Printable Business Purchase and Sale Agreement Form

When considering the transfer of ownership in a business, a Business Purchase and Sale Agreement (BPSA) serves as a vital tool to ensure a smooth and legally binding transaction. This comprehensive document outlines the terms and conditions under which a buyer acquires a business from a seller. Key aspects of the agreement include the purchase price, payment terms, and the assets being sold, which may encompass tangible items like equipment and inventory, as well as intangible assets such as trademarks and customer lists. Additionally, the BPSA addresses contingencies that may arise, including financing conditions and due diligence requirements, which protect both parties during the transaction process. Furthermore, it delineates representations and warranties made by the seller regarding the business's financial health and operational status, ensuring transparency and trust. By clearly defining the rights and obligations of each party, the Business Purchase and Sale Agreement not only facilitates the sale but also helps mitigate potential disputes, paving the way for a successful transition of ownership.

Common mistakes

-

Overlooking Details: Many individuals fail to read the entire agreement thoroughly. Important details can easily be missed, leading to misunderstandings later on.

-

Incorrect Valuation: Misjudging the value of the business can lead to either overpaying or underselling. It's crucial to conduct a proper valuation before filling out the form.

-

Neglecting Contingencies: Some people forget to include contingencies. These are conditions that must be met for the sale to proceed, such as securing financing or passing inspections.

-

Missing Signatures: It’s surprising how often signatures are overlooked. Ensure that all necessary parties sign the agreement to avoid any legal complications.

-

Ignoring Legal Obligations: Failing to comply with local laws and regulations can cause significant issues. Understanding the legal landscape is vital when completing the agreement.

-

Inadequate Disclosure: Not fully disclosing relevant information about the business can lead to trust issues. Transparency is key to a successful transaction.

-

Assuming Standard Clauses: Many believe that standard clauses are one-size-fits-all. Customizing terms to fit the specific transaction can prevent future disputes.

-

Rushing the Process: Taking your time is essential. Rushing can lead to mistakes that could have been easily avoided with a more careful review.

-

Not Seeking Professional Help: Some individuals think they can handle everything on their own. Consulting with a legal professional can provide valuable insights and help avoid pitfalls.

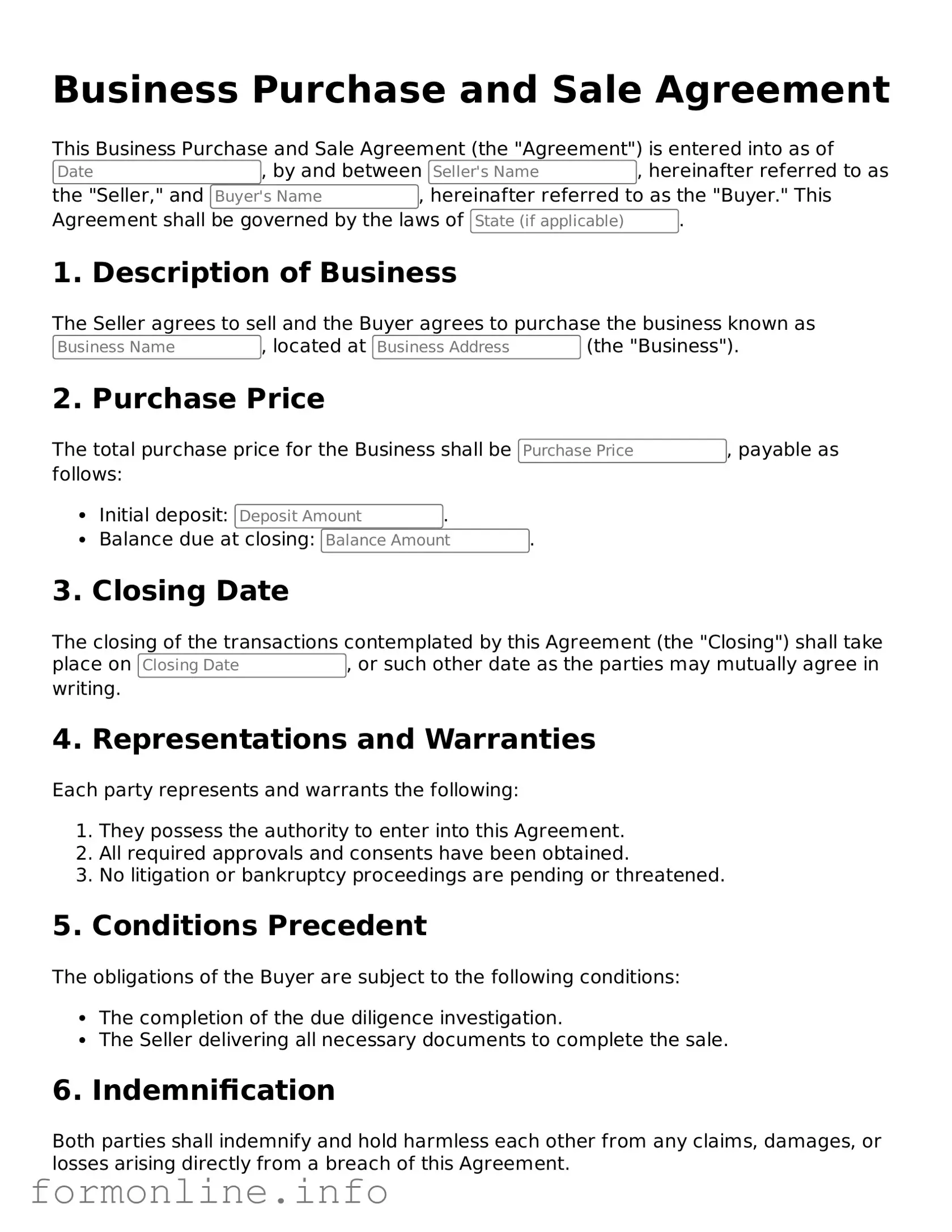

Preview - Business Purchase and Sale Agreement Form

Business Purchase and Sale Agreement

This Business Purchase and Sale Agreement (the "Agreement") is entered into as of , by and between , hereinafter referred to as the "Seller," and , hereinafter referred to as the "Buyer." This Agreement shall be governed by the laws of .

1. Description of Business

The Seller agrees to sell and the Buyer agrees to purchase the business known as , located at (the "Business").

2. Purchase Price

The total purchase price for the Business shall be , payable as follows:

- Initial deposit: .

- Balance due at closing: .

3. Closing Date

The closing of the transactions contemplated by this Agreement (the "Closing") shall take place on , or such other date as the parties may mutually agree in writing.

4. Representations and Warranties

Each party represents and warrants the following:

- They possess the authority to enter into this Agreement.

- All required approvals and consents have been obtained.

- No litigation or bankruptcy proceedings are pending or threatened.

5. Conditions Precedent

The obligations of the Buyer are subject to the following conditions:

- The completion of the due diligence investigation.

- The Seller delivering all necessary documents to complete the sale.

6. Indemnification

Both parties shall indemnify and hold harmless each other from any claims, damages, or losses arising directly from a breach of this Agreement.

7. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of , without regard to its conflict of laws principles.

8. Entire Agreement

This Agreement constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior negotiations, representations, or agreements.

9. Signatures

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

Seller:

Buyer:

Common Forms:

Vehicle Lease Agreement Pdf - All operational activities must align with the designated Community Transportation Service Plan.

The Arizona University Application form is a crucial document for students seeking undergraduate admission to institutions such as Arizona State University, Northern Arizona University, and the University of Arizona. This form includes a request for a waiver of the application fee, specifically for Arizona residents who may face financial hardship. To navigate the requirements and process effectively, students can refer to AZ Forms Online, ensuring that all eligible applicants have the opportunity to apply.

Roof Certification Template - Plays a critical role in home sales involving structured financing.

Documents used along the form

When engaging in a business transaction, several important documents often accompany the Business Purchase and Sale Agreement. Each of these documents serves a unique purpose and helps to ensure a smooth transfer of ownership. Here are five common forms you might encounter:

- Letter of Intent (LOI): This document outlines the preliminary agreement between the buyer and seller. It typically includes key terms and conditions, signaling both parties' intention to move forward with the sale.

- Confidentiality Agreement: Also known as a Non-Disclosure Agreement (NDA), this document protects sensitive information shared during negotiations. It ensures that both parties keep proprietary information confidential.

- Due Diligence Checklist: This is a tool used by buyers to assess the business they are considering purchasing. It lists all necessary documents and information the buyer should review, such as financial statements, contracts, and employee records.

- Bill of Sale: This document serves as proof of the transfer of ownership. It details the items being sold and confirms that the buyer has paid for them, providing legal protection for both parties.

- Mobile Home Bill of Sale: This legal document is essential for transferring ownership of a mobile home, providing necessary details such as buyer and seller information, mobile home description, and sale price. For more information, visit the Mobile Home Bill of Sale.

- Closing Statement: This document summarizes the financial aspects of the transaction. It includes details about the sale price, adjustments, and any fees, ensuring transparency at the closing of the sale.

Each of these documents plays a crucial role in the business sale process. Understanding their purposes can help both buyers and sellers navigate the complexities of the transaction more effectively.

Similar forms

The Letter of Intent (LOI) is a preliminary document that outlines the basic terms of a business deal before the final agreement is drafted. Similar to the Business Purchase and Sale Agreement, the LOI expresses the intention of both parties to proceed with the transaction. It typically includes key details such as the purchase price, payment terms, and a timeline for closing the deal. However, unlike the final agreement, the LOI is usually non-binding, allowing both parties to negotiate further without legal obligations.

The Asset Purchase Agreement (APA) focuses specifically on the purchase of individual assets of a business rather than the entire business entity. Like the Business Purchase and Sale Agreement, the APA details the terms of the transaction, including the assets being sold and their valuation. Both documents serve to protect the interests of the buyer and seller, ensuring that all necessary information is disclosed and agreed upon before the sale is finalized.

The Stock Purchase Agreement (SPA) is another document similar to the Business Purchase and Sale Agreement, but it specifically pertains to the purchase of stock in a corporation. This agreement outlines the terms under which the buyer acquires shares from the seller. Like the Business Purchase and Sale Agreement, it includes provisions for price, payment methods, and representations and warranties, but it focuses on ownership transfer rather than the business's operational assets.

The Confidentiality Agreement, also known as a Non-Disclosure Agreement (NDA), is crucial during the negotiation phase of a business sale. This document ensures that sensitive information shared between the buyer and seller remains confidential. While the Business Purchase and Sale Agreement finalizes the transaction, the Confidentiality Agreement protects both parties' interests during discussions and due diligence, ensuring that proprietary information is not disclosed to outside parties.

The Due Diligence Checklist is an essential tool used during the evaluation of a business before purchase. It outlines all the necessary information and documentation that the buyer should review to assess the business's value and risks. Similar to the Business Purchase and Sale Agreement, it aims to ensure that both parties are fully informed before finalizing the sale. The checklist helps identify any potential issues that could affect the transaction, allowing for informed decision-making.

The Purchase Order (PO) is a document used in the sale of goods and services, but it shares similarities with the Business Purchase and Sale Agreement in that it formalizes a buyer's intent to purchase. Both documents outline the specifics of the transaction, including quantities, prices, and delivery terms. While a PO is typically used for smaller transactions, it serves a similar purpose in establishing the terms of the sale and protecting both parties' interests.

The Bill of Sale is a document that serves as proof of the transfer of ownership of goods or assets. In the context of a business sale, it provides evidence that the buyer has acquired specific assets from the seller. Similar to the Business Purchase and Sale Agreement, the Bill of Sale outlines the details of the transaction, including what is being sold and for how much. It acts as a legal record of the sale, ensuring clarity and reducing potential disputes in the future.

For those interested in the preliminary documents for investment, understanding the significance of an "Investment Letter of Intent" can be invaluable for outlining intentions before formal agreements are made. This letter not only sets the stage for future negotiations but also clarifies essential terms that will govern the investment relationship, making it a cornerstone document for investors. For more information, visit our guide on key elements of the Investment Letter of Intent.

The Partnership Agreement is relevant when a business is being sold to a new partner or when existing partners are buying out one another. This agreement outlines the terms of the partnership, including each partner's contributions, profit-sharing, and responsibilities. Like the Business Purchase and Sale Agreement, it is designed to protect the interests of all parties involved, ensuring that everyone is on the same page regarding the terms of the partnership and the sale.

Dos and Don'ts

When filling out the Business Purchase and Sale Agreement form, attention to detail is crucial. Here are some important dos and don'ts to keep in mind:

- Do provide accurate and complete information about the business being sold.

- Do clearly outline the terms of the sale, including payment details and timelines.

- Don't leave any sections blank; incomplete forms can lead to delays or complications.

- Don't rush through the process; take your time to review each section carefully.

Key takeaways

When filling out and using a Business Purchase and Sale Agreement form, it is essential to keep several key points in mind. These takeaways can help ensure that the process runs smoothly and that all parties are adequately protected.

- Identify the Parties: Clearly state the names and addresses of both the buyer and seller. This information is crucial for establishing who is involved in the transaction.

- Define the Business: Provide a detailed description of the business being sold, including its legal structure, assets, and liabilities. This helps clarify what is included in the sale.

- Purchase Price: Specify the total purchase price and outline the payment terms. This should include any deposits, financing arrangements, or payment schedules.

- Due Diligence: Include a provision for due diligence. This allows the buyer to investigate the business's financials, operations, and legal standing before finalizing the purchase.

- Representations and Warranties: Both parties should make representations and warranties regarding the business. This includes affirmations about the business's condition and compliance with laws.

- Closing Conditions: Outline the conditions that must be met before closing the sale. This may include obtaining necessary approvals or completing certain transactions.

- Dispute Resolution: Include a clause for resolving disputes that may arise from the agreement. This can help prevent lengthy and costly legal battles in the future.

By adhering to these key takeaways, parties can create a comprehensive Business Purchase and Sale Agreement that serves to protect their interests throughout the transaction.

How to Use Business Purchase and Sale Agreement

After obtaining the Business Purchase and Sale Agreement form, it is essential to complete it accurately to ensure all parties understand the terms of the transaction. Follow these steps to fill out the form effectively.

- Identify the Parties: Begin by clearly stating the names and addresses of both the buyer and the seller. This ensures that all parties are properly identified.

- Describe the Business: Provide a detailed description of the business being sold. Include the business name, location, and any relevant identifiers such as registration numbers.

- Specify the Purchase Price: Clearly outline the total purchase price for the business. Include any payment terms or conditions that apply.

- Detail Included Assets: List all assets included in the sale, such as equipment, inventory, or intellectual property. Be thorough to avoid future disputes.

- Outline Liabilities: Specify any liabilities that the buyer will assume as part of the purchase. This could include debts or pending legal issues.

- Set Closing Date: Indicate the date on which the sale will be finalized. This is critical for planning and logistics.

- Include Contingencies: If applicable, mention any contingencies that must be met before the sale can proceed, such as financing approval or regulatory approvals.

- Signatures: Ensure that both parties sign and date the agreement. This formalizes the document and indicates acceptance of the terms.

Once the form is completed, review it carefully for accuracy and completeness. It may be beneficial to consult with a legal professional to ensure all necessary elements are included and properly stated.