Free Articles of Incorporation Template for California State

When starting a business in California, one of the first essential steps is to file the Articles of Incorporation. This document serves as the foundation for your corporation and outlines key information about your business. It includes the corporation's name, which must be unique and comply with state regulations. The form also requires the purpose of the corporation, which can be general or specific, depending on your business goals. Additionally, you will need to provide the address of the corporation's initial registered office and the name of its registered agent. This agent will act as the official point of contact for legal documents. The Articles of Incorporation may also include details about the number of shares the corporation is authorized to issue, which is crucial for future fundraising and ownership structure. By properly completing and filing this form, you can ensure that your corporation is legally recognized in California, paving the way for your business to thrive.

Common mistakes

-

Incorrect Business Name: One common mistake is not following the naming rules. The business name must be unique and not too similar to existing entities. Ensure that the name includes a designation like "Corporation" or "Incorporated."

-

Missing Purpose Statement: Failing to include a clear purpose statement can lead to complications. It's important to briefly describe the nature of your business activities.

-

Improper Number of Shares: Some individuals do not specify the correct number of shares the corporation is authorized to issue. Make sure to indicate both the total number of shares and their par value, if applicable.

-

Neglecting Registered Agent Information: A registered agent must be designated, and their information should be accurate. This agent is responsible for receiving legal documents on behalf of the corporation.

-

Inaccurate Incorporator Details: The incorporator's name and address must be correct. This person is responsible for filing the Articles of Incorporation and must be an individual or a business entity.

-

Ignoring Filing Fees: Many forget to include the required filing fee. Ensure that you check the current fee schedule and include the correct payment with your submission.

-

Failure to Review Before Submission: Rushing through the form can lead to errors. Take the time to review all entries for accuracy and completeness before submitting the form.

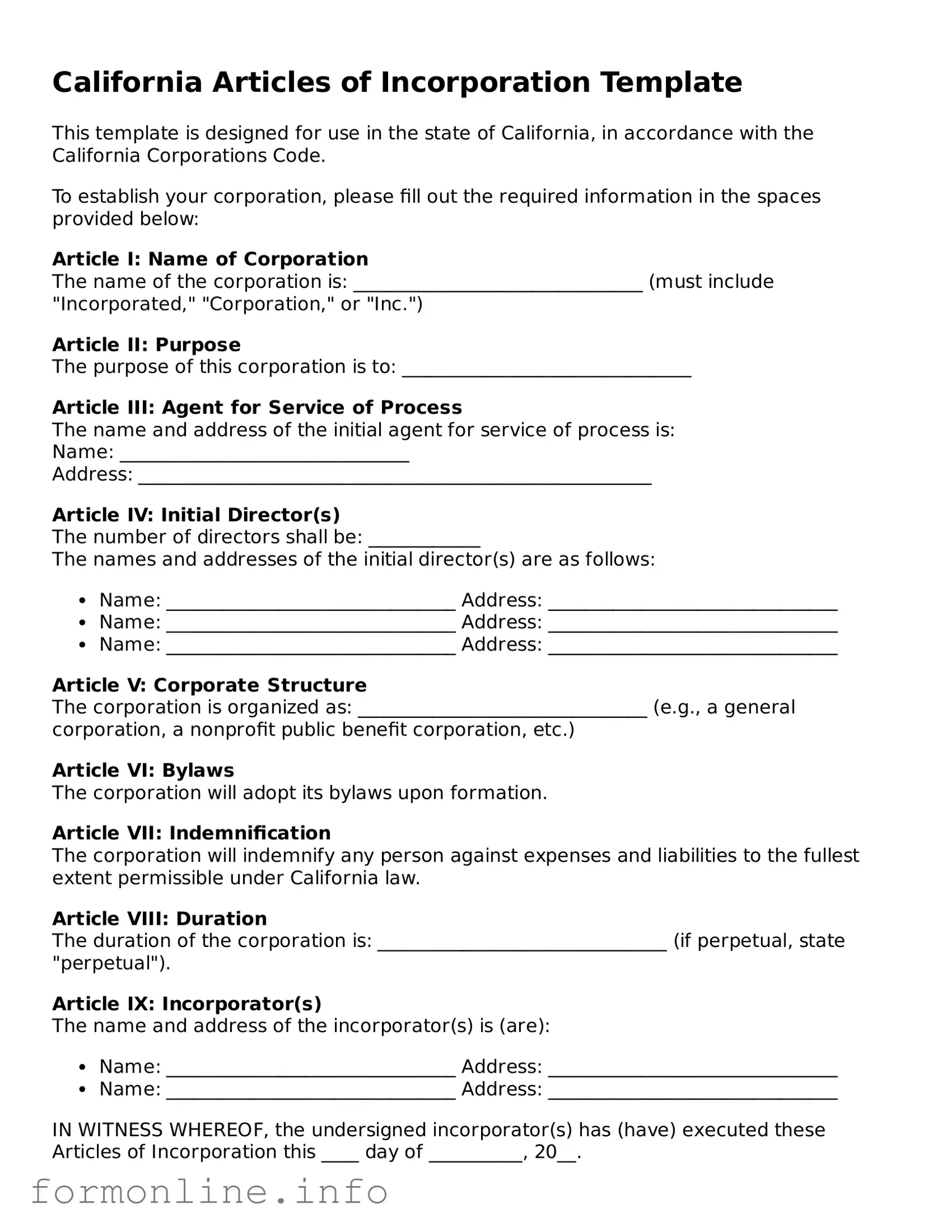

Preview - California Articles of Incorporation Form

California Articles of Incorporation Template

This template is designed for use in the state of California, in accordance with the California Corporations Code.

To establish your corporation, please fill out the required information in the spaces provided below:

Article I: Name of Corporation

The name of the corporation is: _______________________________ (must include "Incorporated," "Corporation," or "Inc.")

Article II: Purpose

The purpose of this corporation is to: _______________________________

Article III: Agent for Service of Process

The name and address of the initial agent for service of process is:

Name: _______________________________

Address: _______________________________________________________

Article IV: Initial Director(s)

The number of directors shall be: ____________

The names and addresses of the initial director(s) are as follows:

- Name: _______________________________ Address: _______________________________

- Name: _______________________________ Address: _______________________________

- Name: _______________________________ Address: _______________________________

Article V: Corporate Structure

The corporation is organized as: _______________________________ (e.g., a general corporation, a nonprofit public benefit corporation, etc.)

Article VI: Bylaws

The corporation will adopt its bylaws upon formation.

Article VII: Indemnification

The corporation will indemnify any person against expenses and liabilities to the fullest extent permissible under California law.

Article VIII: Duration

The duration of the corporation is: _______________________________ (if perpetual, state "perpetual").

Article IX: Incorporator(s)

The name and address of the incorporator(s) is (are):

- Name: _______________________________ Address: _______________________________

- Name: _______________________________ Address: _______________________________

IN WITNESS WHEREOF, the undersigned incorporator(s) has (have) executed these Articles of Incorporation this ____ day of __________, 20__.

Signature of Incorporator: _______________________________

Printed Name: _______________________________

Note: Upon completing this document, it should be filed with the California Secretary of State along with the required filing fee.

Popular Articles of Incorporation State Templates

Florida Corporations - Some states may require additional information depending on their regulations.

Creating a robust estate plan often includes preparing a valuable Last Will and Testament tool, which ensures that your final wishes are honored and your assets are distributed as intended.

Documents used along the form

The California Articles of Incorporation form is essential for establishing a corporation in California. However, several other documents are typically required or recommended during the incorporation process. Below is a list of these documents, along with brief descriptions of each.

- Bylaws: Bylaws outline the internal rules and procedures for the corporation's operations. They cover topics such as board meetings, voting procedures, and the roles of officers.

- Initial Statement of Information: This document must be filed within 90 days of incorporation. It provides essential information about the corporation, including the addresses of its principal office and the names of its officers and directors.

- Employer Identification Number (EIN): An EIN is a unique number assigned by the IRS for tax purposes. It is necessary for opening a business bank account and hiring employees.

- Stock Certificates: These documents represent ownership in the corporation. They are issued to shareholders and include details such as the number of shares owned and the class of stock.

- Shareholder Agreements: This optional document outlines the rights and responsibilities of shareholders. It can address issues such as transfer of shares and dispute resolution.

- Bill of Sale: A necessary document for the effective transfer of ownership, you may need a Bill of Sale form to complete your transaction properly.

- Business Licenses and Permits: Depending on the nature of the business, various licenses or permits may be required at the local, state, or federal level to operate legally.

Each of these documents plays a crucial role in ensuring that a corporation operates smoothly and complies with legal requirements. Proper preparation and filing of these documents can help facilitate a successful incorporation process.

Similar forms

The California Articles of Incorporation form is similar to the Certificate of Incorporation used in many states across the U.S. Both documents serve the primary purpose of officially establishing a corporation. They require basic information such as the corporation's name, purpose, and registered agent. While the specific requirements may vary from state to state, the fundamental goal remains the same: to create a legal entity that can conduct business, enter contracts, and protect its owners from personal liability.

Another comparable document is the Bylaws of a corporation. Bylaws outline the internal rules and procedures for managing the corporation. While the Articles of Incorporation focus on external establishment, Bylaws delve into the governance structure, including the roles of directors and officers, meeting protocols, and voting procedures. Both documents are essential for the functioning of a corporation, but they serve different purposes in defining its operation and organization.

The Limited Liability Company (LLC) Articles of Organization serves a similar function for LLCs. Like the Articles of Incorporation, this document is filed with the state to formally create a legal entity. It includes basic information about the LLC, such as its name, address, and management structure. Both documents provide liability protection to their owners, but the LLC Articles of Organization cater specifically to the unique structure and flexibility of limited liability companies.

The Partnership Agreement is another document that shares similarities with the Articles of Incorporation. While the Articles establish a corporation, the Partnership Agreement formalizes the relationship between partners in a business. It outlines each partner's contributions, responsibilities, profit-sharing arrangements, and dispute resolution methods. Both documents are crucial for clarifying roles and expectations, but they apply to different business structures.

The Certificate of Formation is often used interchangeably with the Articles of Incorporation in some states. This document serves to create a corporation and includes similar information, such as the name of the corporation, its purpose, and the registered agent. The primary distinction lies in the terminology used, which can vary by state, but the function remains consistent in establishing a legal entity.

The Statement of Information is another document that complements the Articles of Incorporation. While the Articles serve to create the corporation, the Statement of Information provides ongoing updates about the corporation’s status, including changes in address, officers, and business activities. This document ensures that the state has current information about the corporation, thereby promoting transparency and compliance.

Understanding the importance of each form related to business formation is critical for entrepreneurs. Among these, the Employment Verification form stands out as it confirms a candidate's job history and qualifications, facilitating a smooth hiring process. For comprehensive resources on employment-related documentation, visit Top Forms Online, which provides valuable insights and templates to assist both employers and job seekers in navigating these essential forms.

The Nonprofit Articles of Incorporation is tailored for organizations that operate without profit motives. Similar to the for-profit Articles of Incorporation, this document establishes the nonprofit entity, detailing its purpose and governance structure. Both documents require foundational information, but the nonprofit version includes specific language related to charitable purposes and the distribution of assets upon dissolution.

The Corporate Resolution is akin to the Articles of Incorporation in that it formalizes decisions made by the corporation's board of directors. While the Articles establish the corporation, a Corporate Resolution documents specific actions, such as the approval of contracts or the appointment of officers. Both are critical for corporate governance, but they address different aspects of corporate operations.

The Assumed Name Certificate, often referred to as a "Doing Business As" (DBA) registration, is similar in that it allows a corporation to operate under a name different from its legal name. While the Articles of Incorporation establish the legal entity, the Assumed Name Certificate provides the flexibility for branding and marketing. Both documents must be filed with the appropriate state authorities to ensure legal compliance.

Finally, the Federal Employer Identification Number (EIN) application is related to the Articles of Incorporation in that it is necessary for the corporation to operate legally. The EIN serves as a unique identifier for tax purposes. While the Articles create the corporation, the EIN is essential for opening bank accounts, hiring employees, and filing taxes. Both documents are fundamental for the legal and operational aspects of a corporation.

Dos and Don'ts

When filling out the California Articles of Incorporation form, it is crucial to follow specific guidelines to ensure a smooth process. Here are seven things you should and shouldn't do:

- Do provide accurate information about your business name, including the correct spelling and any required designations.

- Do ensure that your business name is unique and not already in use by another corporation in California.

- Do include the purpose of your corporation clearly and concisely.

- Do designate an agent for service of process and provide their complete address.

- Don't leave any sections of the form blank; all required fields must be filled out.

- Don't use abbreviations or acronyms in the business name unless they are officially recognized.

- Don't forget to sign and date the form before submission; an unsigned form will be rejected.

Following these guidelines will help you avoid common pitfalls during the incorporation process.

Key takeaways

When filling out and using the California Articles of Incorporation form, keep the following key takeaways in mind:

- Ensure that you have a unique name for your corporation. The name must not be similar to any existing business registered in California.

- Provide a clear purpose for your corporation. This statement should be specific enough to inform the public about your business activities.

- Designate an agent for service of process. This individual or business must have a physical address in California and will receive legal documents on behalf of the corporation.

- Include the number of shares your corporation is authorized to issue. This number determines the ownership structure and potential for raising capital.

- Review the filing fees associated with the Articles of Incorporation. These fees can vary based on the type of corporation you are forming.

- File the completed form with the California Secretary of State. You can submit it online, by mail, or in person, depending on your preference.

How to Use California Articles of Incorporation

After obtaining the California Articles of Incorporation form, you will need to complete it accurately to establish your corporation. This process involves providing essential information about your business and its structure. Once the form is filled out, it must be submitted to the appropriate state agency along with any required fees.

- Begin by downloading the California Articles of Incorporation form from the California Secretary of State's website or obtain a physical copy.

- In the first section, enter the name of your corporation. Ensure that the name complies with California naming requirements and is distinguishable from existing entities.

- Provide the address of the corporation's initial registered office. This must be a physical address in California, not a P.O. Box.

- List the name and address of the corporation's initial agent for service of process. This person or business must be located in California.

- Indicate the purpose of the corporation. A brief statement outlining the business activities is sufficient.

- Specify the total number of shares the corporation is authorized to issue. If there are different classes of shares, include details about each class.

- Provide the names and addresses of the initial directors of the corporation. Include at least one director.

- Sign and date the form. The person completing the form must sign it, certifying that the information is accurate.

- Make copies of the completed form for your records.

- Submit the original form along with the required filing fee to the California Secretary of State's office. Check their website for the current fee amount and acceptable payment methods.