Free Promissory Note Template for California State

The California Promissory Note is a crucial financial document that outlines the terms of a loan agreement between a borrower and a lender. This form serves to formalize the borrower's promise to repay a specific amount of money, along with any interest, by a designated date. Key elements of the note include the principal amount, interest rate, payment schedule, and any provisions for late payments or defaults. Additionally, the form may specify whether the loan is secured or unsecured, impacting the lender's rights in the event of non-payment. Clarity in these terms is essential for both parties, as it helps prevent misunderstandings and disputes. Understanding the California Promissory Note is vital for anyone involved in lending or borrowing money, as it establishes the legal framework for the transaction and ensures that both parties are aware of their rights and responsibilities.

Common mistakes

-

Inaccurate Borrower Information: Many individuals fail to provide complete and correct details about the borrower. This includes the full legal name, address, and contact information. Missing or incorrect information can lead to confusion or disputes later on.

-

Unclear Loan Amount: Some people do not specify the exact loan amount clearly. It's essential to write the amount both in numbers and words to avoid any ambiguity.

-

Omitting Interest Rate: A common mistake is leaving out the interest rate or not making it clear. The interest rate should be clearly stated to ensure both parties understand the terms of repayment.

-

Failure to Define Repayment Terms: Not detailing the repayment schedule can lead to misunderstandings. It's important to specify when payments are due, how much each payment will be, and the total duration of the loan.

-

Neglecting Signatures: Some individuals forget to sign the document or do not have all necessary parties sign it. All parties involved must sign the Promissory Note for it to be legally binding.

-

Not Keeping Copies: After filling out the form, failing to make copies for all parties is a common oversight. Each party should retain a copy of the signed document for their records.

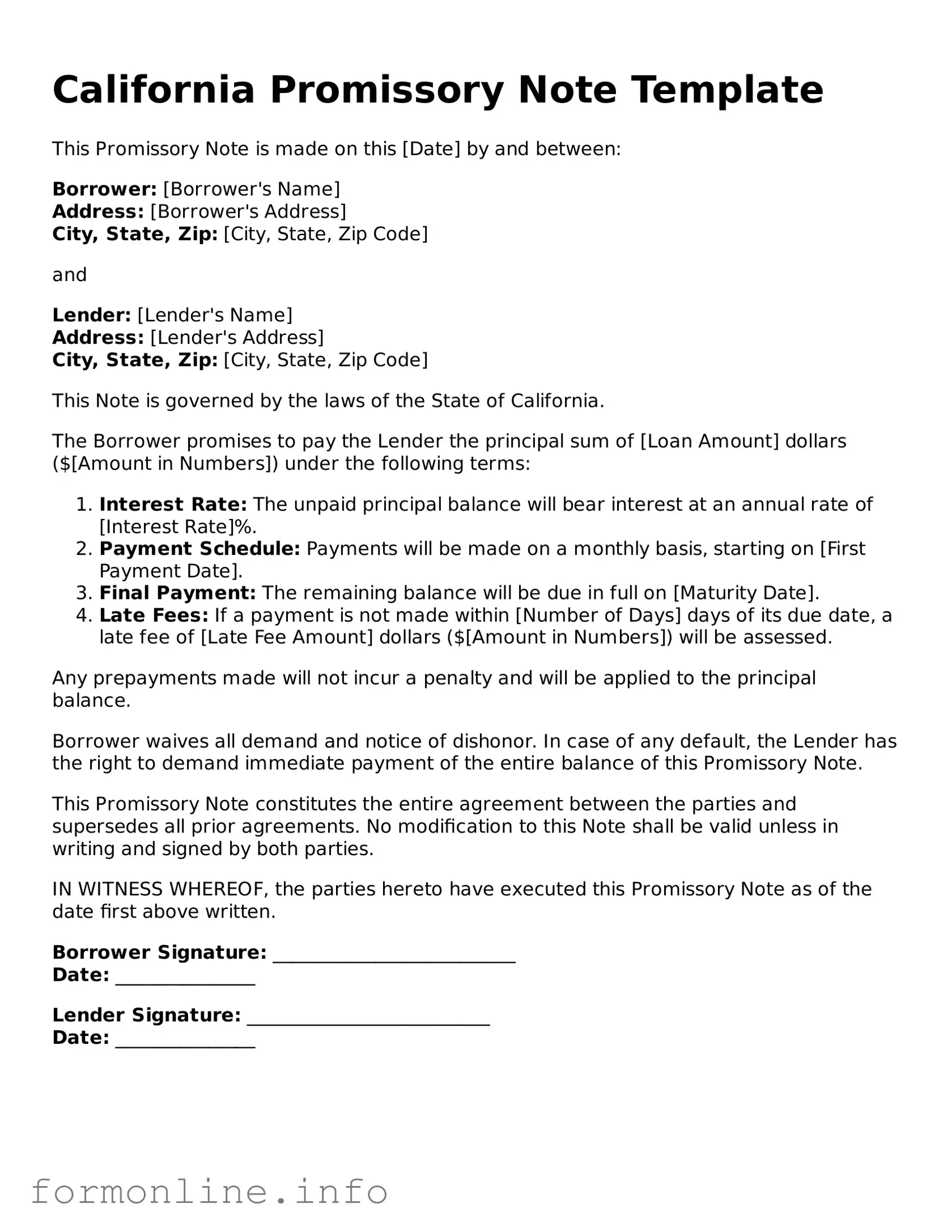

Preview - California Promissory Note Form

California Promissory Note Template

This Promissory Note is made on this [Date] by and between:

Borrower: [Borrower's Name]

Address: [Borrower's Address]

City, State, Zip: [City, State, Zip Code]

and

Lender: [Lender's Name]

Address: [Lender's Address]

City, State, Zip: [City, State, Zip Code]

This Note is governed by the laws of the State of California.

The Borrower promises to pay the Lender the principal sum of [Loan Amount] dollars ($[Amount in Numbers]) under the following terms:

- Interest Rate: The unpaid principal balance will bear interest at an annual rate of [Interest Rate]%.

- Payment Schedule: Payments will be made on a monthly basis, starting on [First Payment Date].

- Final Payment: The remaining balance will be due in full on [Maturity Date].

- Late Fees: If a payment is not made within [Number of Days] days of its due date, a late fee of [Late Fee Amount] dollars ($[Amount in Numbers]) will be assessed.

Any prepayments made will not incur a penalty and will be applied to the principal balance.

Borrower waives all demand and notice of dishonor. In case of any default, the Lender has the right to demand immediate payment of the entire balance of this Promissory Note.

This Promissory Note constitutes the entire agreement between the parties and supersedes all prior agreements. No modification to this Note shall be valid unless in writing and signed by both parties.

IN WITNESS WHEREOF, the parties hereto have executed this Promissory Note as of the date first above written.

Borrower Signature: __________________________

Date: _______________

Lender Signature: __________________________

Date: _______________

Popular Promissory Note State Templates

Printable Promissory Note Template - A Promissory Note contributes to a clear financial relationship.

For landlords looking to enforce a rental agreement, the "necessary Notice to Quit" serves as a critical document to prompt tenants to vacate the premises. It lays out the grounds and timeline for departure, ensuring both parties understand their rights and responsibilities. For more information, you can refer to the necessary Notice to Quit form.

Promissory Note Template Georgia - A Promissory Note can be simple or complex, depending on the terms agreed upon by the parties involved.

Documents used along the form

When dealing with a California Promissory Note, several other forms and documents may be required to ensure a comprehensive understanding of the agreement and to protect the interests of all parties involved. Below is a list of commonly used documents that accompany a Promissory Note.

- Loan Agreement: This document outlines the terms and conditions of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved.

- Security Agreement: If the loan is secured, this agreement details the collateral that the borrower offers to the lender as a guarantee for repayment.

- Disclosure Statement: This statement provides important information about the loan, including fees, interest rates, and potential risks, ensuring that the borrower is fully informed before signing.

- Personal Guarantee: In some cases, a personal guarantee may be required, where an individual agrees to be responsible for the loan if the borrower defaults.

- Deed of Trust: This document is often used in real estate transactions, allowing the lender to take possession of the property if the borrower fails to repay the loan.

- Amortization Schedule: This schedule outlines each payment over the life of the loan, detailing how much goes toward interest and how much reduces the principal balance.

- Loan Payment Receipt: This receipt is issued to the borrower after each payment is made, serving as proof of payment and helping to keep accurate records.

- Mobile Home Bill of Sale: This form is essential for transferring ownership of a mobile home, ensuring both parties are protected. For more details, you can refer to the Mobile Home Bill of Sale.

- Default Notice: If the borrower fails to make payments, this notice informs them of the default and outlines the potential consequences.

- Release of Liability: Once the loan is fully paid, this document confirms that the borrower is no longer liable for the debt and releases any claims the lender may have.

These documents work together to create a clear framework for the loan agreement, ensuring that both the lender and borrower understand their rights and responsibilities. It is essential to review each document carefully to avoid any misunderstandings in the future.

Similar forms

The California Promissory Note is similar to a personal loan agreement. Both documents outline the terms under which one party borrows money from another. They specify the loan amount, interest rate, repayment schedule, and any penalties for late payments. A personal loan agreement, however, may include additional clauses regarding the use of the funds, which is less common in a standard promissory note.

A mortgage note is another document that shares similarities with the California Promissory Note. Like a promissory note, a mortgage note is a written promise to repay borrowed money. However, a mortgage note is specifically tied to real estate transactions, where the property serves as collateral. This added layer of security distinguishes it from a general promissory note, which may not involve collateral.

Understanding the nuances of various financial documents is crucial, especially when considering options for funding education. For those interested in pursuing higher education, the AZ Forms Online provides essential resources regarding the Arizona University Application form, helping streamline the application process for students from diverse backgrounds.

The installment loan agreement also resembles the California Promissory Note. Both documents detail a loan that is repaid over time through scheduled payments. However, installment loans often have fixed terms and may include provisions for early repayment, while promissory notes can be more flexible in terms of repayment conditions.

A business loan agreement is akin to a promissory note in that it formalizes the terms of a loan between a lender and a business. Both documents outline the loan amount, interest rate, and repayment terms. The key difference lies in the borrower; a business loan agreement is specifically designed for corporate entities, while a promissory note can be used for personal loans as well.

A car loan agreement shares similarities with the California Promissory Note, particularly in the context of financing a vehicle purchase. Both documents outline the loan amount and repayment schedule. However, a car loan agreement typically includes specific terms related to the vehicle being financed, such as the make, model, and identification number, which are not found in a standard promissory note.

A student loan agreement is another document that bears resemblance to the California Promissory Note. Both serve as formal agreements for borrowed funds that require repayment. However, student loan agreements often come with unique terms, such as deferment options and income-driven repayment plans, reflecting the specific needs of students.

A credit card agreement is similar to a promissory note in that both involve borrowing money with the obligation to repay. However, credit card agreements usually include revolving credit terms, allowing borrowers to carry a balance and make minimum payments, whereas a promissory note typically requires fixed payments over a specified term.

A debt settlement agreement shares some characteristics with the California Promissory Note. Both documents involve the repayment of debt, but a debt settlement agreement often includes negotiated terms that reduce the total amount owed. This contrasts with a promissory note, which usually reflects the original loan amount without any reductions.

Finally, a loan modification agreement can be likened to a promissory note. Both documents pertain to the repayment of borrowed funds. However, a loan modification agreement specifically alters the terms of an existing loan, such as changing the interest rate or extending the repayment period, while a promissory note typically establishes the original terms of the loan.

Dos and Don'ts

When filling out the California Promissory Note form, it is essential to approach the task with care. This ensures that the document is clear, accurate, and legally binding. Below is a list of things you should and shouldn't do while completing the form.

- Do: Clearly state the loan amount. Make sure the number is accurate and easy to read.

- Do: Include the names and addresses of both the borrower and the lender. This information establishes the parties involved.

- Do: Specify the interest rate, if applicable. Clearly outline how the interest will be calculated.

- Do: Indicate the repayment schedule. Detail when payments are due and the total duration of the loan.

- Do: Sign and date the document. Both parties should provide their signatures to validate the agreement.

- Don't: Leave any sections blank. Incomplete information can lead to misunderstandings or disputes.

- Don't: Use vague language. Be specific to avoid ambiguity in terms and conditions.

- Don't: Forget to keep a copy. Both parties should retain a signed copy for their records.

- Don't: Rush through the process. Take your time to ensure accuracy and clarity in the document.

- Don't: Ignore state laws. Familiarize yourself with California's requirements for promissory notes to ensure compliance.

Key takeaways

Filling out and using the California Promissory Note form is a straightforward process, but attention to detail is crucial. Below are key takeaways that can aid in understanding its use and implications.

- Definition: A promissory note is a written promise to pay a specified amount of money to a designated party under agreed-upon terms.

- Parties Involved: The form must clearly identify the borrower and the lender, including their full names and contact information.

- Loan Amount: The principal amount being borrowed should be stated explicitly. This figure is critical for clarity and enforcement.

- Interest Rate: If applicable, the interest rate must be specified. California law allows for various interest rates, but they must comply with state regulations.

- Payment Terms: The schedule for repayment should be detailed, including the frequency of payments and the due dates.

- Default Conditions: The note should outline what constitutes a default and the remedies available to the lender if the borrower fails to meet their obligations.

- Signatures: Both parties must sign the document for it to be legally binding. A witness or notary may be required for additional validation.

Understanding these elements can help ensure that the promissory note is both effective and enforceable in California.

How to Use California Promissory Note

Filling out the California Promissory Note form is a straightforward process. Once completed, this form will serve as a written agreement between the lender and borrower regarding the terms of a loan. It's important to ensure that all information is accurate and clearly stated to avoid any misunderstandings later on.

- Download the form: Obtain the California Promissory Note form from a reliable source, such as a legal website or office supply store.

- Identify the parties: Fill in the names and addresses of both the borrower and the lender at the top of the form.

- Loan amount: Clearly state the total amount of money being borrowed in the designated section.

- Interest rate: Indicate the interest rate applicable to the loan, if any. Be sure to specify whether it’s a fixed or variable rate.

- Payment terms: Specify how and when payments will be made. Include details about the frequency of payments (monthly, quarterly, etc.) and the due date.

- Maturity date: Enter the date when the loan will be fully paid off, or the final payment is due.

- Signatures: Both the borrower and lender must sign and date the form to make it legally binding.

- Witness or notarization: Depending on your needs, consider having the document witnessed or notarized for added legal protection.

After completing the form, keep a copy for your records. It’s advisable to provide a copy to the other party as well. This ensures that everyone has access to the same information regarding the loan agreement.