Free Deed in Lieu of Foreclosure Template for California State

The California Deed in Lieu of Foreclosure form serves as a legal instrument that allows homeowners facing financial distress to transfer their property back to the lender as a means of avoiding the lengthy and often costly foreclosure process. This option can be beneficial for both parties; homeowners can potentially mitigate the impact on their credit scores and lenders can recover their investment without going through foreclosure. The process typically involves the homeowner voluntarily signing over the deed of the property, effectively relinquishing ownership. In exchange, the lender may agree to cancel the mortgage debt, although this is subject to negotiation and the specific terms outlined in the agreement. It is important for homeowners to understand that while this form can offer a way out of a difficult situation, it may also carry tax implications and affect eligibility for future loans. Additionally, the lender may require the homeowner to provide financial information to assess their situation before accepting the deed. Overall, the California Deed in Lieu of Foreclosure form presents an alternative route for those seeking to resolve their mortgage challenges while minimizing the negative consequences associated with foreclosure.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to accurately describe the property. Ensure that the legal description matches what is on the title deed. This includes the correct address and any relevant parcel numbers.

-

Not Including All Owners: If multiple individuals own the property, all owners must sign the deed. Omitting any owner can lead to complications or invalidate the deed.

-

Failure to Provide Necessary Documentation: Often, individuals neglect to attach required documents, such as the original loan agreement or proof of ownership. These documents are crucial for a smooth process.

-

Ignoring Lender Requirements: Each lender may have specific requirements for accepting a deed in lieu. Failing to consult with the lender can result in rejection of the deed.

-

Not Notarizing the Document: A deed in lieu must be notarized to be legally binding. Skipping this step can lead to legal issues down the line.

-

Overlooking Tax Implications: Many people do not consider the potential tax consequences of a deed in lieu. Consulting a tax advisor is wise to understand any potential liabilities.

-

Failing to Clear Liens: If there are existing liens on the property, these must be addressed before the deed can be transferred. Ignoring this can complicate the process.

-

Not Seeking Legal Advice: Many individuals fill out the form without consulting a legal professional. This can lead to mistakes that could have been easily avoided.

-

Rushing the Process: Taking the time to carefully review each section of the form is essential. Rushing can lead to errors that may delay the process.

-

Not Keeping Copies: After submitting the deed, it’s important to keep copies for your records. Failing to do so can create issues if questions arise later.

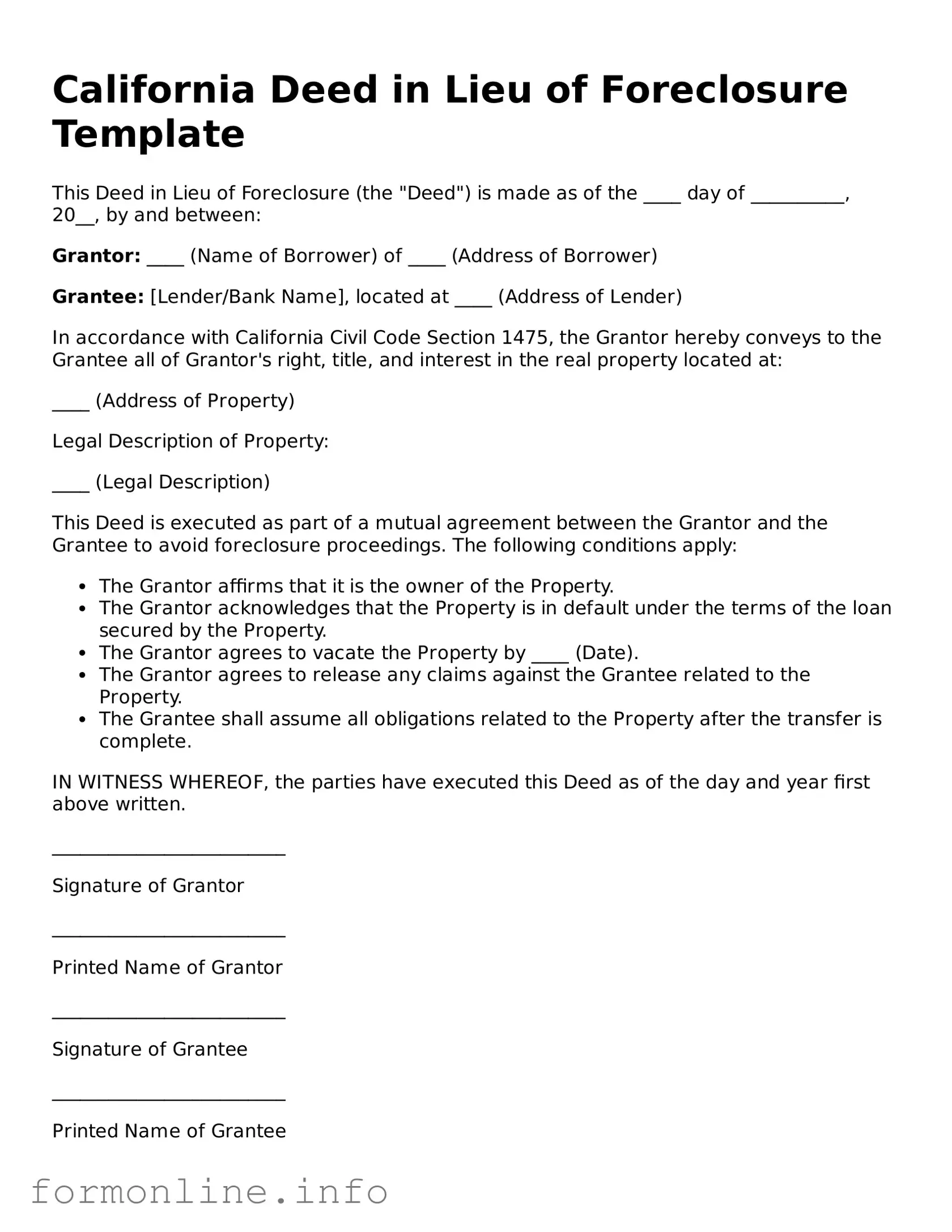

Preview - California Deed in Lieu of Foreclosure Form

California Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure (the "Deed") is made as of the ____ day of __________, 20__, by and between:

Grantor: ____ (Name of Borrower) of ____ (Address of Borrower)

Grantee: [Lender/Bank Name], located at ____ (Address of Lender)

In accordance with California Civil Code Section 1475, the Grantor hereby conveys to the Grantee all of Grantor's right, title, and interest in the real property located at:

____ (Address of Property)

Legal Description of Property:

____ (Legal Description)

This Deed is executed as part of a mutual agreement between the Grantor and the Grantee to avoid foreclosure proceedings. The following conditions apply:

- The Grantor affirms that it is the owner of the Property.

- The Grantor acknowledges that the Property is in default under the terms of the loan secured by the Property.

- The Grantor agrees to vacate the Property by ____ (Date).

- The Grantor agrees to release any claims against the Grantee related to the Property.

- The Grantee shall assume all obligations related to the Property after the transfer is complete.

IN WITNESS WHEREOF, the parties have executed this Deed as of the day and year first above written.

_________________________

Signature of Grantor

_________________________

Printed Name of Grantor

_________________________

Signature of Grantee

_________________________

Printed Name of Grantee

This document is intended to be legally binding. Legal counsel should be consulted to ensure that all state-specific laws and requirements are properly addressed.

Popular Deed in Lieu of Foreclosure State Templates

Sample Deed in Lieu of Foreclosure - It's important for borrowers to document their situation to strengthen their position during negotiations.

The Georgia WC 102B form serves as a formal notice of representation for any party involved in a workers' compensation case, excluding the claimant or employee. This document is essential for attorneys representing employers, insurers, or other interested parties to ensure proper communication with the State Board of Workers' Compensation. For additional resources and information, you can visit georgiapdf.com/. To proceed with the process, fill out the form by clicking the button below.

Georgia Foreclosure Laws - Both parties may benefit from a Deed in Lieu by avoiding lengthy legal proceedings.

Documents used along the form

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer the title of their property to the lender to avoid foreclosure. When utilizing this form, several other documents may also be necessary to complete the process. Below are some commonly used forms and documents that accompany the California Deed in Lieu of Foreclosure.

- Loan Modification Agreement: This document outlines the changes made to the original loan terms. It may include adjustments to the interest rate, payment schedule, or loan balance, aiming to make the mortgage more manageable for the borrower.

- Notice of Default: This notice is typically sent by the lender when a borrower has missed payments. It serves as an official warning that the borrower is in default and outlines the steps needed to remedy the situation or the potential for foreclosure.

- Title Insurance Policy: This insurance protects the lender against any claims or issues related to the property title. It ensures that the title is clear and that the lender has the right to take ownership of the property without legal complications.

- Mobile Home Bill of Sale: This essential document is used to transfer ownership of a mobile home from one party to another, ensuring clarity in the transaction. For more details, refer to the Mobile Home Bill of Sale.

- Settlement Statement: Also known as a HUD-1 statement, this document provides a detailed breakdown of the financial aspects of the transaction. It lists all costs and fees associated with the deed in lieu process, ensuring transparency for both parties.

These documents play a crucial role in the deed in lieu process, helping to clarify the terms and responsibilities for both the borrower and the lender. It is essential to understand each document's purpose to navigate this transition smoothly.

Similar forms

A Short Sale is a process where a homeowner sells their property for less than the amount owed on their mortgage. Similar to a Deed in Lieu of Foreclosure, a short sale allows the homeowner to avoid foreclosure. In both cases, the lender agrees to accept a lesser amount to settle the debt. This can help protect the homeowner's credit score and provide a quicker resolution compared to a lengthy foreclosure process. However, a short sale requires the homeowner to actively find a buyer, which can take time and effort.

A Loan Modification is another option available to homeowners facing financial difficulties. This document involves changing the terms of the existing mortgage to make payments more manageable. Like a Deed in Lieu of Foreclosure, a loan modification aims to prevent foreclosure. Both options require the lender's approval, and while a Deed in Lieu results in the homeowner giving up the property, a loan modification allows the homeowner to retain ownership while making more affordable payments.

A Forebearance Agreement is similar in that it provides temporary relief to homeowners struggling to make mortgage payments. This document allows the borrower to pause or reduce payments for a specified period. While a Deed in Lieu of Foreclosure transfers ownership to the lender, a forbearance agreement keeps the homeowner in their home, giving them time to recover financially. Both options involve negotiation with the lender and can help prevent the more drastic step of foreclosure.

In navigating various housing agreements, it is essential to consider the importance of the Rental Application form, which is crucial for landlords to screen potential tenants effectively. This form gathers vital information about an applicant's background, employment, and rental history, ultimately aiding landlords in selecting tenants who are likely to meet lease obligations. For those interested in utilizing this form, you can view and download the document easily online.

Finally, a Bankruptcy filing can also be compared to a Deed in Lieu of Foreclosure. Filing for bankruptcy can provide immediate relief from creditors and halt foreclosure proceedings. In both cases, the homeowner seeks to alleviate financial pressure. However, bankruptcy is a more complex legal process that can have long-lasting effects on credit scores, while a Deed in Lieu is a straightforward way to relinquish the property without going through a court process.

Dos and Don'ts

When filling out the California Deed in Lieu of Foreclosure form, it’s crucial to follow certain guidelines to ensure the process goes smoothly. Here’s a list of things you should and shouldn't do:

- Do ensure that all information is accurate and complete. Double-check names, addresses, and property details.

- Do consult with a legal professional if you have any doubts or questions about the form.

- Do keep copies of all documents for your records after submission.

- Do submit the form to the correct lender or financial institution.

- Don't rush through the process. Take your time to understand each section of the form.

- Don't sign the form without reviewing it thoroughly. Ensure you understand the implications of the deed in lieu of foreclosure.

Key takeaways

Filling out and using the California Deed in Lieu of Foreclosure form can be a significant step for homeowners facing financial difficulties. Here are some key takeaways to consider:

- The Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer ownership of their property to the lender to avoid foreclosure.

- This process can help homeowners avoid the lengthy and often stressful foreclosure process.

- Homeowners must ensure that all mortgage payments are current or that the lender agrees to accept the deed despite missed payments.

- It is crucial to consult with a legal professional or financial advisor before proceeding, as this decision can have long-term implications.

- Once the deed is signed and accepted, the homeowner relinquishes all rights to the property, so careful consideration is necessary.

- The lender may still pursue a deficiency judgment if the property sells for less than the amount owed on the mortgage, unless waived.

- Homeowners should request a written agreement from the lender detailing any potential tax implications or liabilities associated with the deed transfer.

- Documenting the entire process, including communications with the lender, can be beneficial in case of disputes or misunderstandings later on.

How to Use California Deed in Lieu of Foreclosure

After completing the California Deed in Lieu of Foreclosure form, it is important to ensure that all necessary parties understand the implications of the document. Once filled out, the form should be signed and notarized, then submitted to the appropriate parties, including the lender and the county recorder’s office. This process will help facilitate the transfer of property ownership.

- Begin by obtaining the California Deed in Lieu of Foreclosure form. You can find this form online or through legal document providers.

- Fill in the names of the property owner(s) in the designated section. Ensure that the names match those on the original property title.

- Provide the address of the property being transferred. This should include the street address, city, state, and zip code.

- Identify the lender’s name and address. This information is crucial for the transfer process.

- Include the legal description of the property. This is often found on the original deed and describes the property’s boundaries and location.

- Indicate the date of the transfer. This is the date when the deed will take effect.

- Sign the form in the presence of a notary public. Both property owners should sign if there are multiple owners.

- Have the notary public complete their section, verifying your identity and witnessing the signing of the document.

- Make copies of the signed and notarized form for your records.

- Submit the original signed form to the lender and file it with the county recorder’s office to officially record the transfer.