Free Gift Deed Template for California State

The California Gift Deed form serves as a crucial legal instrument for individuals wishing to transfer property without the exchange of monetary compensation. This document facilitates the voluntary transfer of real estate from one party, known as the donor, to another, referred to as the donee. Essential elements of the form include the identification of both parties, a clear description of the property being gifted, and the donor's intent to make a gift. The form must be executed with the appropriate formalities, typically requiring notarization to ensure its validity. Importantly, the Gift Deed also addresses the implications for taxes and potential liabilities, providing clarity on how the transfer affects both the donor and the donee. By understanding the nuances of the California Gift Deed, individuals can navigate the complexities of property transfers while ensuring compliance with state laws.

Common mistakes

-

Incomplete Information: Failing to fill in all required fields can lead to significant delays or even rejection of the deed. Each section is crucial for legal clarity.

-

Incorrect Property Description: Providing an inaccurate or vague description of the property can create confusion. Always ensure the legal description matches public records.

-

Not Notarizing the Document: A gift deed must be notarized to be valid. Skipping this step can render the document unenforceable.

-

Missing Signatures: Both the donor and the recipient must sign the deed. Omitting one of these signatures can invalidate the transfer.

-

Failure to Record the Deed: After completing the form, it’s essential to record the deed with the county. If you don’t, the gift may not be recognized legally.

-

Ignoring Tax Implications: Some individuals overlook potential tax consequences associated with gifting property. Consulting a tax professional is advisable.

-

Using Outdated Forms: Always ensure you are using the most current version of the Gift Deed form. Using an outdated form may lead to legal complications.

-

Not Understanding the Gift’s Impact: Individuals sometimes fail to grasp how the gift affects their estate planning. Understanding this is crucial for future financial decisions.

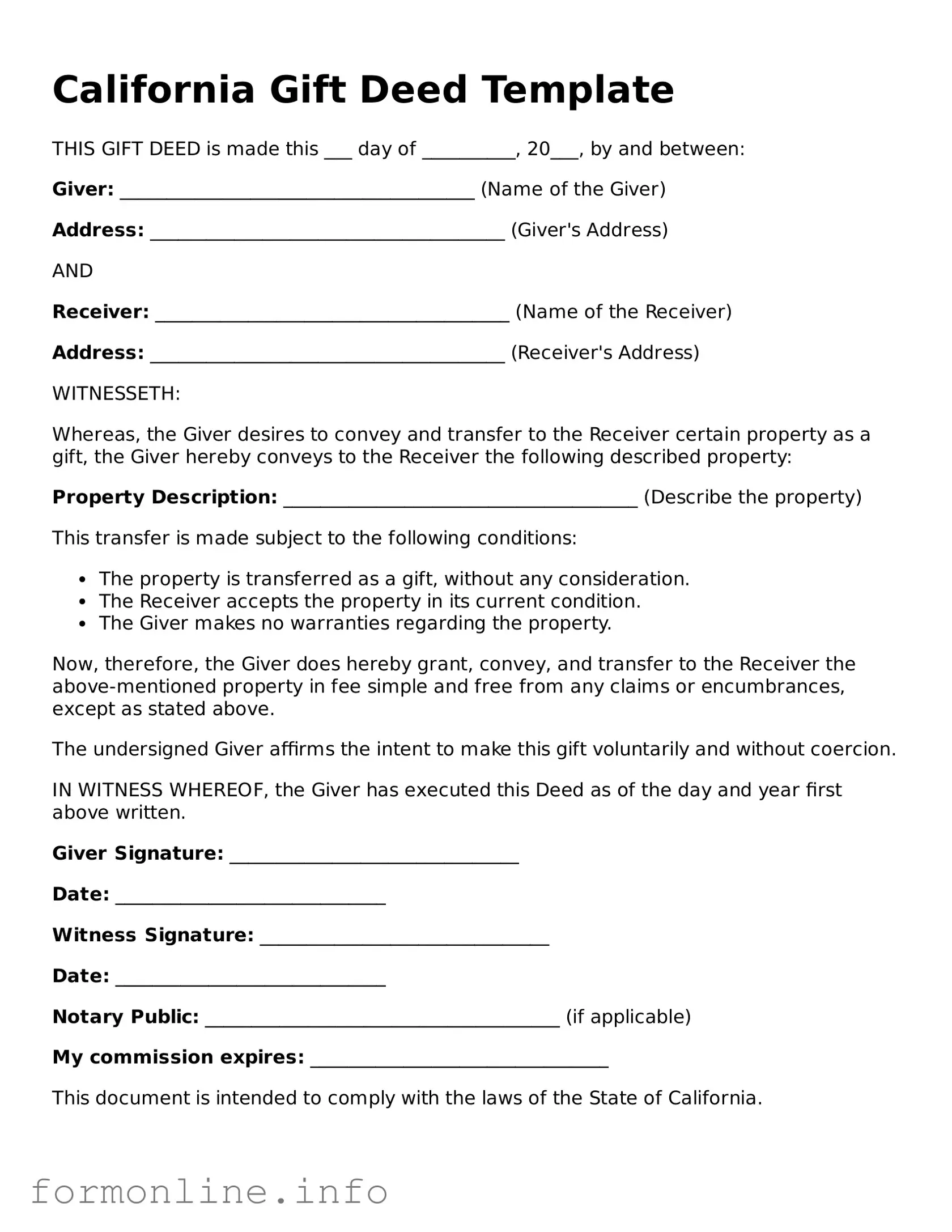

Preview - California Gift Deed Form

California Gift Deed Template

THIS GIFT DEED is made this ___ day of __________, 20___, by and between:

Giver: ______________________________________ (Name of the Giver)

Address: ______________________________________ (Giver's Address)

AND

Receiver: ______________________________________ (Name of the Receiver)

Address: ______________________________________ (Receiver's Address)

WITNESSETH:

Whereas, the Giver desires to convey and transfer to the Receiver certain property as a gift, the Giver hereby conveys to the Receiver the following described property:

Property Description: ______________________________________ (Describe the property)

This transfer is made subject to the following conditions:

- The property is transferred as a gift, without any consideration.

- The Receiver accepts the property in its current condition.

- The Giver makes no warranties regarding the property.

Now, therefore, the Giver does hereby grant, convey, and transfer to the Receiver the above-mentioned property in fee simple and free from any claims or encumbrances, except as stated above.

The undersigned Giver affirms the intent to make this gift voluntarily and without coercion.

IN WITNESS WHEREOF, the Giver has executed this Deed as of the day and year first above written.

Giver Signature: _______________________________

Date: _____________________________

Witness Signature: _______________________________

Date: _____________________________

Notary Public: ______________________________________ (if applicable)

My commission expires: ________________________________

This document is intended to comply with the laws of the State of California.

Popular Gift Deed State Templates

How to Transfer Deed of House - A Gift Deed protects both the giver and the receiver by outlining the terms of the gift.

To facilitate the transfer of ownership, it is essential to complete the Missouri Mobile Home Bill of Sale accurately; this includes utilizing the appropriate legal template such as the Mobile Home Bill of Sale. By providing clear information about the mobile home and involved parties, this document ensures that the transaction is legally binding and protects the interests of both the buyer and seller.

Documents used along the form

The California Gift Deed form is a crucial document for transferring property without any exchange of money. However, several other forms and documents may accompany it to ensure a smooth and legally sound transaction. Below is a list of commonly used documents that complement the Gift Deed form.

- Grant Deed: This document serves as a formal transfer of property ownership and may include warranties regarding the title's validity.

- Quitclaim Deed: Often used to transfer property rights without guaranteeing the title, this deed is simple and quick but offers less protection to the grantee.

- Property Tax Transfer Form: This form notifies the local tax authority about the change in ownership, which may affect property taxes.

- Affidavit of Value: This document provides an estimated value of the property being gifted, which can be important for tax purposes.

- Title Insurance Policy: While not mandatory, this policy protects the new owner against potential title defects that may arise after the transfer.

- Beneficiary Designation Form: This form allows the donor to specify who will receive the property upon their passing, ensuring a clear transfer of ownership.

- North Carolina Motor Vehicle Bill of Sale: For those dealing with vehicle ownership transfers, understanding the autobillofsaleform.com/north-carolina-motor-vehicle-bill-of-sale-form can be essential, as it provides necessary documentation and helps in the registration process.

- Gift Tax Return (Form 709): This IRS form is required if the value of the gift exceeds the annual exclusion limit, ensuring compliance with federal tax laws.

- Consent of Spouse: If applicable, this document provides consent from the spouse of the donor, ensuring that the gift does not violate any community property laws.

- Notarization Certificate: This certificate confirms that the signatures on the Gift Deed have been verified by a notary public, adding an extra layer of authenticity.

Using these documents in conjunction with the California Gift Deed form can facilitate a more efficient property transfer process. Each document serves a specific purpose, enhancing the overall integrity and legality of the transaction.

Similar forms

The California Gift Deed form is similar to a Quitclaim Deed. Both documents are used to transfer property ownership, but a Quitclaim Deed does not guarantee that the person transferring the property actually owns it. Instead, it simply conveys whatever interest the grantor has in the property. This makes it a quicker and often less formal way to transfer property, especially among family members or friends.

Another document that resembles the Gift Deed is the Warranty Deed. Unlike a Gift Deed, a Warranty Deed offers guarantees about the ownership and title of the property. The grantor assures the grantee that they hold clear title to the property and have the right to transfer it. This added security makes Warranty Deeds more common in traditional property sales rather than gifts.

A Bargain and Sale Deed is also similar to a Gift Deed. It transfers property ownership but does not provide any warranties about the title. This means the buyer accepts the property "as is." While a Gift Deed is typically used for no-cost transfers, a Bargain and Sale Deed often involves some form of payment, albeit usually less than the market value.

The Grant Deed shares similarities with the Gift Deed as well. Both documents transfer property ownership, but a Grant Deed includes certain warranties. The grantor guarantees that they have not transferred the property to anyone else and that the property is free from encumbrances, except those disclosed. This makes the Grant Deed a bit more secure than a Gift Deed.

For those navigating the intricacies of vehicle transactions in Alabama, understanding the various legal documents involved is essential. One key element is the Alabama Motor Vehicle Bill of Sale form, which acts as a definitive record of the sale, ensuring all specific terms are captured to safeguard the interests of both the seller and buyer. Whether you are engaging in a simple trade or a significant sale, filling out this form accurately is pivotal. For further assistance and a customizable option, visit billofsaleforvehicles.com/editable-alabama-motor-vehicle-bill-of-sale to access an editable version that complements your needs.

A Trust Transfer Deed is another document that resembles the Gift Deed. This type of deed is used when property is transferred into a trust. While a Gift Deed is often used for personal gifts, a Trust Transfer Deed is typically part of estate planning. Both serve to change ownership but do so in different contexts.

Similarly, a Deed of Trust is comparable to a Gift Deed in that it involves the transfer of property rights. However, a Deed of Trust is primarily used to secure a loan. In this case, the borrower gives the lender a security interest in the property. The ownership remains with the borrower unless they default on the loan, which is a different purpose compared to a Gift Deed.

The Special Warranty Deed is another document that has similarities to the Gift Deed. It conveys property ownership but limits the grantor's warranties to only the time they owned the property. This means that any issues that arose before their ownership are not covered. This can make it a less secure option compared to a full Warranty Deed.

A Leasehold Deed is somewhat similar as it involves property but serves a different function. It grants the right to use and occupy the property for a specified period. Unlike a Gift Deed, which transfers ownership outright, a Leasehold Deed only allows for temporary use, making it a different type of transaction altogether.

The Affidavit of Death is another document that can be related to the Gift Deed, particularly in estate situations. This document is used to transfer property ownership after someone has passed away. While a Gift Deed is used during the grantor's lifetime, the Affidavit of Death facilitates the transfer of property as part of the estate settlement process.

Finally, a Bill of Sale is similar in that it can transfer ownership of personal property, but it is typically used for movable items rather than real estate. While a Gift Deed pertains specifically to real property, a Bill of Sale can apply to a wide range of personal items, such as vehicles or equipment, making it a different but related document.

Dos and Don'ts

When filling out the California Gift Deed form, it’s important to follow certain guidelines to ensure the process goes smoothly. Here are some do's and don'ts to keep in mind:

- Do provide accurate information about the property being gifted.

- Do include the full names of both the donor and the recipient.

- Do sign the form in the presence of a notary public.

- Do check local regulations for any specific requirements.

- Don't leave any fields blank; ensure all necessary information is filled out.

- Don't forget to date the form when signing.

- Don't use outdated versions of the form; always use the most current one.

By adhering to these guidelines, you can help ensure that the gift deed is valid and legally binding.

Key takeaways

When filling out and using the California Gift Deed form, it is important to keep several key points in mind. Here are some essential takeaways:

- The Gift Deed is used to transfer property ownership without any payment.

- Both the donor (the person giving the gift) and the recipient (the person receiving the gift) must be clearly identified.

- Ensure that the legal description of the property is accurate and complete.

- The form must be signed by the donor in front of a notary public.

- Consider whether any tax implications may arise from the gift, such as gift taxes.

- Once completed, the Gift Deed must be recorded with the county recorder's office.

- Keep a copy of the recorded Gift Deed for your records.

- Review any potential impacts on existing mortgages or liens on the property.

- Consult with a legal professional if there are any uncertainties about the process.

- Understand that once the Gift Deed is executed, the transfer is generally irreversible.

How to Use California Gift Deed

After gathering the necessary information, you will proceed to fill out the California Gift Deed form. This document requires specific details to ensure proper completion. Follow these steps carefully to ensure accuracy and compliance with the requirements.

- Obtain the California Gift Deed form. This can be downloaded from a reliable legal website or obtained from a local county recorder's office.

- Begin by filling in the names of the grantor (the person giving the gift) and the grantee (the person receiving the gift). Ensure that the names are spelled correctly and match the names on the title or deed.

- Provide the address of the property being gifted. This should include the street address, city, state, and zip code.

- Include a legal description of the property. This can often be found in previous deeds or property tax statements. It should be detailed enough to clearly identify the property.

- Specify any consideration given for the gift, if applicable. In most cases, this will be stated as "for love and affection" if no monetary value is exchanged.

- Sign the form in the presence of a notary public. The grantor must sign, and the notary will verify the identity and witness the signature.

- Ensure that the notary public completes their section on the form, which includes their signature, seal, and the date of notarization.

- Make copies of the completed form for your records before submitting it.

- File the original Gift Deed with the county recorder's office where the property is located. There may be a filing fee, so check the local requirements.