Free Affidavit of Gift Template for Florida State

The Florida Affidavit of Gift form serves as an important legal document that facilitates the transfer of ownership for various types of property, including vehicles and real estate, without the need for a formal sale. This form is particularly useful for individuals who wish to gift assets to family members or friends, as it helps to clarify the intentions of the giver and provides a clear record of the transaction. By completing the affidavit, the donor affirms that the gift is made voluntarily and without any expectation of compensation. The form typically requires details about the donor and recipient, a description of the property being gifted, and signatures from both parties. Additionally, it may include a statement regarding the donor's authority to transfer the property, ensuring that the transaction is legitimate and legally binding. Understanding the nuances of this form can aid individuals in navigating the complexities of property transfer while ensuring compliance with state laws.

Common mistakes

-

Incomplete Information: Failing to provide all required details, such as the names of both the donor and recipient, can lead to delays or rejection of the affidavit.

-

Incorrect Signatures: Not having the appropriate signatures from both parties can invalidate the document. Ensure that the donor signs the affidavit in the designated area.

-

Missing Notarization: The affidavit must be notarized to be legally binding. Omitting this step can result in the form being deemed ineffective.

-

Failure to Date the Document: Not including the date of signing can create confusion regarding the timing of the gift, potentially affecting tax implications.

-

Incorrect Gift Description: Providing vague or incomplete descriptions of the gifted property can lead to misunderstandings or disputes later on.

-

Ignoring State-Specific Requirements: Each state may have unique requirements for affidavits. Failing to adhere to Florida's specific guidelines can result in complications.

-

Not Keeping Copies: After submitting the affidavit, not retaining a copy for personal records can lead to issues if verification is needed in the future.

-

Overlooking Tax Implications: Not considering the potential tax consequences of the gift can lead to unexpected liabilities for both the donor and recipient.

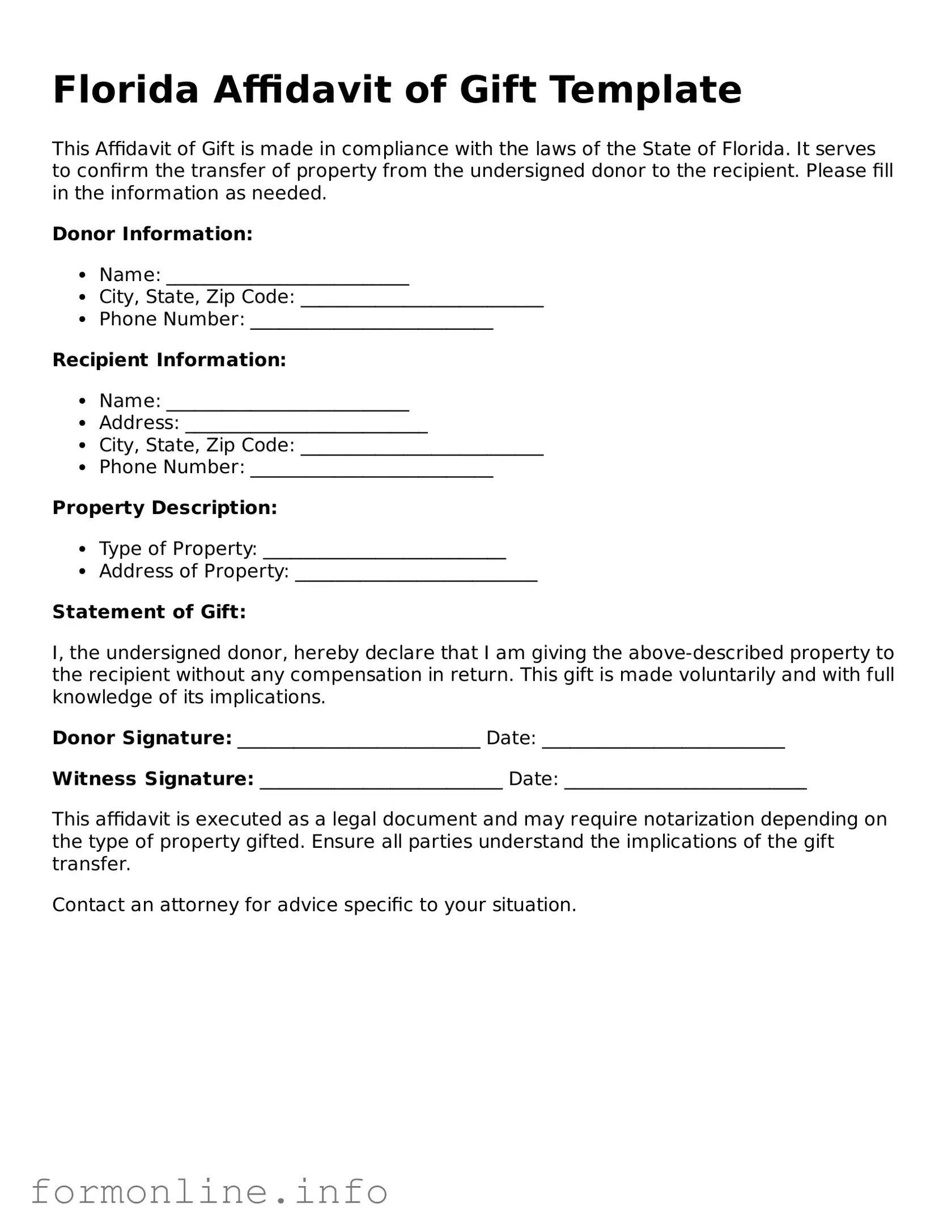

Preview - Florida Affidavit of Gift Form

Florida Affidavit of Gift Template

This Affidavit of Gift is made in compliance with the laws of the State of Florida. It serves to confirm the transfer of property from the undersigned donor to the recipient. Please fill in the information as needed.

Donor Information:

- Name: __________________________

- City, State, Zip Code: __________________________

- Phone Number: __________________________

Recipient Information:

- Name: __________________________

- Address: __________________________

- City, State, Zip Code: __________________________

- Phone Number: __________________________

Property Description:

- Type of Property: __________________________

- Address of Property: __________________________

Statement of Gift:

I, the undersigned donor, hereby declare that I am giving the above-described property to the recipient without any compensation in return. This gift is made voluntarily and with full knowledge of its implications.

Donor Signature: __________________________ Date: __________________________

Witness Signature: __________________________ Date: __________________________

This affidavit is executed as a legal document and may require notarization depending on the type of property gifted. Ensure all parties understand the implications of the gift transfer.

Contact an attorney for advice specific to your situation.

Documents used along the form

When dealing with the Florida Affidavit of Gift form, several other documents may be necessary to ensure a smooth transaction. Each of these documents serves a specific purpose and can help clarify the intent of the gift, provide proof of ownership, or facilitate the transfer process. Below is a list of commonly used forms and documents that often accompany the Affidavit of Gift.

- Bill of Sale: This document serves as proof of the transfer of ownership from the seller to the recipient. It details the item being gifted, its value, and the date of transfer.

- Gift Tax Return (IRS Form 709): If the value of the gift exceeds a certain threshold, the donor may need to file this federal form to report the gift for tax purposes.

- Virginia Homeschool Letter of Intent: The Homeschool Letter of Intent is essential for parents wishing to homeschool in Virginia, as it formalizes the commitment to provide an educational experience outside the traditional school system.

- Title Transfer Document: For gifts involving vehicles or real estate, this document is essential to officially transfer ownership. It includes information about the previous and new owners and the item being transferred.

- Declaration of Value: This document provides a formal statement of the value of the gifted item, which may be necessary for tax or insurance purposes.

- Letter of Intent: A letter from the donor expressing their wish to gift the item can clarify the donor's intentions and provide context for the transaction.

- Notarized Affidavit: Sometimes, a notarized statement from the donor may be required to affirm the authenticity of the gift and the donor's intent.

- Power of Attorney: If the donor is unable to sign the Affidavit of Gift themselves, a Power of Attorney may be needed to allow another person to act on their behalf.

- Proof of Identity: A copy of the donor's identification, such as a driver's license or passport, may be necessary to verify their identity and validate the transaction.

Having these documents prepared and organized can help streamline the gifting process and ensure compliance with any legal requirements. Always consider consulting with a professional to confirm that all necessary paperwork is in order before proceeding with a gift transaction.

Similar forms

The Florida Affidavit of Gift form shares similarities with the Gift Tax Return (IRS Form 709). Both documents are utilized to report the transfer of property or assets without receiving anything in return. While the Affidavit of Gift is typically a state-level form used to assert that a gift has been made, the Gift Tax Return is a federal form that must be filed if the value of the gift exceeds the annual exclusion limit. This means that while the Affidavit of Gift serves as a declaration of the gift, the Gift Tax Return provides the necessary information for tax purposes, ensuring compliance with federal regulations.

Another document that resembles the Florida Affidavit of Gift is the Quitclaim Deed. This legal document is often used to transfer ownership of real estate from one party to another without any warranties. Like the Affidavit of Gift, a Quitclaim Deed can be executed without a monetary exchange, making it a straightforward method for gifting property. Both documents require signatures from the parties involved and serve as a record of the transfer, although the Quitclaim Deed specifically pertains to real property, while the Affidavit of Gift can apply to various types of assets.

The Bill of Sale is also comparable to the Florida Affidavit of Gift. This document is used to transfer ownership of personal property, such as vehicles or equipment, from one individual to another. In cases where the transfer is a gift, the Bill of Sale can indicate that no payment was made, similar to the Affidavit of Gift. Both documents provide a clear record of the transaction, which is essential for legal purposes, particularly in proving ownership and the nature of the transfer.

For those seeking to confirm a person's job history and credentials, the Florida Employment Verification document can be invaluable. It is essential for various applications like loans or job placements, ensuring that potential employers or lenders receive accurate information. To explore this process further, visit this comprehensive guide on Employment Verification.

The Gift Letter is another document that aligns with the Florida Affidavit of Gift. Often used in real estate transactions, a Gift Letter is a statement from the donor confirming that a monetary gift was provided to the recipient, typically for a down payment on a home. Like the Affidavit of Gift, it serves to clarify that the funds are a gift and not a loan, helping to avoid potential misunderstandings. Both documents aim to provide transparency in financial transactions and protect the interests of all parties involved.

The Transfer on Death Deed (TOD) is similar in intent to the Florida Affidavit of Gift, as both documents facilitate the transfer of assets upon the death of the owner. A TOD allows an individual to designate a beneficiary who will automatically receive their property without going through probate. While the Affidavit of Gift is used to document a gift during the owner's lifetime, the TOD serves as a means to ensure that assets are passed on seamlessly after death, reflecting the owner’s wishes regarding their property.

The Power of Attorney (POA) can also be likened to the Florida Affidavit of Gift in that both documents involve the authority to act on behalf of another person. A POA grants someone the legal authority to make decisions regarding finances or property, which can include making gifts. While the Affidavit of Gift is a declaration of a completed gift, a POA may enable someone to execute such a gift on behalf of another individual, emphasizing the importance of trust and clarity in these transactions.

Finally, the Declaration of Trust shares similarities with the Florida Affidavit of Gift, particularly in the context of transferring assets into a trust. A Declaration of Trust outlines the terms and conditions under which assets are held and managed for the benefit of beneficiaries. While the Affidavit of Gift is a straightforward declaration of a gift, the Declaration of Trust can involve more complex arrangements regarding how and when the assets are distributed. Both documents aim to ensure that the intentions of the asset owner are clearly communicated and legally recognized.

Dos and Don'ts

When filling out the Florida Affidavit of Gift form, it is important to follow specific guidelines to ensure accuracy and compliance. Here are eight things you should and shouldn't do:

- Do read the instructions carefully before starting.

- Don't leave any required fields blank; provide all necessary information.

- Do sign and date the form where indicated.

- Don't use white-out or make alterations to the form; any corrections should be initialed.

- Do provide clear and legible information to avoid processing delays.

- Don't submit the form without reviewing it for errors.

- Do keep a copy of the completed form for your records.

- Don't forget to check for any additional documentation that may be required.

Key takeaways

Filling out and using the Florida Affidavit of Gift form is an important process for individuals looking to legally document the transfer of property or assets as a gift. Here are some key takeaways to consider:

- The form must be completed accurately to ensure that the transfer is legally recognized.

- Both the giver and the recipient should sign the affidavit to validate the transaction.

- It is advisable to include a description of the gifted property, including any relevant details such as serial numbers or property addresses.

- Notarization may be required to add an extra layer of authenticity to the document.

- Keep a copy of the completed affidavit for personal records, as it serves as proof of the gift for both parties.

How to Use Florida Affidavit of Gift

Once you have the Florida Affidavit of Gift form in hand, it’s time to fill it out accurately. This form is essential for documenting the transfer of ownership, and completing it correctly ensures that the process goes smoothly. Follow these steps to make sure you fill out the form properly.

- Begin by entering the name of the donor at the top of the form. This is the person giving the gift.

- Next, provide the donor's address. Include the street address, city, state, and ZIP code.

- In the following section, write the name of the recipient. This is the person receiving the gift.

- Then, fill in the recipient's address, similar to how you did for the donor.

- Identify the gift being transferred. Clearly describe the item or property. Be specific to avoid confusion.

- Next, indicate the date the gift is being made. This is important for record-keeping.

- After that, both the donor and recipient need to sign the form. Make sure signatures are clear and legible.

- Lastly, date the signatures to confirm when the document was completed.

Once you have filled out the form, keep a copy for your records. You may need to submit it to relevant authorities or keep it for personal documentation. This ensures that both parties have a clear understanding of the transaction.