Fill Out a Valid Cg 20 10 07 04 Liability Endorsement Form

The CG 20 10 07 04 Liability Endorsement form is an essential document for businesses seeking to extend their insurance coverage to include additional insured parties. This endorsement modifies the existing Commercial General Liability policy, allowing specific individuals or organizations to be added as insureds. It is particularly relevant for owners, lessees, or contractors who may need protection against claims for bodily injury, property damage, or personal and advertising injury that arise from the actions of the primary insured or their representatives. The form outlines the necessary details, such as the names of the additional insured and the locations of covered operations. However, it is important to note that the coverage provided is limited and subject to the terms of any relevant contracts. For instance, if a contract requires a certain level of coverage, the endorsement ensures that the insurance does not exceed what is mandated. Additionally, it specifies exclusions, particularly concerning the timing of claims related to completed work. Understanding these aspects is crucial for anyone involved in contractual agreements or construction projects, as it helps clarify the extent of liability coverage and the responsibilities of all parties involved.

Common mistakes

-

Failing to include the correct policy number: Always ensure that the policy number is accurately entered. An incorrect policy number can lead to confusion and delays in processing your endorsement.

-

Not specifying the additional insured parties: Clearly list the names of the additional insured persons or organizations. Omitting this information may result in insufficient coverage.

-

Ignoring location details: It’s crucial to provide the exact locations of covered operations. Without this, the endorsement may not be valid for the intended areas.

-

Overlooking contractual obligations: Ensure that the coverage provided does not exceed what is required by any contracts or agreements. This is essential to avoid potential disputes.

-

Neglecting to check for exclusions: Review the exclusions carefully. Not understanding what is excluded can lead to unexpected gaps in coverage.

-

Inaccurate completion of the schedule: Double-check that all required fields in the schedule are filled out completely. Incomplete forms can lead to delays or denial of coverage.

-

Failing to understand the limits of insurance: Familiarize yourself with the limits set forth in the endorsement. Knowing these limits helps you understand the extent of coverage available.

-

Submitting the form without review: Always take a moment to review the completed form before submission. Mistakes can be easily overlooked, but a thorough review can catch them.

-

Not keeping a copy: Always keep a copy of the completed endorsement for your records. This is important for future reference and to ensure you have proof of coverage.

Preview - Cg 20 10 07 04 Liability Endorsement Form

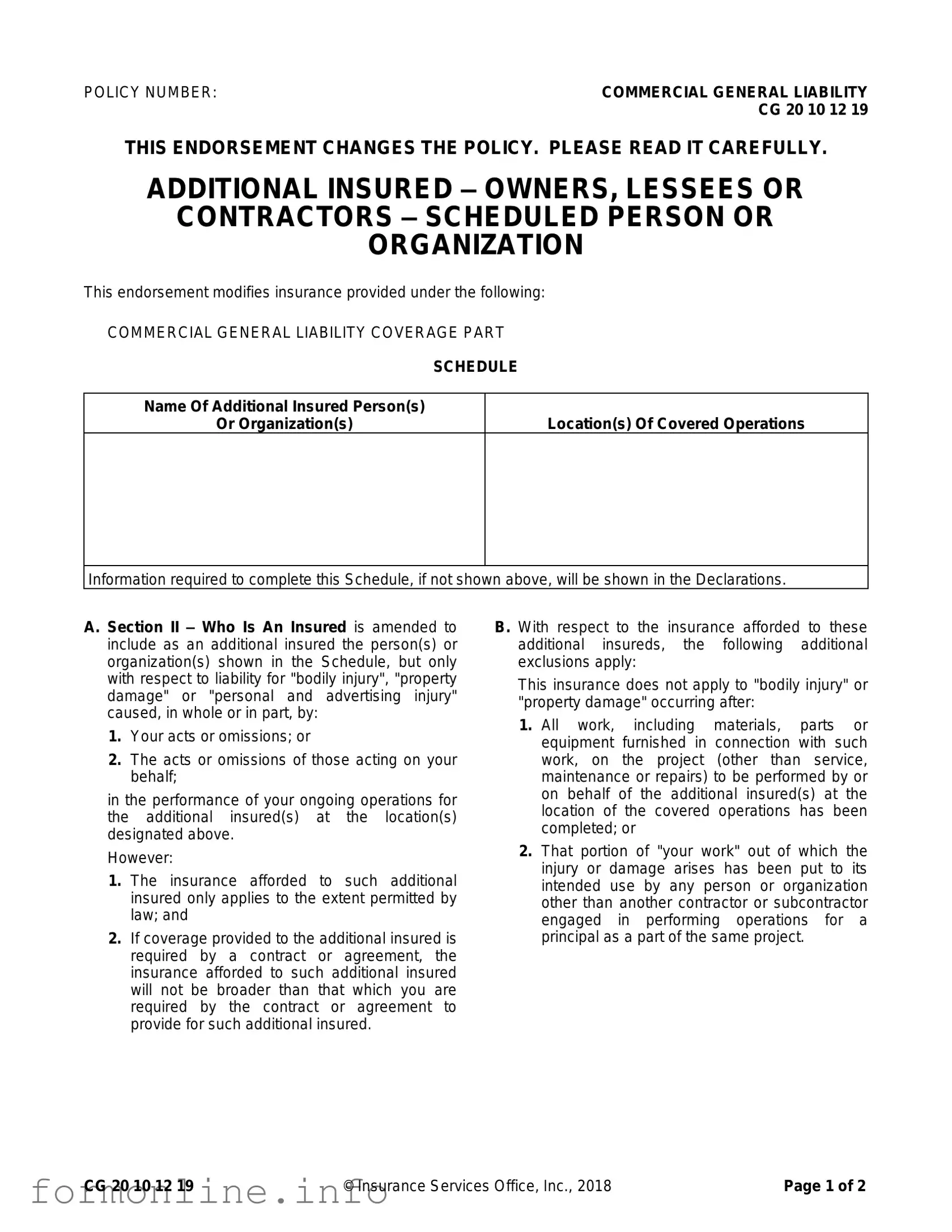

POLICY NUMBER: |

COMMERCIAL GENERAL LIABILITY |

|

CG 20 10 12 19 |

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

ADDITIONAL INSURED – OWNERS, LESSEES OR

CONTRACTORS – SCHEDULED PERSON OR

ORGANIZATION

This endorsement modifies insurance provided under the following:

COMMERCIAL GENERAL LIABILITY COVERAGE PART

SCHEDULE

Name Of Additional Insured Person(s)

Or Organization(s)

Location(s) Of Covered Operations

Information required to complete this Schedule, if not shown above, will be shown in the Declarations.

A. Section II – Who Is An Insured is amended to include as an additional insured the person(s) or organization(s) shown in the Schedule, but only with respect to liability for "bodily injury", "property damage" or "personal and advertising injury" caused, in whole or in part, by:

1.Your acts or omissions; or

2.The acts or omissions of those acting on your behalf;

in the performance of your ongoing operations for the additional insured(s) at the location(s) designated above.

However:

1.The insurance afforded to such additional insured only applies to the extent permitted by law; and

2.If coverage provided to the additional insured is required by a contract or agreement, the insurance afforded to such additional insured will not be broader than that which you are required by the contract or agreement to provide for such additional insured.

B. With respect to the insurance afforded to these additional insureds, the following additional exclusions apply:

This insurance does not apply to "bodily injury" or "property damage" occurring after:

1.All work, including materials, parts or equipment furnished in connection with such work, on the project (other than service, maintenance or repairs) to be performed by or on behalf of the additional insured(s) at the location of the covered operations has been completed; or

2.That portion of "your work" out of which the injury or damage arises has been put to its intended use by any person or organization other than another contractor or subcontractor engaged in performing operations for a principal as a part of the same project.

CG 20 10 12 19 |

© Insurance Services Office, Inc., 2018 |

Page 1 of 2 |

C. With respect to the insurance afforded to these additional insureds, the following is added to

Section III – Limits Of Insurance:

If coverage provided to the additional insured is required by a contract or agreement, the most we will pay on behalf of the additional insured is the amount of insurance:

1.Required by the contract or agreement; or

2.Available under the applicable limits of insurance;

whichever is less.

This endorsement shall not increase the applicable limits of insurance.

Page 2 of 2 |

© Insurance Services Office, Inc., 2018 |

CG 20 10 12 19 |

Other PDF Templates

Yes No Maybe List - It includes activities that range from mild to intense, allowing for open discussion.

In any mobile home transaction, it is important to have the appropriate documentation to ensure clarity and legal compliance. The Ohio Mobile Home Bill of Sale serves as a key element in this process, as it facilitates the transfer of ownership while detailing the buyer and seller's information, the mobile home's specifications, and the agreed sale price. For a comprehensive understanding, it is advisable to refer to the Mobile Home Bill of Sale, which can assist in avoiding any potential ambiguities and safeguarding both parties' interests.

Artist Agreement - Any prior agreements are superseded by this contract.

Documents used along the form

When dealing with the CG 20 10 07 04 Liability Endorsement form, several other documents often come into play. These forms and documents help clarify responsibilities, coverage, and compliance in various situations. Understanding these additional documents can provide a comprehensive view of the insurance landscape.

- Commercial General Liability (CGL) Policy: This is the main insurance policy that covers a business against claims of bodily injury, property damage, and personal injury. The CG 20 10 07 04 form is an endorsement to this policy, modifying its terms.

- South Carolina Motor Vehicle Bill of Sale: This form is essential for documenting the sale of a motor vehicle in South Carolina and can be accessed at https://autobillofsaleform.com/south-carolina-motor-vehicle-bill-of-sale-form.

- Certificate of Insurance (COI): A document that proves the existence of an insurance policy and outlines the coverage details. It is often requested by clients or partners to verify that a contractor or business has the necessary insurance.

- Additional Insured Endorsement: Similar to the CG 20 10 07 04 form, this endorsement adds other parties to the insurance policy as additional insureds. It provides them with coverage under the policy, typically required by contracts.

- Indemnity Agreement: A legal document in which one party agrees to compensate another for certain damages or losses. This agreement often accompanies insurance policies and specifies the responsibilities of each party.

- Waiver of Subrogation: A clause that prevents the insurance company from pursuing a third party for reimbursement after paying a claim. This is often included in contracts to protect the interests of all parties involved.

- Contractor Agreement: A document outlining the terms and conditions between a contractor and a client. It typically includes clauses about insurance requirements, liabilities, and responsibilities.

- Claims Form: A form used to report an incident that may result in a claim against an insurance policy. This document initiates the claims process and provides necessary details about the incident.

- Policy Declarations Page: This page summarizes the key details of an insurance policy, including coverage limits, deductibles, and the insured parties. It serves as a quick reference for understanding the policy's terms.

These documents work together to ensure clarity and compliance in insurance matters. Familiarity with each of them can enhance understanding and management of liability risks, making it easier to navigate the complexities of insurance coverage.

Similar forms

The CG 20 10 07 04 Liability Endorsement form is similar to the Additional Insured Endorsement (CG 20 10) in that both documents extend liability coverage to additional parties. This is particularly relevant in construction and service contracts, where contractors or service providers may need to protect the interests of property owners or other stakeholders. The CG 20 10 specifically adds coverage for the additional insureds regarding liabilities arising from the contractor's or service provider's operations. Both forms share a common goal: to ensure that additional insureds are covered for specific liabilities that may arise during the course of the work performed, thereby minimizing potential disputes and financial risks associated with liability claims.

For LLCs operating in Florida, having a clearly defined Operating Agreement is key to establishing the roles and responsibilities of its members. This vital document ensures proper governance within the company and can be essential when navigating legal or operational disputes. For more information on this crucial document, check out our guide on creating a precise Operating Agreement template tailored for your business needs. Operating Agreement template details.

Another document that shares similarities is the Additional Insured – Owners, Lessees, or Contractors (CG 20 37) endorsement. Like the CG 20 10 07 04, this endorsement also provides liability coverage to additional insureds, but it is often more comprehensive in its scope. The CG 20 37 extends coverage not just for ongoing operations but also for completed operations. This means that if a liability claim arises after the work has been completed, the additional insured may still be protected. The key difference lies in the breadth of coverage, making the CG 20 37 particularly valuable in scenarios where the risk of claims persists after project completion.

The CG 20 11 endorsement is yet another similar document that focuses on providing additional insured status to specific parties. This endorsement is tailored for situations where a contract stipulates that certain parties must be included as additional insureds. It is designed to ensure that the coverage provided is in line with contractual obligations. While the CG 20 10 07 04 focuses on ongoing operations, the CG 20 11 can extend to both ongoing and completed operations, depending on the terms outlined in the policy. This flexibility allows for a more tailored approach to risk management, ensuring that all parties are adequately protected based on the specific requirements of their contracts.

Lastly, the CG 20 26 endorsement is relevant as it pertains to the liability coverage for additional insureds when there is a specific requirement for coverage in a written contract. Similar to the CG 20 10 07 04, this endorsement provides coverage for liabilities arising from the acts or omissions of the named insured. However, the CG 20 26 is particularly focused on the context of liability that arises from the additional insured's operations. This document emphasizes the need for clarity regarding the extent of coverage, ensuring that the additional insured is protected in accordance with the stipulations of the underlying contract. By outlining these specific terms, the CG 20 26 helps to delineate the responsibilities and protections afforded to additional insureds in various contractual relationships.

Dos and Don'ts

When filling out the CG 20 10 07 04 Liability Endorsement form, it’s essential to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn't do:

- Do carefully read the entire endorsement before filling it out to understand its implications.

- Do provide complete and accurate information for the additional insured person(s) or organization(s).

- Do specify the location(s) of the covered operations clearly to avoid confusion.

- Do ensure that the insurance coverage aligns with any contracts or agreements you have in place.

- Don't leave any sections blank; incomplete forms can lead to delays or denial of coverage.

- Don't exaggerate or misrepresent the scope of coverage you are providing.

- Don't forget to check for any additional exclusions that may apply to the additional insureds.

- Don't submit the form without reviewing it for errors or inconsistencies.

Key takeaways

Here are some key takeaways about filling out and using the CG 20 10 07 04 Liability Endorsement form:

- Understand the Purpose: This form adds additional insured parties to your Commercial General Liability policy. It is essential for protecting those parties against claims related to bodily injury, property damage, or personal and advertising injury.

- Complete the Schedule: Ensure that you accurately fill in the names of the additional insured persons or organizations and the locations of covered operations. Missing information can lead to gaps in coverage.

- Know the Limitations: The coverage for additional insureds is limited to what is required by law or specified in a contract. It will not exceed the coverage you are obligated to provide.

- Review Exclusions: Be aware that the endorsement does not cover bodily injury or property damage that occurs after your work on a project has been completed. This includes any materials or equipment related to that work.

- Check Contractual Obligations: If a contract requires additional insured coverage, the limits of insurance provided will be the lesser of what the contract mandates or the policy limits available.

- Consult with Experts: When in doubt, seek advice from an insurance professional or legal expert. They can help clarify any uncertainties regarding the endorsement and its implications for your coverage.

How to Use Cg 20 10 07 04 Liability Endorsement

Filling out the CG 20 10 07 04 Liability Endorsement form is a straightforward process. This form allows you to add additional insured parties to your commercial general liability policy. It’s important to complete it accurately to ensure that the coverage aligns with your contractual obligations and protects all parties involved.

- Obtain the Form: Start by getting a copy of the CG 20 10 07 04 Liability Endorsement form. This can usually be downloaded from your insurance provider’s website.

- Policy Number: Write your policy number in the designated space at the top of the form. This is crucial for identifying your specific coverage.

- Name of Additional Insured: In the section labeled "Name Of Additional Insured Person(s) Or Organization(s)," enter the full names of the individuals or organizations you wish to add as additional insureds.

- Location of Covered Operations: Fill in the "Location(s) Of Covered Operations" section. Specify the locations where the additional insureds will be covered under your policy.

- Review the Declarations: If there is any additional information required that is not on the form, refer to your policy declarations for guidance.

- Signature: Sign and date the form to confirm that all the information provided is accurate and complete.

- Submit the Form: Send the completed form to your insurance provider. Ensure you keep a copy for your records.

After submitting the form, your insurance provider will process it and update your policy accordingly. Make sure to follow up if you do not receive confirmation of the changes in a timely manner.