Fill Out a Valid Fee Worksheet Form

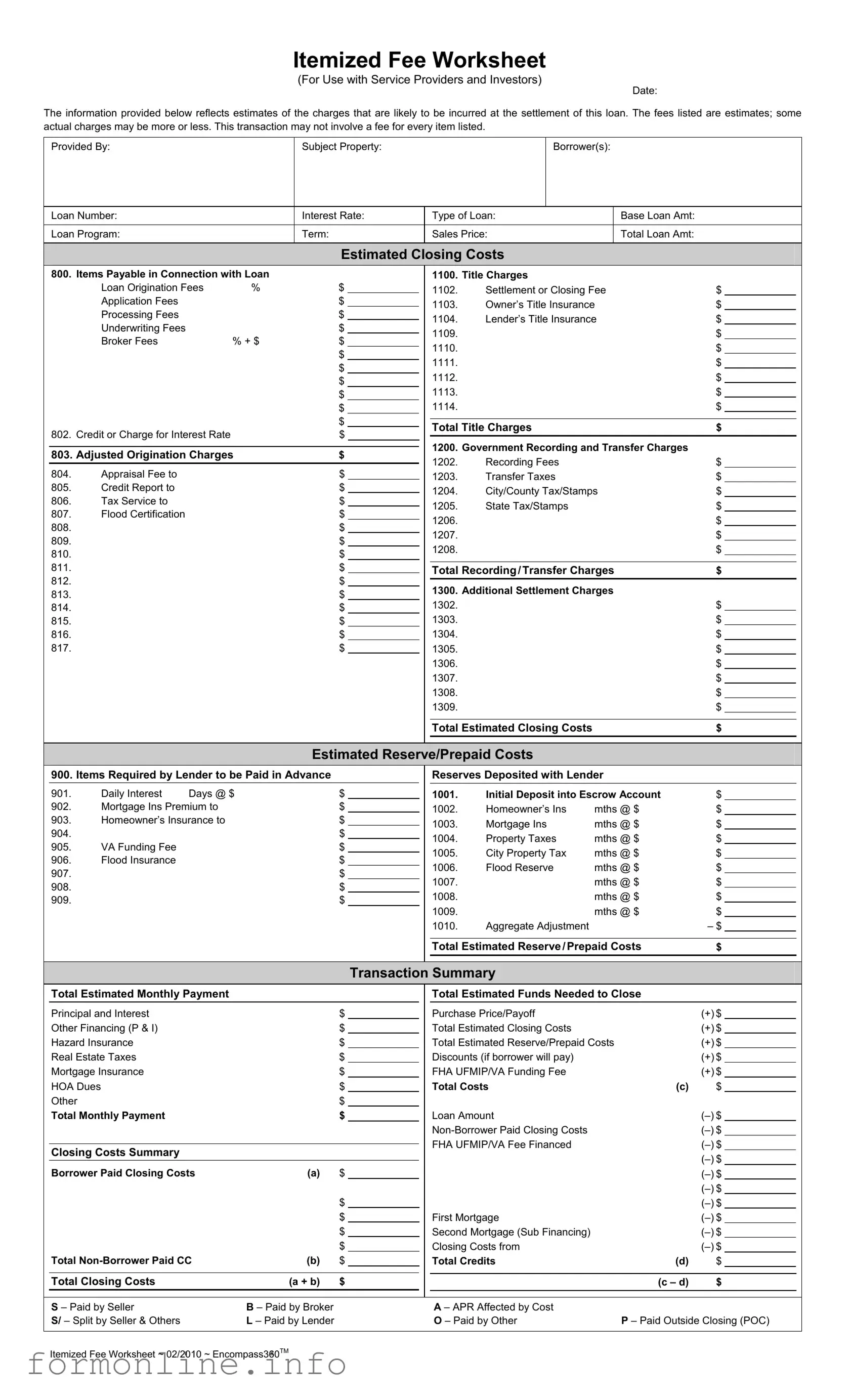

The Fee Worksheet form serves as a crucial tool in the loan settlement process, offering a detailed breakdown of estimated charges associated with a mortgage transaction. This form is designed for both service providers and investors, ensuring transparency and clarity regarding the costs involved. It includes essential information such as the date, subject property, borrower details, loan number, interest rate, and type of loan, providing a comprehensive overview of the financial landscape. The form outlines various categories of fees, including title charges, loan origination fees, and government recording costs, allowing borrowers to anticipate their total closing costs. Each item is listed with an estimated charge, which may fluctuate based on actual expenses incurred at settlement. Additionally, the Fee Worksheet accounts for reserves and prepaid costs, ensuring that borrowers understand the funds required upfront. By presenting this information in an organized manner, the form not only facilitates informed decision-making but also fosters trust between borrowers and lenders, making it an indispensable part of the home financing process.

Common mistakes

-

Neglecting to Double-Check Basic Information: It's crucial to ensure that the date, borrower names, and property address are accurate. Errors in these details can lead to significant delays or complications.

-

Failing to Estimate Closing Costs Accurately: Many people underestimate the closing costs. It's essential to consider all potential fees listed in the worksheet to avoid surprises at closing.

-

Overlooking Additional Charges: Items like application fees, processing fees, and underwriting fees can add up. Make sure to include all applicable charges to get a complete picture of your costs.

-

Not Understanding Title Charges: Title insurance and settlement fees can be confusing. Take the time to understand these charges and ensure they are accurately reflected on the worksheet.

-

Ignoring Reserve and Prepaid Costs: Many forget to include items required by the lender, such as homeowner’s insurance or property taxes. These are critical for an accurate estimate of funds needed at closing.

-

Miscalculating Interest Rates: When estimating the credit or charge for the interest rate, ensure that the calculations are correct. An error here can significantly affect your total costs.

-

Not Including Non-Borrower Paid Closing Costs: If there are costs that someone other than the borrower is paying, they should be included in the worksheet. This helps in understanding the total financial picture.

-

Failing to Keep a Copy: Always keep a copy of the completed Fee Worksheet. This document is essential for reference during the closing process and can help resolve any discrepancies that may arise.

Preview - Fee Worksheet Form

Itemized Fee Worksheet

(For Use with Service Providers and Investors)

Date:

The information provided below reflects estimates of the charges that are likely to be incurred at the settlement of this loan. The fees listed are estimates; some actual charges may be more or less. This transaction may not involve a fee for every item listed.

|

Provided By: |

|

|

Subject Property: |

|

|

|

Borrower(s): |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Loan Number: |

|

|

Interest Rate: |

|

Type of Loan: |

|

Base Loan Amt: |

|

|

|

||||||

|

Loan Program: |

|

|

Term: |

|

|

|

|

Sales Price: |

|

Total Loan Amt: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

Estimated Closing Costs |

|

|

|

|

|

||||||

800. |

Items Payable in Connection with Loan |

|

|

|

1100. |

Title Charges |

|

|

|

|

|

||||||

|

|

Loan Origination Fees |

% |

|

$ |

|

|

1102. |

Settlement or Closing Fee |

$ |

|

|

|||||

|

|

|

|

|

|||||||||||||

|

|

Application Fees |

|

|

|

$ |

|

|

1103. |

Owner’s Title Insurance |

$ |

|

|

||||

|

|

|

|

|

|

|

|||||||||||

|

|

Processing Fees |

|

|

|

$ |

|

|

1104. |

Lender’s Title Insurance |

$ |

|

|

||||

|

|

Underwriting Fees |

|

|

|

$ |

|

|

|

|

|||||||

|

|

|

|

|

|

|

1109. |

|

|

|

|

$ |

|

|

|||

|

|

Broker Fees |

|

% + $ |

|

$ |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

1110. |

|

|

|

|

$ |

|

|

||||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

1111. |

|

|

|

|

$ |

|

|

||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

1112. |

|

|

|

|

$ |

|

|

||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

1113. |

|

|

|

|

$ |

|

|

||

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

$ |

|

|

1114. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Title Charges |

|

|

$ |

|

|

|||

802. |

Credit or Charge for Interest Rate |

|

|

$ |

|

|

|

|

|

|

|

||||||

|

|

|

|

1200. |

Government Recording and Transfer Charges |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

803. Adjusted Origination Charges |

$ |

|

|

|

|

|

||||||||||

|

|

|

1202. |

Recording Fees |

|

|

$ |

|

|

||||||||

804. |

Appraisal Fee to |

|

|

|

$ |

|

|

|

|

|

|

||||||

|

|

|

|

|

1203. |

Transfer Taxes |

|

|

$ |

|

|

||||||

|

|

|

|

|

|

|

|||||||||||

805. |

Credit Report to |

|

|

|

$ |

|

|

1204. |

City/County Tax/Stamps |

$ |

|

|

|||||

806. |

Tax Service to |

|

|

|

$ |

|

|

|

|

||||||||

|

|

|

|

|

1205. |

State Tax/Stamps |

|

|

$ |

|

|

||||||

807. |

Flood Certification |

|

|

|

$ |

|

|

|

|

|

|

||||||

|

|

|

|

|

1206. |

|

|

|

|

$ |

|

|

|||||

808. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

1207. |

|

|

|

|

$ |

|

|

||||

809. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

1208. |

|

|

|

|

$ |

|

|

||||

810. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

811. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

Total Recording/Transfer Charges |

$ |

|

|

|||||||

|

|

|

|

|

|

||||||||||||

812. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1300. |

Additional Settlement Charges |

|

|

|

|||||||

813. |

|

|

|

|

$ |

|

|

|

|

|

|||||||

814. |

|

|

|

|

$ |

|

|

1302. |

|

|

|

|

$ |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

815. |

|

|

|

|

$ |

|

|

1303. |

|

|

|

|

$ |

|

|

||

816. |

|

|

|

|

$ |

|

|

1304. |

|

|

|

|

$ |

|

|

||

817. |

|

|

|

|

$ |

|

|

1305. |

|

|

|

|

$ |

|

|

||

|

|

|

|

|

|

|

|

|

1306. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

1307. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

1308. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

1309. |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Total Estimated Closing Costs |

|

|

$ |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

Estimated Reserve/Prepaid Costs |

|

|

|

|

|

|||||||

|

900. Items Required by Lender to be Paid in Advance |

|

|

|

|

Reserves Deposited with Lender |

|

|

|

||||||||

901. |

Daily Interest |

Days @ $ |

$ |

|

|

1001. |

Initial Deposit into Escrow Account |

$ |

|

|

|||||||

902. |

Mortgage Ins Premium to |

|

|

$ |

|

|

1002. |

Homeowner’s Ins |

mths @ $ |

$ |

|

|

|||||

|

|

|

|

|

|

||||||||||||

903. |

Homeowner’s Insurance to |

|

|

$ |

|

|

1003. |

Mortgage Ins |

mths @ $ |

$ |

|

|

|||||

904. |

|

|

|

|

$ |

|

|

|

|

||||||||

|

|

|

|

|

|

1004. |

Property Taxes |

mths @ $ |

$ |

|

|

||||||

905. |

VA Funding Fee |

|

|

|

$ |

|

|

|

|

||||||||

|

|

|

|

|

1005. |

City Property Tax |

mths @ $ |

$ |

|

|

|||||||

906. |

Flood Insurance |

|

|

|

$ |

|

|

|

|

||||||||

|

|

|

|

|

1006. |

Flood Reserve |

mths @ $ |

$ |

|

|

|||||||

907. |

|

|

|

|

$ |

|

|

|

|

||||||||

|

|

|

|

|

|

1007. |

|

|

mths @ $ |

$ |

|

|

|||||

908. |

|

|

|

|

$ |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

1008. |

|

|

mths @ $ |

$ |

|

|

|||||

909. |

|

|

|

|

$ |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

1009. |

|

|

mths @ $ |

$ |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

1010. |

Aggregate Adjustment |

|

|

– $ |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

Total Estimated Reserve/Prepaid Costs |

$ |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

Transaction Summary |

|

|

|

|

|

|||||

|

Total Estimated Monthly Payment |

|

|

|

|

|

|

Total Estimated Funds Needed to Close |

|

|

|

||||||

|

Principal and Interest |

|

|

|

$ |

|

|

|

Purchase Price/Payoff |

|

|

(+) $ |

|

|

|||

|

Other Financing (P & I) |

|

|

|

$ |

|

|

|

Total Estimated Closing Costs |

|

|

(+) $ |

|

|

|||

|

Hazard Insurance |

|

|

|

$ |

|

|

|

Total Estimated Reserve/Prepaid Costs |

(+) $ |

|

|

|||||

|

Real Estate Taxes |

|

|

|

$ |

|

|

|

Discounts (if borrower will pay) |

|

|

(+) $ |

|

|

|||

|

Mortgage Insurance |

|

|

|

$ |

|

|

|

FHA UFMIP/VA Funding Fee |

|

|

(+) $ |

|

|

|||

|

HOA Dues |

|

|

|

$ |

|

|

|

Total Costs |

|

(c) |

$ |

|

|

|||

|

Other |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Monthly Payment |

|

|

|

$ |

|

|

|

Loan Amount |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

FHA UFMIP/VA Fee Financed |

|

|

|

|

|||

|

Closing Costs Summary |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Borrower Paid Closing Costs |

|

(a) |

$ |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

First Mortgage |

|

|

|

|

|||

|

|

|

|

|

|

$ |

|

|

|

Second Mortgage (Sub Financing) |

|

|

|

|

|||

|

Total |

|

(b) |

$ |

|

|

|

Closing Costs from |

|

|

|||||||

|

|

$ |

|

|

|

Total Credits |

|

(d) |

$ |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Total Closing Costs |

|

(a + b) |

$ |

|

|

|

|

|

|

|

(c – d) |

$ |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

S – Paid by Seller |

|

B – Paid by Broker |

|

|

|

|

A – APR Affected by Cost |

|

|

|

|

|

||||

|

S/ – Split by Seller & Others |

|

L – Paid by Lender |

|

|

|

|

O – Paid by Other |

|

P – Paid Outside Closing (POC) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Itemized Fee Worksheet ~ 02/2010 ~ Encompass360TM

Other PDF Templates

Texas Temporary Tag - Access this form to secure temporary driving authorization for your vehicle.

The Virginia Homeschool Letter of Intent is a formal document that parents must submit to notify their local school division of their intention to homeschool their children. This essential form outlines the family's commitment to providing an educational experience outside of the traditional school setting. To assist parents in this process, resources are available, including the informative Homeschool Letter of Intent, which can help ensure a smooth homeschooling journey.

1098-int - The explanation of the amount due breaks down your principal, interest, escrow, and total fees.

Writs of Certiorari - Your cover page must accurately reflect the details of your case in an organized format.

Documents used along the form

The Fee Worksheet form is an essential document in the loan settlement process, providing a detailed estimate of the charges that borrowers can expect. Alongside this form, several other documents are commonly used to ensure transparency and clarity throughout the transaction. Below are some of the key documents that often accompany the Fee Worksheet.

- Loan Estimate: This document outlines the key terms of the loan, including interest rates, monthly payments, and estimated closing costs. It must be provided to the borrower within three business days of applying for a loan.

- Closing Disclosure: A final statement that details all the costs associated with the loan. It is provided to the borrower at least three days before closing and allows them to review the final terms and costs.

- Title Insurance Policy: This document protects the lender and/or the buyer from potential issues related to the property’s title, such as undisclosed liens or ownership disputes.

- Appraisal Report: Conducted by a licensed appraiser, this report assesses the property's value to ensure it meets the loan amount. It is crucial for both the lender and the borrower.

- Credit Report: A detailed report of the borrower’s credit history. Lenders use this to evaluate the borrower’s creditworthiness and determine loan eligibility.

- Escrow Agreement: This document outlines the terms under which funds will be held in escrow until all conditions of the sale are met. It ensures that both parties fulfill their obligations before funds are released.

- Motorcycle Bill of Sale: Essential for recording the sale of a motorcycle, this legal document covers key transaction details, ensuring clarity and protection for both parties involved. For more information, visit autobillofsaleform.com/motorcycle-bill-of-sale-form/new-york-motorcycle-bill-of-sale-form/.

- Loan Application: The initial form completed by the borrower, providing necessary personal and financial information to the lender. This document initiates the loan process.

Each of these documents plays a critical role in the loan process, ensuring that all parties have a clear understanding of the terms, costs, and obligations involved. By being familiar with these forms, borrowers can navigate the settlement process with greater confidence.

Similar forms

The Loan Estimate form is a document that provides borrowers with a clear overview of the estimated costs associated with their mortgage loan. Similar to the Fee Worksheet, it outlines various fees, including loan origination fees, title insurance, and closing costs. Both documents aim to give borrowers an understanding of their financial obligations before finalizing the loan. The Loan Estimate must be provided within three business days of receiving a loan application, ensuring borrowers have ample time to review their potential expenses.

The Closing Disclosure is another important document that shares similarities with the Fee Worksheet. This form is given to borrowers at least three business days before closing on a mortgage. It details the final loan terms and closing costs, allowing borrowers to compare these figures with those provided in the Loan Estimate. Like the Fee Worksheet, the Closing Disclosure breaks down various charges, including title fees and government recording fees, providing transparency in the closing process.

The Good Faith Estimate (GFE) was previously used in real estate transactions to summarize the costs associated with a mortgage loan. While the GFE has largely been replaced by the Loan Estimate, it shares a similar purpose with the Fee Worksheet. Both documents present an itemized list of expected fees and charges, helping borrowers to understand the financial implications of their loan. The GFE was designed to promote transparency and allow borrowers to shop around for the best mortgage terms.

The HUD-1 Settlement Statement is a document that was commonly used in real estate transactions before the implementation of the Closing Disclosure. It provides a detailed account of all charges and credits associated with a real estate transaction. Much like the Fee Worksheet, the HUD-1 outlines various fees, such as title charges and recording fees. Although it has been largely phased out, it remains similar in function by ensuring that borrowers are aware of the costs involved in closing their loan.

The Itemized Statement of Settlement Charges is a document that lists all costs related to the closing of a real estate transaction. It is similar to the Fee Worksheet in that it provides an itemized breakdown of fees, including lender charges and third-party fees. This document serves to clarify the financial obligations of the borrower, ensuring they understand what they are paying for at closing. Both documents are designed to promote transparency and assist borrowers in budgeting for their loan expenses.

The Pre-Closing Disclosure is a document that provides a summary of the closing costs and terms of a mortgage loan, similar to the Fee Worksheet. It is typically provided to borrowers shortly before the closing date, allowing them to review the final terms of their loan. Both documents aim to ensure that borrowers are fully informed of their financial commitments. The Pre-Closing Disclosure helps to confirm that all parties are on the same page regarding the costs associated with the transaction.

The Employment Verification form is a key document often used in various professional settings, ensuring that employers can substantiate an individual's employment status. For those looking to explore this subject further, the thorough guide on Employment Verification forms offers valuable insights and resources to navigate the verification process effectively.

The Estimated Closing Costs form is another document that resembles the Fee Worksheet. It provides an overview of the anticipated costs that a borrower will incur at closing. Like the Fee Worksheet, this form breaks down various charges, including title fees and government recording fees. The purpose of both documents is to give borrowers a clear understanding of the financial responsibilities they will face when finalizing their mortgage loan.

Dos and Don'ts

When filling out the Fee Worksheet form, it's important to follow some guidelines to ensure accuracy and clarity. Here are six things you should and shouldn't do:

- Do double-check all personal information, including the names of the borrower(s) and property details.

- Don't leave any sections blank; if a fee does not apply, indicate that clearly.

- Do use the most recent estimates for fees to provide an accurate picture of closing costs.

- Don't estimate fees based on outdated information or assumptions; verify current rates.

- Do review the total estimated closing costs carefully to ensure they align with your expectations.

- Don't ignore the importance of signatures; make sure all required parties sign the form where indicated.

Key takeaways

When filling out and using the Fee Worksheet form, keep the following key takeaways in mind:

- Understand the Purpose: This form is designed to provide a detailed estimate of the fees associated with a loan transaction.

- Accurate Information: Ensure that all fields, such as the borrower’s name and loan number, are filled out accurately to avoid confusion later.

- Itemized Estimates: The worksheet breaks down estimated charges into categories, allowing for a clear overview of potential costs.

- Review Fees Carefully: Some fees may vary; review each line item to understand which charges may be higher or lower at closing.

- Closing Costs: Pay special attention to the section on estimated closing costs, as these can significantly impact the total amount needed at settlement.

- Prepaid Costs: Include any items required by the lender to be paid in advance, such as insurance premiums and property taxes.

- Transaction Summary: Use the transaction summary section to calculate the total estimated monthly payment and funds needed to close.

- Credits and Costs: Be aware of how to account for borrower-paid and non-borrower-paid closing costs to get an accurate picture of total expenses.

- Check for Errors: Before submitting the form, double-check all calculations and entries to ensure accuracy.

- Consult Professionals: If uncertain about any fees or terms, consult with a financial advisor or real estate professional for guidance.

How to Use Fee Worksheet

Completing the Fee Worksheet form is an essential step in preparing for the settlement of a loan. It requires careful attention to detail, as the information provided will help estimate the charges that may be incurred. Once you have gathered the necessary information, follow the steps below to accurately fill out the form.

- Enter the Date: Begin by filling in the date at the top of the form.

- Provide Your Information: Fill in the fields for "Provided By," "Subject Property," "Borrower(s)," and "Loan Number."

- Loan Details: Input the "Interest Rate," "Type of Loan," "Base Loan Amount," "Loan Program," "Term," "Sales Price," and "Total Loan Amount."

- Estimated Closing Costs: Start with the section for "Items Payable in Connection with Loan." Enter the relevant fees under "Title Charges," including "Loan Origination Fees," "Settlement or Closing Fee," "Owner’s Title Insurance," and "Lender’s Title Insurance." Add any additional fees as needed.

- Recording and Transfer Charges: Proceed to the "Government Recording and Transfer Charges" section. Fill in the fields for "Recording Fees," "Transfer Taxes," and any other applicable charges.

- Additional Settlement Charges: Complete the "Additional Settlement Charges" section with any other fees that may apply.

- Estimated Reserve/Prepaid Costs: Move to the "Items Required by Lender to be Paid in Advance" section. Document the "Daily Interest Days," "Initial Deposit into Escrow Account," and any insurance or tax-related fees.

- Transaction Summary: Calculate and input the "Total Estimated Monthly Payment," "Total Estimated Funds Needed to Close," and other relevant totals in the summary section.

- Closing Costs Summary: Fill in the "Closing Costs Summary" with all applicable costs and credits, ensuring that totals are calculated accurately.

- Final Review: Double-check all entries for accuracy. Ensure that all necessary fields are completed before finalizing the form.

Once the Fee Worksheet is filled out, it will be used to provide a comprehensive overview of the estimated costs associated with your loan. This information is crucial for both you and your lender as you move forward in the settlement process.