Fill Out a Valid Cash Drawer Count Sheet Form

The Cash Drawer Count Sheet is an essential tool for businesses that handle cash transactions. It helps ensure accuracy in cash management by providing a clear record of the cash in the drawer at the beginning and end of each shift or business day. This form typically includes sections for recording the starting cash balance, the total cash received during the day, and the cash remaining at closing. By documenting these figures, businesses can easily identify discrepancies, track sales, and maintain accountability among employees. Additionally, the Cash Drawer Count Sheet often features space for notes, allowing staff to mention any unusual occurrences or issues that may have arisen during their shift. Overall, this form plays a crucial role in promoting transparency and efficiency in cash handling processes.

Common mistakes

-

Failing to count cash accurately. Many people overlook the importance of double-checking their cash count, leading to discrepancies.

-

Not recording all denominations. It’s essential to list every type of bill and coin. Omitting even one can result in an incorrect total.

-

Neglecting to sign the form. A signature is often required to validate the count. Without it, the form may be considered incomplete.

-

Using unclear handwriting. If the entries are hard to read, it can create confusion and errors in the accounting process.

-

Ignoring discrepancies from previous counts. It’s crucial to address any differences noted in prior counts to ensure accuracy over time.

-

Not keeping a copy of the completed form. Retaining a copy provides a record for future reference and can help resolve any issues that arise.

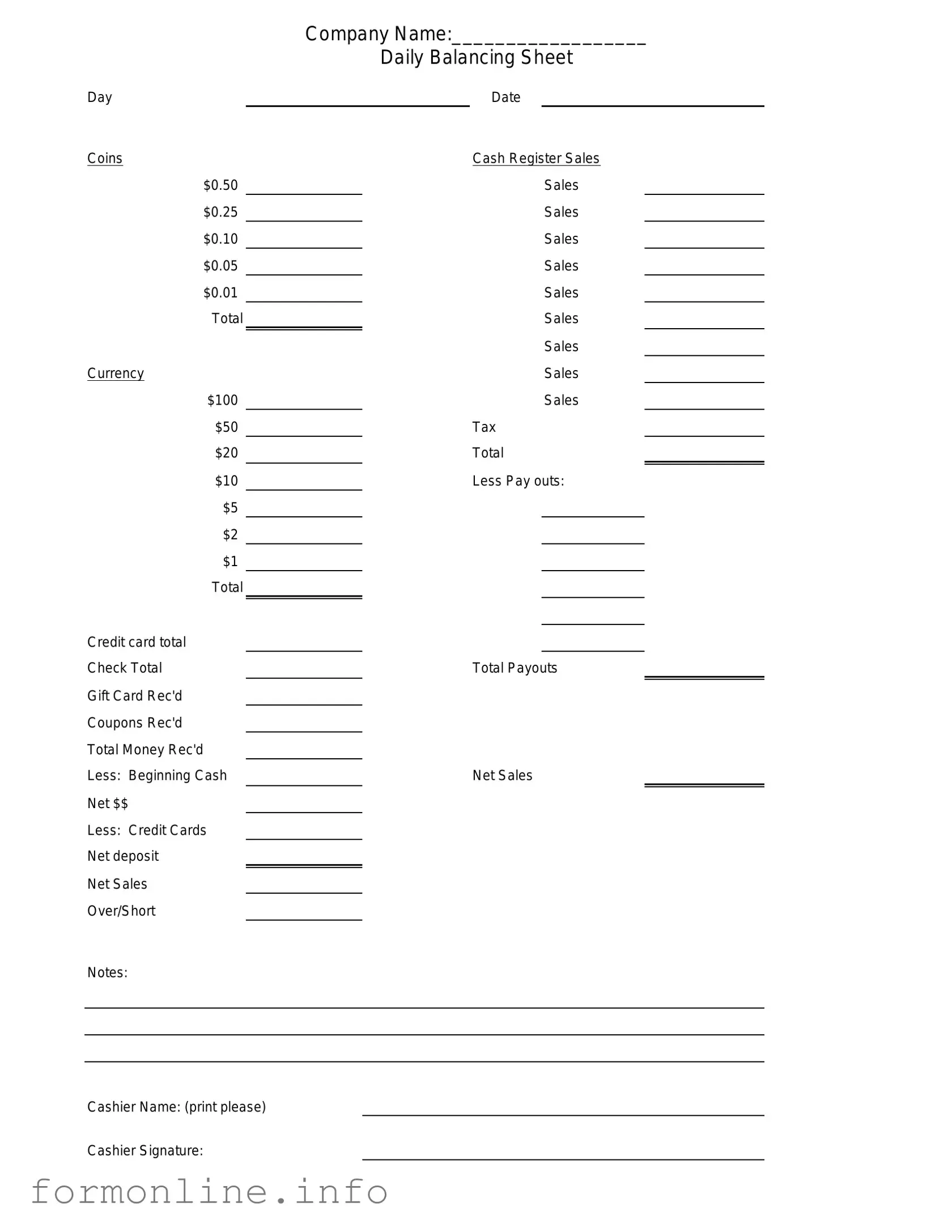

Preview - Cash Drawer Count Sheet Form

|

Company Name:__________________ |

|||||

|

|

Daily Balancing Sheet |

||||

Day |

|

|

Date |

|

||

Coins |

|

|

Cash Register Sales |

|||

$0.50 |

|

|

|

Sales |

|

|

$0.25 |

|

|

|

Sales |

|

|

$0.10 |

|

|

|

Sales |

|

|

$0.05 |

|

|

|

Sales |

|

|

$0.01 |

|

|

|

Sales |

|

|

Total |

|

|

|

Sales |

|

|

|

|

|

|

Sales |

|

|

Currency |

|

|

|

Sales |

|

|

$100 |

|

|

|

Sales |

|

|

$50 |

|

|

Tax |

|

||

$20 |

|

|

Total |

|

||

$10 |

|

|

Less Pay outs: |

|||

$5 |

|

|

|

|

|

|

$2 |

|

|

|

|

|

|

$1 |

|

|

|

|

|

|

Total |

|

|

|

|

|

|

Credit card total |

|

|

|

|

|

|

|

|

|

|

|

|

|

Check Total |

|

|

Total Payouts |

|||

Gift Card Rec'd |

|

|

|

|

|

|

Coupons Rec'd |

|

|

|

|

|

|

Total Money Rec'd |

|

|

|

|

|

|

Less: Beginning Cash |

|

|

Net Sales |

|||

Net $$ |

|

|

|

|

|

|

Less: Credit Cards |

|

|

|

|

|

|

Net deposit |

|

|

|

|

|

|

Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Over/Short |

|

|

|

|

|

|

Notes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cashier Name: (print please)

Cashier Signature:

Other PDF Templates

Player Evaluation - Focuses on the player's capacity to improve their technique, reflecting their overall commitment to progress.

A New York Lease Agreement form is a legal document that outlines the terms and conditions between a landlord and a tenant for renting residential or commercial property. This form serves as a binding contract, detailing rights and responsibilities, payment terms, and duration of the lease. For more information, you can visit https://nypdfforms.com/, as understanding its components is crucial for both parties to ensure a smooth rental experience.

Section 8 Gold Street - Be clear and concise in explaining the challenges you faced in finding housing.

Army Counseling - The DA 4856 format helps standardize the counseling process across the military.

Documents used along the form

The Cash Drawer Count Sheet form is an essential document for tracking cash transactions within a business. Alongside this form, several other documents are commonly used to ensure accurate financial management and accountability. Below is a list of related forms and documents that support cash handling processes.

- Cash Register Tape: This document records the total sales made during a specific period. It provides a detailed breakdown of transactions, including cash, credit, and debit sales.

- Deposit Slip: A deposit slip is used when depositing cash and checks into a bank account. It lists the amount being deposited and serves as a record for both the business and the bank.

- Sales Receipt: A sales receipt is given to customers after a transaction. It serves as proof of purchase and includes details such as the date, items purchased, and total amount paid.

- Living Will Form: This legal document allows individuals to articulate their healthcare preferences should they be unable to communicate. It's an important tool for ensuring that their wishes are respected, such as through a Personal Healthcare Directive, helping families and medical staff navigate critical decisions during tough times.

- End-of-Day Report: This report summarizes daily sales, expenses, and cash on hand. It helps in reconciling cash drawer counts with actual sales figures.

- Expense Report: An expense report tracks business-related expenditures. It details the amount spent, purpose, and method of payment, assisting in maintaining financial records.

- Cash Handling Policy: This document outlines the procedures and guidelines for managing cash within the business. It includes protocols for cash handling, security measures, and employee responsibilities.

Utilizing these documents in conjunction with the Cash Drawer Count Sheet form enhances the accuracy of financial reporting and cash management. Each document plays a vital role in maintaining transparency and accountability within the cash handling process.

Similar forms

The Cash Register Reconciliation Sheet serves a similar purpose by documenting the cash transactions that occur within a cash register over a specific period. It provides a detailed account of sales, returns, and cash received, ensuring that the cash on hand matches the recorded transactions. This document is essential for identifying discrepancies between the expected cash balance and the actual cash available, thus promoting accountability and accuracy in financial reporting.

The Daily Sales Report is another document that aligns closely with the Cash Drawer Count Sheet. This report summarizes all sales activities for a given day, including cash, credit, and other forms of payment. By comparing the Daily Sales Report with the Cash Drawer Count Sheet, businesses can verify that the cash collected matches the sales recorded, which helps in detecting errors or potential theft.

The Petty Cash Log is similar in that it tracks small cash transactions made for miscellaneous expenses. This log records each petty cash disbursement and replenishment, ensuring that the total amount of petty cash on hand aligns with the documented transactions. Like the Cash Drawer Count Sheet, it aims to maintain financial accuracy and prevent misuse of funds.

The Bank Deposit Slip is another comparable document. It details the cash and checks being deposited into a bank account, providing a record of funds transferred from the business to the bank. By cross-referencing the Bank Deposit Slip with the Cash Drawer Count Sheet, businesses can confirm that all cash collected has been accurately deposited, further ensuring financial integrity.

The Sales Receipt serves a similar function by providing proof of individual transactions. Each receipt documents the items sold, the total amount paid, and the method of payment. This documentation is crucial for reconciling cash in the drawer with the sales recorded, as each receipt should correspond to the cash counted at the end of the day.

The Invoice is another document that shares similarities with the Cash Drawer Count Sheet. While invoices are typically used for credit sales, they still provide a record of sales transactions. Businesses can use invoices to verify that all sales have been accounted for in the cash drawer, especially when payments are made later or through different methods.

The Expense Report also bears resemblance, particularly in tracking cash outflows. This report details expenses incurred by employees and the corresponding amounts reimbursed. By maintaining accurate records of expenses alongside the Cash Drawer Count Sheet, businesses can ensure that all cash movements are accounted for, preventing discrepancies in financial records.

For those looking to sell or purchase a motorcycle in Texas, it's essential to utilize a Texas Motorcycle Bill of Sale form to ensure a smooth transaction. This important document captures key details such as the motorcycle's specifications, the sale price, and the identities of both parties involved. By maintaining accurate records, both the buyer and seller can protect their interests and validate the ownership transfer. To acquire this form, you can click to download the template directly online.

Lastly, the Financial Statement summarizes a company's financial performance and position over a specific period. It includes income statements, balance sheets, and cash flow statements. While broader in scope, the Financial Statement relies on accurate cash documentation, including the Cash Drawer Count Sheet, to ensure that the cash balance reported reflects the actual cash on hand, thereby supporting overall financial transparency.

Dos and Don'ts

When filling out the Cash Drawer Count Sheet form, it's important to follow certain guidelines to ensure accuracy and clarity. Here are six things to keep in mind:

- Do double-check the cash amounts before submitting the form.

- Do use clear and legible handwriting to avoid confusion.

- Do ensure all required fields are completed.

- Do sign and date the form at the bottom.

- Don't leave any fields blank; fill in all necessary information.

- Don't use correction fluid or tape on the form; it can cause discrepancies.

Key takeaways

Filling out and using the Cash Drawer Count Sheet form is an important task for managing cash flow effectively. Here are some key takeaways to keep in mind:

- Accuracy is crucial. Ensure that all amounts are counted and recorded correctly to avoid discrepancies.

- Consistency matters. Use the same method for counting cash each time to maintain reliable records.

- Document everything. Write down every denomination and the total amount to provide a clear picture of the cash drawer's status.

- Verify with a second person. Having another individual double-check the counts can help catch any errors before finalizing the sheet.

- Use it regularly. Regularly filling out the Cash Drawer Count Sheet can help identify patterns in cash flow and detect issues early.

- Store it securely. Keep completed forms in a safe place to protect sensitive financial information.

- Review periodically. Regularly review past count sheets to assess trends and make informed decisions about cash management.

How to Use Cash Drawer Count Sheet

After obtaining the Cash Drawer Count Sheet form, you will need to fill it out accurately to ensure proper tracking of cash amounts. This process involves entering specific information regarding the cash drawer's contents and verifying totals. Follow these steps to complete the form correctly.

- Begin by entering the date at the top of the form.

- Write your name or the name of the person responsible for the cash drawer.

- In the designated area, list the denominations of bills present in the cash drawer. Include $100, $50, $20, $10, $5, and $1 bills.

- Count the number of each denomination and write that number next to the corresponding bill type.

- Calculate the total amount for each denomination by multiplying the number of bills by the value of each bill.

- Sum the total amounts for all denominations to find the overall cash total in the drawer.

- Record the overall cash total in the appropriate section of the form.

- Review all entries for accuracy before finalizing the form.

- Sign and date the form to confirm that the information is correct.

Once the Cash Drawer Count Sheet is completed, it can be submitted to the appropriate supervisor or manager for review. This ensures that all cash handling processes are followed correctly.