Printable Employee Loan Agreement Form

In the realm of employment relationships, financial assistance can sometimes play a pivotal role in supporting employees during challenging times. An Employee Loan Agreement form is a crucial document that outlines the terms and conditions under which an employer provides a loan to an employee. This agreement typically covers essential aspects such as the loan amount, interest rate, repayment schedule, and any applicable fees. It also delineates the responsibilities of both parties, ensuring clarity and mutual understanding. By establishing the expectations for repayment and addressing potential consequences of default, this form serves to protect both the employer's financial interests and the employee's rights. Additionally, the agreement may include provisions for confidentiality and dispute resolution, further fostering a sense of trust and security in the employer-employee relationship. Understanding the intricacies of this document is vital for both parties, as it can help prevent misunderstandings and promote a harmonious workplace environment.

Common mistakes

-

Incomplete Information: Failing to provide all required personal details, such as name, address, and employee ID, can lead to delays or rejection of the agreement.

-

Incorrect Loan Amount: Entering an incorrect loan amount may cause confusion. It is essential to double-check the figures before submission.

-

Missing Signatures: Not signing the document or forgetting to obtain the necessary signatures from both the employee and employer can invalidate the agreement.

-

Omitting Terms and Conditions: Failing to clearly outline repayment terms, interest rates, and any penalties for late payments can lead to misunderstandings later.

-

Ignoring State Regulations: Each state may have specific laws regarding employee loans. Not being aware of these can result in non-compliance.

-

Failure to Keep Copies: Not retaining a copy of the signed agreement for personal records can make it difficult to reference terms in the future.

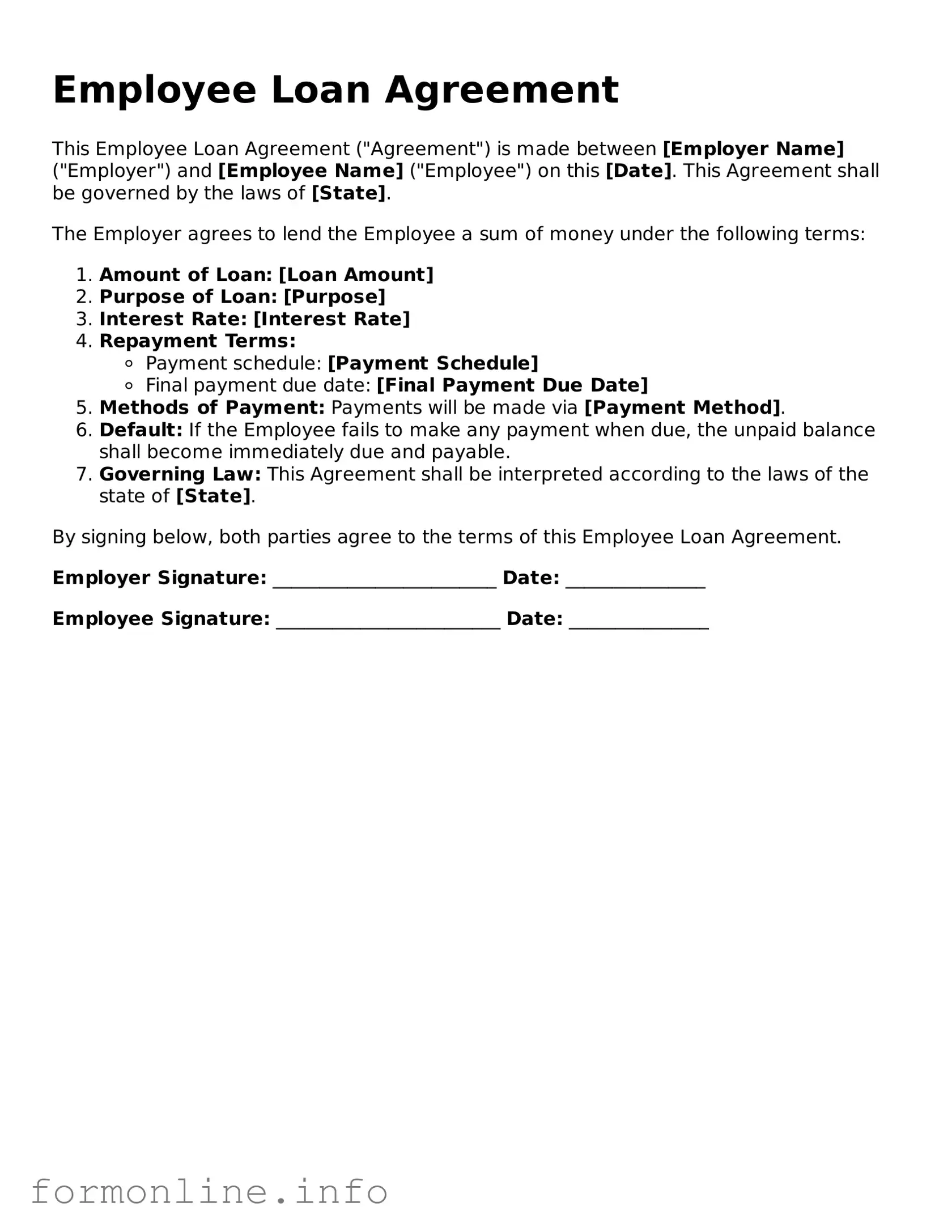

Preview - Employee Loan Agreement Form

Employee Loan Agreement

This Employee Loan Agreement ("Agreement") is made between [Employer Name] ("Employer") and [Employee Name] ("Employee") on this [Date]. This Agreement shall be governed by the laws of [State].

The Employer agrees to lend the Employee a sum of money under the following terms:

- Amount of Loan: [Loan Amount]

- Purpose of Loan: [Purpose]

- Interest Rate: [Interest Rate]

- Repayment Terms:

- Payment schedule: [Payment Schedule]

- Final payment due date: [Final Payment Due Date]

- Methods of Payment: Payments will be made via [Payment Method].

- Default: If the Employee fails to make any payment when due, the unpaid balance shall become immediately due and payable.

- Governing Law: This Agreement shall be interpreted according to the laws of the state of [State].

By signing below, both parties agree to the terms of this Employee Loan Agreement.

Employer Signature: ________________________ Date: _______________

Employee Signature: ________________________ Date: _______________

Documents used along the form

The Employee Loan Agreement form is a critical document that outlines the terms and conditions under which an employee can borrow funds from their employer. However, several other forms and documents are often used in conjunction with this agreement to ensure clarity and compliance. Below is a list of these related documents, each serving a specific purpose in the loan process.

- Loan Application Form: This form collects essential information from the employee, including personal details, the amount requested, and the purpose of the loan. It serves as the initial request for borrowing funds.

- Texas Loan Agreement Form: This legal document outlines the terms and conditions between a borrower and a lender in Texas, ensuring a clear understanding of obligations. To securely establish the terms of your loan, fill out the Texas Loan Agreement form by clicking the button below. For additional resources, visit All Texas Forms.

- Promissory Note: A legal document in which the employee agrees to repay the loan amount under specified terms. It includes details such as interest rates, repayment schedule, and consequences of default.

- Repayment Schedule: This document outlines the timeline for repayments, including due dates and amounts. It helps both parties track the loan repayment process effectively.

- Authorization for Payroll Deduction: This form allows the employer to deduct loan repayments directly from the employee's paycheck. It simplifies the repayment process and ensures timely payments.

- Loan Disclosure Statement: This statement provides the employee with all pertinent information regarding the loan, including interest rates, fees, and other terms. It ensures transparency and informed consent.

- Financial Counseling Agreement: If the loan is substantial, this document may be used to offer financial counseling to the employee. It aims to help the employee manage their finances and understand the implications of taking the loan.

- Termination of Loan Agreement: This form is used to formally document the conclusion of the loan agreement, whether through full repayment or other means. It protects both parties by providing a record of the loan's status.

- Loan Forgiveness Agreement: In certain circumstances, an employer may offer to forgive part or all of the loan. This document outlines the terms and conditions under which forgiveness is granted.

These documents work together to create a comprehensive framework for managing employee loans. Each serves a distinct purpose, ensuring that both the employer and employee have a clear understanding of their rights and responsibilities throughout the loan process.

Similar forms

The Employee Loan Agreement form shares similarities with a Personal Loan Agreement. Both documents outline the terms under which one party lends money to another. They detail the loan amount, interest rate, repayment schedule, and consequences of default. Personal loans are typically used for individual needs, while employee loans are specifically tailored for workplace relationships, fostering trust and responsibility between employer and employee.

Another related document is the Promissory Note. This is a straightforward agreement where the borrower promises to repay a specified amount to the lender. Like the Employee Loan Agreement, a Promissory Note includes key details such as the loan amount and repayment terms. However, it is generally less formal and may not cover aspects like employment status or conditions specific to the workplace.

A Loan Repayment Plan is also similar, as it outlines how the borrower will repay the loan over time. This document typically includes payment amounts and due dates. While an Employee Loan Agreement may incorporate a repayment plan, a standalone Loan Repayment Plan focuses solely on the repayment structure without detailing the initial loan agreement.

The Credit Agreement is another comparable document. This agreement outlines the terms of credit extended to an individual or business. Like the Employee Loan Agreement, it specifies the amount, interest rate, and repayment terms. However, credit agreements often cover broader financial arrangements, including revolving credit, which is not typically the case with employee loans.

A Loan Application form is also relevant. This document is used to request a loan and provides the lender with necessary information about the borrower’s financial situation. While the Employee Loan Agreement finalizes the terms of a loan, the Loan Application is the initial step in the borrowing process, collecting information that helps determine eligibility.

The Mortgage Agreement bears similarities as well, particularly in its structure and the legal obligations it creates. This document is used when a borrower secures a loan against property. Both agreements detail repayment terms and consequences for default. However, a Mortgage Agreement usually involves larger sums and real estate, while an Employee Loan Agreement is more personal and often smaller in scale.

Understanding the nuances of various loan agreements is essential for both lenders and borrowers, particularly when it comes to the specifics of terms and expectations. For those interested in a structured approach to lending, the Employee Loan Agreement lays out a clear framework similar to that of a Personal Loan Agreement or a Promissory Note. To explore these options further and discover how to formalize your agreement, read here.

Lastly, a Lease Agreement can be likened to the Employee Loan Agreement. Both documents establish a contractual relationship between parties, outlining obligations and rights. A Lease Agreement details terms for renting property, including payment and duration. While the contexts differ, both agreements require clear terms to protect the interests of all parties involved.

Dos and Don'ts

When filling out the Employee Loan Agreement form, it is essential to approach the task with care and attention to detail. Below is a list of things you should and shouldn't do to ensure that the process goes smoothly.

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate and complete information.

- Do double-check your entries for any typos or errors.

- Do sign and date the form where required.

- Don't leave any required fields blank.

- Don't use vague or unclear language when describing the purpose of the loan.

- Don't forget to keep a copy of the completed form for your records.

- Don't rush through the process; take your time to ensure everything is correct.

Key takeaways

When filling out and using the Employee Loan Agreement form, several important considerations can help ensure a smooth process for both the employer and the employee. Here are key takeaways to keep in mind:

- Clear Terms: Clearly outline the loan amount, repayment schedule, and interest rates, if applicable. This clarity helps prevent misunderstandings later.

- Documentation: Ensure that all necessary documentation is attached to the agreement. This includes proof of income or employment status, which can support the employee’s ability to repay the loan.

- Signatures Required: Both the employer and employee must sign the agreement. This signature signifies acceptance of the terms and conditions laid out in the document.

- Compliance with Laws: Be aware of any state or federal laws that may impact employee loans. Compliance is crucial to avoid legal issues down the road.

Following these guidelines can help facilitate a positive experience for both parties involved in the loan agreement.

How to Use Employee Loan Agreement

Filling out the Employee Loan Agreement form is straightforward. This form is important for documenting the terms of the loan between the employer and the employee. Follow these steps carefully to ensure all necessary information is provided accurately.

- Begin by entering the date at the top of the form.

- Fill in the employee's full name in the designated space.

- Provide the employee's job title and department.

- Enter the loan amount being requested by the employee.

- Specify the purpose of the loan in the appropriate section.

- Indicate the repayment terms, including the repayment schedule and interest rate if applicable.

- Both the employee and the employer should sign and date the form at the bottom.

Make sure to review the completed form for any errors before submitting it. This will help avoid any delays or misunderstandings regarding the loan agreement.