Fill Out a Valid Fl Dr 312 Form

The FL DR 312 form, officially known as the Affidavit of No Florida Estate Tax Due, serves a critical function for personal representatives managing the estates of deceased individuals in Florida. This form is essential when it has been determined that no Florida estate tax is owed, and it is not necessary to file a federal estate tax return, specifically Form 706 or 706-NA. By completing this affidavit, personal representatives can affirm their status and the estate's tax liability, thereby facilitating the release of any liens imposed by the Florida Department of Revenue. The form requires specific information, including the name of the decedent, their date of death, and confirmation of their citizenship status at the time of passing. Additionally, it places personal liability on the representative for any distributions made from the estate. The completed form must be filed with the appropriate clerk of the circuit court in the county where the decedent owned property, ensuring proper documentation in public records. Notably, this affidavit cannot be utilized for estates that are required to file a federal estate tax return, making its correct application vital for compliance with Florida tax laws.

Common mistakes

-

Incorrect Personal Representative Information: One common mistake is failing to accurately fill in the name of the personal representative. This individual must be clearly identified, as they are responsible for the estate. Missing or incorrect names can lead to delays or complications in the process.

-

Omitting the Decedent’s Details: Another frequent error involves not providing complete information about the decedent. It is essential to include the decedent's full name and date of death. Incomplete information can result in the form being rejected.

-

Misunderstanding Citizenship Status: Many people check the wrong box regarding the decedent's citizenship status. It's important to choose between "U.S. citizen" and "not a U.S. citizen" accurately. This detail affects the estate's tax obligations and can lead to legal issues if misrepresented.

-

Filing with the Wrong Office: A significant mistake is sending the form to the Florida Department of Revenue instead of the appropriate clerk of the circuit court. This misstep can cause unnecessary delays in processing the affidavit.

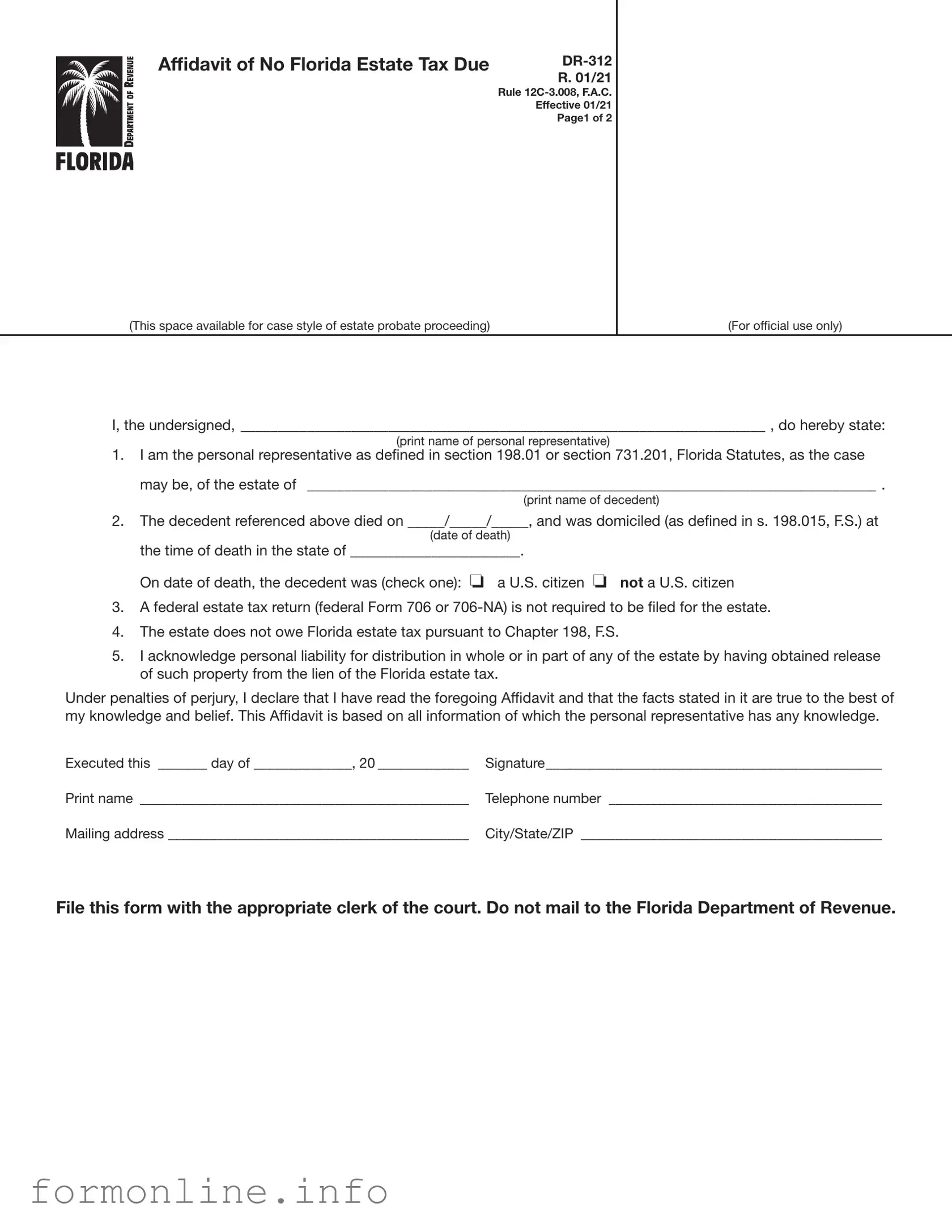

Preview - Fl Dr 312 Form

Affidavit of No Florida Estate Tax Due

Rule

Effective 01/21

Page1 of 2

(This space available for case style of estate probate proceeding) |

(For official use only) |

I, the undersigned, _______________________________________________________________________ , do hereby state:

(print name of personal representative)

1.I am the personal representative as defined in section 198.01 or section 731.201, Florida Statutes, as the case may be, of the estate of _____________________________________________________________________________ .

(print name of decedent)

2.The decedent referenced above died on _____/_____/_____, and was domiciled (as defined in s. 198.015, F.S.) at

(date of death)

the time of death in the state of _______________________.

On date of death, the decedent was (check one): o a U.S. citizen o not a U.S. citizen

3.A federal estate tax return (federal Form 706 or

4.The estate does not owe Florida estate tax pursuant to Chapter 198, F.S.

5.I acknowledge personal liability for distribution in whole or in part of any of the estate by having obtained release of such property from the lien of the Florida estate tax.

Under penalties of perjury, I declare that I have read the foregoing Affidavit and that the facts stated in it are true to the best of my knowledge and belief. This Affidavit is based on all information of which the personal representative has any knowledge.

Executed this _______ day of ______________, 20 _____________ |

Signature________________________________________________ |

Print name _______________________________________________ |

Telephone number _______________________________________ |

Mailing address ___________________________________________ |

City/State/ZIP ___________________________________________ |

File this form with the appropriate clerk of the court. Do not mail to the Florida Department of Revenue.

R. 01/21

Page 2 of 2

Instructions for Completing Form

File this form with the appropriate clerk of the court. Do not mail to the Florida Department of Revenue.

General Information

If Florida estate tax is not due and a federal estate tax return (federal Form 706 or

Form

The

Where to File Form

Form

When to Use Form

Form

and a federal estate tax return (federal Form 706 or

Federal thresholds for filing federal Form 706 only: (For informational purposes only. Please confirm with Form 706 instructions.)

Date of Death |

Dollar Threshold |

(year) |

for Filing Form 706 |

|

(value of gross estate) |

|

|

2000 and 2001 |

$675,000 |

|

|

2002 and 2003 |

$1,000,000 |

|

|

2004 and 2005 |

$1,500,000 |

|

|

For 2006 and forward |

|

go to the IRS website at |

|

www.irs.gov to obtain |

|

thresholds. |

|

|

|

For thresholds for filing federal Form

If an administration proceeding is pending for an estate, Form

To Contact Us

Information, forms, and tutorials are available on the Department’s website floridarevenue.com

If you have any questions, or need assistance, call Taxpayer Services at

To find a taxpayer service center near you, go to: floridarevenue.com/taxes/servicecenters

For written replies to tax questions, write to: Taxpayer Services - Mail Stop

5050 W Tennessee St Tallahassee FL

Subscribe to Receive Email Alerts from the Department.

Subscribe to receive an email when Tax Information Publications and proposed rules are posted to the Department’s website. Subscribe today at floridarevenue.com/dor/subscribe.

Reference Material

Rule Chapter

Other PDF Templates

Free Printable D1 Form - Random checks on those signing photographs will occur to maintain the integrity of the process.

When completing the Texas Motor Vehicle Bill of Sale, it is important to ensure that all details are accurate, as this form acts as an official record of the transaction. For those looking for an easy way to obtain this necessary documentation, you can download the document in pdf, streamlining the process of vehicle ownership transfer.

Identity Verification Form - Signers attest that the information provided on the form is accurate and true.

Documents used along the form

When dealing with the Fl Dr 312 form, several other documents may also be required or useful in the estate administration process. Each document serves a specific purpose and helps ensure that the estate is managed in compliance with Florida law. Here is a brief overview of these documents:

- Federal Form 706: This is the United States Estate (and Generation-Skipping Transfer) Tax Return. It is required for estates that exceed a certain value threshold. Filing this form allows the IRS to assess any federal estate taxes owed.

- Federal Form 706-NA: This form is similar to Form 706 but is specifically for non-resident aliens. It is used to report the estate of a non-citizen decedent and determine any federal estate tax obligations.

- Notice of Administration: This document informs interested parties about the probate proceedings. It outlines the rights of heirs and beneficiaries and provides details about the estate's administration.

- Inventory of Estate Assets: This document lists all assets owned by the decedent at the time of death. It is crucial for understanding the estate's value and for ensuring proper distribution among beneficiaries.

- Arizona RV Bill of Sale Form: This form serves as a crucial document that evidences the transfer of ownership of an RV. For more information, visit https://autobillofsaleform.com/rv-bill-of-sale-form/arizona-rv-bill-of-sale-form/.

- Final Accounting: This report summarizes all financial transactions related to the estate, including income, expenses, and distributions to beneficiaries. It ensures transparency and accountability in the estate administration process.

- Petition for Discharge: Once all debts and taxes are settled, the personal representative may file this petition to request formal closure of the estate. It signifies that the estate administration has been completed according to the law.

Understanding these documents can help streamline the estate administration process. Each plays a vital role in ensuring that the estate is settled correctly and efficiently. If you have questions about any of these forms, seeking guidance from a legal professional is advisable.

Similar forms

The Affidavit of No Florida Estate Tax Due (DR-312) shares similarities with the IRS Form 706, the federal estate tax return. Both documents serve to clarify the tax obligations of an estate following the death of an individual. While the DR-312 indicates that no Florida estate tax is owed, Form 706 is used to report the gross estate and calculate any federal estate tax that may be due. If an estate is required to file Form 706, it cannot use the DR-312, highlighting the critical distinctions between state and federal tax requirements.

The Georgia Trailer Bill of Sale form is a vital document in transactions involving trailer sales, ensuring the transfer of ownership is legally documented. Like other legal forms, it aids in avoiding disputes and clarifies the responsibilities of both seller and buyer. For more details, it's beneficial to refer to resources like https://georgiapdf.com/, which provide comprehensive information on properly handling this essential paperwork.

Another document akin to the DR-312 is the IRS Form 706-NA, which is specifically for nonresident aliens. Similar to the DR-312, this form is utilized when determining whether estate taxes are owed. The primary difference lies in the residency status of the decedent. While the DR-312 is for estates of U.S. citizens or residents, Form 706-NA addresses the unique tax obligations for nonresident decedents, ensuring compliance with federal regulations.

The Florida Department of Revenue's Nontaxable Certificate is also comparable to the DR-312. This certificate was previously issued to confirm that no estate tax was due. However, with the introduction of the DR-312, the Department no longer issues these certificates. Instead, the DR-312 serves as the official document to release the estate from the Florida estate tax lien, streamlining the process for personal representatives.

The Affidavit of Heirship is another relevant document. This affidavit is used to establish the rightful heirs of a decedent’s estate, particularly when no will exists. While the DR-312 focuses on tax liability, the Affidavit of Heirship clarifies ownership and distribution of assets. Both documents are crucial in the probate process, but they serve different purposes in settling an estate.

Similar to the DR-312, the Petition for Summary Administration is a document filed in Florida probate court. This petition is used for small estates that qualify for a simplified probate process. While the DR-312 addresses tax obligations, the Petition for Summary Administration allows for quicker distribution of assets, making it easier for personal representatives to manage estates with minimal complications.

The Last Will and Testament also bears some resemblance to the DR-312. A will outlines how a decedent’s assets should be distributed after death, while the DR-312 focuses on tax obligations. Both documents are essential in the estate administration process. The will provides direction for asset distribution, and the DR-312 ensures compliance with Florida tax laws, helping to avoid potential legal issues.

Lastly, the Certificate of Discharge from Personal Liability can be compared to the DR-312. This certificate is issued to personal representatives once they have fulfilled their duties and obligations regarding the estate. Like the DR-312, it provides assurance that the representative has complied with tax requirements. Both documents protect personal representatives from future claims related to the estate, ensuring they can proceed with confidence in their roles.

Dos and Don'ts

When filling out the Fl Dr 312 form, it’s important to follow specific guidelines to ensure that your submission is accurate and accepted. Here’s a list of things you should and shouldn’t do:

- Do ensure that you are the personal representative of the estate as defined by Florida law.

- Do provide the decedent's full name and date of death accurately.

- Do check the appropriate box to indicate whether the decedent was a U.S. citizen.

- Do file the form directly with the clerk of the circuit court in the county where the decedent owned property.

- Don't mail the form to the Florida Department of Revenue; it must be filed with the court.

- Don't write or mark in the designated 3-inch by 3-inch space at the top right corner of the form.

- Don't use this form if the estate is required to file a federal estate tax return (Form 706 or 706-NA).

- Don't forget to sign and date the affidavit before submitting it.

Key takeaways

Filling out and using the Florida Form DR-312 is a crucial step for personal representatives managing estates not subject to Florida estate tax. Here are key takeaways regarding this process:

- Purpose of the Form: Form DR-312 serves as an affidavit confirming that no Florida estate tax is due for the estate in question.

- Eligibility: This form is applicable only when a federal estate tax return (Form 706 or 706-NA) is not required to be filed.

- Filing Location: Submit the completed form directly to the clerk of the circuit court in the county where the decedent owned property. Do not send it to the Florida Department of Revenue.

- Personal Liability: The personal representative acknowledges personal liability for any distributions made from the estate after obtaining a release from the Florida estate tax lien.

- Evidence of Nonliability: Filing Form DR-312 provides admissible evidence of nonliability for Florida estate tax and effectively removes the Department’s estate tax lien.

- Important Note: Do not use this form if the estate is required to file federal Form 706 or 706-NA, as it will not be valid in those cases.

Understanding these key points can facilitate compliance and ensure that the estate is managed effectively and legally.

How to Use Fl Dr 312

Completing the Fl Dr 312 form is an essential step for personal representatives of estates that are not subject to Florida estate tax. This form must be filed with the clerk of the court to affirm that no estate tax is due. Following these steps will ensure that the process is completed accurately and efficiently.

- Obtain a copy of the Fl Dr 312 form. This can typically be found on the Florida Department of Revenue's website or through the clerk of the court's office.

- In the designated space, print your name as the personal representative of the estate.

- Fill in the name of the decedent in the appropriate section.

- Enter the date of death in the format of MM/DD/YYYY.

- Indicate the state where the decedent was domiciled at the time of death.

- Check the appropriate box to indicate whether the decedent was a U.S. citizen or not.

- Confirm that a federal estate tax return is not required for the estate.

- State that the estate does not owe Florida estate tax under Chapter 198.

- Acknowledge your personal liability regarding the distribution of the estate by signing and dating the form.

- Print your name, provide your telephone number, and fill in your mailing address, including city, state, and ZIP code.

- Leave the 3-inch by 3-inch space in the upper right corner blank for the clerk's use.

- Submit the completed form to the clerk of the circuit court in the county where the decedent owned property. Ensure that you do not mail this form to the Florida Department of Revenue.