Fill Out a Valid Ct Resale Certificate Form

The Connecticut Resale Certificate form plays a crucial role in the state's sales and use tax system, serving as a vital document for businesses engaged in wholesale, retail, manufacturing, or leasing activities. This form allows registered buyers to purchase goods without paying sales tax, provided those goods are intended for resale or for use as components in products that will be sold. Businesses must accurately fill out the form, including their name, address, and state registration numbers, to certify their status as wholesalers, retailers, or other specified categories. By submitting this certificate to sellers, buyers affirm that their purchases are for legitimate business purposes, which helps to streamline the sales process and ensure compliance with tax regulations. Moreover, the form includes a declaration that buyers will pay any applicable sales or use tax if the purchased items are used in a manner that makes them taxable, thus reinforcing the accountability of businesses in tax compliance. Valid until revoked or canceled, the certificate must accompany each order placed, ensuring that all parties are aware of its terms and conditions. This document not only facilitates smoother transactions but also protects both buyers and sellers from potential tax liabilities.

Common mistakes

-

Failing to provide accurate information about the seller. The seller's name and address must be correctly filled out to ensure proper identification.

-

Neglecting to specify the type of business. It is essential to indicate whether the buyer is a wholesaler, retailer, manufacturer, or other specified category.

-

Omitting the state registration or ID numbers. Each state where the buyer is registered must be listed along with the corresponding registration or identification numbers.

-

Not providing a clear description of the products to be purchased. A general description helps clarify the purpose of the purchases.

-

Failing to sign the certificate. An authorized signature is required to validate the certificate and confirm its accuracy.

-

Ignoring the expiration terms. The certificate remains valid until canceled in writing or revoked, and this should be understood by both parties.

-

Not understanding the implications of tax liability. Buyers must be aware that if the purchased items are used for non-resale purposes, they may be liable for sales or use tax.

-

Leaving out the date on the certificate. Including the date is crucial for tracking the validity of the document over time.

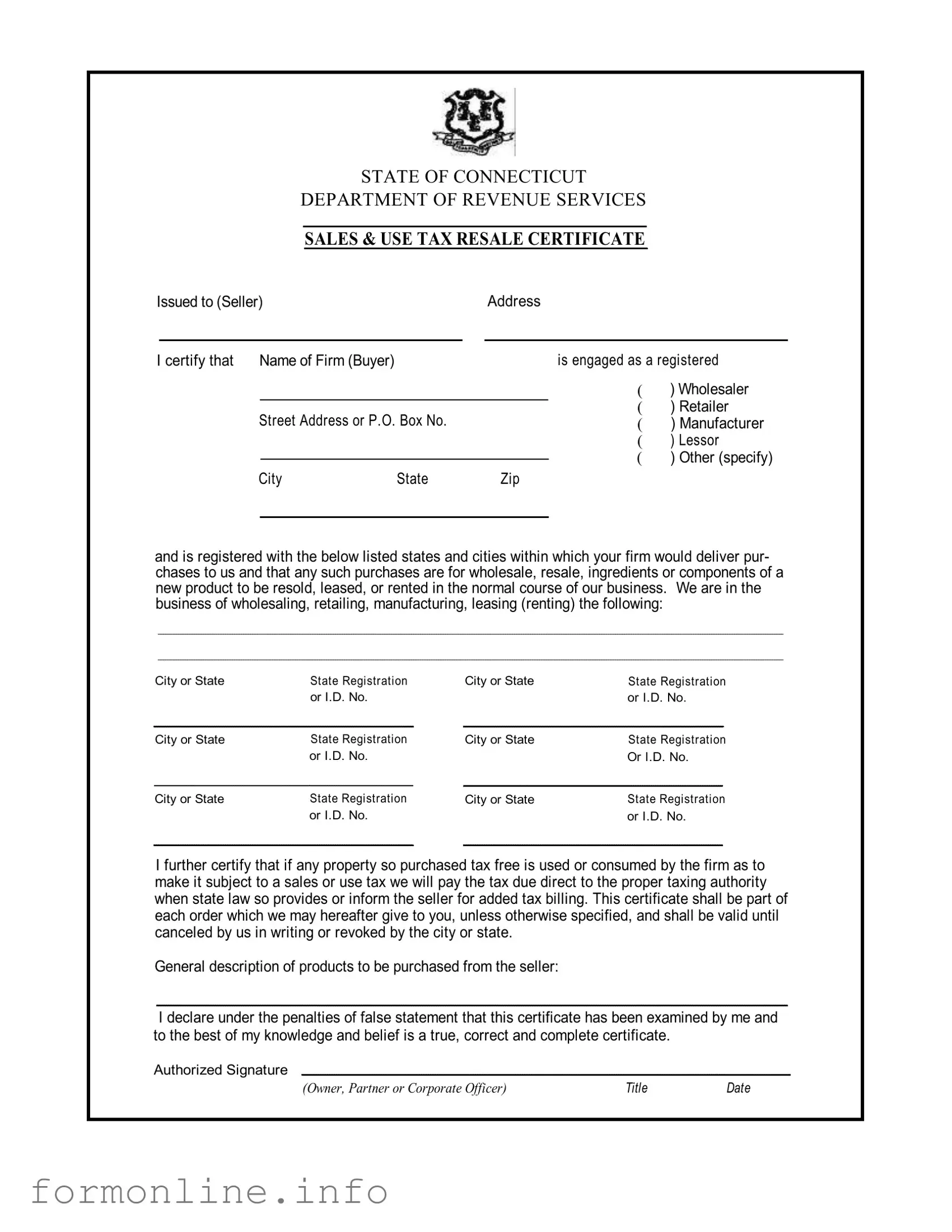

Preview - Ct Resale Certificate Form

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

SALES & USE TAX RESALE CERTIFICATE

Issued to (Seller) |

|

|

Address |

|

||||

|

|

|

|

|

|

|

|

|

I certify that |

Name of Firm (Buyer) |

|

|

|

is engaged as a registered |

|||

|

|

|

|

|

|

|

( |

) Wholesaler |

|

|

Street Address or P.O. Box No. |

( |

) Retailer |

||||

|

|

( |

) Manufacturer |

|||||

|

|

|

|

|

|

( |

) Lessor |

|

|

|

|

|

|

|

|

( |

) Other (specify) |

|

|

|

|

State |

|

|||

|

|

City |

Zip |

|

||||

|

|

|

|

|

|

|

|

|

and is registered with the below listed states and cities within which your firm would deliver pur- chases to us and that any such purchases are for wholesale, resale, ingredients or components of a new product to be resold, leased, or rented in the normal course of our business. We are in the business of wholesaling, retailing, manufacturing, leasing (renting) the following:

City or State |

State Registration |

|

or I.D. No. |

City or State |

State Registration |

|

or I.D. No. |

City or State |

State Registration |

|

or I.D. No. |

City or State |

State Registration |

|

or I.D. No. |

City or State |

State Registration |

|

Or I.D. No. |

City or State |

State Registration |

|

or I.D. No. |

I further certify that if any property so purchased tax free is used or consumed by the firm as to make it subject to a sales or use tax we will pay the tax due direct to the proper taxing authority when state law so provides or inform the seller for added tax billing. This certificate shall be part of each order which we may hereafter give to you, unless otherwise specified, and shall be valid until canceled by us in writing or revoked by the city or state.

General description of products to be purchased from the seller:

I declare under the penalties of false statement that this certificate has been examined by me and to the best of my knowledge and belief is a true, correct and complete certificate.

Authorized Signature

(Owner, Partner or Corporate Officer) |

TITLE |

DATE |

Other PDF Templates

Dd Form 2870 Download - The DD 2870 directs the dental care process for eligible beneficiaries.

The Ohio Mobile Home Bill of Sale is a legal document used to transfer ownership of a mobile home from one party to another. This form provides essential details about the transaction, including the buyer and seller's information, the mobile home's description, and the sale price. Completing this document correctly ensures that both parties have a clear record of the sale and can help facilitate a smooth transfer of ownership. For more information, you can refer to the Mobile Home Bill of Sale.

Georgia Step Parent Adoption Forms Free - Completion of sections 1 and 2 is mandatory before filing the petition.

Why Would a Prosecutor Ask for a Continuance - Signatures must be in ink for the motion to be valid.

Documents used along the form

The Connecticut Resale Certificate form is essential for businesses that purchase goods for resale without paying sales tax. However, several other documents often accompany this form to ensure compliance and clarity in transactions. Below is a list of these related forms and documents.

- Sales Tax Permit: This document proves that a business is registered to collect sales tax. It is necessary for retailers and wholesalers to legally operate and collect taxes on sales.

- Motor Vehicle Bill of Sale Form: This form is essential for documenting the sale or purchase of a vehicle in Ohio. It serves as proof of ownership transfer and is required for vehicle registration. For more information, visit https://autobillofsaleform.com/ohio-motor-vehicle-bill-of-sale-form.

- Purchase Order: A purchase order is a document issued by a buyer to a seller, indicating the types and quantities of products or services they wish to purchase. This helps in formalizing the transaction before it occurs.

- Invoice: An invoice is a bill sent by the seller to the buyer after a sale, detailing the products or services provided and the amount due. It serves as a record of the transaction and may include tax calculations.

- Exemption Certificate: This certificate allows buyers to claim an exemption from sales tax for specific purchases. It is often used by non-profit organizations or government entities that are exempt from taxation.

- Resale Certificate from Other States: If a business operates in multiple states, it may need to provide resale certificates specific to those states. Each state has its own requirements and forms.

- Supplier Agreement: This document outlines the terms and conditions between a supplier and a buyer, including pricing, delivery schedules, and payment terms. It helps to clarify expectations on both sides.

- Tax Exempt Status Letter: This letter is issued by the state to confirm a business's tax-exempt status. It may be required when making purchases that are not subject to sales tax.

- Shipping Documents: These include bills of lading and packing slips that accompany goods during transportation. They provide proof of shipment and can be important for tracking and inventory purposes.

Understanding these documents can streamline business operations and ensure compliance with tax regulations. Each plays a crucial role in the purchasing process and helps maintain clear communication between buyers and sellers.

Similar forms

The Sales Tax Exemption Certificate serves a similar purpose to the Ct Resale Certificate. This document allows buyers to purchase goods without paying sales tax, provided they intend to resell the items. It is typically used by wholesalers and retailers who buy products for resale. The buyer must declare their intention to use the items in their business, and the seller keeps this certificate on file to support the tax-exempt sale.

The Manufacturer's Exemption Certificate is another document that shares similarities with the Ct Resale Certificate. This certificate is specifically for manufacturers who purchase materials to produce a final product. It allows them to buy raw materials without paying sales tax, as these materials will be transformed into a new product. Like the resale certificate, it requires the buyer to certify their manufacturing status and the intended use of the purchased items.

The Purchaser's Certificate is also akin to the Ct Resale Certificate. This document is used by businesses to claim exemption from sales tax on purchases made for resale. It outlines the buyer's business type and confirms that the items will be resold in the normal course of business. The seller retains this certificate to validate the tax-free transaction, similar to the resale certificate process.

The Nonprofit Organization Exemption Certificate is relevant for nonprofit entities. This document allows qualifying organizations to purchase goods without incurring sales tax. Nonprofits must demonstrate their tax-exempt status and the intended use of the purchased items. This certificate, like the Ct Resale Certificate, helps ensure compliance with tax regulations while supporting the organization's mission.

The Agricultural Exemption Certificate is used by farmers and agricultural businesses. It enables them to purchase certain items tax-free, as these items are essential for agricultural production. The buyer must certify that the items will be used in farming activities. This certificate functions similarly to the Ct Resale Certificate by providing a tax exemption based on the intended use of the purchased goods.

The Government Entity Exemption Certificate applies to purchases made by government agencies. This document allows these entities to buy goods without paying sales tax. Government agencies must provide proof of their status to the seller, who then retains the certificate for tax compliance. This process mirrors the use of the Ct Resale Certificate in that it facilitates tax-exempt transactions for specific buyers.

The Educational Institution Exemption Certificate is designed for schools and educational organizations. This certificate allows these institutions to purchase supplies and materials without sales tax. The buyer must confirm their educational status and the intended use of the items. Similar to the Ct Resale Certificate, this document helps educational institutions manage costs while adhering to tax regulations.

The Religious Organization Exemption Certificate is for religious entities seeking to purchase items without sales tax. This document requires the buyer to affirm their religious status and the intended use of the items. The seller keeps this certificate on file to validate the tax-exempt sale, paralleling the process of using the Ct Resale Certificate for resale purposes.

Understanding the intricacies of various forms such as the Connecticut Resale Certificate and others is essential for businesses to operate efficiently and legally. For example, when transferring ownership of a mobile home, one will need to utilize the Mobile Home Bill of Sale form, which serves to clarify the transaction terms between the buyer and seller, ensuring a smooth and compliant transfer of property rights.

Finally, the Direct Pay Permit is similar to the Ct Resale Certificate in that it allows certain buyers to purchase goods without paying sales tax at the point of sale. Instead, the buyer pays sales tax directly to the state. This permit is often issued to large businesses that make significant purchases. It streamlines the purchasing process while ensuring tax compliance, much like the resale certificate does for resellers.

Dos and Don'ts

When filling out the Connecticut Resale Certificate form, it's essential to follow specific guidelines to ensure accuracy and compliance. Here’s a list of things to do and avoid:

- Do provide complete and accurate information about your business, including the name and address.

- Do check the appropriate box indicating your business type, such as wholesaler, retailer, or manufacturer.

- Do include all relevant state registration or identification numbers for each location where you operate.

- Do clearly describe the products you intend to purchase from the seller.

- Do ensure that the authorized signature is from an owner, partner, or corporate officer.

- Don't leave any sections blank; incomplete forms can lead to delays or rejections.

- Don't use outdated information; make sure all details are current and valid.

- Don't forget to keep a copy of the completed certificate for your records.

- Don't assume that the certificate is valid indefinitely; be aware of any changes or cancellations that may occur.

By following these guidelines, you can help ensure a smooth process when utilizing the Connecticut Resale Certificate form.

Key takeaways

When filling out and using the Connecticut Resale Certificate form, there are several important points to keep in mind:

- Eligibility Requirements: Only businesses registered as wholesalers, retailers, manufacturers, or lessors can use this certificate. Ensure that your business falls into one of these categories.

- Accurate Information: Provide complete and accurate details about your business, including the name, address, and registration numbers for each relevant state or city. Incomplete information may lead to complications.

- Purpose of Use: The certificate is intended for purchases that will be resold, leased, or rented in the normal course of business. Using it for personal purchases or non-resale items is not permitted.

- Tax Responsibilities: If any purchased items are used in a manner that incurs tax liability, the buyer must pay the tax directly to the appropriate taxing authority. This obligation remains even when using the resale certificate.

How to Use Ct Resale Certificate

Completing the Connecticut Resale Certificate form is a straightforward process that requires specific information about your business and the purchases you intend to make. After filling out the form, you will be able to present it to your seller, allowing you to make tax-exempt purchases for resale purposes. Below are the steps to fill out the form accurately.

- Begin by entering the name of the seller in the "Issued to" section.

- Provide the seller's address, including the street address, city, and zip code.

- In the section labeled "Name of Firm," write the name of your business.

- Indicate your business type by checking the appropriate box: Wholesaler, Retailer, Manufacturer, Lessor, or Other. If you select "Other," specify the type of business.

- Fill in your business's street address or P.O. Box number, along with the city and zip code.

- List the states and cities where your firm is registered to conduct business. For each location, provide the state and the registration or identification number.

- Write a general description of the products you plan to purchase from the seller.

- Sign the form in the "Authorized Signature" section. This signature should be from an owner, partner, or corporate officer.

- Include your title and the date of signing the form.