Fill Out a Valid California Affidavit of Death of a Trustee Form

The California Affidavit of Death of a Trustee form serves as an essential document in the realm of estate management and trust administration. When a trustee passes away, this form provides a clear and structured way to notify interested parties and to facilitate the transition of responsibilities. It typically includes vital information such as the name of the deceased trustee, the date of their death, and details about the trust they managed. By completing this affidavit, the successor trustee or a designated representative can affirm the death, thereby allowing for the proper handling of the trust assets. Additionally, the form often requires the inclusion of supporting documentation, such as a certified copy of the death certificate, to validate the claims made within. This process not only helps to maintain transparency among beneficiaries but also ensures that the trust can continue to operate smoothly despite the loss of its original trustee. Understanding the significance of this form is crucial for anyone involved in trust administration, as it plays a pivotal role in upholding the intentions of the trustor and protecting the interests of the beneficiaries.

Common mistakes

-

Incorrect Trustee Information: People often forget to double-check the name and details of the deceased trustee. Ensure the name matches exactly as it appears in the trust documents.

-

Missing Signatures: A common oversight is failing to obtain the necessary signatures. All required parties must sign the affidavit for it to be valid.

-

Inaccurate Dates: Filling in the wrong date of death can lead to complications. Always verify the date before submitting the form.

-

Neglecting Supporting Documents: Some individuals forget to attach required documents, such as a death certificate. These documents are often essential for processing the affidavit.

-

Not Following State Guidelines: Each state has specific requirements. Failing to follow California's guidelines can result in delays or rejection of the affidavit.

-

Omitting Contact Information: Some people forget to include their contact information. This can hinder communication if there are questions about the affidavit.

-

Overlooking Notarization: Many fail to have the affidavit notarized. Notarization is often a crucial step that cannot be skipped.

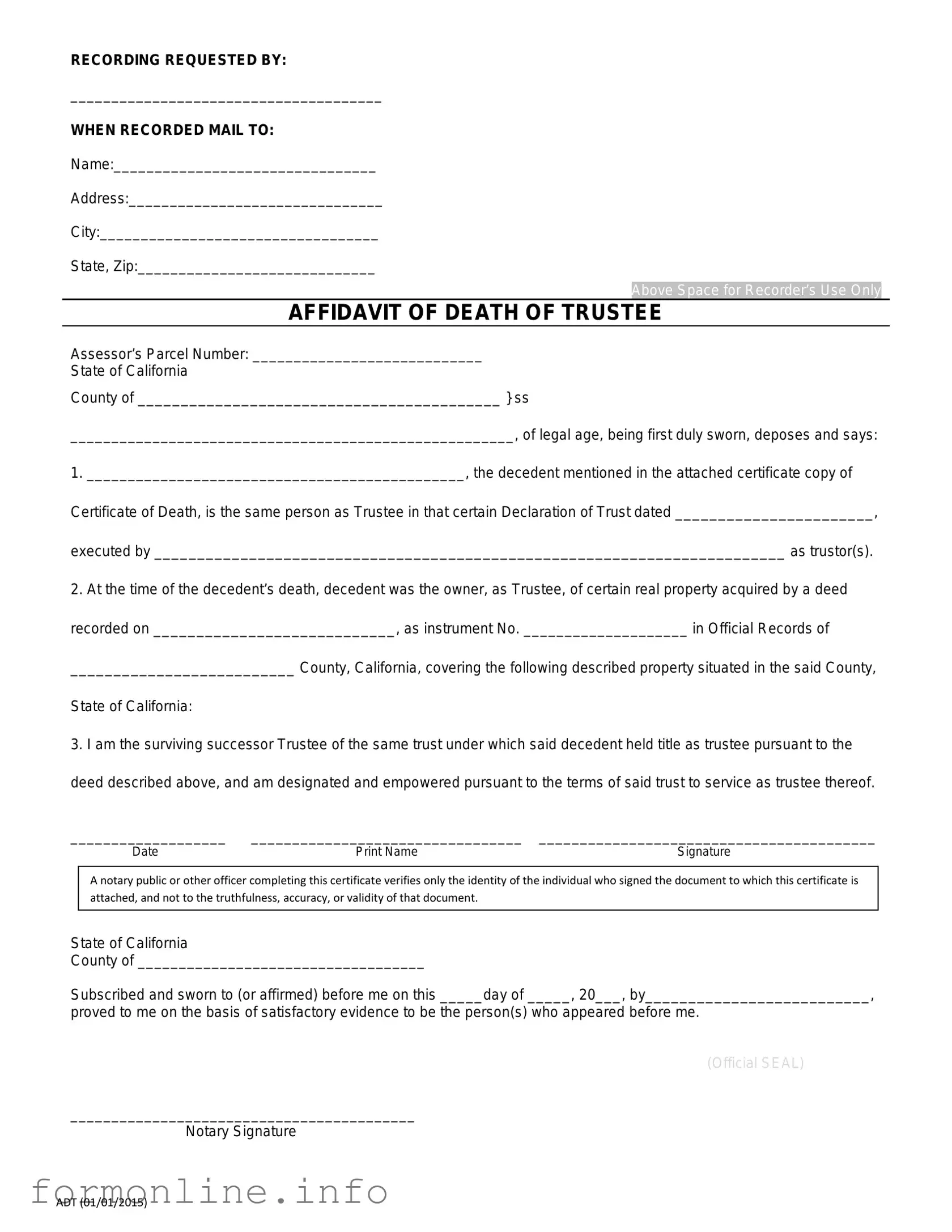

Preview - California Affidavit of Death of a Trustee Form

RECORDING REQUESTED BY:

______________________________________

WHEN RECORDED MAIL TO:

Name:________________________________

Address:_______________________________

City:__________________________________

State, Zip:_____________________________

Above Space for Recorder’s Use Only

AFFIDAVIT OF DEATH OF TRUSTEE

Assessor’s Parcel Number: ____________________________

State of California

County of __________________________________________ } ss

______________________________________________________, of legal age, being first duly sworn, deposes and says:

1.______________________________________________, the decedent mentioned in the attached certificate copy of Certificate of Death, is the same person as Trustee in that certain Declaration of Trust dated _______________________, executed by _________________________________________________________________________ as trustor(s).

2.At the time of the decedent’s death, decedent was the owner, as Trustee, of certain real property acquired by a deed recorded on ____________________________, as instrument No. ____________________ in Official Records of

__________________________ County, California, covering the following described property situated in the said County,

State of California:

3.I am the surviving successor Trustee of the same trust under which said decedent held title as trustee pursuant to the deed described above, and am designated and empowered pursuant to the terms of said trust to service as trustee thereof.

___________________ |

_________________________________ |

_________________________________________ |

Date |

Print Name |

Signature |

A notary public or other officer completing this certificate verifies only the identity of the individual who signed the document to which this certificate is attached, and not to the truthfulness, accuracy, or validity of that document.

State of California

County of ___________________________________

Subscribed and sworn to (or affirmed) before me on this _____day of _____, 20___, by__________________________,

proved to me on the basis of satisfactory evidence to be the person(s) who appeared before me.

(Official SEAL)

__________________________________________

Notary Signature

ADT (01/01/2015)

Other PDF Templates

Annual Summary and Transmittal of U.S. Information Returns - Taxpayers should be aware of the retention period for copies of the 1096 form.

For anyone looking to complete the sale of a vehicle, the North Carolina Motor Vehicle Bill of Sale form is crucial, as it not only facilitates ownership transfer but also provides essential details required for registration. To ensure a smooth transaction, you can find this form and additional resources at autobillofsaleform.com/north-carolina-motor-vehicle-bill-of-sale-form/.

Aphis Form 7001 - Involving your veterinarian in the process reflects responsible pet ownership.

Documents used along the form

The California Affidavit of Death of a Trustee form is an important document used to formally declare the death of a trustee in a trust arrangement. When completing this process, several other forms and documents may also be required to ensure proper administration of the trust and its assets. Below is a list of commonly associated documents.

- Death Certificate: This official document provides proof of the trustee's death and is often required to validate the Affidavit of Death.

- Trust Agreement: This document outlines the terms and conditions of the trust, including the roles and responsibilities of the trustee and beneficiaries.

- Certificate of Trust: This document summarizes key details of the trust without revealing the entire trust agreement, often used to establish the trust's existence to third parties.

- Non-disclosure Agreement: A Georgia Non-disclosure Agreement (NDA) is essential for protecting sensitive information. For more details, visit https://georgiapdf.com/.

- Notice to Beneficiaries: This notice informs all beneficiaries of the trust about the trustee's death and any subsequent actions that may affect their interests.

- Change of Trustee Form: This form is used to officially designate a new trustee following the death of the previous trustee, ensuring continuity in trust management.

- Asset Inventory List: This document details all assets held within the trust, which is essential for the proper distribution of assets to beneficiaries.

- Tax Documents: Depending on the trust's structure and assets, various tax forms may need to be completed to address any tax obligations resulting from the trustee's death.

Utilizing these documents in conjunction with the California Affidavit of Death of a Trustee can help facilitate a smooth transition and proper management of the trust's assets. Each document serves a specific purpose in the overall process of trust administration.

Similar forms

The California Affidavit of Death of a Trustee form shares similarities with the Affidavit of Death form used in various states. This document serves to declare the death of an individual, often for purposes related to estate management. Like the California version, this affidavit typically requires information about the deceased, including their name, date of death, and relevant details about their estate. It is essential for ensuring that the deceased’s affairs are settled according to their wishes and state laws.

Another document that is similar is the Certificate of Death. This official record, issued by a government authority, confirms the individual’s death. While the Affidavit of Death of a Trustee may be used in conjunction with this certificate, it serves a different purpose. The certificate provides proof of death, while the affidavit is used to manage trust assets and facilitate the transfer of responsibilities.

The Last Will and Testament also bears resemblance to the California Affidavit of Death of a Trustee. Both documents are critical in the estate planning process. The will outlines how a person's assets should be distributed after their death, while the affidavit is used to inform relevant parties of the trustee's death, allowing for the proper administration of the trust. Both documents help ensure that the deceased's wishes are honored.

For those in Texas looking to document the sale and transfer of personal property, it's essential to use the appropriate legal forms, including the Texas Bill of Sale. This document is necessary to ensure clarity and legality in transactions, and you can find more information for the form that suits your needs.

The Trust Administration Checklist is another related document. This checklist guides the trustee or executor through the steps necessary to manage a trust or estate after a death. It often includes tasks that must be completed following the death of a trustee, similar to the actions prompted by the Affidavit of Death of a Trustee. Both documents focus on the orderly management of the deceased's affairs.

The Power of Attorney can also be compared to the California Affidavit of Death of a Trustee. While a power of attorney grants someone the authority to act on behalf of another person while they are alive, it becomes void upon the death of the principal. The affidavit serves to notify others of the death, which is a necessary step for the authority granted by the power of attorney to end. Both documents are essential for managing legal and financial matters.

Lastly, the Estate Inventory form is similar in that it is used to list and value the assets of a deceased person. This document is often completed after the death of a trustee to provide a clear picture of the estate's contents. Like the affidavit, the estate inventory is crucial for the proper administration of the deceased's affairs and ensures that all assets are accounted for during the distribution process.

Dos and Don'ts

When filling out the California Affidavit of Death of a Trustee form, it’s essential to approach the task with care. Here are ten things to keep in mind:

- Do read the entire form carefully before you start filling it out.

- Don't leave any required fields blank; incomplete forms can lead to delays.

- Do provide accurate information about the deceased trustee, including their full name and date of death.

- Don't use nicknames or abbreviations when entering names.

- Do sign and date the form in the designated areas.

- Don't forget to have your signature notarized if required.

- Do check for any additional documentation that may need to accompany the form.

- Don't assume that the form will be accepted without proper identification or proof of death.

- Do keep a copy of the completed form for your records.

- Don't submit the form without reviewing it for errors or omissions.

By following these tips, you can help ensure that the process goes smoothly and that the affidavit is processed without unnecessary complications.

Key takeaways

When filling out and using the California Affidavit of Death of a Trustee form, consider the following key takeaways:

- The form is essential for transferring trust property after a trustee's death.

- Accurate information must be provided, including the deceased trustee's name, date of death, and trust details.

- The affidavit should be signed in front of a notary public to ensure its validity.

- File the completed affidavit with the appropriate county recorder's office to update public records.

- Consulting with an attorney may be beneficial to address any specific legal questions or concerns.

How to Use California Affidavit of Death of a Trustee

After gathering the necessary information, you will be ready to complete the California Affidavit of Death of a Trustee form. This form is essential for notifying relevant parties about the death of a trustee and facilitating the management of the trust. Follow the steps below to ensure accurate completion.

- Begin by downloading the California Affidavit of Death of a Trustee form from a reliable source.

- In the first section, fill in the name of the deceased trustee. Ensure the spelling is correct.

- Provide the date of death. This information is crucial and should match official records.

- Next, indicate the name of the trust that the deceased was managing. This helps identify the trust in question.

- Fill in the date the trust was created. This date should also be verified against trust documents.

- Complete the section detailing the name and address of the successor trustee, if applicable. This person will take over the trustee duties.

- If there are any additional relevant details, include them in the designated area of the form.

- Sign and date the affidavit at the bottom. Your signature confirms the information provided is accurate.

- Have the affidavit notarized. A notary public will verify your identity and witness your signature.

- Make copies of the completed and notarized affidavit for your records and for any parties that require notification.

Once the form is completed and notarized, it should be filed with the appropriate court or provided to interested parties as necessary. This step ensures that the trust can be managed according to its terms following the trustee's death.