Fill Out a Valid Cash Receipt Form

The Cash Receipt form plays a crucial role in financial transactions, serving as a vital document for both businesses and individuals. This form is used to record the details of cash received, ensuring accurate tracking and accountability. Key elements typically included on the form are the date of the transaction, the name of the payer, the amount received, and the method of payment, whether cash, check, or electronic transfer. Additionally, the form may feature a unique receipt number for easy reference and auditing purposes. By providing a clear and organized way to document incoming funds, the Cash Receipt form helps prevent discrepancies and supports effective financial management. It is essential for maintaining transparency in accounting practices and can be invaluable during tax preparation or financial reviews. Overall, this simple yet effective tool streamlines the process of cash handling, making it easier for businesses to maintain accurate records and for individuals to keep track of their financial dealings.

Common mistakes

-

Failing to enter the correct date. Always ensure the date reflects when the payment was received.

-

Not providing a complete description of the payment. A clear description helps in identifying the purpose of the payment.

-

Omitting the payer's name. Including the name of the individual or organization making the payment is crucial.

-

Incorrectly recording the payment amount. Double-check the figures to avoid discrepancies.

-

Using the wrong payment method. Specify whether the payment was made by cash, check, or credit card.

-

Not signing the form. A signature is often required to validate the receipt.

-

Neglecting to keep a copy of the receipt. Retaining a copy is important for record-keeping and future reference.

-

Failing to provide the transaction ID or reference number. This information aids in tracking the payment.

-

Leaving out additional notes or comments. If there are special instructions or details, include them for clarity.

-

Not reviewing the completed form before submission. A final review can catch errors that may have been overlooked.

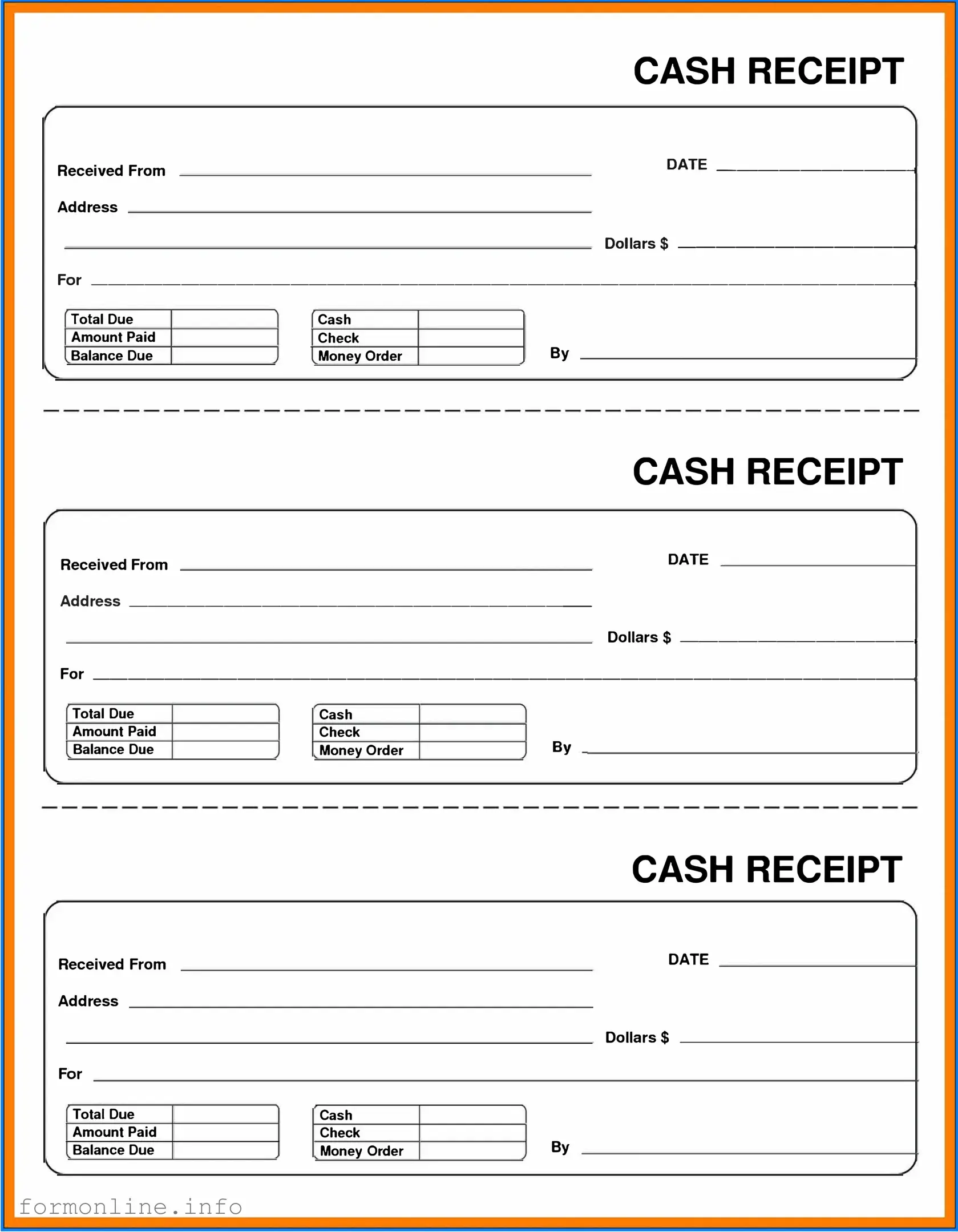

Preview - Cash Receipt Form

CASH RECEIPT

Received From |

|

� |

|||

Address |

|

|

Dollars$ |

||

|

|

|

|

||

|

� |

||||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

CASH RECEIPT

Received From |

|

|

|

|

|

|

|

|

|

DATE |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||||

Address ________________________ |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Dollars$ |

+ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Due |

|

|

|

|

|

Cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Amount Paid |

|

|

|

|

|

Check |

|

|

By |

|

|

|

|

|

|

Balance Due |

|

|

|

|

|

Money Order |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH RECEIPT

Received From |

|

DATE |

|||

Address |

|

|

|

||

|

|

|

|

Dollars$ |

|

For |

|

|

|

||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

Other PDF Templates

Section 8 Housing Requirements - Disabled applicants may receive assistance to modify policies and procedures for better access.

Sample Closing Disclosure - This estimate is crucial for informed financial decision-making.

In addition to serving as proof of ownership, a Trailer Bill of Sale form is essential for ensuring a smooth transaction process between the seller and the buyer. For those looking to create this document, a useful resource can be found at autobillofsaleform.com/trailer-bill-of-sale-form/, where templates and guidelines are provided to simplify the process.

How Do I Change My Address - This form is a tool for updating delivery preferences.

Documents used along the form

The Cash Receipt form is an essential document used to acknowledge the receipt of cash payments. However, it is often accompanied by several other forms and documents that help maintain accurate financial records and ensure proper accounting practices. Below is a list of commonly used forms that complement the Cash Receipt form.

- Invoice: An invoice is a detailed statement issued by a seller to a buyer. It outlines the products or services provided, their quantities, prices, and total amount due. This document serves as a request for payment and is often referenced when a cash receipt is generated.

- Deposit Slip: A deposit slip is used when cash or checks are deposited into a bank account. It provides a record of the transaction, including the amount being deposited, and is often matched with the Cash Receipt form to confirm that funds have been received and recorded accurately.

- Payment Voucher: A payment voucher is an internal document that authorizes a payment to be made. It includes details such as the purpose of the payment and the recipient's information. This document helps ensure that payments are properly authorized and documented before cash is disbursed.

- Application Form: The AZ Forms Online is utilized for students applying to Arizona universities, enabling them to submit applications efficiently while potentially requesting a waiver for the application fee.

- Receipt Book: A receipt book contains pre-printed receipts that can be issued for cash transactions. Each receipt serves as proof of payment and can be used alongside the Cash Receipt form to provide a complete record of transactions.

- Credit Memo: A credit memo is issued to document a reduction in the amount owed by a customer. This may occur due to returns or adjustments. It is important to keep track of credit memos to ensure that cash receipts accurately reflect the amounts received.

- Account Statement: An account statement summarizes all transactions over a specific period for a customer or vendor. It provides a comprehensive view of payments received and outstanding balances, serving as a useful reference for reconciling the Cash Receipt form with overall account activity.

These documents work together to create a clear and organized financial record. Utilizing them effectively can enhance accountability and transparency in cash management practices.

Similar forms

The Cash Receipt form is similar to the Invoice. Both documents serve the purpose of tracking financial transactions. An invoice details the goods or services provided and the amount owed by the customer, while a cash receipt confirms that payment has been received. Essentially, the invoice is a request for payment, and the cash receipt is proof of that payment. They work together to ensure accurate financial records for both the seller and buyer.

An Estimate is another document that shares similarities with the Cash Receipt form. An estimate provides a projected cost for goods or services before the transaction takes place. Once the customer agrees to the estimate, they might proceed to make a payment, leading to the issuance of a cash receipt. Both documents help manage expectations and track the flow of money, although they occur at different stages of the transaction process.

The Texas Mobile Home Bill of Sale form is a crucial document used to transfer ownership of a mobile home from one party to another. This form provides essential details about the transaction, including the identities of the buyer and seller, as well as information about the mobile home itself. Understanding this form is important for ensuring a smooth and legal transfer of property rights in Texas. For more information, you can visit the Mobile Home Bill of Sale site.

Lastly, the Payment Voucher is another document that resembles the Cash Receipt form. A payment voucher is used to authorize a payment to a vendor or supplier. It includes details such as the amount to be paid and the purpose of the payment. Once the payment is made, a cash receipt is issued as confirmation. Both documents play a crucial role in ensuring that payments are processed correctly and that there is a record of financial exchanges.

Dos and Don'ts

When filling out the Cash Receipt form, it's essential to follow certain guidelines to ensure accuracy and compliance. Here are four things you should and shouldn't do:

- Do: Double-check all amounts before submission to avoid errors.

- Do: Clearly write the date of the transaction to maintain proper records.

- Don't: Leave any fields blank; incomplete forms can lead to processing delays.

- Don't: Use correction fluid; it can create confusion and may invalidate the receipt.

Key takeaways

When filling out and using the Cash Receipt form, consider the following key takeaways:

- Ensure all fields are completed accurately. This includes the date, amount received, and the purpose of the transaction.

- Keep a copy of the Cash Receipt for your records. This serves as proof of payment and can be important for future reference.

- Use the form consistently for all cash transactions. This helps maintain clear financial records and simplifies tracking income.

- Review the form for any errors before finalizing. Mistakes can lead to discrepancies in financial reporting.

How to Use Cash Receipt

After gathering the necessary information, you're ready to fill out the Cash Receipt form. This form is essential for documenting cash transactions accurately. Follow the steps below to ensure all details are captured correctly.

- Begin by entering the date of the transaction in the designated space.

- Write the name of the person or business making the payment.

- In the next field, specify the amount of cash received.

- Indicate the purpose of the payment in the provided section.

- Include any relevant reference number, if applicable.

- Sign the form to validate the transaction.

- Make a copy of the completed form for your records.