: |

|

|

Savings Account #: |

|

Home Equity Loan: |

ILoan Balance: |

|

|

Address: |

|

|

Address: |

|

Address: |

|

|

Phone:

Phone:

Phone:

Trade References

Company Name: |

Company Name: |

Company Name: |

|

|

|

Contact Name: |

Contact Name: |

Contact Name: |

|

|

|

Address: |

Address: |

Address: |

|

|

|

Phone: |

Phone: |

Phone: |

|

|

|

Account Opened Since: |

Account Opened Since: |

Account Opened Since: |

|

|

|

Credit Limit: |

Credit Limit: |

Credit Limit: |

|

|

|

Current Balance: |

Current Balance: |

Current Balance: |

|

|

|

I hereby certify that the information contained herein is complete and accurate. This information has been furnished with the understanding that it is to be used to determine the amount and conditions of the credit to be extended. Furthermore, I hereby authorize the financial institutions listed in this credit application to release necessary information to the company for which credit is being applied for in order to verify the information contained herein.

_________________________________________________________ ______________________________________

Signature |

Date |

Other PDF Templates

Writing Daily Security Guard Log Book Sample - The form promotes diligent reporting of incidents like theft or vandalism.

Girlfriend Application Funny - Start your adventure toward finding someone who truly resonates with you!

For individuals considering the legal implications of health and financial decisions, understanding the significance of a Durable Power of Attorney for medical decisions can provide clarity and reassurance, ensuring that preferences are respected when one is unable to voice them.

Peco Philadelphia Phone Number - Fill in the electrician or contractor’s information clearly.

Documents used along the form

When applying for business credit, several other forms and documents often accompany the Business Credit Application form. Each of these documents serves a specific purpose and helps lenders assess the creditworthiness of your business. Understanding these forms can streamline the application process and enhance your chances of approval.

- Personal Guarantee: This document is typically required when the business is a new venture or lacks a substantial credit history. It holds the business owner personally responsible for the debt if the business fails to repay. This added assurance can make lenders more willing to extend credit.

- Business Plan: A well-crafted business plan outlines your business goals, strategies, and financial projections. Lenders may request this document to evaluate the viability of your business and understand how you plan to use the credit effectively.

- Last Will and Testament Form: When planning for the future, it's important to consider the comprehensive Last Will and Testament resources to ensure your wishes are documented properly.

- Financial Statements: These include balance sheets, income statements, and cash flow statements. Providing accurate and up-to-date financial statements helps lenders assess your business’s financial health and ability to repay the credit.

- Tax Returns: Often, lenders will request personal and business tax returns from the past few years. These documents provide a comprehensive view of your income and expenses, further informing the lender's decision-making process.

Incorporating these documents along with your Business Credit Application can significantly improve your application’s strength. Being prepared with the right paperwork not only demonstrates professionalism but also builds trust with potential lenders. Take the time to gather these forms, and you’ll be well on your way to securing the credit your business needs.

Similar forms

The Business Loan Application is similar to the Business Credit Application form in that both documents are used to assess a business's financial health and creditworthiness. A business loan application typically requests detailed information about the company's financial statements, credit history, and future projections. This information helps lenders determine whether to approve the loan and under what terms, much like how a credit application evaluates the risk of extending credit to a business.

The Vendor Credit Application serves a similar purpose by allowing suppliers to evaluate a business's creditworthiness before extending trade credit. This document usually requires information about the business's ownership, financial status, and payment history with other vendors. Both applications aim to mitigate risk for the creditor by gathering essential financial information about the applicant.

The Personal Guarantee form, while focused on individual credit, shares similarities with the Business Credit Application in that it often requires personal financial information from business owners. This document is typically signed by owners to guarantee the business's debts. Just as the Business Credit Application assesses the company’s ability to repay, the Personal Guarantee evaluates the owner's financial stability and commitment to the business's obligations.

The Business Financial Statement is another document that parallels the Business Credit Application. This statement provides a snapshot of the business's financial position, including assets, liabilities, and equity. Lenders and creditors use this information to gauge the company's overall financial health, similar to how they would analyze the data provided in a credit application.

The Trade Reference Request form is also akin to the Business Credit Application. This document seeks information from other businesses about the applicant's payment history and reliability. By gathering references, creditors can assess the applicant's creditworthiness and payment behavior, much like the evaluations made in a credit application.

The Credit Report, while not a form completed by the business, is essential in the credit evaluation process. It provides a comprehensive view of a business's credit history, including past loans, payment patterns, and outstanding debts. Creditors often rely on this report alongside the Business Credit Application to make informed decisions about extending credit.

In addition to these various forms, employers often need to verify previous employment when assessing candidates. This is where the Employment Verification form comes into play, serving as a vital tool to confirm job history and qualifications. To learn more about how to effectively implement this process, you can refer to Top Forms Online, which provides resources that simplify understanding the requirements and procedures associated with employment verification.

The Business Plan can also be compared to the Business Credit Application. A well-prepared business plan outlines the company's goals, strategies, and financial projections. Lenders may request a business plan to understand the applicant's vision and how they plan to manage their finances, which complements the information gathered in a credit application.

Lastly, the Partnership Agreement may relate to the Business Credit Application in scenarios where multiple owners are involved. This document outlines the roles, responsibilities, and financial commitments of each partner. Creditors may review this agreement to assess the stability and structure of the business, similar to how they evaluate the credit application for risk assessment.

Dos and Don'ts

When filling out a Business Credit Application form, there are some important dos and don'ts to keep in mind. Following these tips can help ensure a smooth process.

- Do provide accurate and complete information. This helps build trust with the lender.

- Do read the application carefully before submitting. Make sure you understand all the questions.

- Do include all required documents. Missing paperwork can delay your application.

- Do check your credit history beforehand. Knowing your score can help you prepare.

- Don't leave any sections blank. If something doesn't apply, write "N/A" instead.

- Don't exaggerate your business's income or assets. Honesty is crucial for approval.

By following these guidelines, you can make the application process easier and more effective.

Key takeaways

Filling out a Business Credit Application form is a crucial step for any business seeking credit. Here are some key takeaways to keep in mind:

- Accurate Information: Ensure that all information provided is accurate and up-to-date. Inaccuracies can lead to delays or denials.

- Business Structure: Clearly indicate your business structure, whether it’s a sole proprietorship, partnership, LLC, or corporation. This affects how credit is evaluated.

- Credit History: Be prepared to provide details about your business's credit history. Lenders will review this to assess risk.

- Financial Statements: Include recent financial statements. These documents provide insight into your business's financial health.

- References: List trade references or other creditors who can vouch for your payment history. This can strengthen your application.

- Personal Guarantee: Understand that many lenders may require a personal guarantee from the business owner. This means personal assets could be at risk.

- Review Terms: Carefully review the terms and conditions associated with the credit. Understand interest rates, payment terms, and any fees.

- Follow Up: After submission, follow up with the lender to confirm receipt and inquire about the timeline for a decision.

- Maintain Records: Keep a copy of the completed application and all supporting documents. This can be useful for future applications or disputes.

By following these guidelines, businesses can improve their chances of securing the credit they need to grow and succeed.

How to Use Business Credit Application

Once you have the Business Credit Application form in hand, it's important to fill it out accurately to ensure a smooth application process. This form typically requires various details about your business, including its structure, financial information, and credit history. Follow the steps below to complete the form effectively.

- Provide Business Information: Fill in the legal name of your business, the business address, and any additional contact information such as phone numbers and email addresses.

- Specify Business Structure: Indicate whether your business is a sole proprietorship, partnership, corporation, or LLC. This helps lenders understand your business's legal framework.

- List Owners and Officers: Include the names and titles of all owners and key officers. This section may also require their contact information and ownership percentages.

- Provide Financial Information: Enter your business's annual revenue, net profit, and any other relevant financial data. This information helps assess your business's financial health.

- Credit References: List at least three credit references. Include the names of the companies, contact persons, phone numbers, and account numbers if applicable.

- Sign and Date the Application: Ensure that the form is signed by an authorized representative of the business and include the date of signing. This confirms that the information provided is accurate and complete.

After completing the form, review all entries for accuracy. Once you are satisfied with the information, submit the application as instructed, either online or through the specified mailing address. This step is crucial for initiating the credit evaluation process.