Printable Deed in Lieu of Foreclosure Form

The Deed in Lieu of Foreclosure form serves as a critical tool for homeowners facing financial distress and potential foreclosure. This legal document allows a homeowner to voluntarily transfer ownership of their property to the lender, effectively settling the mortgage debt without the lengthy and often painful foreclosure process. By opting for this route, homeowners can avoid the negative repercussions associated with foreclosure, such as damage to their credit score and the potential for legal battles. The form outlines the terms of the transfer, including any agreements regarding the property's condition and the release of the borrower from further obligations under the mortgage. It is essential for homeowners to understand the implications of this decision, as it may impact their future borrowing capabilities and financial standing. Additionally, the form typically includes provisions that protect both parties, ensuring a smoother transition of ownership and minimizing disputes. Engaging with this option requires careful consideration and, often, legal guidance to navigate the complexities involved.

State-specific Tips for Deed in Lieu of Foreclosure Templates

Common mistakes

-

Not Understanding the Process: Many individuals rush into signing the Deed in Lieu of Foreclosure without fully grasping what it entails. This document transfers ownership of the property back to the lender, which can have significant implications for credit and future homeownership.

-

Failing to Review the Terms: Some people overlook the specific terms outlined in the form. They might not read the fine print, which can lead to unexpected consequences, such as potential tax liabilities or deficiencies in the mortgage.

-

Not Seeking Professional Advice: It’s common for individuals to fill out the form without consulting a legal or financial expert. This can result in mistakes that could have been easily avoided with proper guidance.

-

Ignoring Other Options: Many individuals focus solely on the Deed in Lieu of Foreclosure and ignore other alternatives. Options like loan modification or short sales may provide a better outcome for their financial situation.

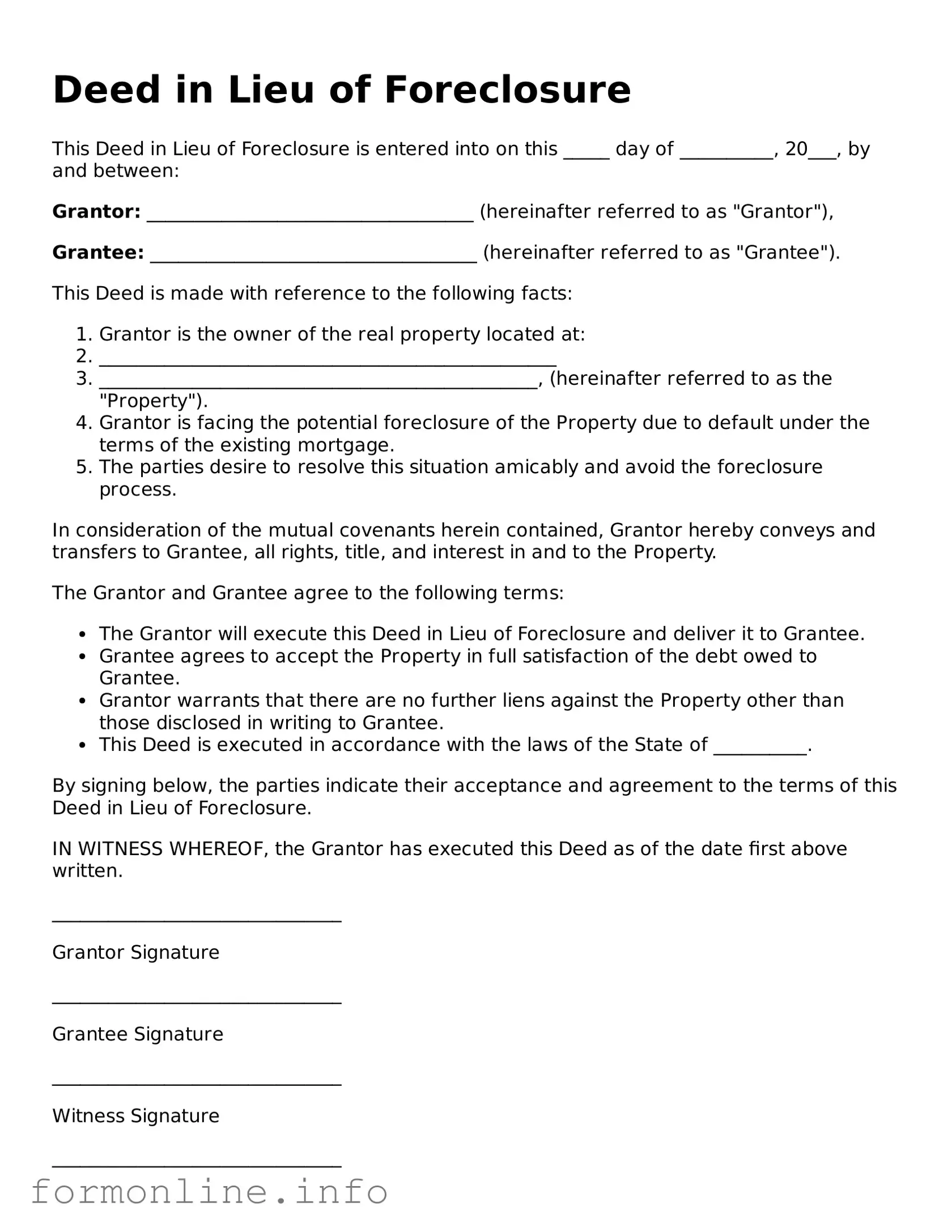

Preview - Deed in Lieu of Foreclosure Form

Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is entered into on this _____ day of __________, 20___, by and between:

Grantor: ___________________________________ (hereinafter referred to as "Grantor"),

Grantee: ___________________________________ (hereinafter referred to as "Grantee").

This Deed is made with reference to the following facts:

- Grantor is the owner of the real property located at:

- _________________________________________________

- _______________________________________________, (hereinafter referred to as the "Property").

- Grantor is facing the potential foreclosure of the Property due to default under the terms of the existing mortgage.

- The parties desire to resolve this situation amicably and avoid the foreclosure process.

In consideration of the mutual covenants herein contained, Grantor hereby conveys and transfers to Grantee, all rights, title, and interest in and to the Property.

The Grantor and Grantee agree to the following terms:

- The Grantor will execute this Deed in Lieu of Foreclosure and deliver it to Grantee.

- Grantee agrees to accept the Property in full satisfaction of the debt owed to Grantee.

- Grantor warrants that there are no further liens against the Property other than those disclosed in writing to Grantee.

- This Deed is executed in accordance with the laws of the State of __________.

By signing below, the parties indicate their acceptance and agreement to the terms of this Deed in Lieu of Foreclosure.

IN WITNESS WHEREOF, the Grantor has executed this Deed as of the date first above written.

_______________________________

Grantor Signature

_______________________________

Grantee Signature

_______________________________

Witness Signature

_______________________________

Notary Public

More Types of Deed in Lieu of Foreclosure Templates:

Free Printable Gift Deed Form - Gift Deeds can help in estate planning, facilitating smoother distribution of assets after death.

For those seeking a reliable resource, the Florida Last Will and Testament form is crucial for ensuring that one’s final wishes concerning asset distribution are honored. Access this essential guide to the Last Will and Testament process for effective estate planning at https://floridapdfform.com/printable-last-will-and-testament/.

Lady Bird Deed Example - This deed can minimize family conflicts by outlining clear successors to the property.

Documents used along the form

A Deed in Lieu of Foreclosure can be a useful option for homeowners facing financial difficulties. Along with this form, several other documents may be needed to complete the process effectively. Below is a list of commonly used forms and documents that accompany the Deed in Lieu of Foreclosure.

- Loan Modification Agreement: This document outlines the new terms of the loan, including interest rates and payment schedules. It is used when a lender agrees to modify the existing loan rather than proceeding with foreclosure.

- Mobile Home Bill of Sale: This essential document facilitates the transfer of ownership rights for mobile homes, ensuring clarity in details such as buyer and seller information, the home's description, and the sale price. For more information, visit the Mobile Home Bill of Sale.

- Property Title Report: A report that provides details about the property’s ownership and any liens or encumbrances. This helps ensure that the property title is clear before transferring ownership.

- Release of Liability: This document releases the homeowner from further obligations related to the mortgage after the deed is transferred. It protects the homeowner from future claims on the debt.

- Affidavit of Title: A sworn statement confirming the seller's ownership of the property and that there are no undisclosed liens or claims. This is important for establishing clear ownership during the transfer process.

Understanding these documents can help homeowners navigate the Deed in Lieu of Foreclosure process more smoothly. Each document serves a specific purpose and contributes to a successful resolution of the situation.

Similar forms

The first document similar to a Deed in Lieu of Foreclosure is a Short Sale Agreement. In a short sale, the homeowner sells the property for less than the amount owed on the mortgage, with the lender’s approval. This process allows the homeowner to avoid foreclosure while still relieving them of the mortgage debt. Both documents serve as alternatives to foreclosure, providing a way for homeowners to exit their mortgage obligations, but a short sale involves selling the property rather than transferring ownership back to the lender.

Another comparable document is a Loan Modification Agreement. This agreement involves changing the terms of an existing mortgage to make it more affordable for the homeowner. It may include lowering the interest rate, extending the loan term, or even reducing the principal balance. Like a Deed in Lieu of Foreclosure, a loan modification aims to prevent foreclosure, allowing the homeowner to keep their property while managing their financial situation. However, a loan modification keeps the homeowner in possession of the property, unlike a deed in lieu, which transfers ownership.

A third similar document is a Forebearance Agreement. In this arrangement, the lender agrees to temporarily suspend or reduce mortgage payments for the homeowner facing financial difficulties. This can provide critical relief during tough times, allowing the homeowner to catch up on payments without the immediate threat of foreclosure. While both a Deed in Lieu of Foreclosure and a Forbearance Agreement aim to address the financial struggles of the homeowner, the former involves relinquishing the property, whereas the latter maintains ownership during the agreed-upon forbearance period.

The Texas Mobile Home Bill of Sale is essential for ensuring the legal transfer of ownership when selling or buying a mobile home. This crucial document helps prevent any ambiguities by detailing the buyer's and seller's information as well as the specifications of the mobile home involved in the transaction. For more information, you can refer to the Mobile Home Bill of Sale which provides templates and insights to help navigate this process smoothly.

Lastly, a Bankruptcy Filing can also be considered similar. Filing for bankruptcy can provide homeowners with a temporary reprieve from foreclosure, as it places an automatic stay on creditor actions. This gives the homeowner time to reorganize their debts or negotiate with lenders. While both a Deed in Lieu of Foreclosure and bankruptcy can halt foreclosure proceedings, the key difference lies in the outcomes: a deed transfers the property back to the lender, while bankruptcy may allow the homeowner to retain ownership if they can successfully restructure their debts.

Dos and Don'ts

When filling out the Deed in Lieu of Foreclosure form, it is important to approach the process carefully. Here are some guidelines to help you navigate this situation effectively.

- Do read the entire form thoroughly before starting.

- Do gather all necessary documents related to your mortgage and property.

- Do ensure that you understand the implications of signing the deed.

- Do consult with a legal professional if you have any questions.

- Don't rush through the form; take your time to fill it out accurately.

- Don't omit any required information; completeness is crucial.

- Don't sign the document without verifying that it is correct.

- Don't ignore any deadlines associated with the process.

- Don't hesitate to ask for help if you are unsure about any part of the form.

Following these guidelines can help ensure that you complete the Deed in Lieu of Foreclosure form correctly and understand the consequences of your actions.

Key takeaways

When considering a Deed in Lieu of Foreclosure, it is essential to understand the implications and processes involved. Here are some key takeaways to keep in mind:

- Understand the Process: A Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer ownership of the property to the lender to avoid foreclosure. This process can be less damaging to your credit than a foreclosure.

- Negotiate Terms: Before signing the deed, it is crucial to negotiate the terms with the lender. This may include discussing any potential deficiencies or outstanding debts that may still be owed after the transfer.

- Seek Legal Advice: Consulting with a legal professional can provide valuable insights. They can help you navigate the complexities of the agreement and ensure that your rights are protected throughout the process.

- Document Everything: Keep thorough records of all communications and agreements with the lender. This documentation can be vital should any disputes arise in the future.

By considering these key points, individuals can make more informed decisions regarding their financial futures and the management of their properties.

How to Use Deed in Lieu of Foreclosure

After completing the Deed in Lieu of Foreclosure form, you will need to submit it to your lender. This step is crucial as it initiates the process of transferring the property back to the lender. Be sure to keep copies of all documents for your records.

- Begin by obtaining the Deed in Lieu of Foreclosure form from your lender or an online legal resource.

- Fill in your name and contact information at the top of the form.

- Provide the property address, including city, state, and ZIP code.

- Enter the lender's name and contact information in the designated section.

- Include the loan number associated with the mortgage you are surrendering.

- Clearly state the date on which you are signing the form.

- Review the terms outlined in the form carefully. Make sure you understand them before proceeding.

- Sign and date the form in the appropriate spaces provided.

- Have the form notarized, if required by your state or lender.

- Make copies of the completed form for your records.

- Submit the original form to your lender via the method they specify, such as mail or in-person delivery.