Printable Commercial Lease Agreement Form

A Commercial Lease Agreement is a crucial document for both landlords and tenants engaging in business activities within a rented space. This agreement outlines the terms and conditions under which a tenant can occupy a commercial property, ensuring that both parties have a clear understanding of their rights and responsibilities. Key aspects of the form include the duration of the lease, the rental amount, and the payment schedule. It also addresses maintenance responsibilities, permitted uses of the property, and provisions for renewal or termination of the lease. Additionally, the agreement may include clauses regarding security deposits, insurance requirements, and any specific regulations that the tenant must follow. By clearly detailing these elements, the Commercial Lease Agreement serves as a foundation for a successful landlord-tenant relationship, minimizing potential disputes and providing a framework for business operations.

State-specific Tips for Commercial Lease Agreement Templates

Common mistakes

Filling out a Commercial Lease Agreement can be a daunting task. It’s essential to get it right, as mistakes can lead to misunderstandings or even legal issues down the line. Here’s a list of common mistakes people make when completing this important document:

-

Neglecting to read the entire lease:

Many individuals rush through the lease agreement, failing to understand all the terms and conditions. This can lead to surprises later on.

-

Not specifying the rental amount clearly:

It's crucial to clearly state the rent amount, payment due dates, and any late fees. Ambiguities can create disputes.

-

Ignoring additional costs:

Many forget to account for additional expenses such as maintenance fees, utilities, and property taxes. Be thorough in understanding what costs are included and what are not.

-

Failing to define the lease term:

Not specifying the start and end dates of the lease can lead to confusion. Clearly outline the duration of the lease agreement.

-

Overlooking renewal options:

Some people forget to include or clarify renewal options. It’s important to know whether you can extend the lease and under what conditions.

-

Not addressing maintenance responsibilities:

Who is responsible for repairs and maintenance? Clearly outline these responsibilities to avoid disputes later.

-

Ignoring the termination clause:

Understanding how to terminate the lease is vital. Ensure the conditions for termination are clearly stated.

-

Failing to include a dispute resolution process:

Disagreements can happen. Including a method for resolving disputes can save both parties time and money.

-

Not consulting a professional:

Many people attempt to fill out the lease on their own without seeking legal advice. Consulting a lawyer can help avoid costly mistakes.

By being aware of these common pitfalls, you can approach the Commercial Lease Agreement with confidence and clarity. Taking the time to fill it out correctly will pay off in the long run.

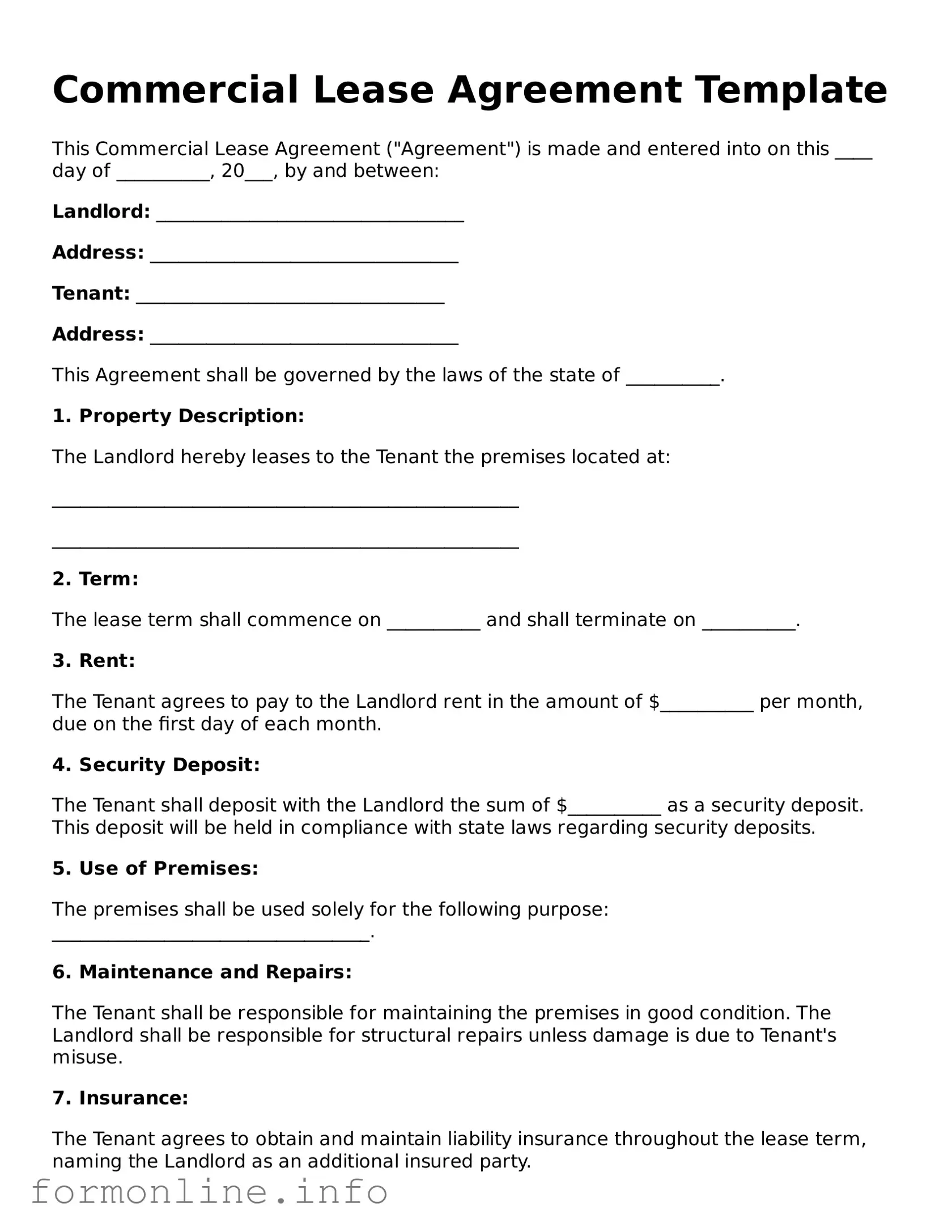

Preview - Commercial Lease Agreement Form

Commercial Lease Agreement Template

This Commercial Lease Agreement ("Agreement") is made and entered into on this ____ day of __________, 20___, by and between:

Landlord: _________________________________

Address: _________________________________

Tenant: _________________________________

Address: _________________________________

This Agreement shall be governed by the laws of the state of __________.

1. Property Description:

The Landlord hereby leases to the Tenant the premises located at:

__________________________________________________

__________________________________________________

2. Term:

The lease term shall commence on __________ and shall terminate on __________.

3. Rent:

The Tenant agrees to pay to the Landlord rent in the amount of $__________ per month, due on the first day of each month.

4. Security Deposit:

The Tenant shall deposit with the Landlord the sum of $__________ as a security deposit. This deposit will be held in compliance with state laws regarding security deposits.

5. Use of Premises:

The premises shall be used solely for the following purpose: __________________________________.

6. Maintenance and Repairs:

The Tenant shall be responsible for maintaining the premises in good condition. The Landlord shall be responsible for structural repairs unless damage is due to Tenant's misuse.

7. Insurance:

The Tenant agrees to obtain and maintain liability insurance throughout the lease term, naming the Landlord as an additional insured party.

8. Termination:

This Agreement may be terminated by either party with __________ days written notice.

9. Governing Law:

This Agreement shall be governed and interpreted in accordance with the laws of the State of __________.

10. Entire Agreement:

This document constitutes the entire Agreement between the parties. Any amendments must be in writing and signed by both parties.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the day and year first above written.

Landlord's Signature: _______________________________ Date: ___________

Tenant's Signature: _______________________________ Date: ___________

More Types of Commercial Lease Agreement Templates:

Parking Agreement Contract - Establishes a method for record-keeping of lease payments.

In order to streamline the sales process and mitigate potential disputes, having a reliable form such as the Mobile Home Bill of Sale is essential. This document not only serves as proof of the transaction but also helps in clearly defining the responsibilities of both the buyer and seller, ensuring that all necessary information regarding the mobile home is accurately captured and understood.

Documents used along the form

A Commercial Lease Agreement is a crucial document that outlines the terms and conditions between a landlord and a tenant for leasing a commercial property. However, several other forms and documents often accompany this agreement to ensure a smooth leasing process and to protect the interests of both parties. Below is a list of commonly used documents.

- Letter of Intent (LOI): This document outlines the preliminary agreement between the landlord and tenant before the formal lease is drafted. It typically includes key terms such as rental rate, lease duration, and any special conditions. An LOI serves as a foundation for negotiations and helps clarify the expectations of both parties.

- Texas Real Estate Purchase Agreement: This essential document outlines the terms of property transactions, ensuring clarity and protection for both buyers and sellers. You can find the Real Estate Purchase Agreement form to assist in this process.

- Personal Guarantee: This document may be required by the landlord to ensure that the tenant or business owner is personally liable for the lease obligations. If the business fails, the landlord can seek payment from the individual who signed the guarantee, providing an additional layer of security for the landlord.

- Estoppel Certificate: This certificate is a statement from the tenant confirming the terms of the lease, including the rent amount and any agreements made. It is often requested by lenders or potential buyers of the property to verify the status of the lease and the tenant's obligations.

- Lease Addendum: An addendum is an additional document that modifies or adds specific terms to the original lease agreement. This may include changes to the rental rate, maintenance responsibilities, or other conditions that were not included in the initial lease.

These documents play a significant role in the leasing process, ensuring that both the landlord and tenant have a clear understanding of their rights and responsibilities. Properly preparing and reviewing these forms can help prevent misunderstandings and protect both parties throughout the lease term.

Similar forms

A Commercial Lease Agreement is similar to a Residential Lease Agreement in that both documents outline the terms under which a tenant can occupy a property. While a Residential Lease typically pertains to living spaces, such as apartments or houses, a Commercial Lease focuses on business properties. Both agreements cover essential elements like rent amount, duration of the lease, and responsibilities for maintenance. However, the specific legal implications and regulations governing each type can vary significantly based on local laws and the nature of the occupancy.

Another document that shares similarities with a Commercial Lease Agreement is a Sublease Agreement. In a sublease, the original tenant leases out a portion or the entirety of the space to another party, known as the subtenant. This document outlines the terms under which the subtenant can occupy the property, including rent payments and duration. Like a Commercial Lease, a Sublease Agreement must also adhere to the conditions set forth in the original lease, ensuring that the rights and obligations of all parties are respected.

A Partnership Agreement often parallels a Commercial Lease Agreement when a business entity is formed to operate within a leased space. This document details the roles, responsibilities, and profit-sharing arrangements among partners. While it does not govern the use of the property directly, it may reference the lease to clarify how business operations will be conducted in that space. Both documents require clear definitions to prevent misunderstandings among parties involved.

A Purchase Agreement is another document that bears resemblance to a Commercial Lease Agreement, especially in cases where a tenant is considering buying the leased property. This document outlines the terms of sale, including price, contingencies, and closing details. Both agreements require careful negotiation and clear communication to ensure that the expectations of both parties are met, especially regarding property condition and financial arrangements.

An Operating Agreement, commonly used by Limited Liability Companies (LLCs), is similar to a Commercial Lease Agreement in that it defines the management structure and operational procedures of a business. While it does not directly address property use, it may reference the lease to clarify how the business will operate within the leased space. Both documents emphasize the importance of clear terms to guide the parties involved in their respective roles.

Understanding the various legal documents involved in property transactions is crucial for both buyers and sellers. The Pennsylvania Motor Vehicle Bill of Sale form is an essential tool in motor vehicle sales; it documents the transfer of ownership between parties and ensures legal protection. For more information on this vital form, you can visit autobillofsaleform.com/pennsylvania-motor-vehicle-bill-of-sale-form.

A Confidentiality Agreement, or Non-Disclosure Agreement (NDA), can also be compared to a Commercial Lease Agreement. While the former protects sensitive information shared between parties, both documents necessitate clarity and mutual understanding. In a commercial context, a lease may include clauses that address confidentiality regarding business operations or proprietary information shared during the lease term, thus intertwining the two agreements.

A Letter of Intent (LOI) often precedes a Commercial Lease Agreement and outlines the preliminary terms of a proposed lease. This document expresses the intention of both parties to enter into a lease agreement and can include key points such as rental rates and lease duration. While not legally binding, it sets the stage for negotiations, similar to how a lease agreement establishes the framework for occupancy and responsibilities.

A Bill of Sale is akin to a Commercial Lease Agreement when it involves the transfer of property rights, particularly in a business context. This document outlines the terms under which ownership of goods or equipment is transferred from one party to another. In commercial leasing, a Bill of Sale may accompany the lease if the tenant is purchasing equipment necessary for their business operations, highlighting the interconnectedness of leasing and ownership in a commercial setting.

A License Agreement can be compared to a Commercial Lease Agreement in that both documents grant permission for the use of property, but with different implications. A License Agreement provides a non-exclusive right to use a property or resource, often for a specific purpose, without transferring any ownership rights. In contrast, a lease typically involves more defined rights and responsibilities, as well as a longer-term commitment to occupy the space.

Finally, an Employment Agreement may share similarities with a Commercial Lease Agreement in the context of a business operating within a leased space. While an Employment Agreement outlines the terms of employment, including duties and compensation, it may reference the leased property if the employee's work is conducted on-site. Both documents require clarity regarding the expectations and responsibilities of the parties involved, ensuring a smooth operational flow within the business environment.

Dos and Don'ts

When filling out a Commercial Lease Agreement form, it's important to be thorough and careful. Here are some things to keep in mind:

- Do: Read the entire lease agreement carefully before filling it out.

- Do: Provide accurate information about the business and the premises.

- Do: Review the terms of the lease, including rent, duration, and any additional fees.

- Do: Ask questions if any part of the agreement is unclear.

- Do: Keep a copy of the signed lease for your records.

- Don't: Rush through the form; take your time to ensure accuracy.

- Don't: Leave any sections blank unless instructed to do so.

- Don't: Ignore any clauses that seem unusual or unfavorable.

- Don't: Sign the lease without understanding all terms and conditions.

Key takeaways

When filling out and using a Commercial Lease Agreement form, keep the following key takeaways in mind:

- Understand the terms of the lease. Carefully read through each section to know your rights and responsibilities.

- Clearly define the rental space. Specify the exact location and boundaries of the property being leased.

- Include the lease duration. State the start and end dates to avoid any confusion later.

- Outline payment details. Clearly indicate the rent amount, payment schedule, and any additional fees.

- Address maintenance responsibilities. Specify who is responsible for repairs and upkeep of the property.

- Know the termination clauses. Understand the conditions under which the lease can be ended by either party.

How to Use Commercial Lease Agreement

Filling out a Commercial Lease Agreement form is an important step in securing a rental space for your business. This process requires careful attention to detail to ensure all necessary information is accurately provided. Follow these steps to complete the form effectively.

- Read the Instructions: Before starting, read any provided instructions carefully to understand what information is required.

- Enter the Date: Write the date on which you are filling out the form at the top.

- Identify the Parties: Fill in the names and addresses of both the landlord and tenant. Make sure to include any business names if applicable.

- Describe the Property: Provide the address and a brief description of the commercial space being leased.

- Lease Term: Specify the start and end dates of the lease. Include any options for renewal if applicable.

- Rent Amount: Clearly state the monthly rent amount and any other fees that may apply, such as utilities or maintenance costs.

- Security Deposit: Indicate the amount of the security deposit required and the conditions for its return.

- Signatures: Ensure that both the landlord and tenant sign the agreement. Include the date of each signature.

- Review: Double-check all entries for accuracy before submitting the form.