Free General Power of Attorney Template for California State

In California, the General Power of Attorney form serves as a vital legal tool that allows individuals to appoint someone they trust to make decisions on their behalf. This document can cover a broad range of financial and legal matters, from managing bank accounts and handling real estate transactions to filing taxes and overseeing investments. By designating an agent, or attorney-in-fact, individuals can ensure that their affairs are managed according to their wishes, even if they become incapacitated or unavailable. Importantly, the powers granted can be customized to fit specific needs, allowing for a flexible approach to financial management. It is crucial to understand the implications of this form, including the responsibilities it places on the agent and the potential risks involved. Additionally, the General Power of Attorney can be revoked at any time, as long as the principal is mentally competent, providing a level of control and security. Overall, this form is an essential component of effective personal and financial planning in California.

Common mistakes

-

Incomplete Information: One common mistake is leaving sections blank. Every part of the form must be filled out completely. Missing information can lead to confusion or even invalidate the document.

-

Improper Signatures: All required signatures must be present. This includes the principal's signature and, in some cases, witnesses or a notary. Failing to obtain the necessary signatures can render the form ineffective.

-

Choosing the Wrong Agent: Selecting an untrustworthy or unqualified agent can lead to significant issues. It is crucial to choose someone who is reliable and understands the responsibilities they will assume.

-

Not Specifying Powers Clearly: Vague language regarding the powers granted can create misunderstandings. Clearly outlining the specific powers helps ensure that the agent acts within the intended scope.

-

Failing to Update the Document: Life circumstances change, and so should your power of attorney. Neglecting to update the form when necessary can result in outdated information that may not reflect current wishes.

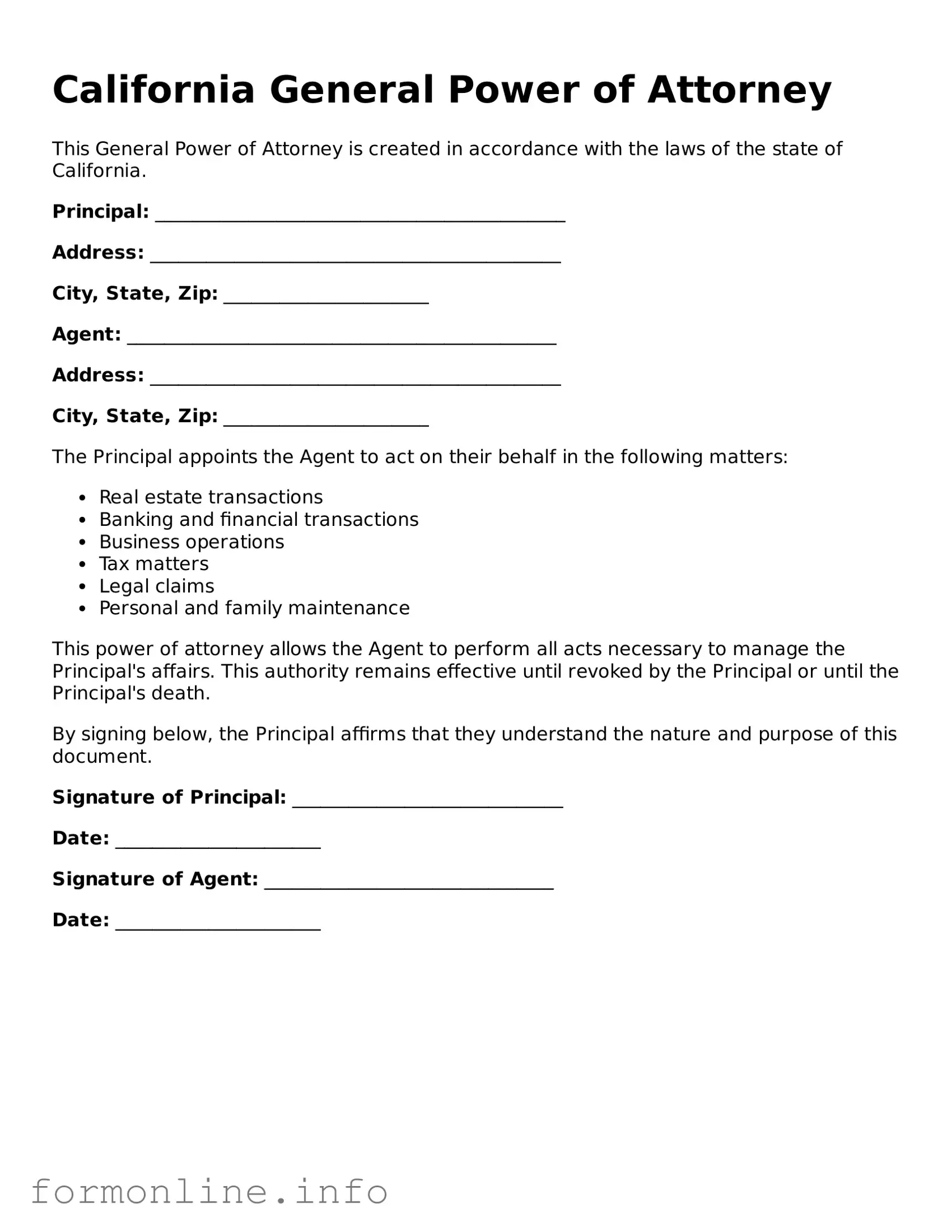

Preview - California General Power of Attorney Form

California General Power of Attorney

This General Power of Attorney is created in accordance with the laws of the state of California.

Principal: ____________________________________________

Address: ____________________________________________

City, State, Zip: ______________________

Agent: ______________________________________________

Address: ____________________________________________

City, State, Zip: ______________________

The Principal appoints the Agent to act on their behalf in the following matters:

- Real estate transactions

- Banking and financial transactions

- Business operations

- Tax matters

- Legal claims

- Personal and family maintenance

This power of attorney allows the Agent to perform all acts necessary to manage the Principal's affairs. This authority remains effective until revoked by the Principal or until the Principal's death.

By signing below, the Principal affirms that they understand the nature and purpose of this document.

Signature of Principal: _____________________________

Date: ______________________

Signature of Agent: _______________________________

Date: ______________________

Popular General Power of Attorney State Templates

Free Durable Power of Attorney Form Florida - It can relieve stress during difficult times by ensuring someone can manage your responsibilities.

To facilitate a smooth transaction in the purchase or sale of a motorcycle, it is crucial to have a complete understanding of the Texas Motorcycle Bill of Sale form. This document not only formalizes the transfer of ownership but also protects both parties involved by providing important details such as the motorcycle's specifics and the agreed price. For those looking to obtain this essential form, you can click to download it conveniently online.

Power of Attorney in Georgia - This document can help prevent delays in managing your affairs.

Documents used along the form

A California General Power of Attorney (GPOA) is an important document that allows someone to act on your behalf in financial and legal matters. However, there are other forms and documents that are often used alongside the GPOA to ensure comprehensive management of your affairs. Below is a list of these documents, each serving a unique purpose.

- Durable Power of Attorney: This document remains effective even if you become incapacitated. It allows your agent to make decisions on your behalf when you are unable to do so.

- Quitclaim Deed Form: When transferring property ownership with minimal formalities, refer to the Quitclaim Deed for family transfers and estate matters to facilitate clear documentation.

- Advance Healthcare Directive: This document outlines your healthcare preferences and appoints someone to make medical decisions for you if you cannot communicate your wishes.

- Living Will: A living will specifies your wishes regarding end-of-life medical care. It guides your loved ones and healthcare providers in critical situations.

- Financial Power of Attorney: Similar to the GPOA, this document focuses solely on financial matters, giving your agent the authority to manage your finances and assets.

- Trust Document: A trust can hold and manage your assets for your benefit or for your beneficiaries. It can help avoid probate and provide more control over how your assets are distributed.

- HIPAA Authorization: This document allows your healthcare providers to share your medical information with designated individuals. It ensures your privacy while allowing others to assist with your care.

- Will: A will outlines how you want your assets distributed after your death. It names an executor to manage your estate and can appoint guardians for minor children.

- Property Transfer Documents: These documents facilitate the transfer of property ownership, such as deeds or titles, and are necessary for real estate transactions.

- Business Power of Attorney: If you own a business, this document allows someone to make business decisions and handle transactions on your behalf, ensuring continuity in operations.

Using these documents in conjunction with a California General Power of Attorney can provide a more comprehensive approach to managing your legal and financial affairs. Each document serves a specific purpose and can help ensure that your wishes are respected and followed.

Similar forms

The Durable Power of Attorney is similar to the California General Power of Attorney in that both allow an individual, known as the principal, to designate another person, the agent, to make decisions on their behalf. The key difference lies in the durability aspect; the Durable Power of Attorney remains effective even if the principal becomes incapacitated, while the General Power of Attorney typically becomes void under such circumstances. This feature makes the Durable Power of Attorney a preferred choice for long-term planning, particularly in health care and financial matters.

The Medical Power of Attorney specifically focuses on health care decisions. Like the General Power of Attorney, it allows the principal to appoint an agent. However, the Medical Power of Attorney is limited to medical decisions, such as treatment options and end-of-life care. This document ensures that the principal's health care preferences are honored when they are unable to communicate their wishes due to illness or injury.

The Limited Power of Attorney grants an agent authority to act on behalf of the principal for specific tasks or transactions. This document is similar to the General Power of Attorney in that it involves an agent making decisions for the principal. However, the Limited Power of Attorney restricts the agent's powers to defined situations, such as selling a property or managing a bank account, making it a more focused option for particular needs.

The Springing Power of Attorney activates under certain conditions, typically when the principal becomes incapacitated. This document shares similarities with the General Power of Attorney in that it designates an agent for decision-making. However, the Springing Power of Attorney does not grant authority until the specified conditions are met, providing an additional layer of control for the principal.

The Financial Power of Attorney is tailored specifically for financial matters, allowing the agent to manage the principal’s financial affairs. Similar to the General Power of Attorney, it grants authority to the agent but is focused solely on financial transactions, such as paying bills, managing investments, and filing taxes. This document is particularly useful for individuals who need assistance with their finances while retaining control over other aspects of their lives.

Understanding the legal documentation involved in transactions such as the Mobile Home Bill of Sale is crucial for ensuring clarity and legality in property transfers. This form aids in outlining the details and terms between buyer and seller, which is pivotal for a successful negotiation. For further assistance with such documents, you can visit https://nypdfforms.com/.

The Revocation of Power of Attorney document serves to cancel any previously granted power of attorney, including the General Power of Attorney. While it does not create an authority, it is crucial for maintaining control over one's affairs. This document ensures that the principal can revoke powers granted to an agent if circumstances change or if the principal no longer wishes to be represented by that individual.

The Advance Healthcare Directive combines elements of both a Medical Power of Attorney and a living will. It allows individuals to express their health care preferences and appoint an agent to make decisions on their behalf. Similar to the General Power of Attorney, it empowers an agent to act, but it specifically addresses medical treatment choices and end-of-life care, making it a comprehensive document for health care planning.

Dos and Don'ts

When filling out the California General Power of Attorney form, it is essential to approach the task with care. Here are five important do's and don'ts to keep in mind:

- Do: Clearly identify the agent you are appointing. Include their full name and address to avoid confusion.

- Do: Specify the powers you are granting. Be as detailed as possible to ensure your intentions are understood.

- Do: Sign the document in the presence of a notary public. This step is crucial for the validity of the form.

- Do: Keep a copy of the completed form for your records. This will be helpful for future reference.

- Do: Review the form thoroughly before submission. Ensure all information is accurate and complete.

- Don't: Leave any sections blank. Incomplete forms can lead to legal complications.

- Don't: Use vague language. Ambiguity can cause misunderstandings about the powers granted.

- Don't: Forget to date the document. An undated form may be questioned regarding its validity.

- Don't: Assume that all agents have the same powers. Specify any limitations or conditions if necessary.

- Don't: Ignore state-specific requirements. Familiarize yourself with California's regulations regarding power of attorney.

Key takeaways

Understanding the California General Power of Attorney (POA) form can empower individuals to manage their affairs effectively. Here are some essential takeaways to consider:

- Purpose: A General Power of Attorney allows you to designate someone to act on your behalf in financial and legal matters.

- Agent Selection: Choose a trustworthy person as your agent, as they will have significant authority over your affairs.

- Durability: This form can be made durable, meaning it remains effective even if you become incapacitated.

- Limitations: Be clear about the powers you grant. You can limit the scope of authority to specific transactions or decisions.

- Signing Requirements: The form must be signed by you and, in most cases, witnessed or notarized to be valid.

- Revocation: You have the right to revoke the power of attorney at any time, as long as you are mentally competent.

- State-Specific Rules: Familiarize yourself with California laws, as they may differ from other states regarding POA forms.

- Use Cases: This form is useful for managing bank accounts, real estate transactions, and other financial matters.

- Communication: Discuss your intentions with your agent to ensure they understand your wishes and expectations.

- Legal Advice: Consider seeking legal advice if you have questions or concerns about filling out the form correctly.

By keeping these points in mind, individuals can navigate the process of establishing a General Power of Attorney in California with confidence.

How to Use California General Power of Attorney

Filling out the California General Power of Attorney form is a crucial step in ensuring your financial and legal matters are handled according to your wishes. This form allows you to designate someone you trust to act on your behalf. Make sure to complete it accurately to avoid any issues down the line.

- Begin by downloading the California General Power of Attorney form from a reliable source.

- Read the instructions carefully to understand what information is required.

- In the first section, fill in your full name and address as the principal.

- Next, provide the name and address of the agent you are appointing. This is the person who will act on your behalf.

- Specify the powers you are granting to your agent. You can choose general powers or limit them to specific areas.

- If applicable, include any additional instructions or limitations regarding your agent’s authority.

- Sign and date the form in the designated area. Your signature must match the name you provided at the top.

- Have the form notarized to ensure its validity. This step is important for legal recognition.

- Make copies of the completed form for your records and for your agent.

Once you have filled out the form, ensure that your appointed agent understands their responsibilities. Keep the original document in a safe place and share copies with relevant parties as needed.