Free Deed in Lieu of Foreclosure Template for Florida State

In Florida, homeowners facing financial difficulties may find themselves exploring alternatives to foreclosure, one of which is the Deed in Lieu of Foreclosure. This legal document allows a homeowner to voluntarily transfer their property title to the lender, effectively relinquishing ownership in exchange for the cancellation of the mortgage debt. By opting for this route, homeowners can avoid the lengthy and often stressful foreclosure process. The Deed in Lieu of Foreclosure form outlines the terms of this transfer, including any potential obligations or agreements between the homeowner and the lender. It is essential to understand that this process can impact your credit score, but it may also provide a quicker resolution and the chance to start anew. This form serves as a critical tool for both parties, ensuring that the transition is handled smoothly and legally, paving the way for a more manageable financial future.

Common mistakes

-

Not Understanding the Process: Many people rush into filling out the Deed in Lieu of Foreclosure form without fully understanding what it means. It’s important to grasp that this document transfers ownership of the property back to the lender, which can have long-term implications.

-

Incorrect Property Description: A common mistake is failing to provide an accurate description of the property. This includes the legal description and the address. Inaccuracies can lead to complications or delays in the process.

-

Not Including All Necessary Signatures: The form requires signatures from all parties involved. Forgetting to include a spouse or co-owner can invalidate the deed and complicate matters further.

-

Ignoring Lender Requirements: Each lender may have specific requirements for accepting a Deed in Lieu of Foreclosure. Some may need additional documents or information. Failing to comply with these can result in rejection.

-

Overlooking Tax Implications: People often forget to consider the tax consequences of transferring property. This can lead to unexpected tax liabilities. Consulting a tax professional is advisable before proceeding.

-

Not Seeking Legal Advice: Many individuals attempt to navigate this process alone. Not seeking legal advice can result in mistakes that may be costly. A lawyer can help ensure that the form is filled out correctly and that all legal obligations are met.

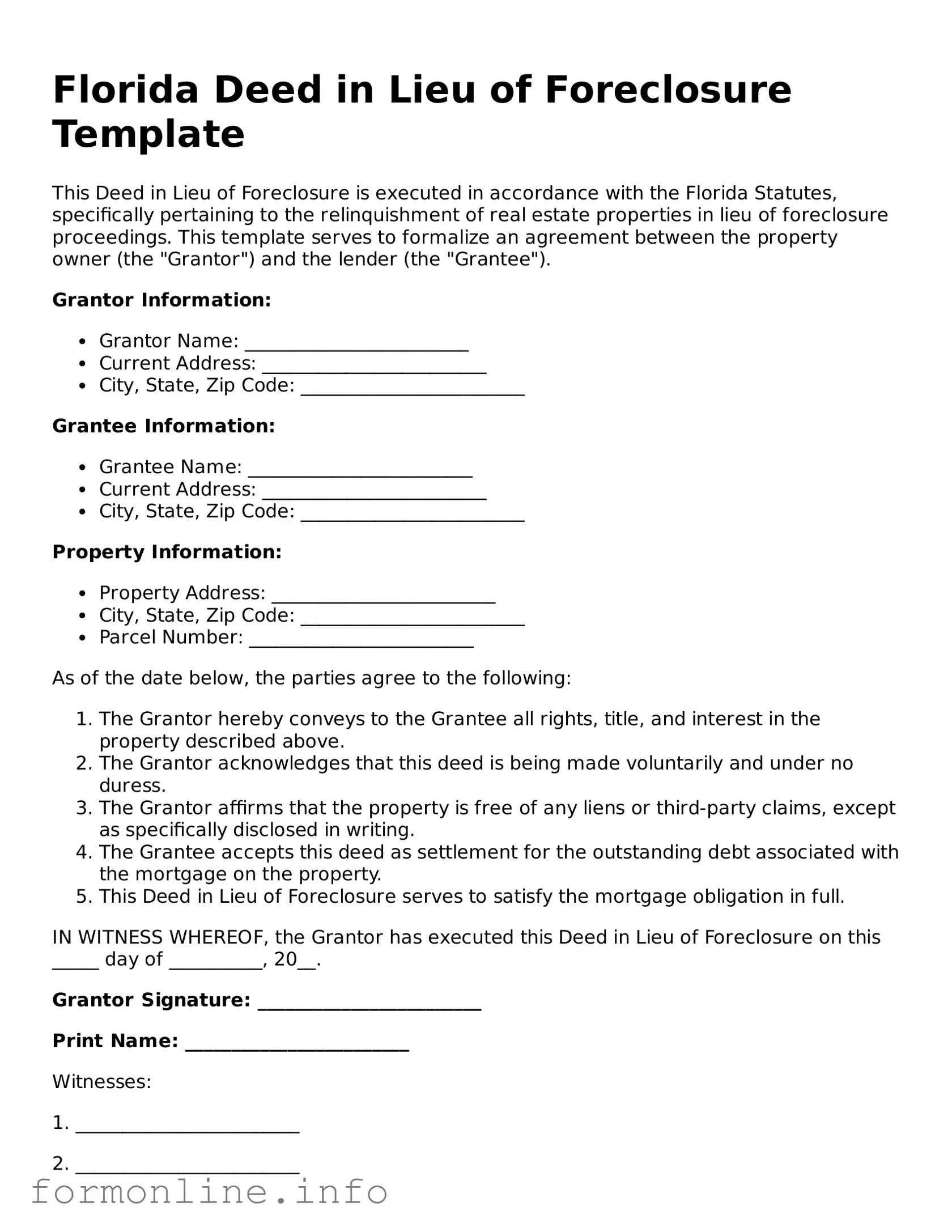

Preview - Florida Deed in Lieu of Foreclosure Form

Florida Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is executed in accordance with the Florida Statutes, specifically pertaining to the relinquishment of real estate properties in lieu of foreclosure proceedings. This template serves to formalize an agreement between the property owner (the "Grantor") and the lender (the "Grantee").

Grantor Information:

- Grantor Name: ________________________

- Current Address: ________________________

- City, State, Zip Code: ________________________

Grantee Information:

- Grantee Name: ________________________

- Current Address: ________________________

- City, State, Zip Code: ________________________

Property Information:

- Property Address: ________________________

- City, State, Zip Code: ________________________

- Parcel Number: ________________________

As of the date below, the parties agree to the following:

- The Grantor hereby conveys to the Grantee all rights, title, and interest in the property described above.

- The Grantor acknowledges that this deed is being made voluntarily and under no duress.

- The Grantor affirms that the property is free of any liens or third-party claims, except as specifically disclosed in writing.

- The Grantee accepts this deed as settlement for the outstanding debt associated with the mortgage on the property.

- This Deed in Lieu of Foreclosure serves to satisfy the mortgage obligation in full.

IN WITNESS WHEREOF, the Grantor has executed this Deed in Lieu of Foreclosure on this _____ day of __________, 20__.

Grantor Signature: ________________________

Print Name: ________________________

Witnesses:

1. ________________________

2. ________________________

State of Florida

County of ________________________

Popular Deed in Lieu of Foreclosure State Templates

California Property Transfer Deed - Prior to signing, it’s recommended that homeowners consult with a real estate attorney to understand implications.

In order to complete the transaction, both parties should familiarize themselves with the importance of the Georgia Motor Vehicle Bill of Sale form, which can be further explored at https://georgiapdf.com, as it ensures a seamless transfer of ownership and helps to avoid any potential disputes in the future.

Documents used along the form

When navigating the process of a Deed in Lieu of Foreclosure in Florida, several other forms and documents can be essential. These documents help clarify the situation, protect the interests of all parties involved, and ensure a smoother transition. Below is a list of common forms that you may encounter alongside the Deed in Lieu of Foreclosure.

- Loan Modification Agreement: This document outlines changes to the original loan terms, such as interest rates or repayment schedules. It may be considered before opting for a Deed in Lieu of Foreclosure, as it can provide an alternative solution to avoid foreclosure.

- Foreclosure Notice: This official notice informs the homeowner of the lender's intent to initiate foreclosure proceedings. It serves as a critical communication tool, outlining the timeline and steps leading up to foreclosure.

- Property Condition Disclosure Statement: This form provides information about the condition of the property being transferred. It helps ensure transparency between the borrower and lender regarding any existing issues with the property.

- Motorcycle Bill of Sale: This form is essential for recording the sale or transfer of a motorcycle in Wisconsin, providing legal protection for both the buyer and seller. For more details, visit https://autobillofsaleform.com/motorcycle-bill-of-sale-form/wisconsin-motorcycle-bill-of-sale-form/.

- Release of Liability: This document releases the borrower from any further obligations related to the mortgage once the Deed in Lieu is executed. It is vital for protecting the borrower from future claims by the lender.

- Settlement Statement: Often used in real estate transactions, this document details the financial aspects of the transfer, including any costs associated with the Deed in Lieu of Foreclosure. It ensures that both parties are aware of the financial implications of the agreement.

Understanding these documents can significantly ease the process of a Deed in Lieu of Foreclosure. Each form plays a unique role in ensuring that all parties are informed and protected during this challenging time.

Similar forms

A Mortgage Release, also known as a Satisfaction of Mortgage, is a document that signifies the borrower has paid off their mortgage loan in full. Similar to a Deed in Lieu of Foreclosure, it serves to clear the title of the property. Once recorded, it officially releases the lender's claim on the property, allowing the homeowner to transfer ownership without the burden of the mortgage. Both documents aim to simplify the process of transferring property ownership and alleviating debt, but a Mortgage Release occurs after full payment rather than as a solution to default.

A Short Sale Agreement involves the sale of a property for less than the total amount owed on the mortgage. Like a Deed in Lieu of Foreclosure, it provides a way for homeowners to avoid foreclosure. In both cases, the lender must agree to the terms, as they will incur a loss. However, a Short Sale requires the property to be sold on the open market, while a Deed in Lieu allows for a direct transfer back to the lender, often streamlining the process for the borrower.

The process of transferring ownership of a mobile home can be made clearer through the use of the Mobile Home Bill of Sale, which serves as crucial documentation for both buyers and sellers. By utilizing this form, parties can ensure a smooth transaction, safeguarding their rights in the process.

A Loan Modification Agreement is a document that alters the terms of an existing mortgage to make it more affordable for the borrower. This can include changes to the interest rate, payment schedule, or loan balance. Similar to a Deed in Lieu of Foreclosure, it is a tool to help homeowners avoid foreclosure. However, while a Deed in Lieu transfers ownership to the lender, a Loan Modification keeps the borrower in their home, allowing them to continue making payments under the new terms.

A Forebearance Agreement allows a borrower to temporarily pause or reduce their mortgage payments. This document is similar to a Deed in Lieu of Foreclosure in that it aims to prevent foreclosure by providing relief to the borrower. However, while a Deed in Lieu results in the transfer of property ownership, a Forbearance Agreement maintains the borrower’s ownership while offering them time to recover financially.

A Bankruptcy Filing can also serve as a protective measure for homeowners facing foreclosure. It creates an automatic stay, halting all collection efforts, including foreclosure proceedings. Like a Deed in Lieu of Foreclosure, it can provide a way out of financial distress. However, bankruptcy can have long-lasting effects on a borrower’s credit and financial future, while a Deed in Lieu is a more direct resolution that allows for the transfer of property back to the lender.

A Quitclaim Deed is a legal instrument used to transfer a property interest from one party to another. This document is similar to a Deed in Lieu of Foreclosure in that it facilitates a transfer of ownership. However, a Quitclaim Deed does not involve any financial settlement or agreement with a lender, and it does not relieve the grantor of any debts associated with the property. In contrast, a Deed in Lieu specifically addresses the resolution of mortgage debt.

An Assignment of Mortgage is a document that transfers the rights and interests of a mortgage from one lender to another. It shares similarities with a Deed in Lieu of Foreclosure in that both involve the transfer of rights related to property ownership. However, an Assignment of Mortgage does not change the ownership of the property itself; it merely changes the party entitled to collect payments. A Deed in Lieu, on the other hand, results in the lender taking back the property.

A Property Settlement Agreement is often used in divorce proceedings to divide marital assets, including real estate. Similar to a Deed in Lieu of Foreclosure, it involves the transfer of property ownership. However, a Property Settlement Agreement is typically the result of negotiation between parties and does not necessarily involve any debt relief or lender participation, whereas a Deed in Lieu directly addresses mortgage default and lender acceptance.

An Affidavit of Title is a document where the seller of a property attests to their ownership and the absence of liens or encumbrances. This document is similar to a Deed in Lieu of Foreclosure in that both confirm ownership status. However, an Affidavit of Title is usually used in the sale process to assure buyers of clear title, while a Deed in Lieu is used to transfer property back to the lender to resolve mortgage issues.

Finally, a Release of Lien is a document that removes a lien from a property, often after a debt has been paid. This document is similar to a Deed in Lieu of Foreclosure in that both serve to clear encumbrances on a property. However, a Release of Lien typically follows the payment of debts, while a Deed in Lieu occurs when the borrower cannot meet their mortgage obligations and voluntarily transfers the property to the lender.

Dos and Don'ts

When filling out the Florida Deed in Lieu of Foreclosure form, it's important to approach the process with care. Here are some essential dos and don’ts to keep in mind:

- Do ensure that all information is accurate and complete. Double-check names, addresses, and legal descriptions.

- Do consult with a legal professional if you have any questions about the process or implications.

- Do sign the document in the presence of a notary public to validate your signature.

- Do keep copies of all documents for your records after submission.

- Don't rush through the form. Take your time to understand each section before filling it out.

- Don't leave any sections blank unless instructed. This can lead to delays or complications.

- Don't ignore any potential tax implications. Consider seeking advice on how this may affect your financial situation.

Key takeaways

Filling out and using the Florida Deed in Lieu of Foreclosure form is a significant step for homeowners facing financial difficulties. Understanding the implications and requirements can help ensure a smoother process. Here are some key takeaways to consider:

- Voluntary Transfer: A Deed in Lieu of Foreclosure is a voluntary transfer of property from the homeowner to the lender. This option allows homeowners to avoid the lengthy and often stressful foreclosure process.

- Impact on Credit: While a Deed in Lieu may have a less severe impact on your credit score compared to a foreclosure, it will still be reported negatively. Understanding this can help you make informed decisions about your financial future.

- Clear Title: By completing the Deed in Lieu, the lender typically agrees to release the homeowner from the mortgage obligation. However, ensure that the title is clear of any other liens or claims before proceeding.

- Seek Legal Advice: It is crucial to consult with a legal expert or a housing counselor before signing any documents. They can provide guidance tailored to your situation and help you understand all potential consequences.

How to Use Florida Deed in Lieu of Foreclosure

After completing the Florida Deed in Lieu of Foreclosure form, the next steps involve submitting the document to the appropriate parties, typically the lender and local county office. It is crucial to ensure that all information is accurate and that the document is signed in the presence of a notary public. This helps to avoid any delays in processing.

- Obtain the Florida Deed in Lieu of Foreclosure form from a reliable source or your lender.

- Fill in the names of the parties involved. This includes the borrower and the lender.

- Provide the property address. Ensure that it matches the official records.

- Include a legal description of the property. This can often be found on the property deed or tax records.

- State the consideration, which is typically the amount owed on the mortgage.

- Sign the form in the designated area. Ensure that the signature is clear and matches the name on the document.

- Have the form notarized. A notary public must witness the signing of the document.

- Make copies of the completed and notarized form for your records.

- Submit the original form to the lender and file a copy with the local county office, if required.