Printable Credit Check Authorization Form

When navigating the world of credit, the Credit Check Authorization form plays a pivotal role in facilitating financial transactions. This essential document grants lenders permission to access an individual's credit report, which is a crucial step in assessing creditworthiness. By signing this form, applicants acknowledge their understanding of the process and consent to the lender's examination of their credit history. The form typically includes personal information such as name, address, Social Security number, and date of birth, all of which help verify the identity of the applicant. Additionally, it outlines the purpose of the credit check, ensuring transparency in the lending process. Understanding the nuances of this authorization is vital for anyone looking to secure a loan, rental agreement, or any financial service that requires a credit assessment. By being informed about the implications of signing this form, individuals can make better decisions regarding their financial futures.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required personal details. This can include missing names, addresses, or Social Security numbers. Each field is crucial for accurate processing.

-

Incorrect Information: Some people mistakenly enter incorrect data. A wrong Social Security number or misspelled name can lead to delays or denials.

-

Signature Issues: A common mistake is neglecting to sign the form. Without a signature, the authorization is not valid, and the credit check cannot proceed.

-

Failure to Read Instructions: Skipping the instructions can result in misunderstandings about what is required. Reading the guidelines thoroughly ensures compliance with all necessary steps.

-

Not Providing Contact Information: Some individuals forget to include their phone number or email address. This information is essential for follow-up communications regarding the credit check.

-

Ignoring Expiration Dates: Authorization forms may have expiration dates. Submitting an outdated form can lead to rejection, requiring individuals to start the process anew.

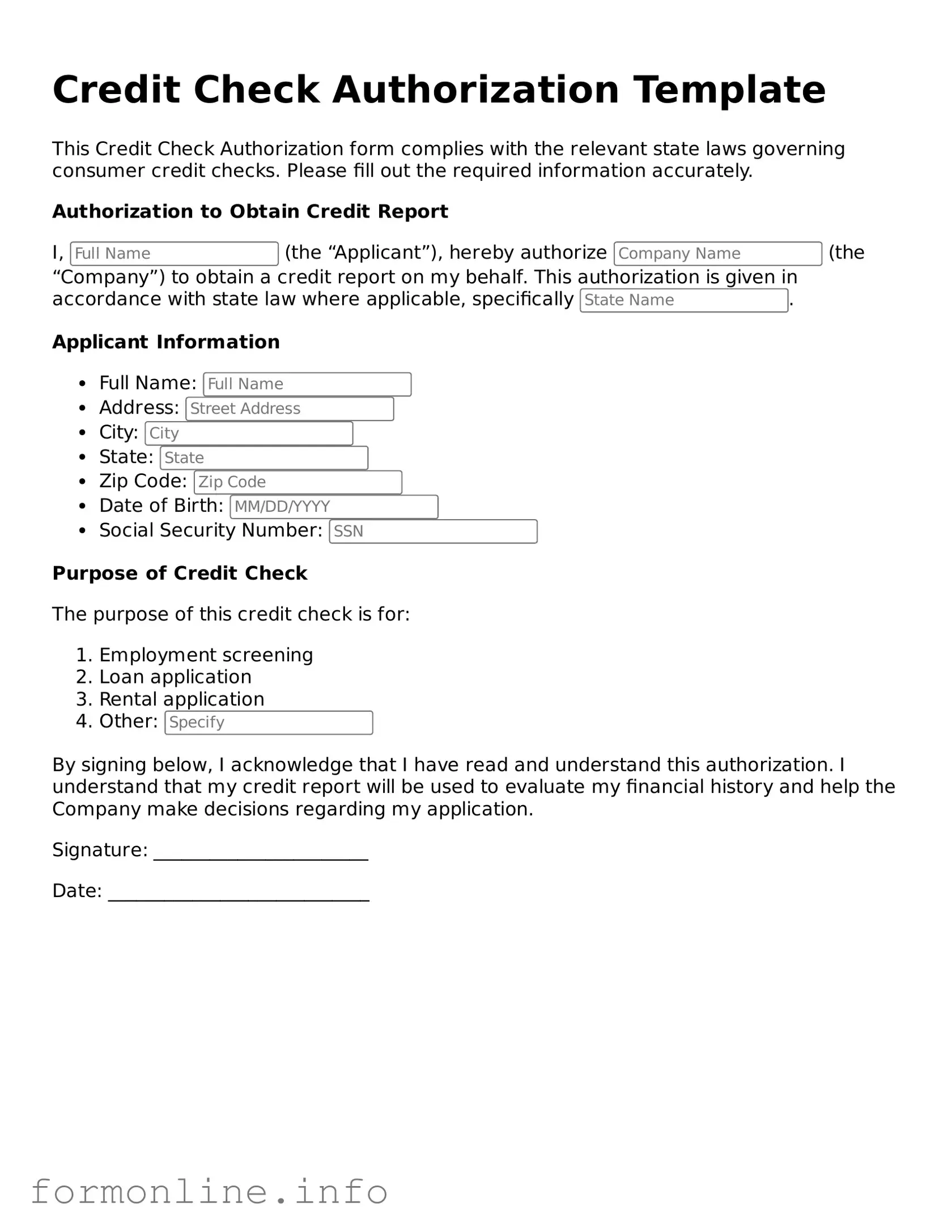

Preview - Credit Check Authorization Form

Credit Check Authorization Template

This Credit Check Authorization form complies with the relevant state laws governing consumer credit checks. Please fill out the required information accurately.

Authorization to Obtain Credit Report

I, (the “Applicant”), hereby authorize (the “Company”) to obtain a credit report on my behalf. This authorization is given in accordance with state law where applicable, specifically .

Applicant Information

- Full Name:

- Address:

- City:

- State:

- Zip Code:

- Date of Birth:

- Social Security Number:

Purpose of Credit Check

The purpose of this credit check is for:

- Employment screening

- Loan application

- Rental application

- Other:

By signing below, I acknowledge that I have read and understand this authorization. I understand that my credit report will be used to evaluate my financial history and help the Company make decisions regarding my application.

Signature: _______________________

Date: ____________________________

Common Forms:

Roof Certification Template - Valid for a minimum of two years against moisture issues.

For those looking to ensure a seamless transfer of ownership, a well-prepared important vehicle release of liability document is crucial. This form not only enhances transparency in the transaction but also protects the seller from future liabilities related to the vehicle.

Reference Letter for Immigration - This letter acknowledges the individual's contributions to cultural events in the community.

Documents used along the form

The Credit Check Authorization form is an important document used to obtain permission from an individual to conduct a credit check. This form is often accompanied by other related documents that help facilitate the process of evaluating an applicant's financial background. Below is a list of additional forms that may be used in conjunction with the Credit Check Authorization form.

- Rental Application: This document collects personal information from a prospective tenant, including employment history, income, and references. It helps landlords assess whether an applicant is suitable for tenancy.

- Employment Verification Form: This form is used to confirm an applicant's employment status and income. Employers or third-party verification services often fill it out to provide accurate information about the applicant's job history.

- Investment Letter of Intent: This document expresses a potential investor's preliminary commitment to participate in a financial transaction, serving as a foundational agreement. For more information, refer to the Letter of Intent to Invest.

- Background Check Consent Form: This document grants permission for a background check to be conducted. It typically includes criminal history, employment verification, and other relevant checks, ensuring that the applicant is aware of the process.

- Lease Agreement: Once a tenant is approved, this legally binding document outlines the terms and conditions of the rental arrangement. It includes details about rent, duration, and responsibilities of both the landlord and tenant.

- Financial Disclosure Form: This form requires the applicant to disclose their financial situation, including assets and liabilities. It is often used by landlords or lenders to evaluate the applicant's ability to meet financial obligations.

Using these forms together can streamline the process of evaluating an applicant's suitability for rental or credit approval. Each document serves a specific purpose, contributing to a comprehensive assessment of an individual's financial reliability and character.

Similar forms

The Credit Check Authorization form is similar to a Rental Application form. Both documents require individuals to provide personal information, such as their name, address, and social security number. The purpose of the Rental Application is to assess a potential tenant's suitability for a property. Just like the Credit Check Authorization, it often includes a consent section where the applicant agrees to allow the landlord to verify their credit history and rental background.

Another document that shares similarities is the Employment Application. This form also collects personal details and includes sections for consent to conduct background checks. Employers use this document to evaluate a candidate’s qualifications and character. The consent portion of the Employment Application allows employers to check credit histories, criminal records, and other relevant information, mirroring the intent of the Credit Check Authorization.

The Loan Application form is yet another document that resembles the Credit Check Authorization. When applying for a loan, individuals must provide financial information, including income and debts. Lenders often require authorization to check the applicant's credit history to assess their creditworthiness. Both forms emphasize the importance of consent for accessing sensitive financial information.

The Background Check Authorization form is closely related as well. This document is used by various organizations to obtain permission to investigate an individual's history, including credit, criminal, and employment records. Like the Credit Check Authorization, it requires clear consent from the individual and serves to protect the organization by ensuring they have the right to conduct the check.

In financial dealings, it is essential to have proper documentation to ensure that transactions are legitimate and transparent. One such document is the General Bill of Sale form, which serves as a legal record for transferring ownership of personal property between a seller and a buyer. This form not only provides proof of purchase but also signifies that the seller has relinquished all rights to the property. To avoid any ambiguities in the transaction, it is advisable to open the form and properly fill it out, thereby offering protection for both parties involved.

The Insurance Application form also bears similarities. Individuals seeking insurance coverage must fill out this form, providing personal and financial information. Insurers often include a section that allows them to check the applicant’s credit history as part of the underwriting process. This ensures that they can assess risk accurately, similar to how credit checks are used in other contexts.

The Authorization for Release of Information form is another relevant document. This form is often used in medical and legal contexts to allow third parties to access personal information. Like the Credit Check Authorization, it requires explicit consent from the individual, ensuring that their data is handled appropriately and legally. Both forms aim to protect privacy while facilitating necessary checks.

Lastly, the Tenant Screening Authorization form is akin to the Credit Check Authorization. When prospective tenants apply for rental properties, landlords often use this document to obtain permission to conduct background and credit checks. This ensures that the landlord can make informed decisions about potential tenants, reflecting the same principles of consent and information verification found in the Credit Check Authorization.

Dos and Don'ts

When filling out a Credit Check Authorization form, it's important to ensure accuracy and clarity. Here’s a list of things you should and shouldn't do to make the process smoother.

- Do: Read the entire form carefully before filling it out.

- Do: Provide accurate and up-to-date personal information.

- Do: Sign and date the form where required.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any required fields blank.

- Don't: Use nicknames or abbreviations for your name.

- Don't: Submit the form without reviewing it for errors.

Key takeaways

When filling out and using the Credit Check Authorization form, keep these key takeaways in mind:

- Understand the Purpose: This form allows a lender or service provider to check your credit history. It’s important to know why they need this information.

- Provide Accurate Information: Ensure all details you enter are correct. Mistakes can lead to delays or complications in the approval process.

- Review Before Signing: Always read the entire form before you sign. Make sure you understand what you are agreeing to, including how your information will be used.

- Keep a Copy: After submitting the form, keep a copy for your records. This can be helpful if any questions arise later.

How to Use Credit Check Authorization

After you complete the Credit Check Authorization form, the information will be reviewed to facilitate the credit check process. This step is crucial for determining your eligibility for various services or financial products. Follow the steps below to accurately fill out the form.

- Begin by entering your full name in the designated field.

- Provide your current address, including city, state, and zip code.

- Fill in your date of birth in the specified format (MM/DD/YYYY).

- Input your Social Security Number, ensuring accuracy to avoid delays.

- Include your phone number and email address for contact purposes.

- Review the section that requests your consent for the credit check. Make sure to read any accompanying statements carefully.

- Sign and date the form at the bottom to validate your authorization.