Fill Out a Valid Childcare Receipt Form

The Childcare Receipt form serves as a crucial document for parents and guardians seeking to track their childcare expenses. This form includes essential details such as the date of service, the amount paid, and the name of the individual or organization providing the childcare. Additionally, it specifies the name(s) of the child or children receiving care, ensuring clarity and accountability. The period during which the childcare services were rendered is also noted, providing a clear timeline for both parties. Finally, the provider's signature affirms the transaction, adding an extra layer of verification. By using this form, families can maintain organized records of their childcare expenses, which may be beneficial for budgeting or tax purposes.

Common mistakes

-

Neglecting to include the date: Failing to write the date on the receipt can lead to confusion about when the services were rendered.

-

Omitting the amount: Leaving the amount blank or incorrectly entered can cause disputes over payment and services provided.

-

Not specifying the recipient: Forgetting to include the name of the person or entity making the payment can complicate record-keeping.

-

Ignoring the names of the children: Failing to list the names of the children receiving care can lead to issues in verifying services rendered.

-

Missing the service dates: Not filling in the start and end dates for the childcare services can create ambiguity regarding the duration of care.

-

Provider's signature not included: Without the provider's signature, the receipt may not be considered valid or official.

-

Using unclear handwriting: Illegible writing can result in misinterpretation of important details on the receipt.

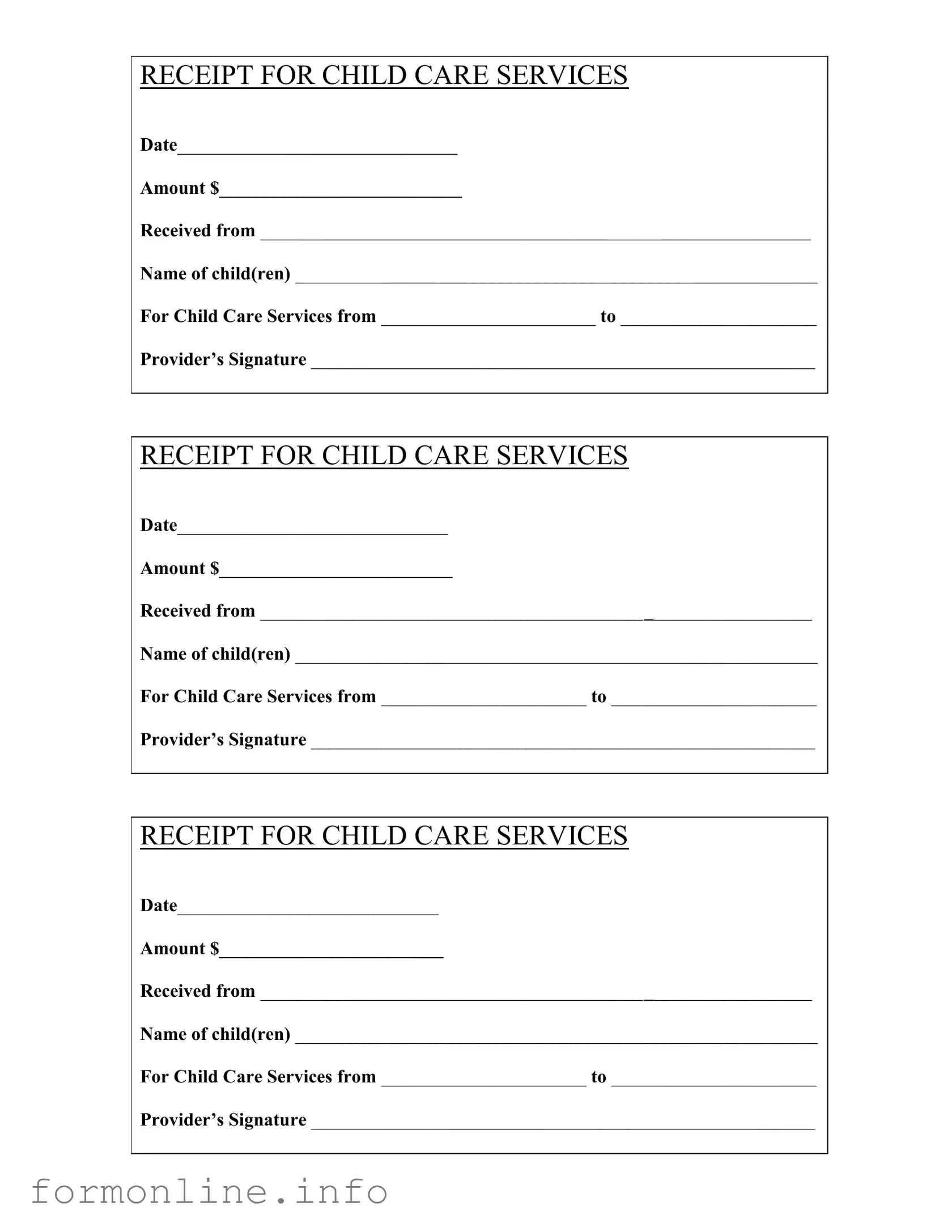

Preview - Childcare Receipt Form

RECEIPT FOR CHILD CARE SERVICES

Date______________________________

Amount $__________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from _______________________ to _____________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date_____________________________

Amount $_________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date____________________________

Amount $________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

Other PDF Templates

Aws Certified Welders - The date the welder is qualified is marked, establishing a timeline for credentials.

When engaging in the sale of a boat, it is crucial to utilize the New York Boat Bill of Sale form, which facilitates the proper transfer of ownership and safeguards both the seller and buyer's interests. For those looking to access this important document, it can be found at https://nypdfforms.com/, ensuring a smooth and legally sound transaction.

IRS E-file Signature Authorization - The service of e-filing through a preparer is made official with this signature.

Documents used along the form

When managing childcare services, several documents complement the Childcare Receipt form. Each document serves a unique purpose, helping parents and providers maintain clear records and ensure compliance with various regulations.

- Childcare Agreement: This document outlines the terms and conditions of the childcare arrangement. It typically includes details such as hours of operation, fees, and responsibilities of both the provider and the parents.

- Mobile Home Bill of Sale: This essential document facilitates the transfer of ownership of a mobile home, detailing necessary components such as buyer and seller information, and the sale price. For more information, visit the Mobile Home Bill of Sale.

- Emergency Contact Form: This form provides essential information about whom to contact in case of an emergency. It often includes details about the child’s medical history and any allergies, ensuring that caregivers have the necessary information readily available.

- Child Enrollment Form: This form gathers important information about the child, including their name, age, and any special needs. It helps the provider understand the child’s requirements and preferences, facilitating a better care experience.

- Tax Information Form: Often required for tax purposes, this document helps parents keep track of childcare expenses. It provides necessary details for claiming childcare deductions on tax returns, which can significantly benefit families financially.

Utilizing these forms alongside the Childcare Receipt can streamline communication between parents and providers. Proper documentation fosters transparency and accountability, ultimately enhancing the childcare experience for everyone involved.

Similar forms

The first document similar to the Childcare Receipt form is the Invoice for Services Rendered. This document outlines the services provided by a service provider, including details such as the date of service, the amount charged, and the recipient's information. Like the Childcare Receipt, it serves as proof of payment and can be used for record-keeping and tax purposes. Both documents require signatures to validate the transaction and confirm that services were delivered as agreed.

A second comparable document is the Payment Receipt for Tuition Fees. This receipt is issued by educational institutions to acknowledge the payment of tuition fees by students or their guardians. It typically includes the date, the amount paid, and the name of the student. Similar to the Childcare Receipt, it confirms that payment has been made for a specific service over a defined period, ensuring transparency and accountability for both parties involved.

The third document is the Receipt for Medical Services. This form is provided by healthcare providers to patients after payment for medical services. It includes essential details such as the date of service, the amount paid, and the name of the patient. Like the Childcare Receipt, it serves as proof of payment and is often necessary for insurance claims or tax deductions, making it an important document for financial record-keeping.

The Texas Motor Vehicle Bill of Sale form serves as a critical document, formalizing the sale of a vehicle from one person to another within the state of Texas. It not only provides undeniable proof of purchase but also plays a pivotal role in the official transfer of ownership. This form, essential for both buyer and seller, must be completed accurately to ensure a smooth transition, and more information can be found at autobillofsaleform.com/texas-motor-vehicle-bill-of-sale-form.

Lastly, the Rent Receipt is another document that shares similarities with the Childcare Receipt. It is given by landlords to tenants as confirmation of rent payment. This receipt includes the date of payment, the amount received, and the tenant's name. Both documents function as proof of financial transactions, helping to maintain clear records for both the payer and the recipient. Each serves a critical role in documenting services rendered or payments made.

Dos and Don'ts

When filling out the Childcare Receipt form, it's important to ensure accuracy and clarity. Here are some guidelines to follow and avoid:

- Do fill in the date clearly to avoid confusion.

- Do write the total amount received in full, including cents.

- Do provide the full name of the person receiving the receipt.

- Do list all children’s names for whom the childcare services were provided.

- Don't leave any sections blank; complete every part of the form.

- Don't use abbreviations that may cause misunderstandings.

Key takeaways

When filling out and using the Childcare Receipt form, keep these key takeaways in mind:

- Accurate Dates: Always fill in the correct dates for the childcare services. This ensures clarity on the period covered by the receipt.

- Clear Amounts: Specify the exact amount paid for the services. Double-check this figure for accuracy.

- Provider Information: Include the name of the childcare provider clearly. This helps in identifying who provided the services.

- Child's Name: List the name(s) of the child or children receiving care. This is essential for record-keeping and tax purposes.

- Signature Requirement: Ensure the provider signs the receipt. A signature validates the transaction and confirms receipt of payment.

- Multiple Receipts: If services span multiple days, consider issuing separate receipts for each period. This can simplify tracking and documentation.

- Record Keeping: Keep copies of all receipts for your records. These documents may be necessary for tax deductions or audits.

- Filing for Taxes: Use these receipts when filing your taxes. They can help substantiate childcare expenses that may qualify for deductions.

- Review Before Submission: Before submitting any receipts for reimbursement or tax purposes, review them for completeness and accuracy.

How to Use Childcare Receipt

Filling out the Childcare Receipt form is a straightforward process. This form is essential for documenting the payment for childcare services. Follow these steps carefully to ensure that all necessary information is included.

- Start by entering the Date of the receipt in the designated space.

- Next, write the Amount received for childcare services.

- In the section labeled Received from, fill in the name of the person making the payment.

- List the Name of child(ren) receiving care.

- Indicate the period of childcare services by filling in the From and To dates.

- Finally, the provider must sign the form in the Provider’s Signature section.