Free Last Will and Testament Template for California State

Creating a Last Will and Testament is a crucial step in ensuring that your wishes are honored after your passing. In California, this legal document serves as a roadmap for how your assets should be distributed, who will take care of your minor children, and how your final affairs should be managed. The California Last Will and Testament form allows you to specify beneficiaries, appoint an executor, and outline any specific bequests you wish to make. Additionally, it provides a framework for addressing debts and taxes, ensuring that your estate is settled according to your desires. Understanding the components of this form, including the importance of signatures and witnesses, is essential for anyone looking to create a valid will in California. By taking the time to properly fill out and execute this document, you can provide peace of mind for yourself and your loved ones during a challenging time.

Common mistakes

-

Not Being Clear About Beneficiaries: One common mistake is failing to clearly identify beneficiaries. When listing individuals or organizations, it’s crucial to provide full names and, if possible, their relationship to you. Ambiguities can lead to disputes among heirs.

-

Forgetting to Sign the Document: A will must be signed to be valid. Some individuals overlook this essential step, thinking that simply filling out the form is sufficient. Without a signature, the document may not hold up in court.

-

Neglecting to Update the Will: Life changes, such as marriage, divorce, or the birth of children, can affect your wishes. Failing to update your will after significant life events can lead to unintended consequences, such as excluding a loved one.

-

Not Considering Witness Requirements: California law requires that a will be witnessed by at least two individuals. Many people forget this requirement or choose witnesses who are not disinterested parties, which can invalidate the will.

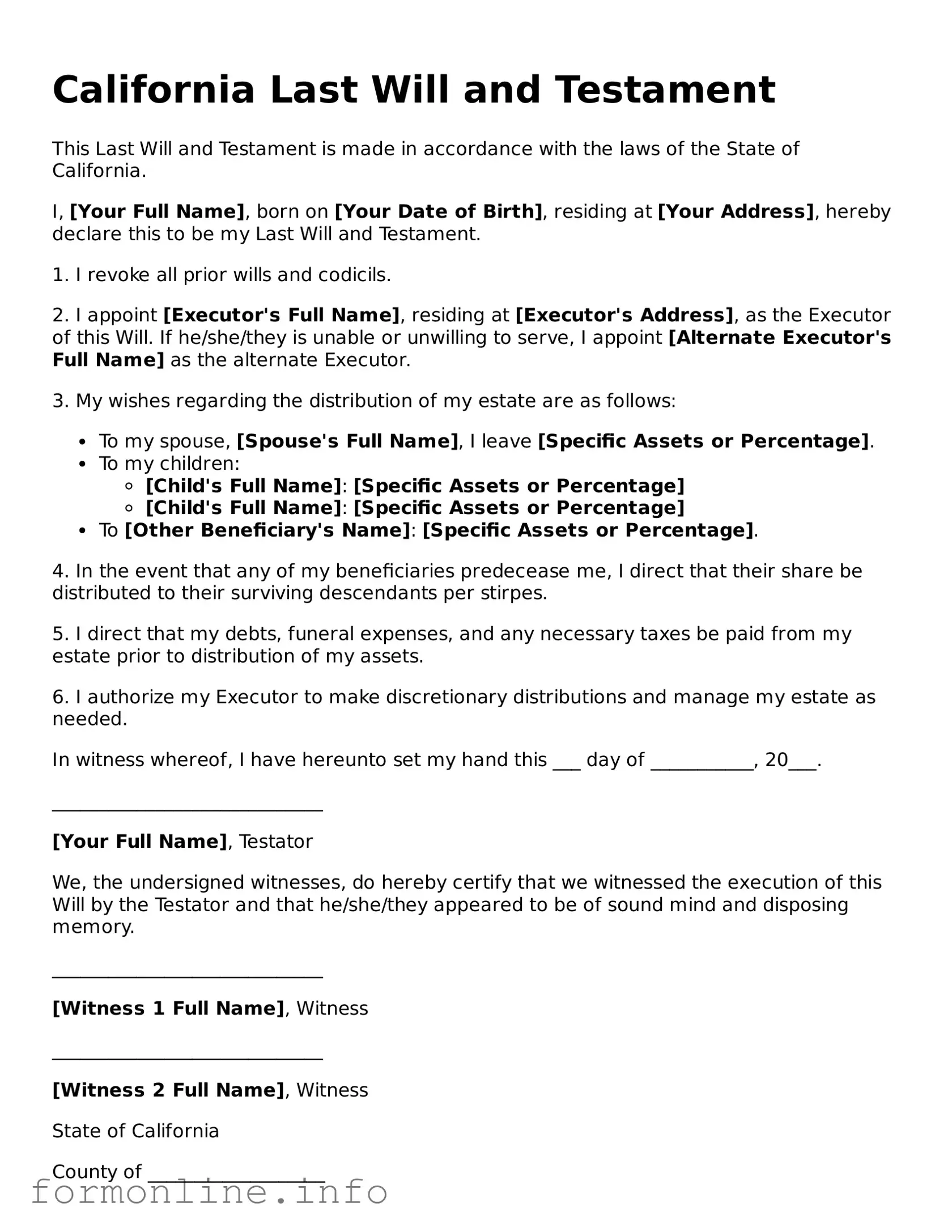

Preview - California Last Will and Testament Form

California Last Will and Testament

This Last Will and Testament is made in accordance with the laws of the State of California.

I, [Your Full Name], born on [Your Date of Birth], residing at [Your Address], hereby declare this to be my Last Will and Testament.

1. I revoke all prior wills and codicils.

2. I appoint [Executor's Full Name], residing at [Executor's Address], as the Executor of this Will. If he/she/they is unable or unwilling to serve, I appoint [Alternate Executor's Full Name] as the alternate Executor.

3. My wishes regarding the distribution of my estate are as follows:

- To my spouse, [Spouse's Full Name], I leave [Specific Assets or Percentage].

- To my children:

- [Child's Full Name]: [Specific Assets or Percentage]

- [Child's Full Name]: [Specific Assets or Percentage]

- To [Other Beneficiary's Name]: [Specific Assets or Percentage].

4. In the event that any of my beneficiaries predecease me, I direct that their share be distributed to their surviving descendants per stirpes.

5. I direct that my debts, funeral expenses, and any necessary taxes be paid from my estate prior to distribution of my assets.

6. I authorize my Executor to make discretionary distributions and manage my estate as needed.

In witness whereof, I have hereunto set my hand this ___ day of ___________, 20___.

_____________________________

[Your Full Name], Testator

We, the undersigned witnesses, do hereby certify that we witnessed the execution of this Will by the Testator and that he/she/they appeared to be of sound mind and disposing memory.

_____________________________

[Witness 1 Full Name], Witness

_____________________________

[Witness 2 Full Name], Witness

State of California

County of ___________________

On this ___ day of ___________, 20___, before me, a Notary Public in and for said County, personally appeared [Your Full Name], known to be the person whose name is subscribed to this instrument, and acknowledged that he/she/they executed the same.

_____________________________

Notary Public Signature

Popular Last Will and Testament State Templates

How to Make a Will in Florida - With a will, you can leave behind personal messages or gifts to family and friends.

When engaging in the sale of a mobile home, it is essential to complete the necessary paperwork to ensure a legitimate transfer of ownership. One important document in this process is the Mobile Home Bill of Sale, which includes vital information about the transaction, protecting both the buyer and seller throughout the process.

Online Will Georgia - Can dictate periodic family meetings to discuss legacy and wishes.

Documents used along the form

When planning for the future, a California Last Will and Testament is just one piece of the puzzle. Several other important documents can help ensure that your wishes are honored and that your loved ones are taken care of. Here are four key forms and documents often used alongside a will.

- Durable Power of Attorney: This document allows you to appoint someone to manage your financial affairs if you become incapacitated. It gives that person the authority to make decisions on your behalf, ensuring your financial matters are handled according to your wishes.

- Advance Healthcare Directive: Also known as a living will, this document outlines your preferences for medical treatment in case you cannot communicate your wishes. It can specify your desires regarding life-sustaining treatments and appoint someone to make healthcare decisions for you.

- Revocable Living Trust: This legal arrangement allows you to place your assets into a trust during your lifetime. You maintain control over the assets, and upon your passing, they can be distributed to your beneficiaries without going through probate, making the process quicker and often less costly.

- Quitclaim Deed: When transferring property ownership, utilize the reliable Quitclaim Deed form guidance to facilitate a straightforward process.

- Beneficiary Designations: Certain assets, like life insurance policies and retirement accounts, allow you to designate beneficiaries directly. This means those assets can pass directly to your chosen individuals upon your death, bypassing the will and probate process altogether.

Incorporating these documents into your estate plan can provide clarity and peace of mind. Each serves a unique purpose, working together to ensure that your wishes are respected and that your loved ones are supported when the time comes.

Similar forms

The California Last Will and Testament is similar to a Living Trust in that both documents are used to manage an individual’s assets and distribute them upon death. A Living Trust allows a person to transfer their assets into a trust during their lifetime, which can then be managed by a trustee. This can help avoid the probate process, which is often required for a will. Additionally, a Living Trust can provide more privacy, as it does not become a public record like a will does. Both documents aim to ensure that an individual's wishes are honored after their passing, but they operate in slightly different ways and have different implications for asset management.

Another document that resembles a Last Will and Testament is a Durable Power of Attorney. This document allows a person to appoint someone else to make financial or legal decisions on their behalf if they become incapacitated. While a will only takes effect after death, a Durable Power of Attorney is active during the individual's lifetime. It ensures that someone can manage financial affairs without going through court proceedings. Both documents are essential for planning for the future and ensuring that one’s preferences are respected, but they serve different purposes in terms of timing and scope of authority.

A Health Care Directive, also known as an Advance Health Care Directive, is similar to a Last Will and Testament in that it outlines an individual’s preferences regarding medical treatment and end-of-life care. This document comes into play when a person is unable to communicate their wishes due to illness or injury. While a will addresses the distribution of assets, a Health Care Directive focuses on medical decisions. Both documents are vital for ensuring that a person’s wishes are honored, but they pertain to different aspects of personal planning.

Understanding the Arizona University Application form is essential for students looking to navigate the admission process effectively. The Arizona University Application form is a crucial document for students seeking undergraduate admission to institutions such as Arizona State University, Northern Arizona University, and the University of Arizona, and includes a request for a waiver of the application fee for Arizona residents facing financial hardship. For more details on this application process, students can visit AZ Forms Online.

The Revocable Trust, much like a Last Will and Testament, is a tool for estate planning. It allows individuals to manage their assets during their lifetime and specify how they should be distributed after death. A Revocable Trust can be altered or revoked at any time while the individual is alive. Unlike a will, which goes through probate, a Revocable Trust can help avoid this process, allowing for a more streamlined transfer of assets. Both documents serve the purpose of ensuring that a person's wishes regarding their assets are fulfilled, but they differ in their flexibility and how they are executed after death.

Finally, a Codicil is a document that serves as an amendment to an existing Last Will and Testament. It allows individuals to make changes or additions to their will without having to create an entirely new document. This can include updating beneficiaries or altering specific bequests. A Codicil must be executed with the same formalities as a will to be valid. Both a will and a Codicil work together to reflect a person’s current wishes regarding their estate, but the Codicil specifically modifies the original will rather than serving as a standalone document.

Dos and Don'ts

When filling out the California Last Will and Testament form, it’s important to follow certain guidelines to ensure that your wishes are clearly stated and legally binding. Here’s a list of things you should and shouldn’t do:

- Do ensure you are of sound mind and at least 18 years old.

- Do clearly identify yourself and your beneficiaries.

- Do specify how you want your assets distributed.

- Do sign the document in the presence of at least two witnesses.

- Don't use vague language that could lead to confusion.

- Don't forget to date the will.

- Don't include any illegal instructions or conditions.

- Don't leave out important details about your estate.

Key takeaways

When it comes to creating a Last Will and Testament in California, understanding the key elements of the process is essential. Here are some important takeaways to consider:

- Eligibility: To create a valid will in California, you must be at least 18 years old and of sound mind. This means you should understand the nature of the document and the implications of your decisions.

- Written Document: California requires that a will be in writing. While it can be handwritten, typed, or printed, it must be clear and legible to ensure your intentions are understood.

- Signature Requirement: You must sign your will at the end. If you are unable to sign, you may have someone else sign on your behalf in your presence, but this must be done according to specific legal requirements.

- Witnesses: California law requires that your will be witnessed by at least two individuals who are not beneficiaries. These witnesses must observe you signing the will or acknowledge your signature.

- Revocation: A will can be revoked or modified at any time before your death. To do this, you can create a new will or physically destroy the old one, ensuring that your latest intentions are clear.

- Filing with the Court: While it is not necessary to file your will with the court while you are alive, it must be filed after your death to initiate the probate process. Keeping your will in a safe place is crucial.

Understanding these elements can help ensure that your wishes are honored and that the process of distributing your estate is as smooth as possible.

How to Use California Last Will and Testament

After obtaining the California Last Will and Testament form, you will need to complete it accurately to ensure your wishes are clearly expressed. This process involves providing essential information about your assets, beneficiaries, and the individual you trust to execute your will.

- Title the Document: At the top of the form, write "Last Will and Testament."

- Identify Yourself: Include your full name, address, and date of birth. This establishes your identity as the testator.

- Declare Your Intent: State that you are of sound mind and that this document reflects your wishes.

- List Your Beneficiaries: Clearly name the individuals or organizations you wish to inherit your assets. Specify what each beneficiary will receive.

- Appoint an Executor: Choose a trusted person to carry out the terms of your will. Include their full name and contact information.

- Detail Your Assets: Provide a comprehensive list of your assets, including real estate, bank accounts, personal property, and any other valuables.

- Include Guardianship Provisions: If you have minor children, name a guardian for them in the event of your passing.

- Sign and Date the Will: Sign your will in the presence of at least two witnesses. Include the date of signing.

- Witness Signatures: Have your witnesses sign the document, including their names and addresses. They should not be beneficiaries.

- Store the Will Safely: Keep the original will in a secure location, such as a safe or with your attorney.