Fill Out a Valid Erc Broker Market Analysis Form

The Worldwide ERC® Broker’s Market Analysis and Strategy Report serves as a vital tool for real estate brokers seeking to provide a thorough evaluation of a property's market position. This comprehensive form facilitates an in-depth analysis of the subject property's condition, competitive landscape, and anticipated marketability, ultimately guiding brokers in estimating the Most Likely Sales Price (MLSP). It is important to note that this report is not intended to serve as a home inspection or appraisal, and it does not adhere to the Uniform Standards of Professional Appraisal Practice. Brokers must also be mindful of state-specific disclosure requirements when utilizing this form. The report outlines procedural guidelines for contacting homeowners, inspecting properties, and submitting findings, ensuring that all necessary information is collected efficiently. Additionally, it includes sections for detailed property descriptions, improvements made, and any relevant locational issues that may impact the property's insurability and value. By systematically addressing these elements, the Broker’s Market Analysis form empowers real estate professionals to make informed decisions and provide clients with accurate assessments of their properties.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to significant gaps in the analysis. This includes missing details about the property’s condition, improvements made, or the homeowner's purchase price.

-

Ignoring State-Specific Requirements: Each state has unique disclosure laws. Not being aware of these requirements can result in legal issues. It's crucial to include any necessary disclosures relevant to the property.

-

Misunderstanding the Purpose of the Form: This form is not an appraisal or a home inspection. Confusing it with these processes can lead to inaccurate assessments of the property's value and condition.

-

Neglecting to Document Market Conditions: Failing to provide insights on local market trends can hinder the accuracy of the Most Likely Sales Price. It's important to include data on comparable sales and market activity.

Preview - Erc Broker Market Analysis Form

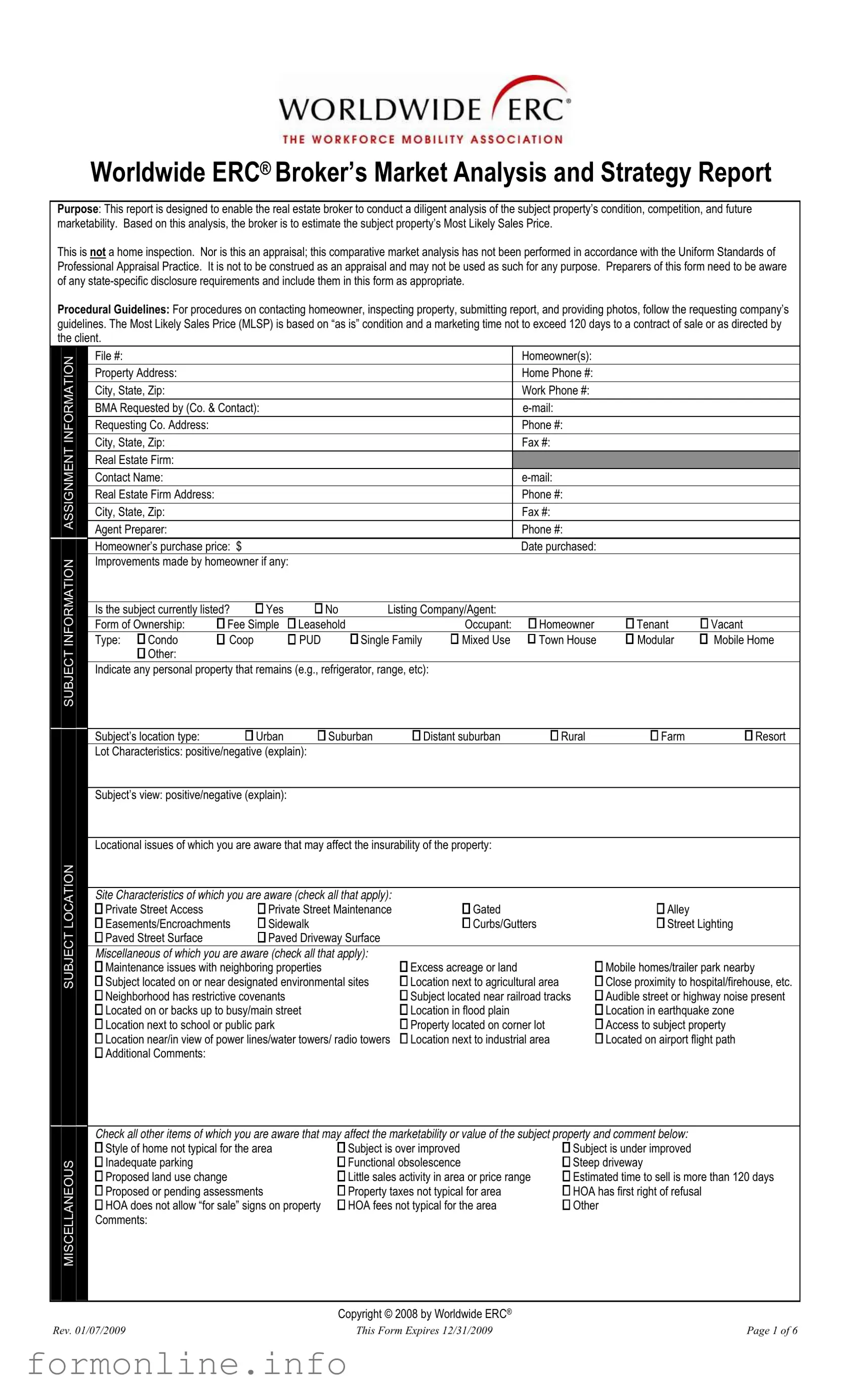

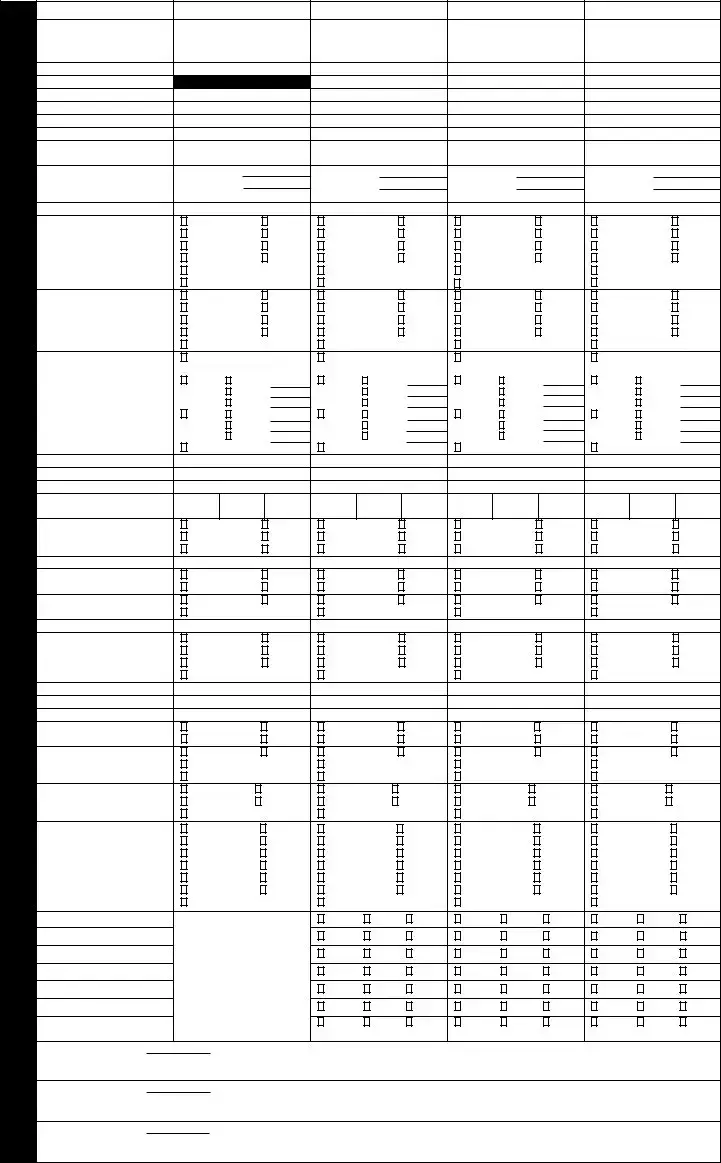

Worldwide ERC® Broker’s Market Analysis and Strategy Report

Purpose: This report is designed to enable the real estate broker to conduct a diligent analysis of the subject property’s condition, competition, and future marketability. Based on this analysis, the broker is to estimate the subject property’s Most Likely Sales Price.

This is not a home inspection. Nor is this an appraisal; this comparative market analysis has not been performed in accordance with the Uniform Standards of Professional Appraisal Practice. It is not to be construed as an appraisal and may not be used as such for any purpose. Preparers of this form need to be aware of any

Procedural Guidelines: For procedures on contacting homeowner, inspecting property, submitting report, and providing photos, follow the requesting company’s guidelines. The Most Likely Sales Price (MLSP) is based on “as is” condition and a marketing time not to exceed 120 days to a contract of sale or as directed by the client.

|

INFORMATION |

|

File #: |

|

|

|

|

|

|

|

Homeowner(s): |

|

|

|

|

|

Property Address: |

|

|

|

|

|

|

|

Home Phone #: |

|

|

||

|

|

City, State, Zip: |

|

|

|

|

|

|

|

Work Phone #: |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

BMA Requested by (Co. & Contact): |

|

|

|

|

|

|

|

|||||

|

|

Requesting Co. Address: |

|

|

|

|

|

|

|

Phone #: |

|

|

||

|

|

City, State, Zip: |

|

|

|

|

|

|

|

Fax #: |

|

|

||

|

ASSIGNMENT |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Real Estate Firm: |

|

|

|

|

|

|

|

|

|

|

||

|

|

Contact Name: |

|

|

|

|

|

|

|

|

|

|||

|

|

Real Estate Firm Address: |

|

|

|

|

|

|

|

Phone #: |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

City, State, Zip: |

|

|

|

|

|

|

|

Fax #: |

|

|

||

|

|

Agent Preparer: |

|

|

|

|

|

|

|

Phone #: |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Homeowner’s purchase price: $ |

|

|

|

|

|

|

Date purchased: |

|

|

|

|

INFORMATION |

|

|

Improvements made by homeowner if any: |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Is the subject currently listed? |

□ Yes |

□ No |

|

Listing Company/Agent: |

|

|

|

|

|||

|

|

|

Form of Ownership: |

□ Fee Simple |

□ Leasehold |

|

|

Occupant: |

|

□ Homeowner |

□ Tenant |

□ Vacant |

||

|

|

|

Type: □ Condo |

Coop |

PUD |

Single Family |

Mixed Use |

|

Town House |

Modular |

Mobile Home |

|||

|

SUBJECT |

|

|

□ Other: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Indicate any personal property that remains (e.g., refrigerator, range, etc): |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Subject’s location type: |

|

□ Urban |

□ Suburban |

□ Distant suburban |

|

□ Rural |

□ Farm |

□ Resort |

||

|

|

|

|

Lot Characteristics: positive/negative (explain): |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Subject’s view: positive/negative (explain): |

|

|

|

|

|

|

|

|

||

Locational issues OF WHICH you are aware that may affect the insurability of the property:

LOCATION |

Site Characteristics of which you are aware (check all that apply): |

|

|

|

□ Private Street Access |

□ Private Street Maintenance |

□ Gated |

□ Alley |

|

□ Easements/Encroachments |

□ Sidewalk |

□ Curbs/Gutters |

□ Street Lighting |

|

SUBJECT |

□ Paved Street Surface |

□ Paved Driveway Surface |

|

|

Miscellaneous of which you are aware (check all that apply): |

|

|

||

□ Maintenance issues with neighboring properties |

□ Excess acreage or land |

□ Mobile homes/trailer park nearby |

||

□ Subject located on or near designated environmental sites |

□ Location next to agricultural area |

□ Close proximity to hospital/firehouse, etc. |

||

|

□ Neighborhood has restrictive covenants |

□ Subject located near railroad tracks |

□ Audible street or highway noise present |

|

|

□ Located on or backs up to busy/main street |

□ Location in flood plain |

□ Location in earthquake zone |

|

|

□ Location next to school or public park |

□ Property located on corner lot |

□ Access to subject property |

|

|

□ Location near/in view of power lines/water towers/ radio towers |

□ Location next to industrial area |

□ Located on airport flight path |

|

|

□ Additional Comments: |

|

|

|

Check all other items of which you are aware that may affect the marketability or value of the subject property and comment below:

|

□ Style of home not typical for the area |

□ Subject is over improved |

□ Subject is under improved |

MISCELLANEOUS |

□ Inadequate parking |

□ Functional obsolescence |

□ Steep driveway |

□ Proposed land use change |

□ Little sales activity in area or price range |

□ Estimated time to sell is more than 120 days |

|

□ Proposed or pending assessments |

□ Property taxes not typical for area |

□ HOA has first right of refusal |

|

□ HOA does not allow “for sale” signs on property |

□ HOA fees not typical for the area |

□ Other |

|

Comments: |

|

|

|

|

|

|

Copyright © 2008 by Worldwide ERC®

Rev. 01/07/2009 |

This Form Expires 12/31/2009 |

Page 1 of 6 |

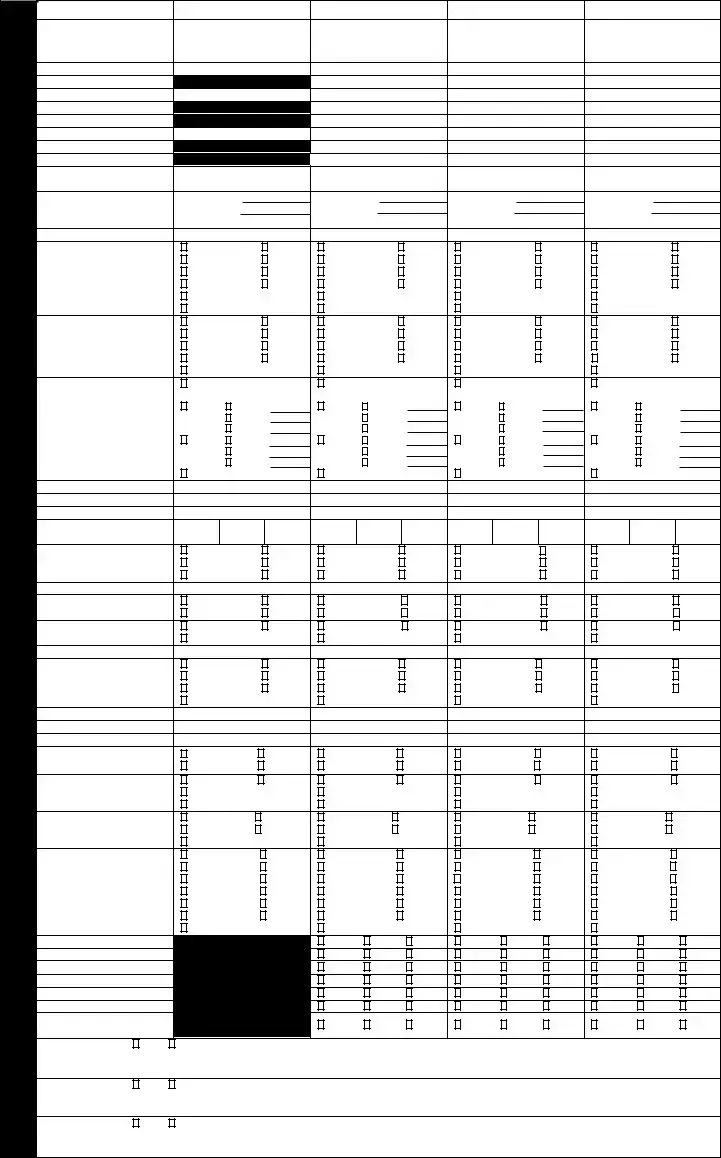

SUBJECT CONDITION

INSPECTIONS/DISCLOSURES

Property Condition

For all the following of which you are aware or observe in viewing the property, check the appropriate box(es) and describe:

□Décor of home is personalized or dated:

□Incomplete construction:

□Evidence of past or present water damage:

□Cracks or stains on walls, floors, or ceilings:

□Oil tank (abandoned):

□Oil tank (in use):

□Underground storage tank (abandoned):

□Underground storage tank (in use):

□Synthetic stucco:

□Suspected structural problems:

□Evidence of odor:

□Evidence of pet damage:

□Evidence of deferred maintenance: Additional Comments:

Recommended Repairs and Improvements |

|

|

|

Interior Items |

|

|

R&I Estimates |

□ Paint |

Estimated cost per item: $ |

Comment: |

|

□ Flooring |

Estimated cost per item: $ |

Comment: |

|

□ Wall paper removal |

Estimated cost per item: $ |

Comment: |

|

□ Appliances |

Estimated cost per item: $ |

Comment: |

|

□ Cabinets |

Estimated cost per item: $ |

Comment: |

|

□ Light fixtures |

Estimated cost per item: $ |

Comment: |

|

□ Countertops |

Estimated cost per item: $ |

Comment: |

|

□ Bathroom fixtures |

Estimated cost per item: $ |

Comment: |

|

□ Other: |

Estimated cost per item: $ |

Comment: |

|

□ Other: |

Estimated cost per item: $ |

Comment: |

|

□ Other: |

Estimated cost per item: $ |

Comment: |

|

Total Estimated Cost for Interior Repairs |

$ |

||

|

|

|

|

Exterior Items |

|

|

R&I Estimates |

□ Landscaping |

Estimated cost per item: $ |

Comment: |

|

□ Paint |

Estimated cost per item: $ |

Comment: |

|

□ Driveway/walkway |

Estimated cost per item: $ |

Comment: |

|

□ Porch/deck |

Estimated cost per item: $ |

Comment: |

|

□ Pool |

Estimated cost per item: $ |

Comment: |

|

□ Spa |

Estimated cost per item :$ |

Comment: |

|

□ Gutters |

Estimated cost per item: $ |

Comment: |

|

□ Siding |

Estimated cost per item: $ |

Comment: |

|

□ Trim |

Estimated cost per item: $ |

Comment: |

|

□ Roof |

Estimated cost per item: $ |

Comment: |

|

□ Detached structures |

Estimated cost per item: $ |

Comment: |

|

□ Debris removal |

Estimated cost per item: $ |

Comment: |

|

□ Windows and screens |

Estimated cost per item: $ |

Comment: |

|

□ Other: |

Estimated cost per item: $ |

Comment: |

|

□ Other: |

Estimated cost per item: $ |

Comment: |

|

□ Other: |

Estimated cost per item: $ |

Comment: |

|

Total Estimated Cost for Exterior RepairS |

$ |

|

|

List all required, customary and additionally recommended inspections (e.g., municipal, certificate of occupancy, environmental, etc.): Required:

Customary:

Additionally recommended for the subject property:

Subject property issues OF WHICH you are aware that may affect insurability of the subject property:

List all required disclosures:

Copyright © 2008 by Worldwide ERC®

Rev. 01/07/2009 |

This Form Expires 12/31/2009 |

Page 2 of 6 |

|

|

Identify the most probable means of financing for the subject: |

□ FHA |

□ VA |

□ Cash |

□ Conventional |

|||||||||||||||||||||||

|

|

□ Other: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Describe the terms of the financing type identified above: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Identify and describe any financing concessions that may be necessary to secure the sale of the subject property. |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

□ Points: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

□ Closing Costs: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

□ Other: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

FINANCING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Do you anticipate any issues that may affect the ability to secure financing for the subject property (e.g., condition, zoning, environmental, HOA, etc.)? |

||||||||||||||||||||||||||||

|

□ Yes □ No |

If yes, comment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

If the subject property is a common interest development (e.g., condo, townhouse, PUD), what is the ratio of owners to investors? |

|

□ N/A |

|

|

|

|

|||||||||||||||||||||

|

|

Owners: |

% |

Investors: |

% |

(total MUST equal 100%) |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HOA Fees: $ |

|

|

|

|

How often are they paid? |

|

□ Monthly |

□ Quarterly |

|

□ |

□ Annually |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Items included in HOA Fees: □ Trash |

|

|

|

|

□ Landscaping |

□ Snow Removal |

□ Exterior Building Maintenance |

||||||||||||||||||||

|

|

|

|

|

|

|

|

□ Security/Concierge Services |

□ Insurance |

□ Taxes |

|

□ Amenities |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

□ Common Area Maintenance |

WATER |

|

|

SEWER |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

□ Other: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Are you aware of any special assessments covered by the HOA? |

□ Yes |

□ No |

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

If yes, indicate the amount of assessment: $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

Describe what the special assessment covers: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

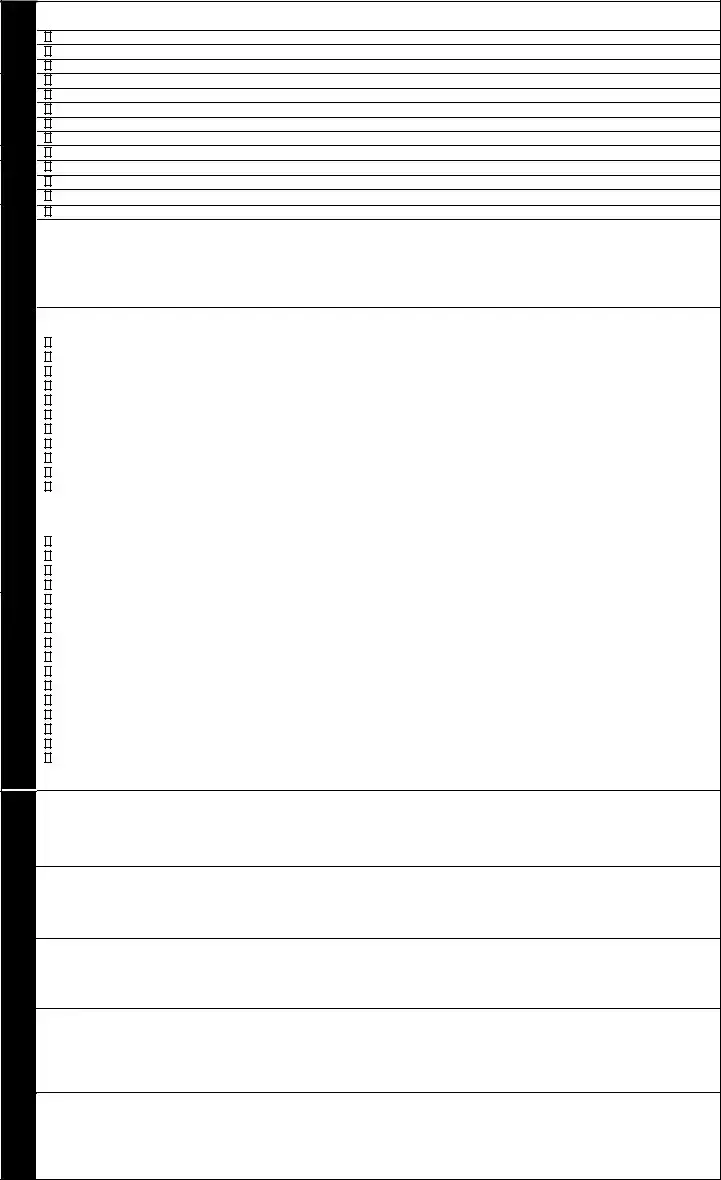

Subject Neighborhood (For purposes of this report, the subject neighborhood is defined by the preparer of this form. Identify what you regard as the |

|||||||||||||||||||||||||||

|

|

subject neighborhood and then use statistics that you have gathered which reflect that market area. Note: the neighborhood might be a MLS area, a |

|||||||||||||||||||||||||||

|

|

particular section of a town, a specific subdivision, or an entire community. This is described as the “micro area.”) |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

Subject neighborhood is defined as: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Price Range: $ |

|

|

|

|

|

|

to $ |

|

|

|

|

|

|

|

Property Values are: □ Increasing |

% in past |

|

months |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

□ Stable |

|

|

|

|

|

|

|

||

|

|

Average |

|

|

|

days |

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

□ Decreasing |

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

(# of days) |

|

|

|

|

|

% in past |

months |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calculate the months supply of inventory (Absorption Rate): |

|

|

|

Type of competing listings |

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Homes |

|

|

|

|

|

|

% |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Resale |

|

|

|

|

|

|

% |

|

||

|

|

Number of active listings ÷ |

Avg. number of sales per month |

= |

Number of months needed |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

REO/Foreclosure |

|

|

|

|

|

% |

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

for the last 6 months |

|

|

|

|

to sell existing inventory |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate |

|

|

|

|

|

|

% |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total (MUST equal 100%) |

|

|

|

|

|

100% |

|

|||

|

|

Describe all marketing concessions/incentives being offered to buyers and/or brokers on competing properties: |

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

CONDITIONS |

|

Recommend any marketing concessions/incentives that should be offered for the subject: |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MARKET |

|

Describe major corporation(s) in this neighborhood that are moving into, out of, or planning layoffs: |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

Describe current economic conditions (positive or negative) that may have an Effect on the marketability of the property: |

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

Broader Market Area (For purposes of this report, the broader market area is defined as that area beyond the subject neighborhood in which buyers will |

|||||||||||||||||||||||||||

|

|

look for comparable properties. This is described as the “macro area.” In some instances, the broader market area will be the same as the subject’s |

|||||||||||||||||||||||||||

|

|

neighborhood. If this is the case, indicate it below.) |

What do you consider the “broader market area” to be for this property? |

|

|

|

|

|

|

||||||||||||||||||||

Are there any specific issues in the broader market area which are not reflected in the specific neighborhood that might affect the sale of the subject property? Consider types of competing homes (e.g., new construction, REO’s); incentives or concessions that are occurring; economic conditions; a dramatically different price range than the subject; days on market; etc.

Copyright © 2008 by Worldwide ERC®

Rev. 01/07/2009 |

This Form Expire 12/31/2009 |

Page 3 of 6 |

COMPETING LISTINGS

ITEM |

SUBJECT |

Competing Listing #1 |

Competing Listing #2 |

Competing Listing #3 |

||||||||||||

Address, City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current MLS # |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proximity to Subject |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Original List Price |

$ |

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

|

Current List Price |

$ |

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

|

Seller Concessions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last Price Change Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

from original list date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Previous listing history for last |

Orig. List Price $ |

|

Orig. List Price $ |

|

Orig. List Price $ |

|

Orig. List Price $ |

|

||||||||

Last List Price $ |

|

Last List Price |

$ |

|

Last List Price |

$ |

|

Last List Price |

$ |

|

||||||

12 months |

|

|

|

|

||||||||||||

DOM: |

|

|

DOM: |

|

|

|

DOM: |

|

|

|

DOM: |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Style |

□ Brick |

|

□ Wood |

□ Brick |

|

|

□ Wood |

□ Brick |

|

|

□ Wood |

□ Brick |

|

|

□ Wood |

|

|

|

|

|

|

|

|

|

|||||||||

|

□ Composite |

□ Stone |

□ Composite |

|

□ Stone |

□ Composite |

|

□ Stone |

□ Composite |

|

□ Stone |

|||||

Exterior Finish |

□ Aluminum |

□ Stucco |

□ Aluminum |

|

□ Stucco |

□ Aluminum |

|

□ Stucco |

□ Aluminum |

|

□ Stucco |

|||||

(Check all that apply) |

□ Synthetic Stucco |

□ Vinyl |

□ Synthetic Stucco |

□ Vinyl |

□ Synthetic Stucco |

□ Vinyl |

□ Synthetic Stucco |

□ Vinyl |

||||||||

|

□ Hardcoat Stucco |

|

□ Hardcoat Stucco |

|

□ Hardcoat Stucco |

|

□ Hardcoat Stucco |

|

||||||||

|

□ Other: |

|

|

□ Other: |

|

|

|

□ Other: |

|

|

|

□ Other: |

|

|

|

|

|

□ Composite |

□ Slate |

□ Composite |

|

□ Slate |

□ Composite |

|

□ Slate |

□ Composite |

|

□ Slate |

|||||

Roof Type |

□ Tar |

|

□ Tile |

□ Tar |

|

|

□ Tile |

□ Tar |

|

|

□ Tile |

□ Tar |

|

|

□ Tile |

|

□ Wood shake |

□ Tin |

□ Wood shake |

|

□ Tin |

□ Wood shake |

|

□ Tin |

□ Wood shake |

|

□ Tin |

||||||

(Check all that apply) |

|

|

|

|||||||||||||

□ Asphalt shingle |

□ Copper |

□ Asphalt shingle |

□ Copper |

□ Asphalt shingle |

□ Copper |

□ Asphalt shingle |

□ Copper |

|||||||||

|

||||||||||||||||

|

□ Other: |

|

|

□ Other: |

|

|

|

□ Other: |

|

|

|

□ Other: |

|

|

|

|

|

□ None |

|

|

□ None |

|

|

|

□ None |

|

|

|

□ None |

|

|

|

|

|

□ Garage |

|

# of Cars |

□ Garage |

|

|

# of Cars |

□ Garage |

|

|

# of Cars |

□ Garage |

|

|

# of Cars |

|

|

□ Attached |

□ Attached |

□ Attached |

□ Attached |

||||||||||||

Car Storage/Type |

|

□ Detached |

|

□ Detached |

|

□ Detached |

|

□ Detached |

||||||||

|

□ |

|

□ |

|

|

□ |

|

|

□ |

|

||||||

(Check all that apply) |

□ Carport |

□ Carport |

|

□ Carport |

|

□ Carport |

|

|||||||||

□ Attached |

□ Attached |

□ Attached |

□ Attached |

|||||||||||||

|

|

□ Detached |

|

□ Detached |

|

□ Detached |

|

□ Detached |

||||||||

|

□ Other: |

□ |

□ Other: |

□ |

|

□ Other: |

□ |

|

□ Other: |

□ |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Year Built |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lot Size |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Appx. Gross Living Area |

|

|

Sq. Ft |

|

|

|

Sq. Ft |

|

|

|

Sq. Ft |

|

|

|

Sq. Ft |

|

Above Grade Room Count |

Tot |

Brms. |

Baths |

Tot. |

Brms. |

Baths |

Tot. |

Brms. |

Baths |

Tot. |

Brms. |

Baths |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Basement |

□ None |

|

□ Partial |

□ None |

|

|

□ Partial |

□ None |

|

|

□ Partial |

□ None |

|

|

□ Partial |

|

□ SLAB |

|

□ Full |

□ SLAB |

|

|

□ Full |

□ SLAB |

|

|

□ Full |

□ SLAB |

|

|

□ Full |

||

(Check all that apply) |

|

|

|

|

|

|

|

|||||||||

□ Crawl Space |

□ Crawl Space |

|

□ Crawl Space |

|

□ Crawl Space |

|

||||||||||

|

|

|

|

|||||||||||||

Basement Finish |

□ None |

|

□ Partial |

□ None |

|

|

□ Partial |

□ None |

|

|

□ Partial |

□ None |

|

|

□ Partial |

|

Attic (Check all that apply) |

|

|

|

|

|

|

|

|||||||||

□ Crawl Space |

□ Full |

□ Crawl Space |

|

□ Full |

□ Crawl Space |

|

□ Full |

□ Crawl Space |

|

□ Full |

||||||

|

|

|

|

|||||||||||||

Attic Access |

□ Walkup |

|

□ Hatch |

□ Walkup |

|

|

□ Hatch |

□ Walkup |

|

|

□ Hatch |

□ Walkup |

|

|

□ Hatch |

|

□ Pull down steps |

|

□ Pull down steps |

|

□ Pull down steps |

|

□ Pull down steps |

|

|||||||||

|

|

|

|

|

||||||||||||

Bonus Room |

□ None |

|

□ Barn |

□ None |

|

|

□ Barn |

□ None |

|

|

□ Barn |

□ None |

|

|

□ Barn |

|

|

|

|

|

|

|

|

|

|||||||||

Detached Structures |

□ Guest House |

□ Studio |

□ Guest House |

|

□ Studio |

□ Guest House |

|

□ Studio |

□ Guest House |

|

□ Studio |

|||||

(Check all that apply) |

□ Pool House |

□ Shed |

□ Pool House |

|

□ Shed |

□ Pool House |

|

□ Shed |

□ Pool House |

|

□ Shed |

|||||

|

□ Other: |

|

|

□ Other: |

|

|

|

□ Other: |

|

|

|

□ Other: |

|

|

|

|

Deck/Patio |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pool/Spa |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fireplace(s) |

□ Public |

|

□ Private |

□ Public |

|

|

□ Private |

□ Public |

|

|

□ Private |

□ Public |

|

|

□ Private |

|

Water Supply |

|

|

|

|

|

|

|

|||||||||

□ Community |

□ Well |

□ Community |

|

□ Well |

□ Community |

|

□ Well |

□ Community |

|

□ Well |

||||||

|

|

|

|

|||||||||||||

|

□ Septic |

|

□ Sewer |

□ Septic |

|

|

□ Sewer |

□ Septic |

|

|

□ Sewer |

□ Septic |

|

|

□ Sewer |

|

Waste Disposal |

□ Cesspool |

|

□ Cesspool |

|

|

□ Cesspool |

|

|

□ Cesspool |

|

|

|||||

|

□ Other: |

|

|

□ Other: |

|

|

|

□ Other: |

|

|

|

□ Other: |

|

|

|

|

Type of Air Conditioning |

□ None |

|

□ Central |

□ None |

|

□ Central |

□ None |

|

□ Central |

□ None |

|

□ Central |

||||

□ Window/Wall |

□ Heat Pump |

□ Window/Wall |

□ Heat Pump |

□ Window/Wall |

□ Heat Pump |

□ Window/Wall |

□ Heat Pump |

|||||||||

(Check all that apply) |

||||||||||||||||

□ Other: |

|

|

□ Other: |

|

|

|

□ Other: |

|

|

|

□ Other: |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

□ None |

|

□ Gas |

□ None |

|

|

□ Gas |

□ None |

|

|

□ Gas |

□ None |

|

|

□ Gas |

|

|

□ Propane |

|

□ Electric |

□ Propane |

|

|

□ Electric |

□ Propane |

|

|

□ Electric |

□ Propane |

|

|

□ Electric |

|

Type of Heating System |

□ Radiant |

|

□ Oil |

□ Radiant |

|

|

□ Oil |

□ Radiant |

|

|

□ Oil |

□ Radiant |

|

|

□ Oil |

|

□ Wood stove |

□ Solar |

□ Wood stove |

|

□ Solar |

□ Wood stove |

|

□ Solar |

□ Wood stove |

|

□ Solar |

||||||

(Check all that apply) |

|

|

|

|||||||||||||

□ Base Board |

□ Coal |

□ Base Board |

|

□ Coal |

□ Base Board |

|

□ Coal |

□ Base Board |

|

□ Coal |

||||||

|

|

|

|

|||||||||||||

|

□ Heat pump |

□ Radiator |

□ Heat pump |

|

□ Radiator |

□ Heat pump |

|

□ Radiator |

□ Heat pump |

|

□ Radiator |

|||||

|

□ Other: |

|

|

□ Other: |

|

|

|

□ Other: |

|

|

|

□ Other: |

|

|

|

|

Location |

|

|

|

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

||||

Lot Characteristics |

|

|

|

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

||||

View |

|

|

|

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

||||

Floor Plan Utility |

|

|

|

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

||||

Ext. Condition’s Appeal |

|

|

|

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

||||

Int. Condition’s Appeal |

|

|

|

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

||||

Overall Rating of Listings as |

|

|

|

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

||||

Compared to Subject |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Listing #1: Date inspected: |

Comments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Listing #2: Date inspected: |

Comments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Listing #3: Date inspected: |

Comments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Copyright © 2008 by Worldwide ERC®

Rev. 01/07/2009 |

This Form Expires 12/31/2009 |

Page 4 of 6 |

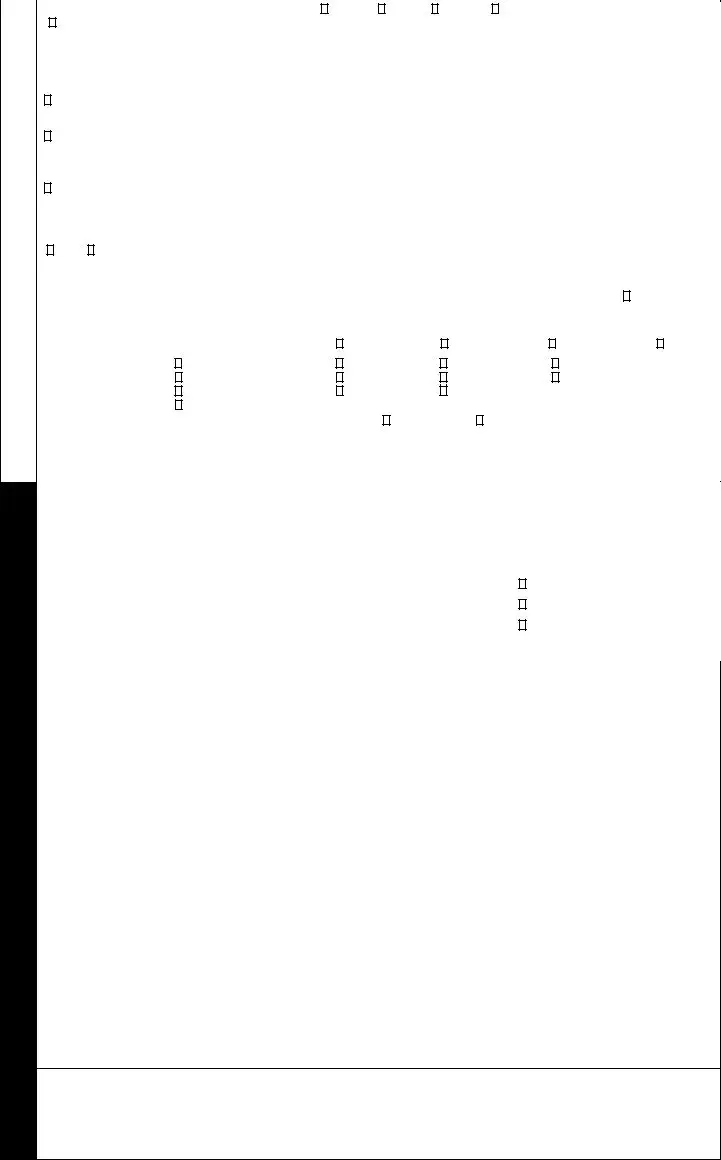

Instructions: Select sales within the last six months which are suitable and similar to the subject property and within the same/similar market area.

COMPARABLE SALES

ITEM |

SUBJECT |

Comparable Sale #1 |

Comparable Sale #2 |

Comparable Sale #3 |

|||||||||

Address, City |

|

|

|

|

|

|

|

|

|

|

|

|

|

MLS # |

|

|

|

|

|

|

|

|

|

|

|

|

|

Proximity to Subject |

|

|

|

|

|

|

|

|

|

|

|

|

|

Original List Price |

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

|

Final List Price |

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

|

Sales Price |

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

|

Seller Concessions |

|

|

|

|

|

|

|

|

|

|

|

|

|

Under Contract Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

Closing Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

from original list date |

|

|

|

|

|

|

|

|

|

|

|

|

|

Previous listing history for last |

Orig. List Price $ |

|

Orig. List Price $ |

|

Orig. List Price $ |

|

Orig. List Price $ |

|

|||||

Last List Price $ |

|

Last List Price $ |

|

Last List Price $ |

|

Last List Price $ |

|

||||||

12 months |

|

|

|

|

|||||||||

DOM: |

|

|

DOM: |

|

|

DOM: |

|

|

DOM: |

|

|

||

|

|

|

|

|

|

|

|

|

|||||

Style |

□ Brick |

|

□ Wood |

□ Brick |

|

□ Wood |

□ Brick |

|

□ Wood |

□ Brick |

|

□ Wood |

|

|

|

|

|

|

|||||||||

|

□ Composite |

□ Stone |

□ Composite |

□ Stone |

□ Composite |

□ Stone |

□ Composite |

□ Stone |

|||||

Exterior Finish |

□ Aluminum |

□ Stucco |

□ Aluminum |

□ Stucco |

□ Aluminum |

□ Stucco |

□ Aluminum |

□ Stucco |

|||||

(Check all that apply) |

□ Synthetic Stucco |

□ Vinyl |

□ Synthetic Stucco |

□ Vinyl |

□ Synthetic Stucco |

□ Vinyl |

□ Synthetic Stucco |

□ Vinyl |

|||||

|

□ Hardcoat Stucco |

|

□ Hardcoat Stucco |

|

□ Hardcoat Stucco |

|

□ Hardcoat Stucco |

|

|||||

|

□ Other: |

|

|

□ Other: |

|

|

□ Other: |

|

|

□ Other: |

|

|

|

|

□ Composite |

□ Slate |

□ Composite |

□ Slate |

□ Composite |

□ Slate |

□ Composite |

□ Slate |

|||||

Roof Type |

□ Tar |

|

□ Tile |

□ Tar |

|

□ Tile |

□ Tar |

|

□ Tile |

□ Tar |

|

□ Tile |

|

□ Wood shake |

□ Tin |

□ Wood shake |

□ Tin |

□ Wood shake |

□ Tin |

□ Wood shake |

□ Tin |

||||||

(Check all that apply) |

|||||||||||||

□ Asphalt shingle |

□ Copper |

□ Asphalt shingle |

□ Copper |

□ Asphalt shingle |

□ Copper |

□ Asphalt shingle |

□ Copper |

||||||

|

|||||||||||||

|

□ Other: |

|

|

□ Other: |

|

|

□ Other: |

|

|

□ Other: |

|

|

|

|

□ None |

|

|

□ None |

|

|

□ None |

|

|

□ None |

|

|

|

|

□ Garage |

|

# of Cars |

□ Garage |

|

# of Cars |

□ Garage |

|

# of Cars |

□ Garage |

|

# of Cars |

|

|

□ Attached |

□ Attached |

□ Attached |

□ Attached |

|||||||||

Car Storage/Type |

|

□ Detached |

|

□ Detached |

|

□ Detached |

|

□ Detached |

|||||

|

□ |

|

□ |

|

|

□ |

|

|

□ |

|

|||

(Check all that apply) |

□ Carport |

□ Carport |

|

□ Carport |

|

□ Carport |

|

||||||

□ Attached |

□ Attached |

□ Attached |

□ Attached |

||||||||||

|

|

□ Detached |

|

□ Detached |

|

□ Detached |

|

□ Detached |

|||||

|

□ Other: |

□ |

□ Other: |

□ |

|

□ Other: |

□ |

|

□ Other: |

□ |

|

||

|

|

|

|

|

|

|

|

|

|||||

Year Built |

|

|

|

|

|

|

|

|

|

|

|

|

|

Lot Size |

|

|

|

|

|

|

|

|

|

|

|

|

|

Appx. Gross Living Area |

|

|

Sq. Ft |

|

|

Sq. Ft |

|

|

Sq. Ft |

|

|

Sq. Ft |

|

Above Grade Room Count |

Tot. |

Brms. |

Baths |

Tot. |

Brms. |

Baths |

Tot. |

Brms. |

Baths |

Tot. |

Brms. |

Baths |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Basement |

□ None |

|

□ Partial |

□ None |

|

□ Partial |

□ None |

|

□Partial |

□ None |

|

□ Partial |

|

□ SLAB |

|

□ Full |

□ SLAB |

|

□ Full |

□ SLAB |

|

Full |

□ SLAB |

|

□ Full |

||

(Check all that apply) |

|

|

|

|

|||||||||

□ Crawl Space |

□ Crawl Space |

□ Crawl Space |

□ Crawl Space |

||||||||||

|

|||||||||||||

Basement Finish |

□ Full |

|

□ Partial |

□ Full |

|

□ Partial |

□ Full |

|

□ Partial |

□ Full |

|

□ Partial |

|

Attic (Check all that apply) |

|

|

|

|

|||||||||

□ Crawl Space |

□ None |

□ Crawl Space |

□ None |

□ Crawl Space |

□ None |

□ Crawl Space |

□ None |

||||||

|

|||||||||||||

Attic Access |

□ Walkup |

|

□ Hatch |

□ Walkup |

|

□ Hatch |

□ Walkup |

|

□ Hatch |

□ Walkup |

|

□ Hatch |

|

□ Pull down steps |

|

□ Pull down steps |

|

□ Pull down steps |

|

□ Pull down steps |

|

||||||

|

|

|

|

|

|||||||||

Bonus Room |

□ None |

|

□ Barn |

□ None |

|

□ Barn |

□ None |

|

□ Barn |

□ None |

|

□ Barn |

|

|

|

|

|

|

|||||||||

Detached Structures |

□ Guest House |

□ Studio |

□ Guest House |

□ Studio |

□ Guest House |

□ Studio |

□ Guest House |

□ Studio |

|||||

(Check all that apply) |

□ Pool House |

□ Shed |

□ Pool House |

□ Shed |

□ Pool House |

□ Shed |

□ Pool House |

□ Shed |

|||||

|

□ Other: |

|

|

□ Other: |

|

|

□ Other: |

|

|

□ Other: |

|

|

|

Deck/Patio |

|

|

|

|

|

|

|

|

|

|

|

|

|

Pool/Spa |

|

|

|

|

|

|

|

|

|

|

|

|

|

Fireplace(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Water Supply |

□ Public |

|

□ Private |

□ Public |

|

□ Private |

□ Public |

|

□ Private |

□ Public |

|

□ Private |

|

□ Community |

□ Well |

□ Community |

□ Well |

□ Community |

□ Well |

□ Community |

□ Well |

||||||

|

|||||||||||||

|

□ Septic |

|

□ Sewer |

□ Septic |

|

□ Sewer |

□ Septic |

|

□ Sewer |

□ Septic |

|

□ Sewer |

|

Waste Disposal |

□ Cesspool |

|

□ Cesspool |

|

□ Cesspool |

|

□ Cesspool |

|

|||||

|

□ Other: |

|

|

□ Other: |

|

|

□ Other: |

|

|

□ Other: |

|

|

|

Type of Air Conditioning |

□ None |

|

□ Central |

□ None |

□ Central |

□ None |

□ Central |

□ None |

□ Central |

||||

□ Window/Wall |

□ Heat Pump |

□ Window/Wall □ Heat Pump |

□ Window/Wall □ Heat Pump |

□ Window/Wall □ Heat Pump |

|||||||||

(Check all that apply) |

|||||||||||||

□ Other: |

|

|

□ Other: |

|

|

□ Other: |

|

|

□ Other: |

|

|

||

|

|

|

|

|

|

|

|

|

|||||

|

□ None |

|

□ Gas |

□ None |

|

□ Gas |

□ None |

|

□ Gas |

□ None |

|

□ Gas |

|

|

□ Propane |

|

□ Electric |

□ Propane |

|

□ Electric |

□ Propane |

|

□ Electric |

□ Propane |

|

□ Electric |

|

Type of Heating System |

□ Radiant |

|

□ Oil |

□ Radiant |

|

□ Oil |

□ Radiant |

|

□ Oil |

□ Radiant |

|

□ Oil |

|

□ Wood stove |

□ Solar |

□ Wood stove |

□ Solar |

□ Wood stove |

□ Solar |

□ Wood stove |

□ Solar |

||||||

(Check all that apply) |

|||||||||||||

□ Base Board |

□ Coal |

□ Base Board |

□ Coal |

□ Base Board |

□ Coal |

□ Base Board |

□ Coal |

||||||

|

|||||||||||||

|

□ Heat pump |

□ Radiator |

□ Heat pump |

□ Radiator |

□ Heat pump |

□ Radiator |

□ Heat pump |

□ Radiator |

|||||

|

□ Other: |

|

|

□ Other: |

|

|

□ Other: |

|

|

□ Other: |

|

|

|

Location |

|

|

|

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

|

Lot Characteristics |

|

|

|

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

|

View |

|

|

|

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

|

Floor Plan Utility |

|

|

|

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

|

Ext. Condition’s Appeal |

|

|

|

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

|

Int. Condition’s Appeal |

|

|

|

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

|

Overall Rating of Sales as |

|

|

|

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

□ Superior |

□ Similar |

□ Inferior |

|

Compared to Subject |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

Sales #1: Inspected? □ Yes |

□ No Comments: |

|

|

|

|

|

|

|

|

|

|

||

Sales #2: Inspected?

□Yes

□ No Comments:

Sales #3: Inspected?

□Yes

□ No Comments:

Copyright © 2008 by Worldwide ERC®

Rev. 01/07/2009 |

This Form Expires 12/31/2009 |

Page 5 of 6 |

MOST LIKELY |

BUYER(S) |

MARKETING STRATEGY |

|

VALUE |

ANALYSIS |

SIGNATURES |

|

Check all that apply: |

|

|

|

|

□ Local Buyer |

□ Transferee |

□ International Buyer |

□ |

□ |

□ Empty Nester |

□ Military |

□ Parent Purchaser for Child |

□ |

□ Investor |

□ |

□ Other: |

|

|

|

What are the three - five challenges to getting this property sold?

1.

2.

3.

4.

5.

What are the three - five actions necessary to address the challenges identified above?

1.

2.

3.

4.

5.

What are the top five creative ideas you will use in marketing this property keeping in mind the challenges and actions identified above?

1.

2.

3.

4.

5.

Additional Comments:

Most Likely Sales Price (MLSP): $ |

|

|

|

Suggested List Price (SLP): $ |

|

|

|

The MLSP is based on “as is” condition and a marketing time not to exceed |

|

|

|

days to a contract of sale. |

|||

|

|

|

|

(# of days) |

|||

|

|

|

|

|

|

|

|

File #: |

|

|

Real Estate Firm: |

||||

|

|

|

|

|

|

|

|

Real Estate Firm Tax ID #: |

|

|

Date of Inspection: |

||||

|

|

|

|

|

|

|

|

Contact Name: |

|

|

Agent Preparer Name: |

||||

|

|

|

|

|

|

|

|

Contact Signature: |

|

|

Agent Preparer Signature: |

||||

|

|

|

|

|

|

|

|

Copyright © 2008 by Worldwide ERC®

Rev. 01/07/2009 |

This Form Expires 12/31/2009 |

Page 6 of 6 |

Other PDF Templates

Phone Insurance Claim - This is a go-to document when seeking device replacements.

The Washington Homeschool Letter of Intent form is a crucial document for families who choose to educate their children at home. This form notifies the state of a family's decision to homeschool and outlines the basic information required by law. Completing this form is an essential first step in ensuring that homeschooling is recognized and supported by the state education system, and you can find the necessary template at the Homeschool Letter of Intent.

Annual Summary and Transmittal of U.S. Information Returns - Errors in the 1096 may lead to complications or delays in processing returns.

Documents used along the form

When completing the ERC Broker Market Analysis form, several other documents can complement the information provided and ensure a thorough evaluation of the property. Each of these documents serves a specific purpose and can enhance the accuracy of the analysis.

- Property Disclosure Statement: This document outlines any known issues or defects with the property. It is crucial for informing potential buyers about the condition of the home and any repairs that may be necessary.

- Comparative Market Analysis (CMA): A CMA provides a detailed comparison of similar properties in the area that have recently sold. This helps in establishing a realistic pricing strategy for the subject property based on current market conditions.

- Inspection Report: Conducted by a licensed inspector, this report assesses the property's condition, identifying any structural or mechanical issues. It can significantly influence buyer decisions and negotiations.

- Motorcycle Bill of Sale: A legal document that records the sale of a motorcycle from one person to another, providing essential details about the transaction. For more information, visit https://autobillofsaleform.com/motorcycle-bill-of-sale-form/new-york-motorcycle-bill-of-sale-form.

- Title Report: This document reveals the legal ownership of the property and any liens or encumbrances. Understanding the title status is essential to ensure a smooth transaction.

- Appraisal Report: An appraisal offers an independent evaluation of the property's value, which can be critical for financing purposes. It is conducted by a certified appraiser and ensures that the property's price aligns with its market value.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents will provide rules, regulations, and fees associated with the community. They are vital for potential buyers to understand their obligations and the community's standards.

Utilizing these documents alongside the ERC Broker Market Analysis form can provide a comprehensive view of the property, ensuring that all relevant factors are considered in the assessment. This thorough approach can lead to better-informed decisions for both buyers and sellers.

Similar forms

The Comparative Market Analysis (CMA) is a document that helps real estate agents determine a property's value based on recent sales of similar properties. Like the Erc Broker Market Analysis form, the CMA focuses on the property's condition, competition, and potential marketability. Both documents require detailed information about the subject property and comparable properties to arrive at an estimated sales price. The CMA is typically used by agents to guide sellers in setting a competitive listing price.

In the context of understanding essential real estate documents, it's important to recognize that the Georgia Divorce form is not just a legal requirement but also a significant procedural step that shares a commonality with various property-related agreements, addressing the need for accurate and transparent information. For those navigating personal transitions, utilizing resources like https://georgiapdf.com/ can facilitate a clear understanding of the necessary steps involved in both divorce proceedings and property transactions.

The Appraisal Report is another document that shares similarities with the Erc Broker Market Analysis form. It is conducted by a licensed appraiser and provides a formal estimate of a property's value. While the Erc form is not an appraisal, both documents analyze the property's condition and comparable sales. The Appraisal Report adheres to specific standards and regulations, making it more formal than the Broker Market Analysis, which is intended for internal use by brokers.

The Property Inspection Report is similar in that it assesses the physical condition of a property. This document provides detailed findings about structural issues, repairs needed, and overall maintenance. While the Erc form includes some aspects of property condition, the Inspection Report is more comprehensive and focuses specifically on the physical attributes of the home. Both documents can influence the perceived value of the property but serve different purposes in the real estate process.

The Listing Agreement outlines the terms between a seller and a real estate agent for selling a property. It often references market analysis to justify the listing price. Like the Erc Broker Market Analysis form, the Listing Agreement aims to set a price based on market conditions and property features. Both documents require input from the agent regarding the property's marketability and competitive position.

The Seller Disclosure Statement is a document that provides potential buyers with information about the property's condition and any known issues. This statement is similar to the Erc form in that both require the seller to disclose important details about the property. While the Erc form focuses on market analysis, the Seller Disclosure Statement emphasizes transparency and informs buyers about potential concerns that could affect their decision.

The Market Analysis Report is a broader document that encompasses various factors affecting the real estate market, including economic conditions, trends, and demographics. It shares similarities with the Erc Broker Market Analysis form in that both analyze market conditions to estimate property values. However, the Market Analysis Report provides a more comprehensive overview of the market as a whole, while the Erc form focuses specifically on a single property.

The Real Estate Investment Analysis is a document used by investors to evaluate the potential return on investment for a property. This analysis often includes a detailed look at market conditions, property performance, and financial projections. Similar to the Erc Broker Market Analysis form, it assesses the property's marketability and value. However, the Investment Analysis is more focused on the financial aspects and long-term viability of the property as an investment.

Dos and Don'ts

- Do read the instructions carefully before starting the form to ensure you understand each section.

- Do provide accurate and complete information about the property, including all relevant details.

- Do follow the procedural guidelines set by the requesting company for contacting homeowners and submitting reports.

- Do ensure you are aware of state-specific disclosure requirements and include them in the form as needed.

- Don't skip any sections, as each part of the form is important for a thorough analysis.

- Don't make assumptions about property conditions; only report what you can observe or verify.

- Don't forget to include any necessary comments or explanations for your observations.

- Don't submit the form without reviewing it for any errors or omissions.

Key takeaways

- Purpose of the Form: The ERC Broker Market Analysis form is intended for real estate brokers to analyze a property's condition, competition, and future marketability. This analysis helps estimate the property's Most Likely Sales Price (MLSP).

- Not an Appraisal: It is crucial to understand that this form is not a home inspection or an appraisal. It should not be used as such for any purpose.

- State-Specific Requirements: Brokers must be aware of and incorporate any state-specific disclosure requirements relevant to the property in question.

- Procedural Guidelines: Follow the requesting company's guidelines for contacting the homeowner, inspecting the property, submitting the report, and providing necessary photos.

- Market Analysis: The analysis should include a detailed review of competing properties and current market conditions to support the estimated sales price.

How to Use Erc Broker Market Analysis

Completing the ERC Broker Market Analysis form is essential for providing a thorough evaluation of a property. This document will guide you through the process, ensuring that all necessary information is collected accurately and efficiently. Follow the steps below to fill out the form correctly.

- Begin with the INFORMATION section. Fill in the file number, homeowner(s) name, property address, and phone numbers for both home and work.

- Provide the details of the requesting company, including the name, contact person, email, and address.

- In the ASSIGNMENT section, enter the real estate firm name, contact name, email, and address. Include the agent preparer's phone number and the homeowner's purchase price and purchase date.

- Document any improvements made by the homeowner and indicate if the property is currently listed. Specify the listing company or agent.

- Choose the form of ownership and occupant type from the provided options. Note any personal property that remains with the property.

- Assess the subject's location type and describe the lot characteristics, view, and any locational issues that may affect insurability.

- Check all applicable site characteristics and miscellaneous issues that may impact the property.

- In the SUBJECT CONDITION INSPECTIONS/DISCLOSURES section, check boxes for any observed property conditions and provide descriptions where necessary.

- Estimate repair costs for interior and exterior items, documenting comments and total estimated costs for each category.

- List all required and customary inspections, along with any disclosures that apply to the property.

- Identify the most probable means of financing and describe any necessary financing concessions.

- Note any anticipated issues that may affect financing and provide details about the neighborhood and broader market area.

- Gather data on competing listings and comparable sales, ensuring to include all relevant details for each property.

- Finally, review all sections for completeness and accuracy before submitting the form.