Free Loan Agreement Template for California State

In California, the Loan Agreement form serves as a crucial document that outlines the terms and conditions of a loan between a lender and a borrower. This form typically includes essential details such as the loan amount, interest rate, repayment schedule, and any collateral that may be required. It is designed to protect the interests of both parties by clearly defining their rights and responsibilities. Additionally, the form may address late fees, default terms, and the process for resolving disputes. By providing a structured framework, the Loan Agreement form helps to foster transparency and trust, ensuring that both the lender and borrower have a mutual understanding of the loan's terms. Understanding this document is vital for anyone considering a loan in California, as it lays the foundation for a successful financial relationship.

Common mistakes

-

Missing Signatures: One of the most common mistakes is forgetting to sign the agreement. Both parties must sign the document to make it valid.

-

Incorrect Dates: Entering the wrong dates can lead to confusion. Ensure all dates are accurate, especially the loan start date and repayment schedule.

-

Incomplete Information: Failing to provide all necessary details, such as the loan amount or interest rate, can cause issues later. Double-check that all sections are filled out completely.

-

Wrong Loan Terms: Misunderstanding or miswriting the loan terms can lead to disputes. Review the terms carefully to ensure they reflect what was agreed upon.

-

Not Keeping Copies: After signing, it's crucial to keep a copy of the agreement. This ensures both parties have access to the terms and can refer back to them if needed.

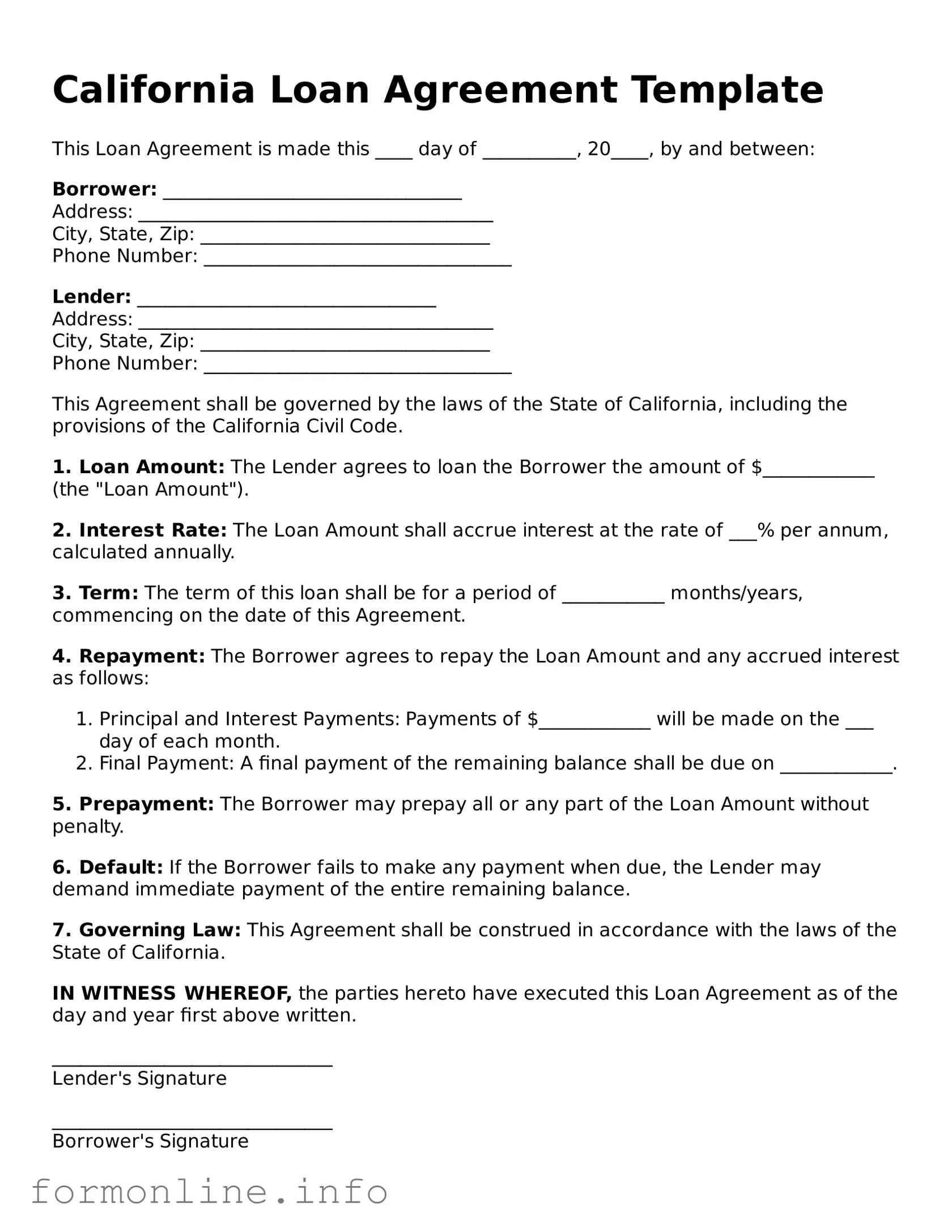

Preview - California Loan Agreement Form

California Loan Agreement Template

This Loan Agreement is made this ____ day of __________, 20____, by and between:

Borrower: ________________________________

Address: ______________________________________

City, State, Zip: _______________________________

Phone Number: _________________________________

Lender: ________________________________

Address: ______________________________________

City, State, Zip: _______________________________

Phone Number: _________________________________

This Agreement shall be governed by the laws of the State of California, including the provisions of the California Civil Code.

1. Loan Amount: The Lender agrees to loan the Borrower the amount of $____________ (the "Loan Amount").

2. Interest Rate: The Loan Amount shall accrue interest at the rate of ___% per annum, calculated annually.

3. Term: The term of this loan shall be for a period of ___________ months/years, commencing on the date of this Agreement.

4. Repayment: The Borrower agrees to repay the Loan Amount and any accrued interest as follows:

- Principal and Interest Payments: Payments of $____________ will be made on the ___ day of each month.

- Final Payment: A final payment of the remaining balance shall be due on ____________.

5. Prepayment: The Borrower may prepay all or any part of the Loan Amount without penalty.

6. Default: If the Borrower fails to make any payment when due, the Lender may demand immediate payment of the entire remaining balance.

7. Governing Law: This Agreement shall be construed in accordance with the laws of the State of California.

IN WITNESS WHEREOF, the parties hereto have executed this Loan Agreement as of the day and year first above written.

______________________________

Lender's Signature

______________________________

Borrower's Signature

Popular Loan Agreement State Templates

Promissory Note Georgia - Outlines the process for loan disbursement upon agreement signing.

When engaging in the purchase or sale of a recreational vehicle in Texas, it is essential to utilize the Texas RV Bill of Sale form to ensure a clear and binding agreement between the parties involved. This document acts as a vital record of the transaction, providing reassurance through its detailed account of the exchange. It is important to have the proper documentation for registration and tax purposes, and you can find more information at https://autobillofsaleform.com/rv-bill-of-sale-form/texas-rv-bill-of-sale-form/.

Sample Promissory Note Florida - Interest calculation and payment frequency are clearly articulated in the agreement.

Documents used along the form

When entering into a loan agreement in California, several other forms and documents may accompany the primary loan agreement. Each document serves a specific purpose and helps clarify the terms and conditions of the loan. Below is a list of commonly used forms.

- Promissory Note: This document outlines the borrower's promise to repay the loan, detailing the amount borrowed, interest rate, repayment schedule, and any penalties for late payments.

- Loan Disclosure Statement: Required by law, this statement provides borrowers with essential information about the loan, including fees, interest rates, and the total cost of borrowing.

- Security Agreement: If the loan is secured by collateral, this agreement specifies the collateral used and the rights of the lender in the event of default.

- Personal Guarantee: This document may be required from individuals who guarantee the loan, ensuring they will be responsible for repayment if the borrower defaults.

- Mobile Home Bill of Sale: This crucial document is necessary for the ownership transfer of a mobile home, ensuring all details are accurately captured, including buyer and seller information, and can be referenced at Mobile Home Bill of Sale.

- Payment Schedule: A detailed breakdown of when payments are due, including the amounts and due dates, helps both parties keep track of obligations.

- Loan Modification Agreement: If changes to the loan terms are necessary, this document formalizes the modifications agreed upon by both the borrower and lender.

- Default Notice: This notice is sent to the borrower if they fail to meet the terms of the loan, outlining the consequences and potential actions the lender may take.

- Release of Lien: Once the loan is repaid, this document is issued to confirm that the lender no longer has a claim on the collateral used for the loan.

Each of these documents plays a crucial role in the loan process, ensuring clarity and protection for both the borrower and lender. Understanding these forms can help facilitate a smoother transaction and minimize misunderstandings.

Similar forms

The California Loan Agreement form shares similarities with a Promissory Note. A Promissory Note is a written promise from a borrower to repay a specified amount of money to a lender, often detailing the interest rate and repayment schedule. Like the Loan Agreement, it outlines the terms of the loan but typically focuses more on the borrower's commitment to repay rather than the broader terms of the agreement. This document is essential for establishing the borrower's legal obligation and can serve as evidence in case of a dispute.

Another document akin to the California Loan Agreement is the Security Agreement. This document outlines the collateral that secures the loan, providing the lender with a claim to specific assets if the borrower defaults. While the Loan Agreement encompasses the overall terms of the loan, including repayment and interest, the Security Agreement specifically addresses the protection of the lender's interests. This ensures that both parties understand the risks involved and the measures in place to mitigate them.

For those navigating the complexities of vehicle transactions, understanding the importance of a proper documentation is essential. The Alabama Motor Vehicle Bill of Sale form provides all the necessary details to ensure a smooth transfer and protects both buyers and sellers in the process. This document acts as definitive proof of purchase and outlines the terms agreed upon, emphasizing the need for accuracy in its completion. For further guidance on how to utilize this essential form, you can visit https://billofsaleforvehicles.com/editable-alabama-motor-vehicle-bill-of-sale/.

A third document that parallels the California Loan Agreement is the Loan Disclosure Statement. This document provides borrowers with essential information about the loan, including terms, fees, and potential risks. While the Loan Agreement itself details the legal obligations, the Loan Disclosure Statement serves as a summary that promotes transparency. It helps borrowers make informed decisions by clearly outlining the financial implications of their loan.

The California Loan Agreement also resembles a Mortgage Agreement, particularly in real estate transactions. A Mortgage Agreement secures a loan with real property, detailing the rights and responsibilities of both the borrower and the lender. Like the Loan Agreement, it specifies the terms of repayment and the consequences of default. However, the Mortgage Agreement is more focused on the property itself, establishing the lender's rights to the property should the borrower fail to meet their obligations.

Lastly, the California Loan Agreement is similar to a Loan Modification Agreement. This document is used when the original terms of a loan need to be changed, often due to financial hardship faced by the borrower. While the Loan Agreement sets the initial terms, the Loan Modification Agreement revises those terms to make repayment more manageable. Both documents aim to protect the lender's interests while addressing the borrower's needs, emphasizing the importance of clear communication and mutual agreement in financial transactions.

Dos and Don'ts

When filling out the California Loan Agreement form, it is essential to follow specific guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do.

- Do read the entire agreement carefully before filling it out.

- Do provide accurate and complete information about all parties involved.

- Do double-check all numbers and dates for correctness.

- Do ensure that you understand the terms and conditions before signing.

- Do keep a copy of the signed agreement for your records.

- Don't leave any fields blank unless instructed to do so.

- Don't use white-out or make alterations to the form.

- Don't rush through the process; take your time to review everything.

- Don't sign the document without fully understanding your obligations.

- Don't ignore any additional documents that may need to be attached.

By adhering to these guidelines, you can help ensure a smooth and effective loan agreement process.

Key takeaways

When filling out and using the California Loan Agreement form, it is crucial to understand several key aspects to ensure compliance and protect your interests.

- Identify the Parties: Clearly state the names and addresses of both the lender and the borrower. This establishes who is involved in the agreement.

- Loan Amount: Specify the exact amount being loaned. This figure should be accurate to avoid disputes later.

- Interest Rate: Clearly outline the interest rate being charged. This should comply with California's usury laws to avoid legal issues.

- Repayment Terms: Detail the repayment schedule, including due dates and payment methods. Clarity here can prevent misunderstandings.

- Default Clauses: Include provisions that outline what happens in the event of a default. This protects the lender's interests.

- Signatures: Ensure that both parties sign the agreement. This makes the document legally binding and enforceable.

Review the completed form carefully before finalizing. Properly executed, a Loan Agreement can serve as a vital tool in managing financial transactions effectively.

How to Use California Loan Agreement

Completing the California Loan Agreement form is a straightforward process that requires careful attention to detail. Follow these steps to ensure that you fill out the form accurately.

- Obtain the form: Download or print the California Loan Agreement form from a reliable source.

- Read the instructions: Familiarize yourself with the form's requirements and sections before starting to fill it out.

- Enter the date: Write the date on which the agreement is being executed at the top of the form.

- Fill in borrower information: Provide the full name, address, and contact information of the borrower.

- Fill in lender information: Include the lender's full name, address, and contact information.

- Specify loan amount: Clearly state the total amount of the loan being agreed upon.

- Detail repayment terms: Outline the repayment schedule, including the due dates and the amount of each payment.

- Include interest rate: Indicate the interest rate applicable to the loan, if any.

- Signatures: Ensure that both the borrower and lender sign and date the form at the designated areas.

- Review the form: Double-check all entries for accuracy and completeness before finalizing.

Once the form is filled out, make copies for both parties. This ensures that each has a record of the agreement. Following these steps will help create a clear and enforceable loan agreement.