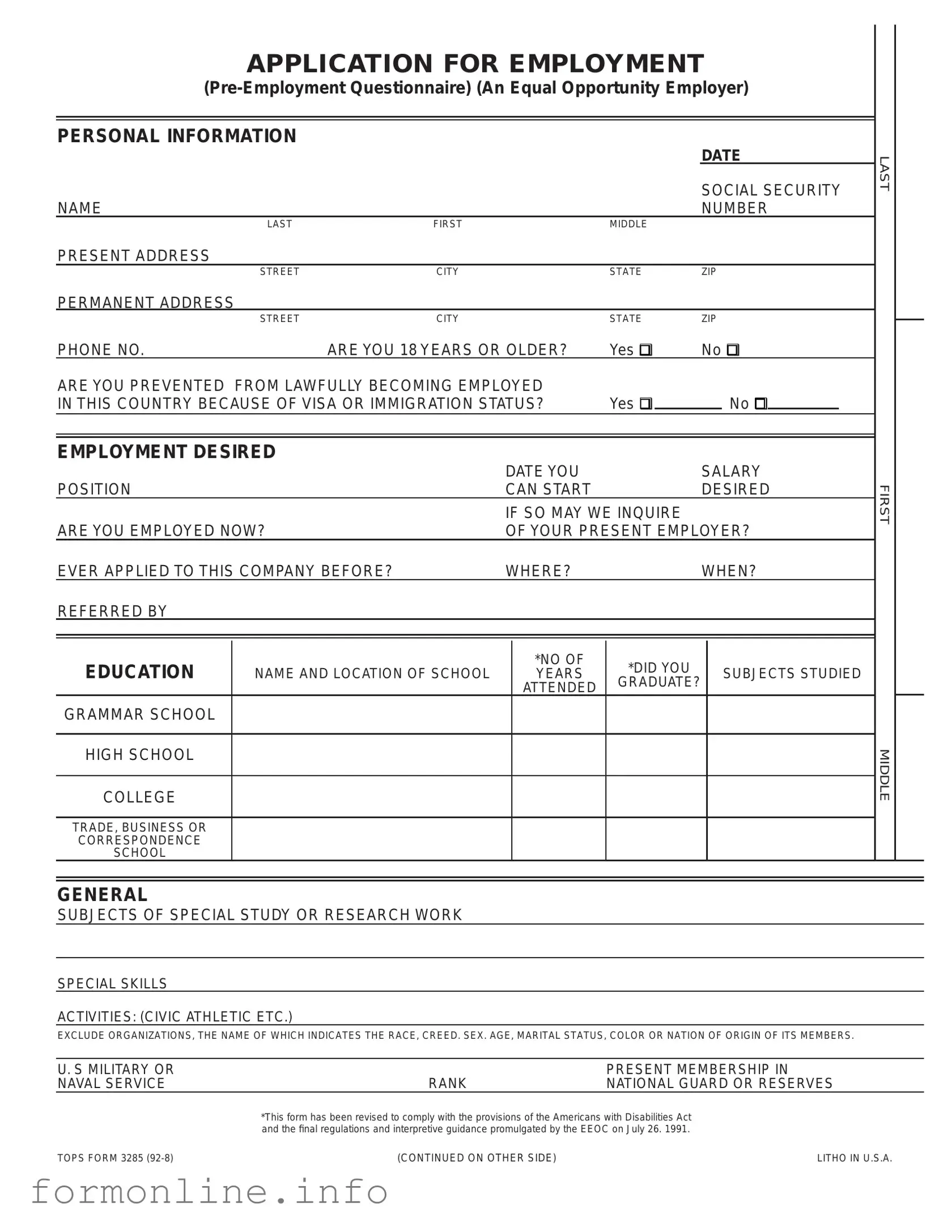

Fill Out a Valid Employment Application Pdf Form

When seeking a new job, one of the first steps candidates often encounter is the completion of an employment application form. This essential document serves as a gateway for potential employers to gather key information about applicants. Typically, an employment application PDF form includes sections for personal details, work history, educational background, and references, allowing candidates to present their qualifications in a structured manner. Additionally, it may require applicants to disclose their availability, desired salary, and any relevant skills or certifications. By filling out this form, job seekers can provide a comprehensive snapshot of their professional journey, helping employers assess their suitability for specific roles. Understanding the components of the employment application PDF form is crucial for candidates aiming to make a strong impression in a competitive job market.

Common mistakes

-

Incomplete Information: Many applicants forget to fill out all required fields. Leaving sections blank can lead to automatic disqualification.

-

Incorrect Contact Details: Providing wrong phone numbers or email addresses can prevent employers from reaching you for interviews.

-

Spelling and Grammar Mistakes: Typos can create a negative impression. Carefully proofread your application before submission.

-

Not Tailoring the Application: Using a generic application for different jobs can hurt your chances. Customize your responses to fit the specific position.

-

Ignoring Instructions: Each application may have specific instructions. Failing to follow them can lead to rejection.

-

Missing References: Not providing references or failing to ask them for permission can leave employers with unanswered questions.

-

Neglecting to Sign: Forgetting to sign the application can render it invalid. Always double-check for your signature before submitting.

Preview - Employment Application Pdf Form

|

|

APPLICATION FOR EMPLOYMENT |

|

|

||||||||||||

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PERSONAL INFORMATION |

|

|

|

|

|

|

|

DATE |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

LAST |

|

|||||

|

|

|

|

|

|

|

|

|

|

SOCIAL SECURITY |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

NAME |

|

|

|

|

|

|

|

|

NUMBER |

|

|

|||||

|

|

LAST |

FIRST |

|

|

|

MIDDLE |

|

|

|

|

|

|

|

||

PRESENT ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STREET |

CITY |

|

|

|

STATE |

ZIP |

|

|

||||||

PERMANENT ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STREET |

CITY |

|

|

|

STATE |

ZIP |

|

|

||||||

|

|

|

|

|

|

|

||||||||||

PHONE NO. |

ARE YOU 18 YEARS OR OLDER? |

|

Yes q |

No q |

|

|

||||||||||

ARE YOU PREVENTED FROM LAWFULLY BECOMING EMPLOYED |

|

|

|

|

|

|

|

|

|

|

|

|||||

IN THIS COUNTRY BECAUSE OF VISA OR IMMIGRATION STATUS? |

|

Yes q |

|

|

|

No q |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYMENT DESIRED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

DATE YOU |

|

|

|

|

SALARY |

|

|

|||||

POSITION |

|

|

CAN START |

|

|

|

|

DESIRED |

FIRST |

|

||||||

|

|

|

|

IF SO MAY WE INQUIRE |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||

ARE YOU EMPLOYED NOW? |

|

OF YOUR PRESENT EMPLOYER? |

|

|

||||||||||||

EVER APPLIED TO THIS COMPANY BEFORE? |

|

WHERE? |

|

|

|

|

WHEN? |

|

|

|||||||

REFERRED BY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EDUCATION |

|

|

|

|

*NO OF |

|

*DID YOU |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

NAME AND LOCATION OF SCHOOL |

|

YEARS |

|

|

|

SUBJECTS STUDIED |

|

|

|||||||

|

|

|

|

|

ATTENDED |

|

GRADUATE? |

|

|

|

|

|

|

|

||

GRAMMAR SCHOOL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MIDDLE |

|

HIGH SCHOOL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COLLEGE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TRADE, BUSINESS OR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CORRESPONDENCE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHOOL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GENERAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUBJECTS OF SPECIAL STUDY OR RESEARCH WORK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

SPECIAL SKILLS

ACTlVITIES: (CIVIC ATHLETIC ETC.)

EXCLUDE ORGANIZATIONS, THE NAME OF WHICH INDICATES THE RACE, CREED. SEX. AGE, MARITAL STATUS, COLOR OR NATION OF ORIGIN OF ITS MEMBERS.

U. S MILITARY OR |

|

PRESENT MEMBERSHIP IN |

NAVAL SERVICE |

RANK |

NATIONAL GUARD OR RESERVES |

*This form has been revised to comply with the provisions of the Americans with Disabilities Act and the fnal regulations and interpretive guidance promulgated by the EEOC on July 26. 1991.

TOPS FORM 3285 |

(CONTINUED ON OTHER SIDE) |

LITHO IN U.S.A. |

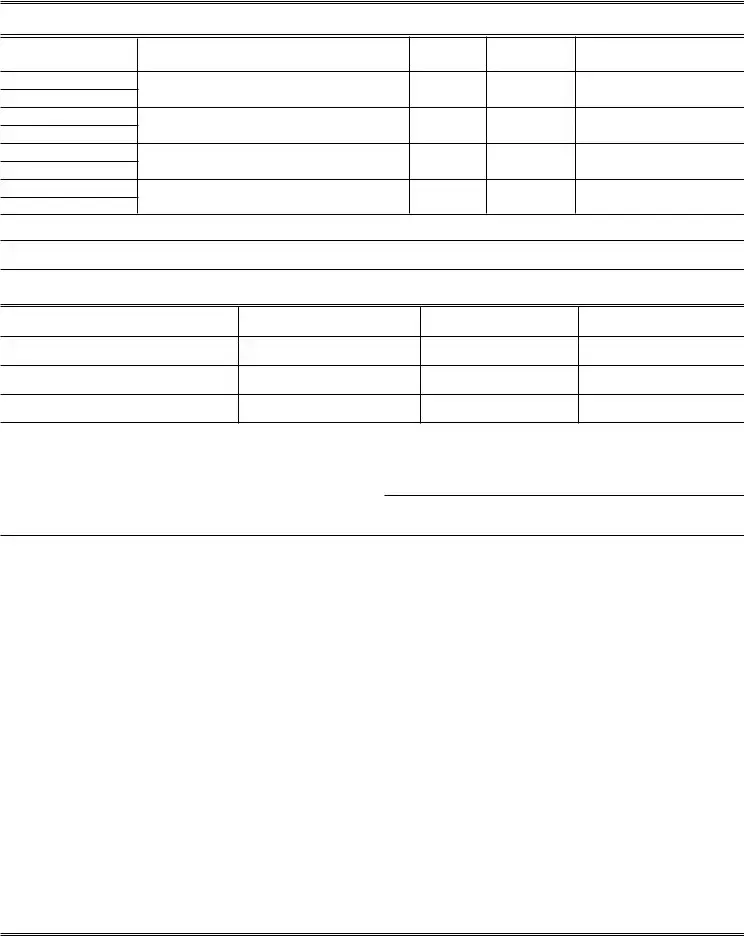

FORMER EMPLOYERS (LIST BELOW LAST THREE EMPLOYERS, STARTING WITH LAST ONE FIRST).

DATE |

NAME AND ADDRESS OF EMPLOYER |

SALARY POSITION REASON FOR LEAVING |

|

MONTH AND YEAR |

|||

|

|

FROM

TO

FROM

TO

FROM

TO

FROM

TO

WHICH OF THESE JOBS DlD YOU LIKE BEST?

WHAT DlD YOU LIKE MOST ABOUT THIS JOB?

REFERENCES: GIVE THE NAMES OF THREE PERSONS NOT RELATED TO YOU, WHOM YOU HAVE KNOWN AT LEAST ONE YEAR.

NAME |

ADDRESS |

BUSINESS |

YEARS |

|

ACQUAINTED |

||||

|

|

|

1

2

3

THE FOLLOWING STATEMENT APPLIES IN: MARYLAND & MASSACHUSETTS. [Fill in name of state.)

IT IS UNLAWFUL IN THE STATE OF ________________________ TO REQUIRE OR ADMINISTER A LIE DETECTOR TEST

AS A CONDITION OF EMPLOYMENT OR CONTINUED EMPLOYMENT. AN EMPLOYER WHO VIOLATES THIS LAW SHALL BE SUBJECT TO CRIMINAL PENALTIES AND CIVIL LIABILITY.

Signature of Applicant

IN CASE OF

EMERGENCY NOTIFY

NAME |

ADDRESS |

PHONE NO. |

"I CERTIFY THAT ALL THE INFORMATION SUBMITTED BY ME ON THIS APPLICATION IS TRUE AND COMPLETE, AND I UNDERSTAND THAT IF ANY FALSE INFORMATION, OMISSIONS, OR MISREPRESENTATIONS ARE DISCOVERED, MY APPLICATION MAY BE REJECTED AND, IF I AM EMPLOYED. MY EMPLOYMENT MAY BE TERMINATED AT ANY TIME.

IN CONSIDERATION OF MY EMPLOYMENT, I AGREE TO CONFORM TO THE COMPANY'S RULES AND REGULATIONS, AND I AGREE THAT MY EMPLOYMENT AND COMPENSATION CAN BE TERMINATED, WITH OR WITHOUT CAUSE. AND WITH OR WITHOUT NOTICE, AT ANY TIME, AT EITHER MY OR THE COMPANY'S OPTION. I ALSO UNDERSTAND AND AGREE THAT THE TERMS AND CONDITIONS OF MY EMPLOYMENT MAY BE CHANGED, WITH OR WITHOUT CAUSE, AND WITH OR WITHOUT NOTICE, AT ANY TIME BY THE COMPANY. I UNDERSTAND THAT NO COMPANY REPRESENTATIVE, OTHER THAN IT'S PRESIDENT, AND THEN ONLY WHEN IN WRONG AND SIGNED BY THE PRESIDENT, HAS ANY AUTHORITY TO ENTER INTO ANY AGREEMENT FOR EMPLOYMENT FOR ANY SPECIFIC PERIOD OF TIME, OR TO MAKE ANY AGREEMENT CONTRARY TO THE FOREGOING.

DATE |

SIGNATURE |

|

|

|

|

|

|

|

|

|

|

|

|

DO NOT WRITE BELOW THIS LINE |

|

INTERVIEWED BY: |

|

DATE: |

|

REMARKS: |

|

|

|

|

|

|

|

NEATNESS |

|

ABILITY |

|

HIRED: q Yes |

q No |

POSITION |

DEPT. |

SALARY/WAGE |

|

DATE REPORTING TO WORK |

|

APPROVED: |

1. |

2. |

3 |

|

EMPLOYMENT MANAGER |

DEPT. HEAD |

GENERAL MANAGER |

This form has been designed to strictly comply with State and Federal fair employment practice laws prohibiting employment discrimination. This Application for Employment Form is sold for general use throughout the United States. TOPS assumes no responsibility for the inclusion in said form of any questions which, when asked by the Employer of the Job Applicant, may violate State and/or Federal Law.

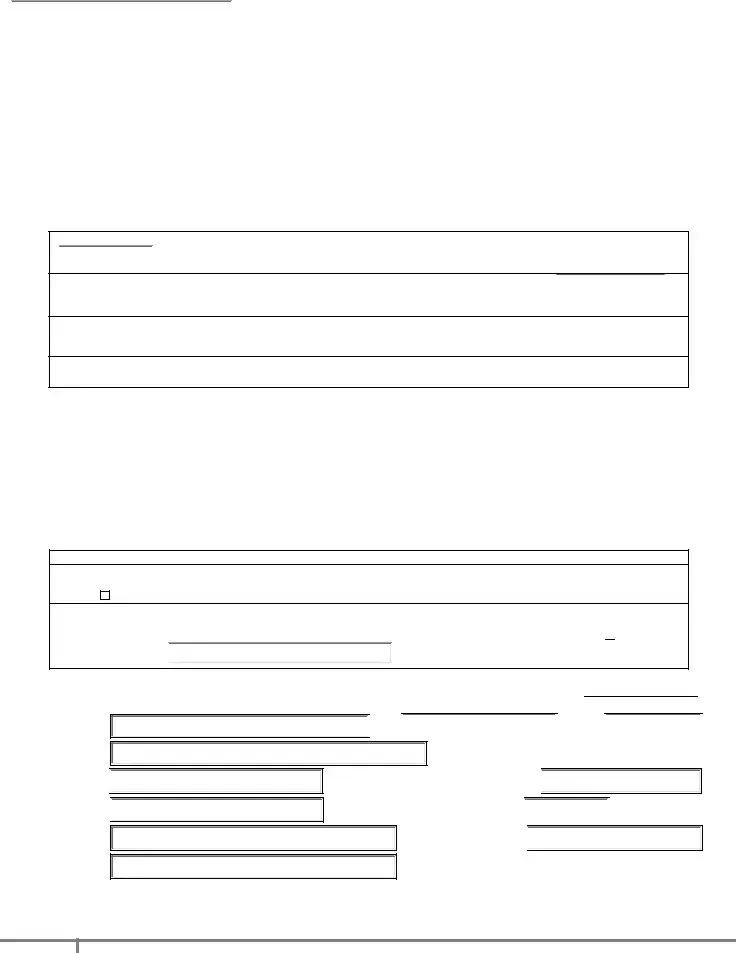

We welcome your application for employment at Southern Platte Fire Protection District (hereinafter referred to as the Company). We are proud that our success is the result of the quality and caliber of our employees. In pursuit of excellence, we require, as a condition of employment, all applicants must consent to and authorize a

The following information is used for identification

purposes in verifying background information.

Printed Name______________________ Date__________

Signature________________________________________

SS#____________________________________________

List any cities and states where you previously resided:

_________________________________________________

_________________________________________________

_________________________________________________

_________________________________________________

DISCLOSURE AND AUTHORIZATION [IMPORTANT

DISCLOSURE REGARDING BACKGROUND INVESTIGATION

(“the Company”) may obtain information about you for employment purposes from a third party consumer reporting agency. Thus, you may be the subject of a “consumer report” and/or an “investigative consumer report” which may include information about your character, general reputation, personal characteristics, and/or mode of living, and which can involve personal interviews with sources such as your neighbors, friends, or associates. These reports may contain information regarding your credit history, criminal history, social security number validation, motor vehicle records (“driving records”), verification of your education or employment history, or other background checks. Credit history will only be requested where such information is substantially related to the duties and responsibilities of the position for which you are applying. You have the right, upon written request made within a reasonable time, to request whether a consumer report has been requested and compiled about you, and disclosure of the nature and scope of any investigative consumer report and to request a copy of your report. Please be advised that the nature and scope of the most common form of investigative consumer report obtained with regard to applicants for employment is an investigation into your education and/or employment history conducted by Validity Screening Solutions, PO Box 860443, Shawnee, KS

(“the Company”) may obtain information about you for employment purposes from a third party consumer reporting agency. Thus, you may be the subject of a “consumer report” and/or an “investigative consumer report” which may include information about your character, general reputation, personal characteristics, and/or mode of living, and which can involve personal interviews with sources such as your neighbors, friends, or associates. These reports may contain information regarding your credit history, criminal history, social security number validation, motor vehicle records (“driving records”), verification of your education or employment history, or other background checks. Credit history will only be requested where such information is substantially related to the duties and responsibilities of the position for which you are applying. You have the right, upon written request made within a reasonable time, to request whether a consumer report has been requested and compiled about you, and disclosure of the nature and scope of any investigative consumer report and to request a copy of your report. Please be advised that the nature and scope of the most common form of investigative consumer report obtained with regard to applicants for employment is an investigation into your education and/or employment history conducted by Validity Screening Solutions, PO Box 860443, Shawnee, KS

New York and Maine applicants or employees only: You have the right to inspect and receive a copy of any investigative consumer report requested by

by contacting the consumer reporting agency identified above directly. You may also contact the Company to request the name, address and telephone number of the nearest unit of the consumer reporting agency designated to handle inquiries, which the Company shall provide within 5 days.

by contacting the consumer reporting agency identified above directly. You may also contact the Company to request the name, address and telephone number of the nearest unit of the consumer reporting agency designated to handle inquiries, which the Company shall provide within 5 days.

New York applicants or employees only: Upon request, you will be informed whether or not a consumer report was requested by  ,

, and if such report was requested, informed of the name and address of the consumer reporting agency that furnished the report. By signing below, you also acknowledge receipt of Article

and if such report was requested, informed of the name and address of the consumer reporting agency that furnished the report. By signing below, you also acknowledge receipt of Article

Oregon applicants or employees only: Information describing your rights under federal and Oregon law regarding consumer identity theft protection, the storage and disposal of your credit information, and remedies available should you suspect or find that the Company has not maintained secured records is available to you upon request.

Washington State applicants or employees only: You also have the right to request from the consumer reporting agency a written summary of your rights and remedies under the Washington Fair Credit Reporting Act.

ACKNOWLEDGMENT AND AUTHORIZATION

I acknowledge receipt of the DISCLOSURE REGARDING BACKGROUND INVESTIGATION and A SUMMARY OF YOUR RIGHTS UNDER THE FAIR CREDIT REPORTING ACT and certify that I have read and understand both of those documents. I hereby authorize the obtaining of “consumer reports” and/or “investigative consumer reports” by the Company at any time after receipt of this authorization and throughout my employment, if applicable. To this end, I hereby authorize, without reservation, any law enforcement agency, administrator, state or federal agency, institution, school or university (public or private), information service bureau, employer, or insurance company to furnish any and all background information requested by Validity Screening Solutions, PO Box 860443, Shawnee, KS

New York applicants or employees only: By signing below, you also acknowledge receipt of Article

Minnesota and Oklahoma applicants or employees only: Please check this box if you would like to receive a copy of a consumer report if one is obtained by the

Company. |

(Must include email address: |

|

) |

|

California applicants or employees only: By signing below, you also acknowledge receipt of the NOTICE REGARDING BACKGROUND INVESTIGATION PURSUANT TO CALIFORNIA LAW. Please check this box if you would like to receive a copy of an investigative consumer report or consumer credit report at no charge if one is obtained by the Company whenever you have a right to receive such a copy under California law. www.validityscreening.com/Site/PrivacyPolicy

(Must include email address:

)

Signature: |

|

Date: |

|

BACKGROUND INFORMATION |

|

Last Name

Other Names/Alias

Social Security # [1][2]

Driver’s License # [2]

Present Address

City/State/Zip

First

First

Middle

Middle

Date of Birth (mm/dd/yyyy) [1][2]

State of Driver’s License [2]

Telephone # (Primary)

[1]This information will be used for background screening purposes only and will not be used as hiring criteria.[2] In Utah, this information may only be collected a) when extending a conditional offer of employment or b) at the time the background report will be run.

3

V 1.0 (Issued: November 2012)

Para información en español, visite www.consumerfinance.gov/learnmore o escribe a la

Consumer Financial Protection Bureau, 1700 G Street N.W., Washington, DC 20552.

A Summary of Your Rights Under the Fair Credit Reporting Act

The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of information in the files of consumer reporting agencies. There are many types of consumer reporting agencies, including credit bureaus and specialty agencies (such as agencies that sell information about check writing histories, medical records, and rental history records). Here is a summary of your major rights under the FCRA. For more information, including information about additional rights, go to www.consumerfinance.gov/learnmore or write to: Consumer Financial Protection Bureau, 1700 G Street N.W., Washington, DC 20552.

•You must be told if information in your file has been used against you. Anyone who uses a credit report or another type of consumer report to deny your application for credit, insurance, or employment – or to take another adverse action against you – must tell you, and must give you the name, address, and phone number of the agency that provided the information.

•You have the right to know what is in your file. You may request and obtain all the information about you in the files of a consumer reporting agency (your “file disclosure”). You will be required to provide proper identification, which may include your Social Security number. In many cases, the disclosure will be free. You are entitled to a free file disclosure if:

•a person has taken adverse action against you because of information in your credit report;

•you are the victim of identity theft and place a fraud alert in your file;

•your file contains inaccurate information as a result of fraud;

•you are on public assistance;

•you are unemployed but expect to apply for employment within 60 days.

In addition, all consumers are entitled to one free disclosure every 12 months upon request from each nationwide credit bureau and from nationwide specialty consumer reporting agencies. See www.consumerfinance.gov/learnmore for additional information.

•You have the right to ask for a credit score. Credit scores are numerical summaries of your

•You have the right to dispute incomplete or inaccurate information. If you identify information in your file that is incomplete or inaccurate, and report it to the consumer reporting agency, the agency must investigate unless your dispute is frivolous. See www.consumerfinance.gov/learnmore for an explanation of dispute procedures.

•Consumer reporting agencies must correct or delete inaccurate, incomplete, or unverifiable information. Inaccurate, incomplete or unverifiable information must be removed or corrected, usually within 30 days. However, a consumer reporting agency may continue to report information it has verified as accurate.

•Consumer reporting agencies may not report outdated negative information. In most cases, a consumer reporting agency may not report negative information that is more than seven years old, or bankruptcies that are more than 10 years old.

•Access to your file is limited. A consumer reporting agency may provide information about you only to people with a valid need – usually to consider an application with a creditor, insurer, employer, landlord, or other business. The FCRA specifies those with a valid need for access.

•You must give your consent for reports to be provided to employers. A consumer reporting agency may not give out information about you to your employer, or a potential employer, without your written consent given to the employer. Written consent generally is not required in the trucking industry. For more information, go to www.consumerfinance.gov/learnmore.

•You may limit “prescreened” offers of credit and insurance you get based on information in your credit report. Unsolicited “prescreened” offers for credit and insurance must include a

•You may seek damages from violators. If a consumer reporting agency, or, in some cases, a user of consumer reports or a furnisher of information to a consumer reporting agency violates the FCRA, you may be able to sue in state or federal court.

•Identity theft victims and active duty military personnel have additional rights. For more information, visit www.consumerfinance.gov/learnmore.

States may enforce the FCRA, and many states have their own consumer reporting laws. In some cases, you may have more rights under state law. For more information, contact your state or local consumer protection agency or your state Attorney General. For information about your federal rights, contact:

TYPE OF BUSINESS: |

CONTACT: |

1.a. Banks, savings associations, and credit unions with total assets of |

a. Consumer Financial Protection Bureau |

over $10 billion and their affiliates. |

1700 G Street NW |

|

Washington, DC 20552 |

b. Such affiliates that are not banks, savings associations, or credit |

b. Federal Trade Commission: Consumer Response Center – FCRA |

unions also should list, in addition to the CFPB |

Washington, DC 20580 |

|

(877) |

2. To the extent not included in item 1 above: |

|

a. National banks, federal savings associations, and federal branches |

a. Office of the Comptroller of the Currency |

and federal agencies of foreign banks |

Customer Assistance Group |

|

1301 McKinney Street, Suite 3450 |

|

Houston, TX |

b. State member banks, branches and agencies of foreign banks (other |

b. Federal Reserve Consumer Help Center |

than federal branches, federal agencies, and Insured State Branches of |

P.O. Box 1200 |

Foreign Banks), commercial lending companies owned or controlled |

Minneapolis, MN 55480 |

by foreign banks, and organizations operating under section 25 or 25A |

|

of the Federal Reserve Act |

|

c. Nonmember Insured Banks, Insured State Branches of Foreign |

c. FDIC Consumer Response Center |

Banks, and insured state savings associations |

1100 Walnut Street, Box #11 |

|

Kansas City, MO 64106 |

d. Federal Credit Unions |

d. National Credit Union Administration |

|

Office of Consumer Protection (OCP) |

|

Division of Consumer Compliance and Outreach (DCCO) |

|

1775 Duke Street |

|

Alexandria, VA 22314 |

3. Air carriers |

Asst. General Counsel for Aviation Enforcement & Proceedings |

|

Aviation Consumer Protection Division |

|

Department of Transportation |

|

1200 New Jersey Avenue, S. E. |

|

Washington, DC 20590 |

4. Creditors Subject to Surface Transportation Board |

Office of Proceedings, Surface Transportation Board |

|

Department of Transportation |

|

395 E Street, S.W. |

|

Washington, DC 20423 |

5. Creditors Subject to Packers and Stockyards Act. 1921 |

Nearest Packers and Stockyards Administration area supervisor |

|

|

6. Small Business Investment Companies |

Associate Deputy Administrator for Capital Access |

|

United States Small Business Administration |

|

406 Third Street, SW, 8th Floor |

|

Washington, DC 20416 |

7. Brokers and Dealers |

Securities and Exchange Commission |

|

100 F St, N.E. |

|

Washington, DC 20549 |

8. Federal Land Banks, Federal Land Bank Associations, Federal |

Farm Credit Administration |

Intermediate Credit Banks, and Production Credit Associations |

1501 Farm Credit Drive |

|

McLean, VA |

9. Retailers, Finance Companies, and All Other Creditors Not Listed |

FTC Regional Office for region in which the creditor operates or |

Above |

Federal Trade Commission: Consumer Response Center – FCRA |

|

Washington, DC 20580 |

|

(877) |

(Updated: November 2012)

Para información en español, visite www.consumerfinance.gov/learnmore o escribe a la Consumer Financial Protection Bureau, 1700 G Street N.W., Washington, DC 20552.

Remedying the Effects of Identity Theft

You are receiving this information because you have notified a consumer reporting agency that you believe you are a victim of identity theft. Identity theft occurs when someone uses your name, Social Security number, date of birth, or other identifying information, without authority, to commit fraud. For example, someone may have committed identity theft by using your personal information to open a credit card account or get a loan in your name. For more information, visit www.consumerfinance.gov/learnmore or write to: Consumer Financial Protection Bureau, 1700 G Street N.W., Washington, DC 20552.

The Fair Credit Reporting Act (FCRA) gives you specific rights when you are, or believe that you are, the victim of identity theft. Here is a brief summary of the rights designed to help you recover from identity theft.

1.You have the right to ask that nationwide consumer reporting agencies place “fraud alerts” in your file to let potential creditors and others know that you may be a victim of identity theft. A fraud alert can make it more difficult for someone to get credit in your name because it tells creditors to follow certain procedures to protect you. It also may delay your ability to obtain credit. You may place a fraud alert in your file by calling just one of the three nationwide consumer reporting agencies. As soon as that agency processes your fraud alert, it will notify the other two, which then also must place fraud alerts in your file.

•Equifax: 1.888.766.0008; www.equifax.com

•Experian: 1.888.397.3742; www.experian.com

•TransUnion: 1.800.680.7289; www.transunion.com

An initial fraud alert stays in your file for at least 90 days. An extended alert stays in your file for seven years. To place either of these alerts, a consumer reporting agency will require you to provide appropriate proof of your identity, which may include your Social Security number. If you ask for an extended alert, you will have to provide an identity theft report. An identity theft report includes a copy of a report you have filed with a federal, state, or local law enforcement agency, and additional information a consumer reporting agency may require you to submit. For more detailed information about the identify theft report, visit www.consumerfinance.gov/learnmore.

2.You have the right to free copies of the information in your file (your “file disclosure”). An initial fraud alert entitles you to a copy of all the information in your file at each of the three nationwide agencies, and an extended alert entitles you to two free file disclosures in a 12- month period following the placing of the alert. These additional disclosures may help you detect signs of fraud, for example, whether fraudulent accounts have been opened in your name or whether someone has reported a change in your address. Once a year, you also have

the right to a free copy of the information in your file at any consumer reporting agency, if you believe it has inaccurate information due to fraud, such as identity theft. You also have the ability to obtain additional free file disclosures under other provisions of the FCRA. See www.consumerfinance.gov/learnmore.

3.You have the right to obtain documents relating to fraudulent transactions made or accounts opened using your personal information. A creditor or other business must give you copies of applications and other business records relating to transactions and accounts that resulted from the theft of your identity, if you ask for them in writing. A business may ask you for proof of your identity, a police report, and an affidavit before giving you the documents. It may also specify an address for you to send your request. Under certain circumstances, a business can refuse to provide you with these documents. See www.consumerfinance.gov/learnmore.

4.You have the right to obtain information from a debt collector. If you ask, a debt collector must provide you with certain information about the debt you believe was incurred in your name by an identity thief – like the name of the creditor and the amount of the debt.

5.If you believe information in your file results from identity theft, you have the right to ask that a consumer reporting agency block that information from your file. An identity thief may run up bills in your name and not pay them. Information about the unpaid bills may appear on your consumer report. Should you decide to ask a consumer reporting agency to block the reporting of this information, you must identify the information to block, and provide the consumer reporting agency with proof of your identity and a copy of your identity theft report. The consumer reporting agency can refuse or cancel your request for a block if, for example, you don’t provide the necessary documentation, or where the block results from an error or a material misrepresentation of fact made by you. If the agency declines or rescinds the block, it must notify you. Once a debt resulting from identity theft has been blocked, a person or business with notice of the block may not sell, transfer, or place the debt for collection.

6.You also may prevent businesses from reporting information about you to consumer reporting agencies if you believe the information is the result of identity theft. To do so, you must send your request to the address specified by the business that reports the information to the consumer reporting agency. The business will expect you to identify what information you do not want reported and to provide an identity theft report.

To learn more about identity theft and how to deal with its consequences, visit www.consumerfinance.gov/learnmore, or write to the Consumer Financial Protection Bureau. You may have additional rights under state law. For more information, contact your local consumer protection agency or your state Attorney General.

In addition to the new rights and procedures to help consumers deal with the effects of identity theft, the FCRA has many other important consumer protections. They are described in more detail at www.consumerfinance.gov/learnmore.

(Updated: November 2012)

Other PDF Templates

Social Security Medicare - This form plays a significant role in ensuring accurate claims are processed by Medicare.

Social Security Pdf - The SS-5 is the key to establishing your Social Security record.

For a thorough understanding of the hiring process, employers can refer to the detailed Employment verification form provided to ensure a smooth verification process.

Training Plan for Stem Opt Students - This form is a critical component in maintaining legal status under the OPT program.

Documents used along the form

When applying for a job, candidates often need to submit various documents alongside the Employment Application PDF form. Each of these documents serves a specific purpose in the hiring process and helps employers assess the qualifications and fit of potential employees.

- Resume: A resume provides a summary of a candidate’s work experience, education, skills, and achievements. It highlights relevant qualifications and gives employers a snapshot of the applicant's professional background.

- Cover Letter: This document accompanies the resume and allows candidates to express their interest in the position. A well-crafted cover letter explains why the applicant is a good fit for the role and can showcase personality and motivation.

- Last Will and Testament: To ensure your assets are distributed according to your wishes, consult the essential guide for creating a Last Will and Testament that outlines your preferences clearly.

- References List: A references list includes names and contact information of individuals who can vouch for the candidate’s work ethic and skills. These references may be former employers, colleagues, or mentors who can provide insight into the applicant's capabilities.

- Portfolio: For creative positions, a portfolio is essential. It contains samples of previous work, such as designs, writing, or projects, demonstrating the candidate’s skills and style to potential employers.

- Background Check Authorization: This form allows the employer to conduct a background check on the candidate. It typically includes consent for checking criminal history, credit reports, or other relevant information that may affect hiring decisions.

- Employment Verification Form: This document is used to confirm a candidate’s previous employment history. It often requires the applicant to provide details about past jobs, including dates of employment and job titles, which can be verified by the employer.

Submitting these documents alongside the Employment Application PDF form can enhance a candidate's chances of making a positive impression during the hiring process. Each piece of information contributes to a comprehensive view of the applicant, helping employers make informed decisions.

Similar forms

The resume serves as a summary of a job candidate's professional experience, education, and skills. Like the Employment Application PDF form, a resume is often the first document employers review. Both documents aim to present the candidate in the best light, highlighting relevant qualifications. While the Employment Application is typically more structured, requiring specific information, a resume allows for more creativity in presentation. However, both documents ultimately seek to convince the employer of the candidate's suitability for the position.

The cover letter complements the resume and Employment Application by providing a personalized introduction. It allows candidates to express their interest in a specific position and explain why they are a good fit. Similar to the Employment Application, the cover letter often addresses the employer directly and outlines key qualifications. However, it offers a narrative style that can convey personality and enthusiasm, which is less common in the other two documents.

The reference list is another essential document that shares similarities with the Employment Application. Both require the candidate to provide information about individuals who can vouch for their skills and character. While the Employment Application may ask for references directly, a separate reference list typically includes names, contact information, and the relationship to the candidate. This document serves to reinforce the claims made in the application and resume.

An interview questionnaire often accompanies the Employment Application process. This document may be provided to candidates prior to an interview, asking them to prepare answers to specific questions. Like the Employment Application, it seeks to gather information about the candidate's background and qualifications. However, the interview questionnaire allows for a more conversational approach, as it often includes open-ended questions that encourage candidates to elaborate on their experiences.

Understanding the importance of documentation in shipping is essential, and one such critical form is the FedEx Bill of Lading. This form serves as a vital shipping document that outlines the details of a freight shipment, establishing the carrier's responsibility for the goods while capturing important information about both the shipper and the recipient. For more insights into this pivotal document, visit Top Forms Online, where you can find further details on its proper completion and significance in ensuring a seamless shipping process with FedEx.

The background check authorization form is crucial in the hiring process, similar to the Employment Application. This document grants permission for employers to investigate a candidate's history, including criminal records and employment verification. Both forms aim to ensure that the candidate is trustworthy and qualified for the position. While the Employment Application collects personal information, the background check authorization focuses on verifying the accuracy of that information.

The job description is another document that aligns with the Employment Application. It outlines the responsibilities and qualifications required for a specific position. Candidates often use the job description to tailor their Employment Application, ensuring that they highlight relevant skills and experiences. Both documents work together to create a clear understanding of what the employer seeks and what the candidate offers.

The onboarding paperwork, which includes various forms and documents completed after a job offer is accepted, also relates to the Employment Application. This paperwork often includes tax forms, direct deposit information, and benefits enrollment. While the Employment Application is focused on the candidate's qualifications, the onboarding paperwork is about transitioning the candidate into an employee. Both sets of documents are essential for establishing a successful employment relationship.

Dos and Don'ts

When filling out the Employment Application PDF form, there are several best practices to follow and some common mistakes to avoid. Here’s a helpful list to guide you through the process:

- Do: Read the entire application carefully before starting.

- Do: Use clear and legible handwriting or type your responses if the form allows.

- Do: Provide accurate and truthful information throughout the application.

- Do: Double-check for spelling and grammatical errors before submitting.

- Do: Include all relevant work experience and skills that relate to the job.

- Do: Sign and date the application where required.

- Do: Keep a copy of the completed application for your records.

- Don't: Leave any required fields blank; fill them in or indicate "N/A" if not applicable.

- Don't: Use abbreviations or slang that may confuse the reader.

- Don't: Provide false information, as this can lead to disqualification.

- Don't: Rush through the application; take your time to ensure accuracy.

- Don't: Forget to review the application for completeness before submission.

- Don't: Submit the application without checking the submission guidelines.

- Don't: Ignore any additional documents or information requested in the application.

Key takeaways

Filling out the Employment Application PDF form correctly is crucial for presenting yourself as a strong candidate. Here are key takeaways to keep in mind:

- Ensure all sections of the form are completed. Incomplete applications may be disregarded.

- Use clear and concise language. Avoid jargon or overly complex terms.

- Double-check your contact information. Accurate details help employers reach you easily.

- Provide specific examples of your skills and experiences. Tailor your responses to the job you are applying for.

- Be honest about your work history. Misrepresenting your experience can lead to disqualification.

- Review the form for spelling and grammatical errors. A polished application reflects your attention to detail.

- Sign and date the application. An unsigned form may not be considered valid.

- Keep a copy of your completed application for your records. This can be useful for future interviews.

- Follow any additional instructions provided by the employer. Adhering to guidelines shows your ability to follow directions.

By keeping these points in mind, you can enhance your chances of making a positive impression on potential employers.

How to Use Employment Application Pdf

When you are ready to apply for a job, completing the Employment Application form is an important step. This form helps employers gather essential information about you, your skills, and your work history. Below are the steps to ensure you fill out the form accurately and completely.

- Start by downloading the Employment Application PDF form from the employer's website or the provided link.

- Open the PDF using a compatible reader. Ensure that you can edit the document if required.

- Begin with your personal information. Fill in your full name, address, phone number, and email address in the designated fields.

- Next, provide your employment history. List your previous jobs in reverse chronological order, including the company name, job title, dates of employment, and a brief description of your responsibilities.

- Include your education details. Enter the names of the schools you attended, the degrees you obtained, and the years you graduated.

- Fill out any additional sections that may ask for references. Provide the names and contact information of individuals who can speak to your qualifications and character.

- Review the form for any errors or missing information. Ensure that all sections are completed to the best of your ability.

- Save the completed form on your device. Consider renaming the file to include your name for easy identification.

- Finally, submit the application according to the employer’s instructions, whether by email, online upload, or physical delivery.

Following these steps will help you complete the Employment Application form efficiently. Take your time to ensure that all information is accurate, as this reflects your attention to detail and professionalism.