Printable Deed Form

When it comes to transferring ownership of property, the Deed form plays a crucial role in ensuring that the transaction is legally recognized and binding. This document serves as a formal record of the transfer, detailing the parties involved, the property description, and the terms of the transfer. It is essential for both the seller and the buyer to understand the significance of the Deed form, as it not only protects their rights but also provides clarity in the ownership process. Various types of deeds exist, including warranty deeds and quitclaim deeds, each serving different purposes depending on the situation. The form must be filled out accurately and may require notarization to be considered valid. Understanding the components of the Deed form, including the signatures, legal descriptions, and any necessary clauses, is vital for a smooth transaction. By familiarizing oneself with this important document, individuals can navigate the complexities of property ownership with greater confidence and peace of mind.

State-specific Tips for Deed Templates

Common mistakes

-

Incorrect Names: One common mistake is not using the full legal names of the parties involved. Nicknames or initials can lead to confusion and potential legal issues.

-

Missing Signatures: Failing to include all required signatures is another frequent error. Each party must sign the deed for it to be valid.

-

Improper Notarization: Not having the deed properly notarized can invalidate the document. Ensure that a qualified notary public witnesses the signing.

-

Incorrect Property Description: Providing an inaccurate or incomplete description of the property can lead to disputes. Always verify that the legal description matches official records.

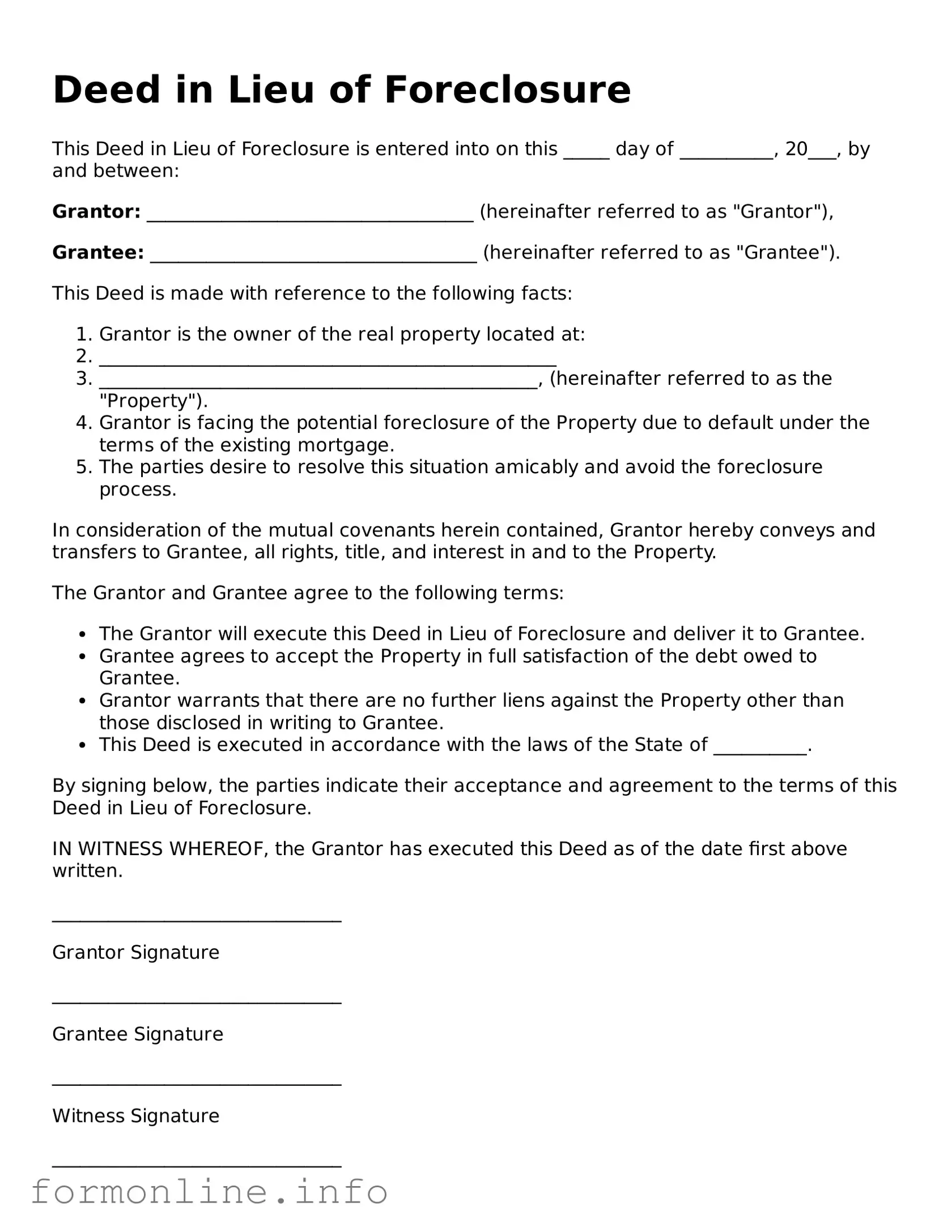

Preview - Deed Form

Warranty Deed Template

This Warranty Deed is made effective as of the _____ day of __________, 20____, in accordance with the laws of the State of __________.

PARTIES:

This deed is executed by:

- Grantor: _____________________________________

- Grantee: _____________________________________

WITNESSETH:

For and in consideration of the sum of $_____________, the Grantor hereby grants, conveys, and warrants to the Grantee the following described real property located in __________ County, State of __________:

Property Description:

___________________________________________________________________________

___________________________________________________________________________

COVENANTS:

- The Grantor warrants that the title to the property is free from all encumbrances.

- The Grantor agrees to defend the title against claims and demands of all persons.

- The Grantee accepts the property subject to all zoning and governmental regulations.

IN WITNESS WHEREOF:

The Grantor has executed this Warranty Deed on the date first above written.

Grantor Signature: ___________________________

Grantee Signature: ___________________________

NOTARY ACKNOWLEDGMENT:

State of __________

County of __________

On this _____ day of __________, 20____, before me, a Notary Public in and for said State and County, personally appeared ______________________________________, known to me (or satisfactorily proven) to be the individual(s) whose name(s) are subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public Signature: ___________________________

My Commission Expires: ___________________________

Common Forms:

Act 221 Disclosure - The form specifies whether any part of the reserve fund is earmarked for a designated project.

When completing an RV sale in Arizona, it is essential to use the appropriate documentation to ensure a smooth transaction. An Arizona RV Bill of Sale form serves as a crucial legal document that facilitates the transfer of ownership while providing important details about the RV involved in the transaction. For more information on the necessary forms, you can visit autobillofsaleform.com/rv-bill-of-sale-form/arizona-rv-bill-of-sale-form, which offers guidance on preparing this document correctly for both buyers and sellers.

Sample Consent Form - This consent form outlines how your image may be featured in educational programs and events.

Documents used along the form

When dealing with property transactions, several forms and documents accompany the Deed form to ensure a smooth process. Each of these documents serves a specific purpose and helps clarify the terms of the transaction. Below are some commonly used documents.

- Title Insurance Policy: This document protects the buyer and lender from potential disputes over property ownership. It ensures that the title is clear of any liens or claims that could affect ownership.

- Bill of Sale: Often used in conjunction with the Deed, this document transfers ownership of personal property that may be included in the sale, such as appliances or furniture.

- Property Disclosure Statement: Sellers typically provide this document to disclose any known issues or defects with the property. It helps buyers make informed decisions based on the property's condition.

- Mobile Home Bill of Sale: This important document outlines the specifics of the sale, including buyer and seller details, the mobile home's description, and the sale price. For more information, you can visit the Mobile Home Bill of Sale.

- Closing Statement: This document outlines the financial details of the transaction. It includes the sale price, closing costs, and any adjustments made during the closing process.

Understanding these documents can help clarify the responsibilities and rights of all parties involved in a property transaction. Each plays a crucial role in ensuring that the transfer of ownership is legally sound and transparent.

Similar forms

A Quitclaim Deed is similar to a standard Deed form in that it transfers ownership of property from one party to another. However, it differs in the level of guarantee it provides. A Quitclaim Deed does not guarantee that the grantor holds clear title to the property. Instead, it simply conveys whatever interest the grantor has, if any. This makes it a common choice in situations like transferring property between family members or clearing up title issues, where the parties know each other well.

A Warranty Deed offers a higher level of protection than a standard Deed. It guarantees that the grantor holds clear title to the property and has the right to sell it. This document includes warranties against any claims or encumbrances on the property, which means the buyer can feel secure in their purchase. In essence, while both documents transfer ownership, a Warranty Deed provides more assurance to the buyer regarding the property’s title.

A Special Purpose Deed is used for specific transactions, such as transferring property into a trust or from a trust. Like a standard Deed, it serves to convey ownership but is tailored for unique circumstances. This type of Deed often includes additional provisions that address the specific needs of the parties involved, making it a flexible option for estate planning and similar situations.

When dealing with the transfer of ownership for a mobile home, it's essential to have the proper documentation in place to ensure a smooth transaction. The Mobile Home Bill of Sale serves as a crucial legal document for this purpose, outlining the necessary details of the sale while protecting the rights of both the buyer and the seller.

A Bargain and Sale Deed is another document that resembles a standard Deed. It conveys property from seller to buyer but does not provide any warranties regarding the title. This means that while ownership is transferred, the buyer assumes the risk of any title issues. It’s often used in foreclosure sales or tax lien sales, where the seller may not have clear title to the property.

An Executor’s Deed is issued when a property is transferred as part of an estate settlement. This type of Deed is similar to a standard Deed in that it conveys ownership, but it is executed by an executor or administrator of an estate. This document provides proof that the property has been transferred according to the deceased’s wishes, making it essential for heirs and beneficiaries.

A Trustee’s Deed is used when property is transferred by a trustee, typically in a trust arrangement. Like a standard Deed, it conveys ownership but does so under the authority of the trust. This document ensures that the trustee is acting within their legal rights and responsibilities, which can help protect the interests of the beneficiaries involved.

A Deed of Trust serves a different purpose but is still related to property ownership. It acts as a security instrument in real estate transactions, where the borrower conveys legal title to a trustee as security for a loan. While it does not transfer ownership in the traditional sense, it establishes a legal framework for securing a loan, similar to how a standard Deed establishes ownership rights.

Finally, a Leasehold Deed is similar to a standard Deed in that it involves property rights, but it conveys a leasehold interest rather than full ownership. This document allows a tenant to occupy and use the property for a specified period while outlining the terms of the lease. Though it doesn’t transfer ownership outright, it serves as a legal agreement that protects the rights of both the landlord and tenant.

Dos and Don'ts

When filling out a Deed form, attention to detail is crucial. Here are ten important guidelines to follow:

- Do: Read the entire form carefully before starting.

- Do: Provide accurate and complete information.

- Do: Use clear and legible handwriting if filling out by hand.

- Do: Sign and date the form where required.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any required fields blank.

- Don't: Use abbreviations or shorthand that may cause confusion.

- Don't: Alter the form in any way, such as crossing out information.

- Don't: Forget to check for any specific state requirements.

- Don't: Submit the form without verifying all information is correct.

Key takeaways

When it comes to filling out and using a Deed form, understanding the process is crucial. Here are some key takeaways to keep in mind:

- Know the Purpose: A Deed is a legal document that signifies the transfer of ownership of property. Ensure you understand its importance in real estate transactions.

- Choose the Right Type: There are various types of Deeds, such as Warranty Deeds and Quitclaim Deeds. Selecting the appropriate one is essential for your specific situation.

- Gather Necessary Information: Before filling out the form, collect all relevant details, including the names of the parties involved, property description, and any existing liens.

- Be Accurate: Fill out the form carefully. Mistakes can lead to legal complications or delays in the transfer process.

- Signatures Matter: Ensure that all parties involved sign the Deed. In some cases, notarization may also be required to validate the document.

- Check Local Requirements: Different states have varying laws regarding Deeds. Familiarize yourself with local regulations to ensure compliance.

- File the Deed: After completing the form, it must be filed with the appropriate local government office. This step is crucial for the transfer to be legally recognized.

- Keep Copies: Always retain copies of the signed Deed for your records. This documentation can be important for future reference.

- Seek Professional Help: If you’re unsure about any part of the process, consider consulting a legal professional. Their expertise can provide peace of mind and clarity.

By following these key points, you can navigate the process of filling out and using a Deed form with greater confidence and efficiency.

How to Use Deed

Once you have your Deed form ready, it's time to fill it out carefully. Make sure you have all the necessary information at hand. This will help ensure that the process goes smoothly and that the deed is valid once completed.

- Begin by entering the full name of the grantor (the person transferring the property).

- Next, write the full name of the grantee (the person receiving the property).

- Provide the complete address of the property being transferred. This includes the street address, city, state, and ZIP code.

- Include a legal description of the property. This may be found in previous property documents or through local property records.

- Specify the date of the transaction. This is the date when the deed is being executed.

- If applicable, indicate any conditions or restrictions related to the transfer of the property.

- Have the grantor sign the deed in the designated area. Ensure that the signature matches the name provided earlier.

- In some cases, a notary public must witness the signing. If required, take the deed to a notary and have them complete their section.

- Finally, make copies of the completed deed for both the grantor and grantee for their records.