Free Quitclaim Deed Template for California State

The California Quitclaim Deed is a vital legal document used to transfer ownership of real property from one party to another without any warranties regarding the title. This form is particularly useful when a property owner wishes to convey their interest in a property quickly and simply, often seen in situations such as transferring property between family members or in divorce settlements. Unlike other types of deeds, a quitclaim deed does not guarantee that the title is free of claims or encumbrances, making it essential for the parties involved to understand the implications of this type of transfer. The document typically includes the names of the grantor and grantee, a legal description of the property, and the date of transfer. Additionally, it must be signed by the grantor and notarized to be legally effective. While the quitclaim deed is straightforward, it is crucial for individuals to consider their specific circumstances and potential risks before proceeding with this method of property transfer.

Common mistakes

-

Failing to provide complete information about the grantor and grantee. It is essential to include full names and addresses for both parties involved in the transaction.

-

Not properly identifying the property being transferred. A legal description of the property must be included, which can be found in the original deed or property tax records.

-

Omitting signatures. Both the grantor and any required witnesses must sign the form. Without these signatures, the deed may be considered invalid.

-

Neglecting to have the deed notarized. In California, a quitclaim deed must be notarized to be legally binding. Failure to do so can lead to issues with the transfer of ownership.

-

Not recording the deed with the county recorder's office. After completing the form, it is crucial to submit it for recording. This step ensures that the transfer is publicly documented and protects the interests of the parties involved.

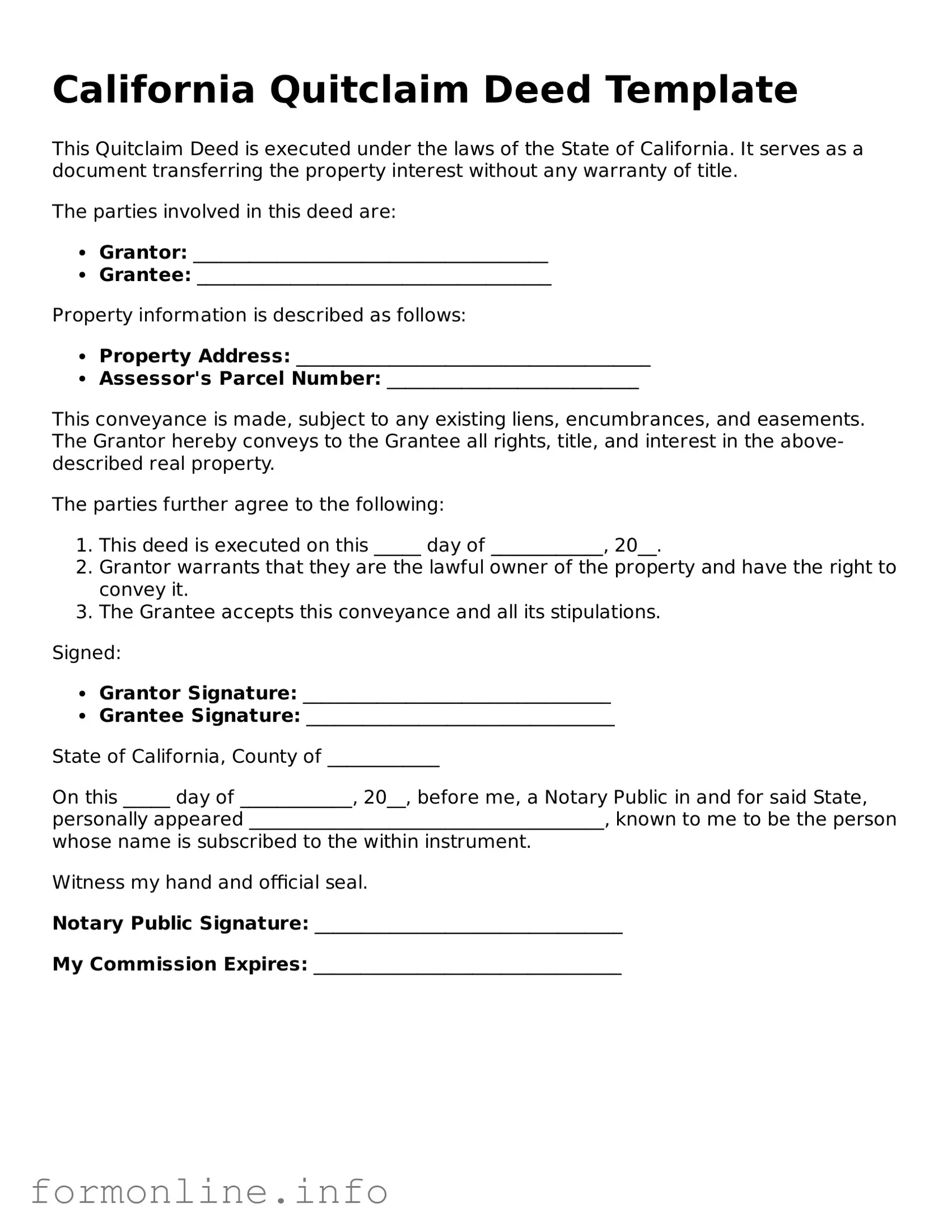

Preview - California Quitclaim Deed Form

California Quitclaim Deed Template

This Quitclaim Deed is executed under the laws of the State of California. It serves as a document transferring the property interest without any warranty of title.

The parties involved in this deed are:

- Grantor: ______________________________________

- Grantee: ______________________________________

Property information is described as follows:

- Property Address: ______________________________________

- Assessor's Parcel Number: ___________________________

This conveyance is made, subject to any existing liens, encumbrances, and easements. The Grantor hereby conveys to the Grantee all rights, title, and interest in the above-described real property.

The parties further agree to the following:

- This deed is executed on this _____ day of ____________, 20__.

- Grantor warrants that they are the lawful owner of the property and have the right to convey it.

- The Grantee accepts this conveyance and all its stipulations.

Signed:

- Grantor Signature: _________________________________

- Grantee Signature: _________________________________

State of California, County of ____________

On this _____ day of ____________, 20__, before me, a Notary Public in and for said State, personally appeared ______________________________________, known to me to be the person whose name is subscribed to the within instrument.

Witness my hand and official seal.

Notary Public Signature: _________________________________

My Commission Expires: _________________________________

Popular Quitclaim Deed State Templates

Quitclaim Deed Attorney - For gift transactions, a Quitclaim Deed can help document the change of ownership clearly.

For further details and resources on the WC-240 form and its importance in workers' compensation, you can visit https://georgiapdf.com/, which provides valuable information to help you navigate this critical aspect of returning to work.

Quit Claim Deed Form Florida - In many cases, no consideration (payment) is required when using a Quitclaim Deed among relatives.

Documents used along the form

A Quitclaim Deed is a crucial document for transferring property ownership in California. However, several other forms and documents are often used in conjunction with it to ensure a smooth transaction. Below is a list of these documents, each serving a specific purpose.

- Grant Deed: This document transfers ownership of real estate and provides a guarantee that the property is free from any liens or encumbrances, except those disclosed. It offers more protection to the grantee than a quitclaim deed.

- Mobile Home Bill of Sale: This document is crucial when transferring ownership of a mobile home, ensuring both parties are protected during the transaction. For more information, you can refer to the Mobile Home Bill of Sale.

- Preliminary Change of Ownership Report: Required by the county assessor, this form must be filed whenever a property changes ownership. It helps assess property taxes and provides necessary information about the transaction.

- Title Report: A title report outlines the legal status of the property, including any liens, easements, or other claims against it. This document is essential for both buyers and sellers to understand the property's condition before the transfer.

- Property Transfer Tax Statement: This statement is often required by local governments when a property is sold or transferred. It outlines any taxes owed on the transfer and ensures compliance with local tax laws.

- Affidavit of Identity: This document may be needed to confirm the identity of the parties involved in the transaction. It can help resolve any discrepancies related to names or identities in public records.

Understanding these documents can help streamline the property transfer process. Each serves a distinct role in ensuring that the transaction is legally sound and that all parties are protected.

Similar forms

The California Grant Deed is similar to the Quitclaim Deed in that it transfers ownership of real property from one party to another. However, the Grant Deed provides certain warranties to the buyer, such as the assurance that the property has not been sold to anyone else and that there are no undisclosed encumbrances. This added layer of protection makes the Grant Deed a more secure option for buyers who want to ensure their ownership rights are clear and protected. While both documents facilitate the transfer of property, the Grant Deed offers more assurance regarding the status of the title.

The Warranty Deed also shares similarities with the Quitclaim Deed, particularly in its function of transferring property ownership. However, the Warranty Deed comes with explicit guarantees from the seller regarding the title's validity. The seller promises that they hold clear title to the property and will defend against any future claims. This makes the Warranty Deed a more favorable option for buyers who seek maximum protection against potential legal disputes over property ownership.

In the context of transferring ownership of recreational vehicles, the Texas RV Bill of Sale form is essential for ensuring a clear and documented transaction. This legal document acts as proof of the sale, outlining critical details that protect both the seller and buyer. For further information on how to properly execute this form and the necessary steps involved, you can visit https://autobillofsaleform.com/rv-bill-of-sale-form/texas-rv-bill-of-sale-form.

The Bargain and Sale Deed is another document that resembles the Quitclaim Deed. It conveys property from one party to another but does not provide the same level of guarantees as a Warranty Deed. The Bargain and Sale Deed implies that the seller has the right to sell the property but does not warrant that the title is free from defects. This type of deed is often used in transactions where the seller may not want to assume liability for any issues related to the title, making it a middle ground between a Quitclaim and a Warranty Deed.

Lastly, the Special Purpose Deed, which includes documents like the Executor's Deed or Trustee's Deed, is similar to the Quitclaim Deed in that it often serves specific purposes, such as transferring property from an estate or a trust. These deeds may not provide warranties about the title, similar to a Quitclaim Deed. They are typically used in situations involving foreclosures, estate settlements, or transfers by fiduciaries, focusing on the unique circumstances surrounding the property transfer rather than the assurances typically found in other deed types.

Dos and Don'ts

When filling out the California Quitclaim Deed form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here are four things you should and shouldn't do:

- Do: Provide accurate information about the property, including the legal description.

- Do: Sign the deed in front of a notary public to validate the document.

- Don't: Leave any sections blank; incomplete forms may lead to issues during processing.

- Don't: Use white-out or any correction fluid on the form; it can invalidate the document.

Key takeaways

When dealing with property transfers in California, understanding the Quitclaim Deed form is essential. Here are some key takeaways to consider:

- Purpose: A Quitclaim Deed allows one party to transfer their interest in a property to another party without making any guarantees about the title's validity.

- Parties Involved: The form requires at least two parties: the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Property Description: It's crucial to provide a complete and accurate description of the property being transferred. This typically includes the address and legal description.

- Signature Requirements: The grantor must sign the Quitclaim Deed in front of a notary public. This step is vital for the deed to be legally recognized.

- Filing the Deed: After completing the form, the Quitclaim Deed must be filed with the county recorder's office where the property is located. This step ensures that the transfer is officially recorded.

- Tax Implications: Be aware that transferring property can have tax consequences. It's wise to consult a tax professional to understand any potential liabilities.

- No Warranty: Remember, a Quitclaim Deed does not provide any warranties or guarantees. If there are issues with the title, the grantee may face challenges.

- Usage Scenarios: Quitclaim Deeds are often used in situations like divorce settlements, transferring property between family members, or clearing up title issues.

Understanding these aspects can help ensure a smooth property transfer process in California.

How to Use California Quitclaim Deed

Once you have gathered the necessary information and documents, you can proceed to fill out the California Quitclaim Deed form. This process involves providing specific details about the property and the parties involved. Careful attention to each section will ensure accuracy and completeness.

- Obtain the Quitclaim Deed form: You can find the form online or at your local county recorder's office.

- Fill in the Grantor's information: Enter the full name(s) of the person(s) transferring the property. Ensure that the names match those on the original title.

- Fill in the Grantee's information: Provide the full name(s) of the person(s) receiving the property. Again, accuracy is crucial here.

- Describe the property: Include the property’s address, legal description, and any other identifying information. This may involve referencing the property’s parcel number.

- Include the consideration: State the amount of money or other value exchanged for the property, if applicable. If the transfer is a gift, indicate that as well.

- Sign the form: The Grantor(s) must sign the document in the presence of a notary public. Ensure that all signatures are original.

- Notarization: Have the notary public complete the notary section, confirming the identities of the signers.

- Submit the form: Take the completed Quitclaim Deed to your local county recorder's office for filing. There may be a fee associated with this process.

After filing the Quitclaim Deed, it is essential to keep a copy for your records. The county recorder's office will provide you with a stamped copy once the deed has been officially recorded. This serves as proof of the property transfer.