Free Deed Template for California State

The California Deed form plays a crucial role in the transfer of property ownership within the state, serving as a legal instrument that facilitates the conveyance of real estate. This form includes essential details such as the names of the parties involved—the grantor, who is the current owner, and the grantee, who is the new owner. It also specifies the property being transferred, often described by its address or legal description. Additionally, the form may outline any conditions or restrictions associated with the transfer, ensuring that both parties understand their rights and obligations. Proper execution of the California Deed form requires notarization, which adds a layer of authenticity and protects against potential disputes. Understanding the nuances of this form is vital for anyone involved in real estate transactions, whether they are buyers, sellers, or legal representatives. By addressing these key components, individuals can navigate the complexities of property transfer with greater confidence and clarity.

Common mistakes

-

Incorrect Property Description: One common mistake is providing an inaccurate or incomplete description of the property. It is essential to include the correct address, parcel number, and any relevant legal descriptions to avoid confusion or disputes in the future.

-

Missing Signatures: All required parties must sign the deed. Failing to include the signature of one or more grantors can render the deed invalid. It is crucial to ensure that all necessary individuals have signed the document before submission.

-

Improper Notarization: The deed must be notarized to be legally binding. Some individuals neglect this step or choose an unqualified notary. Ensure that the notary is properly licensed and that the notarization is completed according to state requirements.

-

Incorrect Use of Names: Using incorrect or inconsistent names can lead to complications. It is vital to use the full legal names of all parties involved, including any applicable middle names or suffixes. This attention to detail helps prevent future legal issues.

-

Failure to Record the Deed: After completing the deed, some individuals forget to file it with the county recorder’s office. Recording the deed is a critical step that protects the rights of the property owner and ensures public notice of ownership.

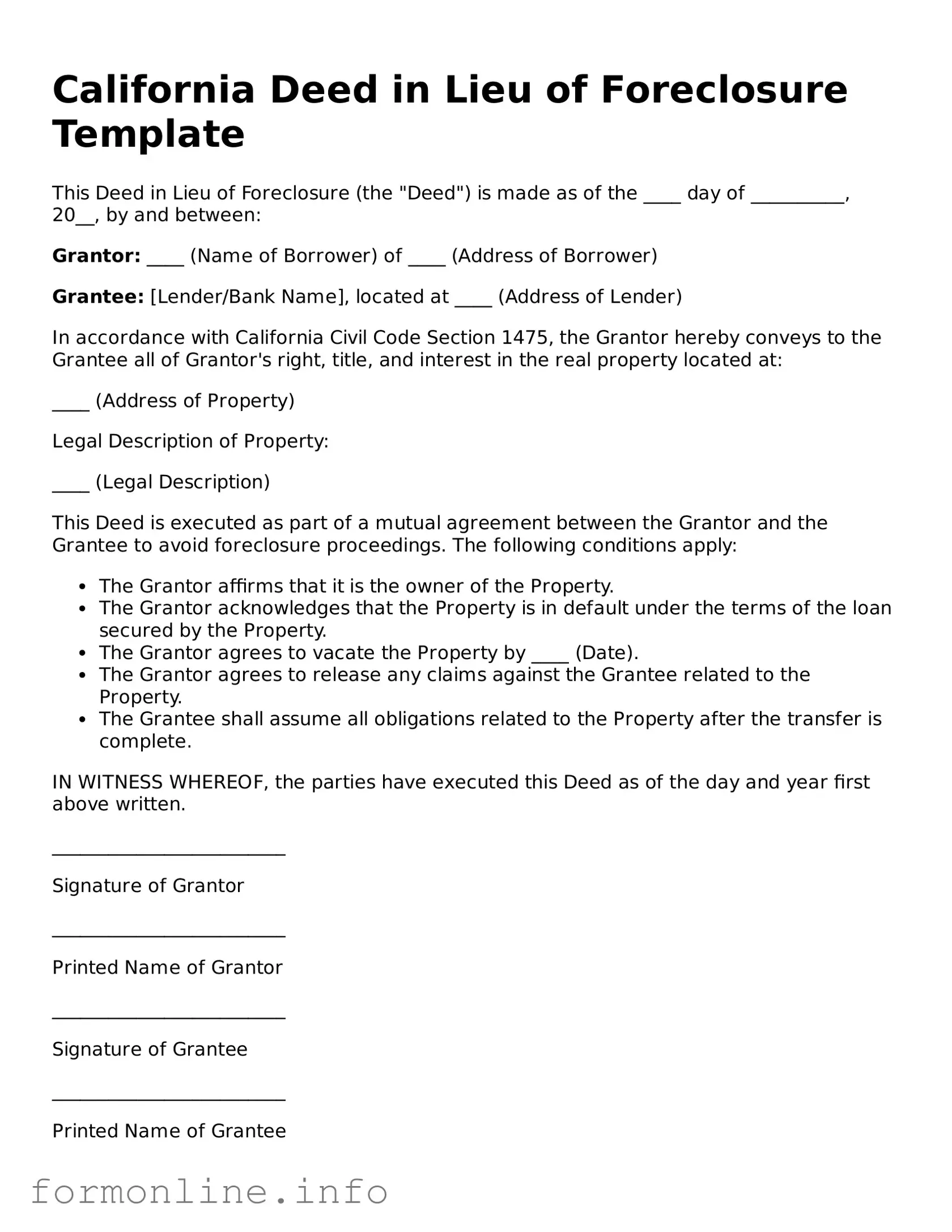

Preview - California Deed Form

California Deed Template

This document serves as a template for a deed specific to the state of California. It is intended to facilitate the transfer of property ownership in accordance with California's legal guidelines.

THIS DEED, made this ____ day of __________, 20__, by and between:

Grantor: __________________________________________ (Name and Address)

Grantee: __________________________________________ (Name and Address)

WITNESSETH:

That the Grantor, for and in consideration of the sum of $________, the receipt of which is hereby acknowledged, does hereby grant, bargain, sell, and convey unto the Grantee the following described real property situated in the County of __________, State of California:

Property Description:

_________________________________________________________________

_________________________________________________________________

This grant is made subject to any and all restrictions, easements, and covenants of record.

IN WITNESS WHEREOF, the Grantor has executed this Deed on the day and year first above written.

_______________________________

(Signature of Grantor)

_______________________________

(Printed Name of Grantor)

_______________________________

(Signature of Witness)

_______________________________

(Printed Name of Witness)

State of California

County of __________

On this ____ day of __________, 20__, before me, a Notary Public in and for said State, personally appeared __________, known to me to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same.

_______________________________

(Notary Public Signature)

My Commission Expires: _______________

This template serves as a guideline. For specific transactions, consider legal advice to ensure compliance with all applicable laws.

Popular Deed State Templates

Florida Deed Form - Buyers should ensure that all parties understand the terms outlined in the Deed.

Completing the necessary paperwork is crucial when buying or selling a vehicle, and one of the most important documents you will need is the South Carolina Motor Vehicle Bill of Sale. This legal form not only confirms the transfer of ownership from the seller to the buyer but also aids in the vehicle's registration. For a detailed guide on how to obtain this essential form, visit autobillofsaleform.com/south-carolina-motor-vehicle-bill-of-sale-form.

Warranty Deed - Essential for any transfer where legal property rights change hands.

Documents used along the form

When engaging in real estate transactions in California, several documents often accompany the California Deed form. Each of these documents plays a crucial role in ensuring that the transfer of property rights is clear, legal, and enforceable. Below is a list of commonly used forms and documents that may be required alongside the California Deed.

- Grant Deed: This document transfers ownership of real property from one party to another. It includes warranties that the property is free from any encumbrances, except those disclosed.

- Quitclaim Deed: A quitclaim deed transfers any interest the grantor may have in the property without making any guarantees about the title. It is often used to clear up title issues or transfer property between family members.

- Preliminary Change of Ownership Report: This form is typically required by the county assessor's office. It provides information about the property transfer and helps determine property tax assessments.

- Title Insurance Policy: This policy protects the buyer and lender from potential defects in the title. It ensures that the title is clear and free from claims that could affect ownership.

- Property Transfer Disclosure Statement: Sellers must provide this document, which outlines any known issues with the property. It ensures that buyers are fully informed before completing the purchase.

- Escrow Instructions: These instructions guide the escrow agent in handling the transaction. They detail how funds and documents should be managed until the sale is finalized.

- Mobile Home Bill of Sale: This form is essential for transferring ownership of mobile homes, ensuring clear terms of the sale and providing proof of ownership transfer, and can be found here: Mobile Home Bill of Sale.

- Loan Documents: If the purchase involves financing, various loan documents will be necessary. These include the promissory note and mortgage or deed of trust, outlining the terms of the loan.

- Affidavit of Identity: This document is sometimes required to confirm the identity of the parties involved in the transaction. It helps prevent fraud and ensures that the correct individuals are signing the deed.

Understanding these documents is essential for anyone involved in real estate transactions in California. Each form serves a specific purpose, contributing to a smooth and legally sound transfer of property ownership. Being aware of these requirements can help individuals navigate the complexities of real estate transactions with confidence.

Similar forms

The California Grant Deed is similar to the California Deed form in that both documents serve to transfer ownership of real property. A Grant Deed provides a guarantee that the property has not been sold to anyone else and that it is free from any undisclosed encumbrances. This deed typically includes a description of the property and the names of the grantor and grantee. Like the California Deed form, the Grant Deed must be signed and notarized to be legally valid, ensuring that the transfer is recognized by the state and recorded in public records.

The Quitclaim Deed also shares similarities with the California Deed form. This document transfers whatever interest the grantor has in the property without making any promises about the title's validity. While the California Deed form may offer warranties regarding the title, the Quitclaim Deed does not. This makes it a quicker option for transferring property, often used among family members or in divorce settlements. Both documents require notarization and recording to ensure the change of ownership is legally acknowledged.

The Warranty Deed is another document akin to the California Deed form, as it guarantees the grantor holds clear title to the property and has the right to sell it. This type of deed provides the highest level of protection for the grantee, as it includes assurances against any future claims on the property. In contrast to the California Deed form, which may or may not include warranties, the Warranty Deed explicitly protects the buyer from potential title issues, making it a preferred choice in many real estate transactions.

For those establishing a business, understanding the components of an essential Operating Agreement document is vital. This form outlines the roles and responsibilities within an LLC and provides clarity on operations. For more information on this topic, visit the comprehensive overview of the Operating Agreement.

The Special Purpose Deed, such as a Trustee's Deed, is also comparable to the California Deed form. This type of deed is used when a property is transferred by a trustee, often in cases involving a trust or foreclosure. It serves a specific purpose and typically contains language that clarifies the authority of the trustee to transfer the property. While the California Deed form is more general, the Special Purpose Deed is tailored to unique circumstances, yet both require proper execution and recording to effectuate the transfer of ownership.

Lastly, the Bargain and Sale Deed resembles the California Deed form in that it conveys property from the seller to the buyer but without any warranties regarding the title. This type of deed implies that the grantor has the right to sell the property but does not guarantee that the title is free from claims. It is often used in transactions where the buyer is aware of potential issues with the title. Like the California Deed form, it must be signed and notarized, and it is typically recorded to formalize the ownership transfer.

Dos and Don'ts

When filling out the California Deed form, it's important to approach the task with care. Here are some essential do's and don'ts to keep in mind:

- Do: Ensure all names are spelled correctly and match official identification.

- Do: Include a complete and accurate legal description of the property.

- Do: Sign the deed in front of a notary public to validate the document.

- Do: Keep a copy of the completed deed for your records.

- Don't: Leave any required fields blank; incomplete forms can lead to delays.

- Don't: Use correction fluid or tape on the form; it can invalidate the document.

- Don't: Forget to check local recording requirements; different counties may have specific rules.

- Don't: Rush through the process; take your time to ensure accuracy and completeness.

Key takeaways

When filling out and using a California Deed form, it's essential to understand a few key points to ensure the process goes smoothly. Here are some important takeaways:

- Identify the Type of Deed: Determine whether you need a grant deed, quitclaim deed, or another type of deed, as each serves different purposes.

- Complete the Form Accurately: Fill in all required fields, including the names of the grantor (the person transferring the property) and grantee (the person receiving the property).

- Provide a Legal Description: Include a precise legal description of the property. This is crucial for identifying the property in question.

- Signatures Required: Ensure that the grantor signs the deed. If there are multiple grantors, all must sign.

- Notarization: Have the deed notarized to validate the signatures. This step is often necessary for the deed to be legally recognized.

- Filing with County Recorder: After completing and notarizing the deed, file it with the county recorder's office where the property is located.

- Understand Transfer Taxes: Be aware of any transfer taxes that may apply when transferring property ownership in California.

- Keep Copies: Retain copies of the completed deed for your records. This can be important for future reference.

- Check for Liens: Before transferring property, check for any existing liens or encumbrances that could affect ownership.

- Consult a Professional: If you have questions or concerns about the process, consider consulting with a real estate attorney or a qualified professional.

By following these guidelines, you can navigate the process of filling out and using a California Deed form with greater confidence. Understanding each step helps ensure that the transfer of property is clear and legally binding.

How to Use California Deed

Once you have your California Deed form ready, it’s time to fill it out carefully. Completing this form accurately is essential for ensuring that the transfer of property rights is valid. Follow these steps to make the process straightforward.

- Gather Necessary Information: Collect details about the property, including the address, parcel number, and legal description.

- Identify the Grantor: Write the name of the person or entity transferring the property. Ensure you use the full legal name.

- Identify the Grantee: Enter the name of the person or entity receiving the property. Again, use the full legal name.

- Complete the Property Description: Fill in the legal description of the property. This may involve referencing a previous deed or a survey.

- Specify the Consideration: Indicate the amount of money or value exchanged for the property. If it’s a gift, state that clearly.

- Sign the Deed: The grantor must sign the deed in front of a notary public. This step is crucial for the deed’s validity.

- Notarization: Have the deed notarized to confirm the identities of the signatories and the authenticity of the signatures.

- Record the Deed: Submit the completed deed to the county recorder’s office where the property is located. This step officially documents the transfer.

After completing these steps, you will have successfully filled out the California Deed form. Make sure to keep copies for your records and confirm that the deed has been recorded properly.