Free Transfer-on-Death Deed Template for California State

In the state of California, individuals seeking to simplify the transfer of their real property upon death have a valuable tool at their disposal: the Transfer-on-Death Deed (TOD Deed). This legal instrument allows property owners to designate one or more beneficiaries who will automatically receive the property without the need for probate, thereby streamlining the process and reducing potential delays and costs associated with estate administration. The form is straightforward, requiring the property owner's information, a clear description of the property, and the names of the beneficiaries. Importantly, the deed must be properly executed and recorded with the county recorder's office to be effective. This mechanism not only provides peace of mind but also empowers individuals to maintain control over their assets during their lifetime while ensuring a seamless transition for their loved ones after they pass. Understanding the nuances of the Transfer-on-Death Deed can help individuals make informed decisions about their estate planning needs, ultimately fostering a sense of security and clarity for both property owners and their beneficiaries.

Common mistakes

-

Incorrect Property Description: Failing to accurately describe the property can lead to complications. It is essential to include the correct address and legal description as per county records.

-

Omitting Required Signatures: The deed must be signed by the property owner. If the owner does not sign the document, it will not be valid.

-

Not Including a Beneficiary: Leaving the beneficiary section blank or naming an ineligible person can result in the property not transferring as intended.

-

Failure to Notarize: The deed must be notarized to be legally binding. Not having a notary public witness the signing can invalidate the document.

-

Improper Recording: After completing the deed, it must be recorded with the county recorder's office. Failing to do so means the transfer may not be recognized.

-

Using the Wrong Form: Using an outdated or incorrect version of the Transfer-on-Death Deed form can lead to issues. Always ensure you are using the latest version.

-

Ignoring State Laws: Not being aware of specific California laws regarding Transfer-on-Death Deeds can lead to mistakes. Familiarity with state regulations is crucial for a valid transfer.

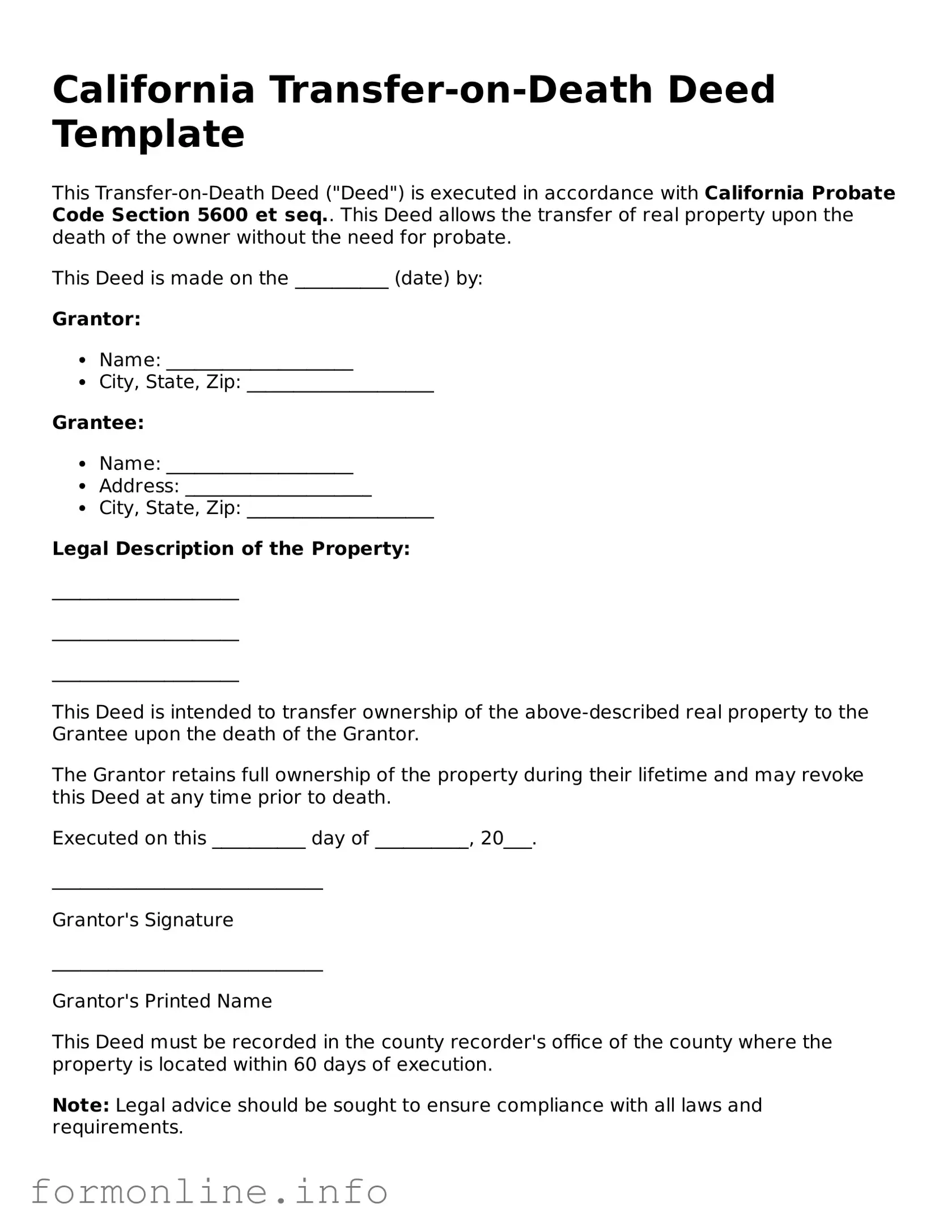

Preview - California Transfer-on-Death Deed Form

California Transfer-on-Death Deed Template

This Transfer-on-Death Deed ("Deed") is executed in accordance with California Probate Code Section 5600 et seq.. This Deed allows the transfer of real property upon the death of the owner without the need for probate.

This Deed is made on the __________ (date) by:

Grantor:

- Name: ____________________

- City, State, Zip: ____________________

Grantee:

- Name: ____________________

- Address: ____________________

- City, State, Zip: ____________________

Legal Description of the Property:

____________________

____________________

____________________

This Deed is intended to transfer ownership of the above-described real property to the Grantee upon the death of the Grantor.

The Grantor retains full ownership of the property during their lifetime and may revoke this Deed at any time prior to death.

Executed on this __________ day of __________, 20___.

_____________________________

Grantor's Signature

_____________________________

Grantor's Printed Name

This Deed must be recorded in the county recorder's office of the county where the property is located within 60 days of execution.

Note: Legal advice should be sought to ensure compliance with all laws and requirements.

Popular Transfer-on-Death Deed State Templates

Transfer on Death Deed Florida Form - Create a customized estate plan using a Transfer-on-Death Deed as an efficient method for passing on real estate.

For those interested in navigating the requirements of the nursing profession, the Arizona Board of Nursing License form is crucial. It details the essential actions needed for acquiring or renewing a nursing license in Arizona, ensuring that applicants are well-informed about the necessary regulations. It is advisable to review the form thoroughly and consult resources like AZ Forms Online for additional guidance on the licensure process.

Georgia Transfer on Death Deed Form - Using this deed helps minimize estate disputes among surviving family members.

Documents used along the form

The California Transfer-on-Death Deed form allows property owners to designate a beneficiary who will inherit the property upon the owner's death, bypassing probate. This document is part of a broader set of legal forms that can help streamline estate planning and property transfer processes. Below is a list of other important forms and documents that are often used in conjunction with the Transfer-on-Death Deed.

- Will: A legal document that outlines how a person's assets and property should be distributed upon their death. It can also name guardians for minor children.

- Revocable Living Trust: A trust that can be altered or revoked by the grantor during their lifetime. It helps avoid probate and can manage assets during incapacity.

- Durable Power of Attorney: This document grants someone the authority to make financial and legal decisions on behalf of another person if they become incapacitated.

- Advance Healthcare Directive: A legal document that allows individuals to specify their healthcare preferences and appoint someone to make medical decisions on their behalf if they are unable to do so.

- Non-disclosure Agreement: To protect sensitive information in business dealings, consider implementing a comprehensive Non-disclosure Agreement framework that outlines confidentiality obligations between parties.

- Beneficiary Designation Forms: These forms are used to designate beneficiaries for financial accounts, insurance policies, and retirement plans, ensuring assets transfer directly to the named individuals.

- Grant Deed: A legal document used to transfer ownership of real property from one party to another, providing a guarantee that the property is free from any liens or encumbrances.

- Affidavit of Death: A sworn statement that confirms the death of an individual, often used to facilitate the transfer of property or assets without going through probate.

- Change of Ownership Statement: This form is typically filed with the county assessor's office to report changes in property ownership, which may be required after a transfer occurs.

Understanding these forms can enhance your estate planning efforts and ensure that your wishes are honored. Each document serves a specific purpose in managing assets and facilitating smooth transitions for your loved ones.

Similar forms

The California Transfer-on-Death Deed (TOD Deed) is similar to a traditional will in that both documents allow individuals to dictate how their property should be distributed upon their death. A will requires the appointment of an executor, who is responsible for managing the estate and ensuring that the deceased's wishes are fulfilled. In contrast, the TOD Deed allows property to transfer directly to a designated beneficiary without the need for probate, simplifying the process and potentially reducing costs for the heirs. Both documents serve to clarify the deceased's intentions, but the TOD Deed offers a more streamlined approach to transferring property ownership.

To facilitate a seamless transfer of ownership in mobile home transactions, it's crucial to utilize the appropriate legal documentation, such as the Mobile Home Bill of Sale, which ensures that both parties are protected and that the sale is conducted with clarity and adherence to applicable laws.

Dos and Don'ts

When filling out the California Transfer-on-Death Deed form, it is essential to follow certain guidelines to ensure the process goes smoothly. Here are nine things you should and shouldn't do:

- Do ensure that you are eligible to use the Transfer-on-Death Deed.

- Do accurately identify the property being transferred.

- Do clearly state the names of the beneficiaries.

- Do sign the deed in front of a notary public.

- Do file the completed deed with the county recorder's office.

- Don't leave any sections of the form blank.

- Don't forget to review the deed for errors before submission.

- Don't assume that the deed is valid without proper notarization.

- Don't neglect to inform beneficiaries about the deed.

Key takeaways

When considering the California Transfer-on-Death Deed form, keep these key takeaways in mind:

- The Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries without going through probate.

- This deed must be properly filled out and recorded with the county recorder's office to be effective.

- It is important to include the full legal description of the property in the deed.

- Beneficiaries can be individuals, organizations, or trusts.

- The property owner can revoke or change the deed at any time before their death.

- Filling out the form requires the property owner’s signature, and it must be notarized.

- Ensure that the deed is recorded before the property owner's death to avoid complications.

- Consulting with a legal professional can help clarify any questions regarding the deed's use.

- Consider potential tax implications for the beneficiaries after the transfer occurs.

How to Use California Transfer-on-Death Deed

Filling out the California Transfer-on-Death Deed form is an important step in ensuring your property is transferred according to your wishes upon your passing. After completing the form, you will need to file it with the appropriate county recorder's office. This ensures that your intentions are legally recognized and helps avoid complications in the future.

- Begin by obtaining the California Transfer-on-Death Deed form. You can find it on the California government website or at your local county recorder's office.

- In the first section, clearly print your name as the transferor (the person transferring the property).

- Next, provide your address, including the city, state, and zip code.

- Identify the property you wish to transfer. Include the full address and legal description of the property. The legal description can often be found on your property tax bill or deed.

- Designate the beneficiaries by writing their names and addresses. You can name one or more individuals or entities.

- If there are multiple beneficiaries, indicate how the property should be divided among them (e.g., equally or in specific percentages).

- Include the date of signing the form.

- Sign the form in the presence of a notary public. The notary will verify your identity and witness your signature.

- Make a copy of the completed form for your records before filing.

- Finally, file the original form with the county recorder's office in the county where the property is located. Pay any required filing fees.