Free Power of Attorney Template for California State

The California Power of Attorney form is a vital legal document that allows individuals to designate someone else to act on their behalf in financial, medical, or legal matters. This form can be tailored to meet specific needs, making it a flexible tool for managing personal affairs. It typically includes sections for naming the agent, outlining the powers granted, and specifying the duration of the authority. By completing this form, a person can ensure that their interests are protected, even if they become unable to make decisions due to illness or incapacity. Additionally, the California Power of Attorney can be revoked or modified at any time, providing peace of mind that control can be maintained over one’s affairs. Understanding the nuances of this form is essential for anyone considering appointing an agent, as it can significantly impact both personal and financial well-being.

Common mistakes

-

Not Specifying the Powers Granted: Many individuals fail to clearly outline the specific powers they wish to grant to their agent. This can lead to confusion and limit the agent's ability to act on behalf of the principal.

-

Choosing the Wrong Agent: Selecting an agent who is not trustworthy or lacks the necessary skills can result in poor decision-making. It’s crucial to choose someone who understands your wishes and can act in your best interest.

-

Not Signing in Front of a Notary: A common oversight is neglecting to have the document notarized. In California, a Power of Attorney must be signed in front of a notary public to be considered valid.

-

Inadequate Witness Signatures: Some people forget that certain types of Power of Attorney require witnesses. Failing to have the required number of witnesses can invalidate the document.

-

Using an Outdated Form: Laws can change, and using an outdated form may lead to complications. Always ensure that you are using the most current version of the Power of Attorney form.

-

Failing to Discuss the Document: Not having a conversation with the chosen agent about the responsibilities and powers granted can lead to misunderstandings. Open communication is essential.

-

Not Keeping Copies: After completing the form, some individuals forget to make copies. Keeping copies for yourself and your agent is vital for reference and to ensure everyone is on the same page.

-

Ignoring State-Specific Requirements: Each state has its own rules regarding Power of Attorney. Ignoring California-specific requirements can lead to the document being deemed invalid.

-

Not Revoking Old Powers of Attorney: If you create a new Power of Attorney, failing to revoke any previous ones can create confusion. It’s important to formally revoke any outdated documents to avoid conflicts.

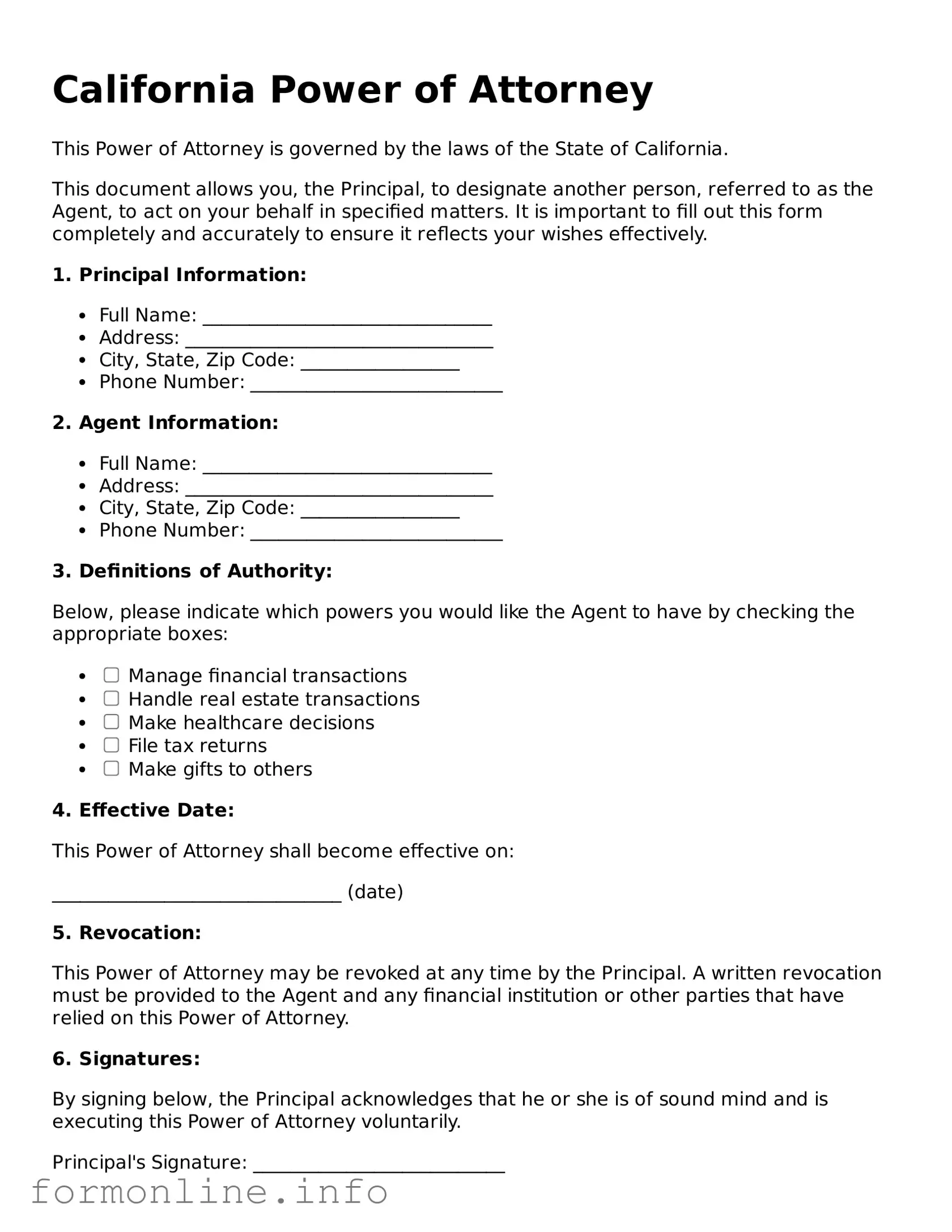

Preview - California Power of Attorney Form

California Power of Attorney

This Power of Attorney is governed by the laws of the State of California.

This document allows you, the Principal, to designate another person, referred to as the Agent, to act on your behalf in specified matters. It is important to fill out this form completely and accurately to ensure it reflects your wishes effectively.

1. Principal Information:

- Full Name: _______________________________

- Address: _________________________________

- City, State, Zip Code: _________________

- Phone Number: ___________________________

2. Agent Information:

- Full Name: _______________________________

- Address: _________________________________

- City, State, Zip Code: _________________

- Phone Number: ___________________________

3. Definitions of Authority:

Below, please indicate which powers you would like the Agent to have by checking the appropriate boxes:

- Manage financial transactions

- Handle real estate transactions

- Make healthcare decisions

- File tax returns

- Make gifts to others

4. Effective Date:

This Power of Attorney shall become effective on:

_______________________________ (date)

5. Revocation:

This Power of Attorney may be revoked at any time by the Principal. A written revocation must be provided to the Agent and any financial institution or other parties that have relied on this Power of Attorney.

6. Signatures:

By signing below, the Principal acknowledges that he or she is of sound mind and is executing this Power of Attorney voluntarily.

Principal's Signature: ___________________________

Date: ________________________________________

Agent's Signature: _____________________________

Date: ________________________________________

Popular Power of Attorney State Templates

Free Poa Forms Florida - Ensures caretakers have the authority to act in the principal's best interest.

The Employment Verification process is critical for employers seeking to validate an individual’s work experience and credentials. For further insights, consider reviewing this guide on how to effectively navigate the Employment Verification procedures at this link.

Poa Medical - A durable Power of Attorney remains effective even if you become incapacitated.

Documents used along the form

A California Power of Attorney is a crucial document that allows an individual to designate another person to make decisions on their behalf. However, it is often used in conjunction with other important documents that help ensure comprehensive planning for various situations. Below are several forms that are commonly associated with a Power of Attorney.

- Advance Healthcare Directive: This document allows an individual to specify their healthcare preferences in case they become unable to communicate their wishes. It combines both a living will and a durable power of attorney for healthcare, ensuring that medical decisions align with the individual's values and desires.

- Durable Power of Attorney: Similar to the standard Power of Attorney, this form remains effective even if the individual becomes incapacitated. It is particularly important for financial matters, as it allows the appointed agent to manage financial affairs without interruption.

- Indemnification and Hold Harmless Agreement: This essential document protects parties involved in agreements, ensuring that one party will not bear the liability for certain actions or damages incurred by another, much like the Indemnification and Hold Harmless Agreement used in various contexts.

- Living Trust: A living trust is a legal arrangement that holds an individual's assets during their lifetime and specifies how those assets should be distributed after death. It can help avoid probate and provides a clear plan for asset management, often working in tandem with a Power of Attorney.

- Will: A will outlines how an individual's assets will be distributed upon their death. While it does not take effect until death, it is essential for ensuring that an individual's wishes are honored and can complement the authority granted in a Power of Attorney.

Each of these documents plays a vital role in personal and financial planning. Together, they create a comprehensive framework that addresses various aspects of decision-making and asset management, ensuring that an individual's preferences are respected and upheld.

Similar forms

The California Power of Attorney form shares similarities with the Durable Power of Attorney. Both documents allow individuals to appoint someone to manage their financial and legal affairs. The key difference lies in durability; the Durable Power of Attorney remains effective even if the principal becomes incapacitated, while a standard Power of Attorney may not. This feature makes the Durable Power of Attorney a vital tool for long-term planning, ensuring that decisions can still be made on behalf of the individual when they are unable to do so themselves.

Another document akin to the California Power of Attorney is the Healthcare Power of Attorney. This form specifically allows individuals to designate someone to make medical decisions on their behalf if they are unable to communicate their wishes. While the California Power of Attorney focuses on financial and legal matters, the Healthcare Power of Attorney is tailored to health-related decisions. Both documents empower agents to act in the best interest of the principal, ensuring that their preferences are respected in critical situations.

The Living Will is also similar to the California Power of Attorney, particularly in the context of healthcare decisions. A Living Will outlines an individual's preferences regarding medical treatment and end-of-life care. While the Power of Attorney appoints someone to make decisions, the Living Will serves as a guide for that agent, detailing specific wishes about life-sustaining treatments. Together, these documents provide comprehensive coverage for both healthcare and legal matters.

Understanding the different types of power of attorney documents is crucial for making informed decisions about your healthcare and financial management. For instance, individuals can benefit from resources like the Top Forms Online to assist in gathering the necessary forms and information that guide them through these important legal processes.

The Revocable Trust is another document that shares similarities with the California Power of Attorney. Both tools allow individuals to manage their assets and designate someone to handle their affairs. However, a Revocable Trust can help avoid probate, as assets placed in the trust are transferred outside of the individual's estate upon death. While the Power of Attorney is effective during the individual's lifetime, the Revocable Trust continues to function after death, making it a powerful estate planning tool.

The Guardianship document is also relevant when discussing the California Power of Attorney. While the Power of Attorney allows individuals to appoint someone to manage their affairs, a Guardianship is a court-appointed role that provides authority over a person who is unable to care for themselves. The process of establishing a Guardianship involves court approval, making it more formal and often more complex than creating a Power of Attorney. Both documents aim to protect individuals, but they operate in different contexts and levels of authority.

Another similar document is the Advance Healthcare Directive. This combines elements of both the Healthcare Power of Attorney and the Living Will. It allows individuals to appoint a healthcare agent while also specifying their medical treatment preferences. Like the California Power of Attorney, this directive ensures that an individual’s wishes are followed, but it focuses specifically on healthcare decisions. It empowers agents to make informed choices based on the principal's values and desires.

Lastly, the Financial Power of Attorney is closely related to the California Power of Attorney. This document is specifically designed to give someone authority to manage financial matters, such as paying bills, managing investments, and handling real estate transactions. While the California Power of Attorney may encompass a broader range of powers, the Financial Power of Attorney is more focused on financial responsibilities. Both documents serve to delegate authority, ensuring that important decisions can be made when the principal is unavailable or incapacitated.

Dos and Don'ts

When filling out the California Power of Attorney form, there are important guidelines to follow. Here is a list of things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Do ensure that you understand the powers you are granting.

- Do use clear and legible handwriting or type the information.

- Do sign and date the form in the appropriate sections.

- Do have the document notarized if required.

- Don't leave any blank spaces on the form.

- Don't use the form if you are under duress or not of sound mind.

- Don't forget to provide copies to your agent and relevant parties.

- Don't assume that all powers are automatically included; specify as needed.

- Don't neglect to review the form periodically to ensure it still meets your needs.

Key takeaways

Ensure you choose a reliable agent. Your agent will make decisions on your behalf, so select someone you trust to act in your best interest.

Be clear about the powers you grant. Specify whether you want to give your agent broad authority or limit their powers to specific tasks.

Sign the document in front of a notary. California law requires that the Power of Attorney form be notarized to be legally valid.

Keep copies of the form. After completing the Power of Attorney, provide copies to your agent and any institutions that may need it, such as banks or healthcare providers.

How to Use California Power of Attorney

After obtaining the California Power of Attorney form, it's essential to fill it out accurately to ensure that it serves its intended purpose. Follow these steps carefully to complete the form correctly.

- Begin by entering the date at the top of the form.

- Identify the principal, who is the person granting power. Write their full name and address in the designated section.

- Next, provide the name and address of the agent, the person receiving the authority.

- Clearly state the powers being granted to the agent. You can select specific powers or grant general authority, depending on your needs.

- If applicable, indicate any limitations on the agent's authority in the space provided.

- Include the effective date of the power of attorney. You can choose for it to take effect immediately or at a later date.

- Sign the form in the presence of a notary public to validate it. Make sure the notary completes their section as well.

- Provide copies of the completed form to the agent and any relevant institutions or individuals who may need it.