Printable Deed of Trust Form

The Deed of Trust form plays a crucial role in real estate transactions, particularly in securing loans for property purchases. This legal document involves three key parties: the borrower, the lender, and a neutral third party known as the trustee. When a borrower takes out a mortgage, the Deed of Trust serves as a means to protect the lender's interest in the property until the loan is fully repaid. In essence, it establishes a security interest in the property, allowing the lender to take possession of it if the borrower defaults on the loan. The form outlines essential details such as the loan amount, interest rate, repayment terms, and the specific rights and responsibilities of each party involved. Additionally, it includes provisions for foreclosure, should the borrower fail to meet their obligations. Understanding the nuances of the Deed of Trust is vital for anyone navigating the complexities of real estate financing, as it not only affects the borrower’s rights but also impacts the lender's ability to recover their investment in the event of default.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to provide a precise and accurate description of the property. The description should include the full address and any relevant parcel or lot numbers. Without this information, the deed may not be legally enforceable.

-

Omitting Borrower and Lender Information: It is crucial to include complete names and addresses of both the borrower and the lender. Omitting this information can lead to confusion or disputes regarding the parties involved in the agreement.

-

Not Signing the Document: A Deed of Trust must be signed by the borrower. Failing to sign the document renders it invalid. Additionally, witnesses or notarization may be required depending on state laws, so it is important to check local requirements.

-

Improperly Notarizing the Document: If notarization is required, ensure that the notary public is properly commissioned and that all signatures are witnessed correctly. An improperly notarized document may not hold up in court.

-

Ignoring State-Specific Requirements: Each state may have unique requirements for a Deed of Trust. Failing to comply with these regulations can lead to the deed being rejected or deemed invalid.

-

Neglecting to Record the Deed: After completing the Deed of Trust, it is essential to record it with the appropriate local government office. Neglecting this step can result in legal complications, especially if there are disputes about ownership or liens on the property.

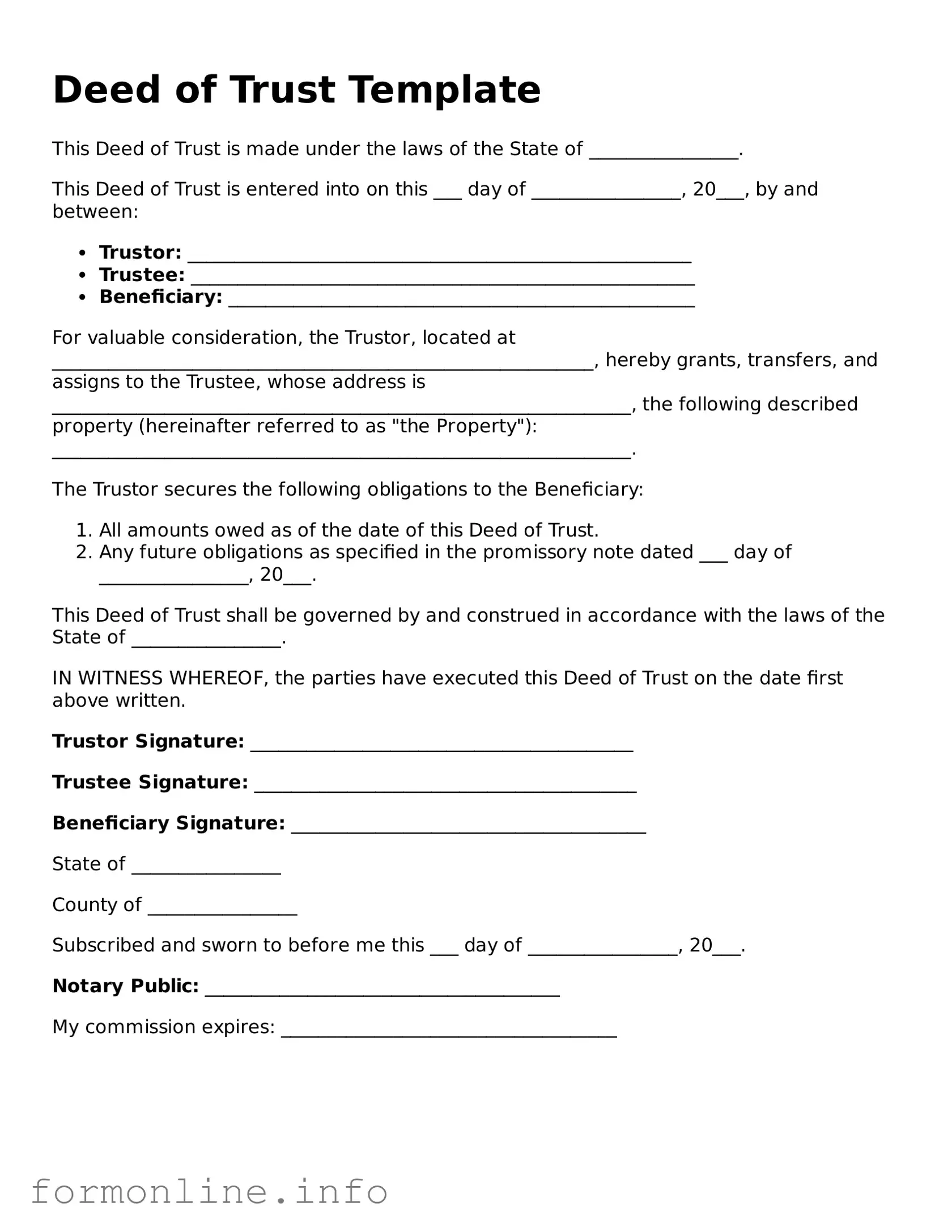

Preview - Deed of Trust Form

Deed of Trust Template

This Deed of Trust is made under the laws of the State of ________________.

This Deed of Trust is entered into on this ___ day of ________________, 20___, by and between:

- Trustor: ______________________________________________________

- Trustee: ______________________________________________________

- Beneficiary: __________________________________________________

For valuable consideration, the Trustor, located at __________________________________________________________, hereby grants, transfers, and assigns to the Trustee, whose address is ______________________________________________________________, the following described property (hereinafter referred to as "the Property"): ______________________________________________________________.

The Trustor secures the following obligations to the Beneficiary:

- All amounts owed as of the date of this Deed of Trust.

- Any future obligations as specified in the promissory note dated ___ day of ________________, 20___.

This Deed of Trust shall be governed by and construed in accordance with the laws of the State of ________________.

IN WITNESS WHEREOF, the parties have executed this Deed of Trust on the date first above written.

Trustor Signature: _________________________________________

Trustee Signature: _________________________________________

Beneficiary Signature: ______________________________________

State of ________________

County of ________________

Subscribed and sworn to before me this ___ day of ________________, 20___.

Notary Public: ______________________________________

My commission expires: ____________________________________

More Types of Deed of Trust Templates:

Lady Bird Deed Example - A Lady Bird Deed is beneficial for anyone wanting to clarify the fate of their property after passing.

The Arizona Transfer-on-Death Deed form allows property owners to designate beneficiaries who will receive their real estate upon their death, avoiding the lengthy probate process. This straightforward tool can simplify estate planning and ensure that your property is transferred according to your wishes. For those interested in securing their legacy, consider filling out the form by visiting todform.com/ to learn more.

What Is Deed in Lieu - Homeowners can regain control over their financial situation through this alternative method.

Documents used along the form

A Deed of Trust is an important document in real estate transactions, particularly when securing a loan. Along with this form, several other documents may be necessary to complete the process. Below is a list of commonly used forms and documents that often accompany a Deed of Trust.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It includes the loan amount, interest rate, and repayment schedule.

- Loan Application: This form collects the borrower's personal and financial information. Lenders use it to assess the borrower's creditworthiness.

- Quitclaim Deed: This document facilitates the transfer of property ownership without guarantees regarding the title, often used among family members; for a template, refer to Legal PDF Documents.

- Title Insurance Policy: This policy protects the lender and borrower against potential title defects. It ensures that the property title is clear of any claims or liens.

- Disclosure Statements: These documents provide important information about the loan terms, fees, and other costs associated with the mortgage. They ensure transparency in the transaction.

- Property Appraisal: An appraisal assesses the property's market value. Lenders require it to ensure the loan amount does not exceed the property's worth.

- Settlement Statement: This document outlines all costs and fees related to the closing of the transaction. It details what the buyer and seller will pay at closing.

- Borrower's Affidavit: This sworn statement confirms the borrower's identity and financial status. It may be required to verify the information provided in the loan application.

These documents work together with the Deed of Trust to ensure a clear understanding of the loan agreement and protect the interests of all parties involved. Being familiar with these forms can help streamline the real estate transaction process.

Similar forms

A mortgage is one of the most common documents similar to a Deed of Trust. Both serve as security for a loan used to purchase real estate. In a mortgage, the borrower retains ownership of the property while the lender has a lien against it. The Deed of Trust, however, involves a third party, known as a trustee, who holds the title until the loan is paid off. This difference in structure can affect the foreclosure process, making the Deed of Trust often quicker and simpler for lenders to enforce.

A promissory note is another document closely related to the Deed of Trust. While the Deed of Trust secures the loan, the promissory note outlines the borrower's promise to repay the loan. It details the loan amount, interest rate, and repayment schedule. Together, these documents create a comprehensive agreement between the borrower and lender, ensuring that both parties understand their obligations and rights.

A loan agreement is similar in that it formalizes the terms of the loan. This document includes details like the loan amount, interest rates, and repayment terms, much like the promissory note. However, the loan agreement may also include additional clauses that cover aspects such as default and remedies. The Deed of Trust complements this by providing a security interest in the property, which can be enforced if the borrower defaults.

Understanding the nuances of real estate documents is essential for effective planning, particularly when it comes to securing future interests. The Alabama Transfer-on-Death Deed offers a unique solution for property owners looking to simplify the transfer of their real estate to heirs, avoiding the complexities of probate. This deed serves as an important tool in estate planning, ensuring that your wishes are honored after your passing. For more information on utilizing this deed, you can visit https://transferondeathdeedform.com/alabama-transfer-on-death-deed/, where you'll find resources that can assist you in making informed decisions about your property and estate.

A lease agreement can also share similarities with a Deed of Trust, particularly in real estate transactions. Both documents involve an agreement regarding property, but a lease grants temporary possession to a tenant without transferring ownership. In contrast, a Deed of Trust secures a loan tied to ownership. However, both documents are essential in defining the rights and responsibilities of the parties involved.

An assignment of rents is another document that can be compared to a Deed of Trust. This document allows a lender to collect rental income directly from tenants if the borrower defaults on the loan. While the Deed of Trust secures the loan with the property itself, the assignment of rents provides an additional layer of security by ensuring that cash flow from the property can be directed to the lender in case of default.

A land contract, or contract for deed, is similar to a Deed of Trust in that it allows a buyer to make payments on a property over time while the seller retains the title until the full purchase price is paid. This arrangement can offer flexibility for buyers who may not qualify for traditional financing. However, unlike a Deed of Trust, the seller does not have to go through a formal foreclosure process to reclaim the property if the buyer defaults.

Dos and Don'ts

When filling out a Deed of Trust form, it is essential to approach the task with care and attention to detail. Here are some important dos and don'ts to keep in mind:

- Do ensure that all parties involved are clearly identified. This includes the borrower, the lender, and any trustees.

- Do provide accurate property information. Include the correct address and legal description of the property being secured.

- Do read the entire document carefully. Understanding each section will help prevent future disputes.

- Do consult with a legal professional if you have questions. Seeking guidance can clarify complex terms and conditions.

- Do sign the document in the presence of a notary. This step is crucial for the document's validity.

- Don't leave any sections blank. Incomplete forms can lead to legal complications down the line.

- Don't use outdated forms. Always ensure you are using the most current version of the Deed of Trust.

- Don't overlook state-specific requirements. Different states may have unique regulations regarding Deeds of Trust.

- Don't rush through the process. Taking your time can help avoid mistakes that could be costly later.

Key takeaways

When dealing with a Deed of Trust, understanding its components and implications is crucial. Here are key takeaways to keep in mind:

- Purpose of the Deed of Trust: This document serves as a security instrument for a loan, allowing a lender to hold an interest in a property until the borrower repays the debt.

- Parties Involved: Typically, there are three parties: the borrower (trustor), the lender (beneficiary), and the third-party trustee who holds the title until the loan is paid off.

- Property Description: A clear and accurate description of the property must be included. This ensures that the property can be easily identified and is legally bound to the Deed of Trust.

- Loan Amount and Terms: Clearly state the loan amount, interest rate, and repayment terms. This information is essential for both parties to understand their obligations.

- Default Clauses: The Deed of Trust should outline what constitutes a default and the remedies available to the lender, including foreclosure procedures.

- Recording the Deed: After signing, the Deed of Trust must be recorded in the appropriate county office to protect the lender's interest and provide public notice of the lien.

- Legal Compliance: Ensure that the Deed of Trust complies with state laws, as regulations can vary significantly. This helps avoid potential legal issues down the line.

By keeping these points in mind, individuals can navigate the process of filling out and utilizing a Deed of Trust more effectively.

How to Use Deed of Trust

After gathering the necessary information, you are ready to fill out the Deed of Trust form. This document is crucial for establishing the relationship between the borrower, the lender, and the property involved. Ensure that all details are accurate and complete to avoid any potential issues in the future.

- Begin by entering the date at the top of the form. This date should reflect when the Deed of Trust is being executed.

- Next, provide the names and addresses of the borrower(s). This section identifies who is responsible for the loan.

- Then, fill in the lender’s name and address. This information is essential for indicating who is providing the loan.

- Specify the legal description of the property. This can usually be found on the property deed or tax documents. It must be accurate to ensure proper identification of the property.

- Indicate the loan amount. This is the total amount borrowed and should match the loan agreement.

- Next, include the interest rate. Clearly state the percentage rate that will apply to the loan.

- Fill in the terms of repayment, including the duration of the loan and the payment schedule. Be specific about monthly, quarterly, or annual payments.

- Sign the document. The borrower(s) must sign in the designated area to validate the agreement.

- Have the document notarized. A notary public will confirm the identities of the signers and witness the signing.

- Finally, make copies of the completed Deed of Trust for your records and provide a copy to the lender.