Fill Out a Valid CBP 6059B Form

The CBP 6059B form plays a crucial role in the customs process for travelers entering the United States. This form is primarily used by U.S. Customs and Border Protection (CBP) to gather important information about incoming passengers and their belongings. Travelers must complete the form to declare items they are bringing into the country, including gifts, food, and other goods. It serves to ensure compliance with U.S. laws and regulations regarding imports. Additionally, the form helps CBP assess duties and taxes that may apply to certain items. The CBP 6059B form is typically distributed on international flights or can be obtained at ports of entry. Proper completion of this form is essential for a smooth entry process, as it aids in the efficient processing of travelers at the border.

Common mistakes

-

Failing to provide accurate personal information. Many individuals do not double-check their names, addresses, or dates of birth, leading to discrepancies.

-

Omitting necessary details about travel plans. Travelers often forget to include information about their flight numbers or the purpose of their visit.

-

Not signing the form. A common oversight is neglecting to sign the CBP 6059B form, which can result in processing delays.

-

Using incorrect or outdated information. Some individuals may provide information that is no longer valid, such as an expired passport number.

-

Misunderstanding the declaration requirements. People sometimes fail to declare items that must be reported, which can lead to fines or confiscation.

-

Providing vague answers. Specificity is crucial; vague responses can cause confusion and require additional questioning by customs officials.

-

Forgetting to include family members. Travelers may neglect to list all accompanying individuals, which can complicate the customs process.

-

Not checking for updates. Regulations can change, and failing to review the latest guidelines may result in incomplete or incorrect submissions.

-

Ignoring the instructions. Some individuals overlook the detailed instructions provided with the form, leading to common mistakes.

-

Submitting the form too late. Timing is important; delays in submission can affect entry into the United States.

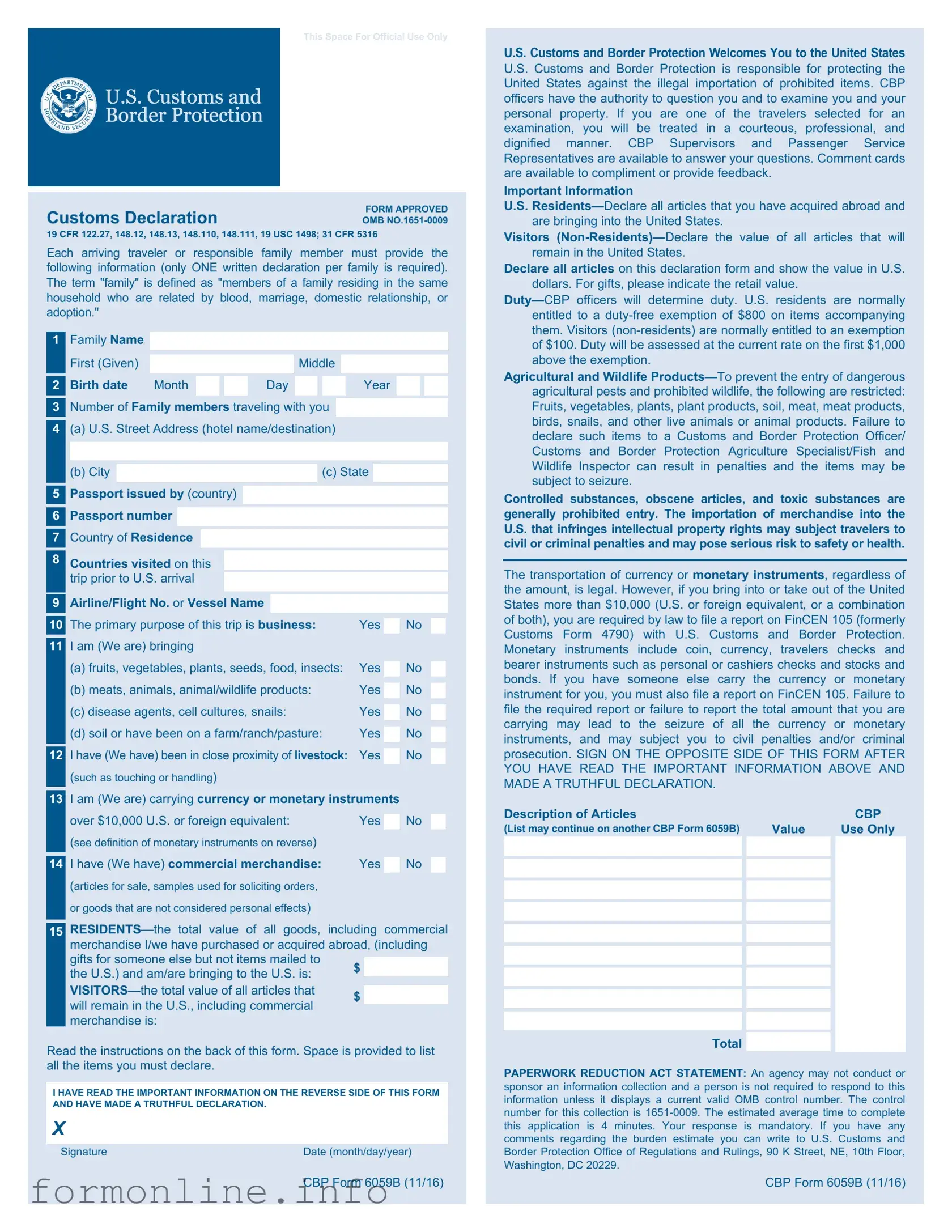

Preview - CBP 6059B Form

This Space For Official Use Only

Customs Declaration |

FORM APPROVED |

OMB |

19 CFR 122.27, 148.12, 148.13, 148.110, 148.111, 19 USC 1498; 31 CFR 5316

Each arriving traveler or responsible family member must provide the following information (only ONE written declaration per family is required). The term "family" is defined as "members of a family residing in the same household who are related by blood, marriage, domestic relationship, or adoption."

1Family Name

|

First (Given) |

|

|

|

|

|

Middle |

|

|

|

|

|||

|

Birth date |

Month |

|

|

|

Day |

|

|

|

|

Year |

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

||||

3Number of Family members traveling with you

4(a) U.S. Street Address (hotel name/destination)

(b) City  (c) State

(c) State

5Passport issued by (country)

6Passport number

7Country of Residence

8 Countries visited on this

trip prior to U.S. arrival

9 |

Airline/Flight No. or Vessel Name |

|

|

|

|

|

|

|

The primary purpose of this trip is business: |

|

|

|

|

|

|

10 |

Yes |

|

No |

|

|

||

11I am (We are) bringing

(a)fruits, vegetables, plants, seeds, food, insects: Yes  No

No

(b) meats, animals, animal/wildlife products: |

Yes |

|

No |

|

(c) disease agents, cell cultures, snails: |

Yes |

|

No |

|

|

|

|||

(d) soil or have been on a farm/ranch/pasture: |

Yes |

|

No |

|

|

|

12I have (We have) been in close proximity of livestock: Yes  No (such as touching or handling)

No (such as touching or handling)

13I am (We are) carrying currency or monetary instruments

|

over $10,000 U.S. or foreign equivalent: |

Yes |

|

No |

|

|

(see definition of monetary instruments on reverse) |

|

|

|

|

|

|

|

|

|

|

14 |

I have (We have) commercial merchandise: |

Yes |

|

No |

|

|

|

||||

|

(articles for sale, samples used for soliciting orders, |

|

|

|

|

|

or goods that are not considered personal effects) |

|

|

|

|

|

|

|

|

|

|

|

|||

15 |

|||

|

merchandise I/we have purchased or acquired abroad, (including |

||

|

gifts for someone else but not items mailed to |

$ |

|

|

|

||

|

the U.S.) and am/are bringing to the U.S. is: |

|

|

|

|

|

|

|

$ |

|

|

|

|

||

|

will remain in the U.S., including commercial |

|

|

|

|

|

|

|

merchandise is: |

|

|

Read the instructions on the back of this form. Space is provided to list all the items you must declare.

I HAVE READ THE IMPORTANT INFORMATION ON THE REVERSE SIDE OF THIS FORM AND HAVE MADE A TRUTHFUL DECLARATION.

X

Signature |

Date (month/day/year) |

U.S. Customs and Border Protection Welcomes You to the United States

U.S. Customs and Border Protection is responsible for protecting the United States against the illegal importation of prohibited items. CBP officers have the authority to question you and to examine you and your personal property. If you are one of the travelers selected for an examination, you will be treated in a courteous, professional, and dignified manner. CBP Supervisors and Passenger Service Representatives are available to answer your questions. Comment cards are available to compliment or provide feedback.

Important Information

U.S.

Visitors

Declare all articles on this declaration form and show the value in U.S. dollars. For gifts, please indicate the retail value.

Agricultural and Wildlife

Controlled substances, obscene articles, and toxic substances are generally prohibited entry. The importation of merchandise into the U.S. that infringes intellectual property rights may subject travelers to civil or criminal penalties and may pose serious risk to safety or health.

The transportation of currency or monetary instruments, regardless of the amount, is legal. However, if you bring into or take out of the United States more than $10,000 (U.S. or foreign equivalent, or a combination of both), you are required by law to file a report on FinCEN 105 (formerly Customs Form 4790) with U.S. Customs and Border Protection. Monetary instruments include coin, currency, travelers checks and bearer instruments such as personal or cashiers checks and stocks and bonds. If you have someone else carry the currency or monetary instrument for you, you must also file a report on FinCEN 105. Failure to file the required report or failure to report the total amount that you are carrying may lead to the seizure of all the currency or monetary instruments, and may subject you to civil penalties and/or criminal prosecution. SIGN ON THE OPPOSITE SIDE OF THIS FORM AFTER YOU HAVE READ THE IMPORTANT INFORMATION ABOVE AND MADE A TRUTHFUL DECLARATION.

Description of Articles |

|

|

CBP |

(List may continue on another CBP Form 6059B) |

|

Value |

Use Only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

PAPERWORK REDUCTION ACT STATEMENT: An agency may not conduct or sponsor an information collection and a person is not required to respond to this information unless it displays a current valid OMB control number. The control number for this collection is

CBP Form 6059B (11/16) |

CBP Form 6059B (11/16) |

Other PDF Templates

Pregnancy Verification Letter Planned Parenthood - A guardian’s involvement may be necessary for minors receiving care.

When completing a transaction for a motorcycle in New York, it is crucial to utilize a New York Motorcycle Bill of Sale form to ensure all parties are protected and the sale is legally recognized. This document not only outlines the details of the buyer and seller but also includes specific information about the motorcycle, thereby providing clarity and security during the transfer. For more details on how to properly execute this process, you can refer to the following link: https://autobillofsaleform.com/motorcycle-bill-of-sale-form/new-york-motorcycle-bill-of-sale-form.

Yes No Maybe List - Explore this list to find out what excites you and your partner the most.

Documents used along the form

The CBP 6059B form, also known as the Customs Declaration form, is essential for travelers entering the United States. It helps customs officials gather information about the items you are bringing into the country. Alongside this form, there are several other documents that travelers often need to complete or present. Below is a list of these documents, along with a brief description of each.

- Passport: This is your primary identification document when traveling internationally. It proves your identity and nationality, allowing you to enter the U.S.

- Motor Vehicle Bill of Sale: This document is essential for recording the transfer of ownership of a vehicle. It includes vital information regarding the vehicle and the parties involved, ensuring all transactions are legally recognized. For more information, visit billofsaleforvehicles.com.

- Visa: Depending on your nationality and purpose of travel, you may need a visa. This document grants you permission to enter the U.S. for a specific period and reason.

- Form I-94: This form records your arrival and departure information. It is crucial for tracking your stay in the U.S. and is typically issued upon arrival.

- Customs Form 7507: This form is used for declaring any items that may require special attention, such as food, plants, or animals. It helps ensure compliance with U.S. regulations.

Being prepared with these documents can streamline your entry process into the United States. Understanding what is required not only helps you avoid delays but also ensures a smoother travel experience overall.

Similar forms

The CBP 6059B form, also known as the Customs Declaration form, is similar to the CBP 7501 form. The CBP 7501 is used for entry summary and provides detailed information about goods being imported into the United States. Both forms require accurate reporting of items and their values, ensuring compliance with U.S. customs regulations. While the 6059B focuses on personal items, the 7501 is more comprehensive, covering commercial imports. Together, they help customs officials assess duties and ensure proper documentation for goods entering the country.

Another document that resembles the CBP 6059B is the I-94 form, which records the arrival and departure of non-U.S. citizens. Like the 6059B, the I-94 requires travelers to provide personal information, including travel history and purpose of entry. While the 6059B is primarily concerned with declaring goods, the I-94 focuses on immigration status. Both forms serve to maintain security and monitor the movement of individuals and goods across U.S. borders.

The CBP 7506 form is also comparable to the CBP 6059B. This form is used for the declaration of personal effects and household goods. Similar to the 6059B, the 7506 requires individuals to list items they are bringing into the U.S. However, it specifically targets those relocating or returning to the U.S. after living abroad. Both forms aim to facilitate the customs process while ensuring that all items are accounted for and comply with regulations.

The Form 8840, the Closer Connection Exception Statement for Aliens, shares similarities with the CBP 6059B in that it requires individuals to disclose personal information. This form is used by non-resident aliens to claim a closer connection to a foreign country for tax purposes. While the focus of the 8840 is on tax residency, both documents require detailed personal information and aim to clarify an individual's status when entering the U.S.

The Declaration of Free Entry of Returned American Products (CBP Form 3311) is another document akin to the CBP 6059B. This form is utilized for items that American citizens are bringing back into the U.S. after a temporary absence. Like the 6059B, it seeks to ensure that the goods are not subject to duties. Both forms facilitate the smooth entry of personal items while maintaining compliance with customs regulations.

In the realm of educational documentation, similar to the importance of various travel forms, the Washington Homeschool Letter of Intent form plays a crucial role for families choosing to educate their children at home. This form notifies the state of a family's decision to homeschool and outlines the basic information required by law. For parents, completing this form is an essential first step in ensuring that homeschooling is recognized and supported by the state education system, much like how different entry forms assist in documenting travelers' intentions. For more information, you can refer to the Homeschool Letter of Intent.

The Form 2866, which is the U.S. Customs and Border Protection (CBP) Application for a Permit to Transfer, is also comparable to the CBP 6059B. This document is used for the transfer of goods between bonded warehouses. While the 6059B focuses on personal declarations, the Form 2866 requires information about the movement of goods under customs supervision. Both forms play a role in regulating the flow of items within the U.S. customs framework.

Lastly, the CBP Form 3299, Declaration for Free Entry of Unaccompanied Articles, is similar to the CBP 6059B. This form is used for items sent to the U.S. that do not accompany the traveler. Like the 6059B, it requires a declaration of the items being imported. Both forms aim to ensure that all goods are properly declared and comply with U.S. customs laws, facilitating a smooth customs process for travelers and importers alike.

Dos and Don'ts

When filling out the CBP 6059B form, it is essential to follow specific guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do.

- Do provide accurate personal information, including your name and address.

- Do declare all items you are bringing into the United States.

- Do check the form for completeness before submission.

- Do use clear and legible handwriting if completing the form by hand.

- Do keep a copy of the completed form for your records.

- Don't leave any required fields blank.

- Don't provide false information or omit details about prohibited items.

- Don't submit the form without reviewing it for errors.

- Don't forget to sign and date the form where indicated.

- Don't use abbreviations that may cause confusion.

Key takeaways

The CBP 6059B form is an important document for travelers entering the United States. Here are some key takeaways to keep in mind:

- Purpose of the Form: This form is used to declare items you are bringing into the U.S., including gifts, food, and other goods.

- Who Needs to Fill It Out: All travelers, including U.S. citizens and foreign visitors, must complete this form if they are bringing items into the country.

- Accuracy is Key: Be honest and accurate when listing items. Misrepresentation can lead to fines or confiscation of goods.

- Customs Allowances: Familiarize yourself with the customs allowances for items you can bring without incurring duties or taxes.

- Submission: You will typically submit the form to a Customs and Border Protection officer upon arrival at the airport or border.

- Keep a Copy: It’s a good idea to keep a copy of the completed form for your records, in case you need to refer to it later.

Understanding these points can help make your entry into the U.S. smoother and more efficient.

How to Use CBP 6059B

Filling out the CBP 6059B form is an important step for travelers entering the United States. This form collects necessary information to ensure a smooth entry process. Below are the steps to complete the form accurately.

- Begin by writing your full name in the designated section. Ensure that it matches your identification documents.

- Provide your date of birth. Use the format MM/DD/YYYY for clarity.

- Indicate your gender by checking the appropriate box.

- Fill in your passport number. Double-check for accuracy to avoid any delays.

- List your country of citizenship. This should be the country that issued your passport.

- Enter your address in the United States, if applicable. If you do not have one, you can leave this section blank.

- Provide your flight information. Include the airline name and flight number.

- Indicate your destination in the United States. This could be a city or specific location.

- Sign and date the form at the bottom. Your signature confirms that the information provided is accurate.

After completing the form, review all entries for any errors. Having accurate information is crucial for a smooth entry into the country. Keep the form handy as you will need to present it upon arrival.