Free Deed Template for Florida State

When it comes to transferring property ownership in Florida, understanding the Florida Deed form is crucial for both buyers and sellers. This legal document serves as the official record of the transfer, outlining essential details such as the names of the parties involved, a description of the property, and any specific terms or conditions related to the transfer. The Florida Deed form can take various forms, including warranty deeds, quitclaim deeds, and special warranty deeds, each serving different purposes and providing varying levels of protection to the parties. It is important to note that the form must be executed correctly, including proper signatures and notarization, to ensure its validity. Additionally, the deed must be filed with the appropriate county clerk’s office to make the transfer public record. Understanding these aspects is vital to ensure a smooth transaction and to protect the interests of all parties involved.

Common mistakes

-

Incorrect Names: One common mistake is misspelling the names of the grantor (seller) or grantee (buyer). Ensure that names are spelled correctly and match the identification documents.

-

Missing Signatures: All parties involved must sign the deed. Forgetting to include a signature can lead to delays or rejection of the document.

-

Improper Notarization: The deed must be notarized correctly. If the notary's information is incomplete or the notary fails to sign, the document may not be valid.

-

Incorrect Property Description: The legal description of the property must be accurate. Errors in this section can create confusion and potential legal issues.

-

Failure to Date the Document: Not dating the deed is another frequent oversight. A date is essential for establishing the timeline of the transaction.

-

Not Following Local Requirements: Each county may have specific requirements for filing a deed. Failing to adhere to these can result in complications.

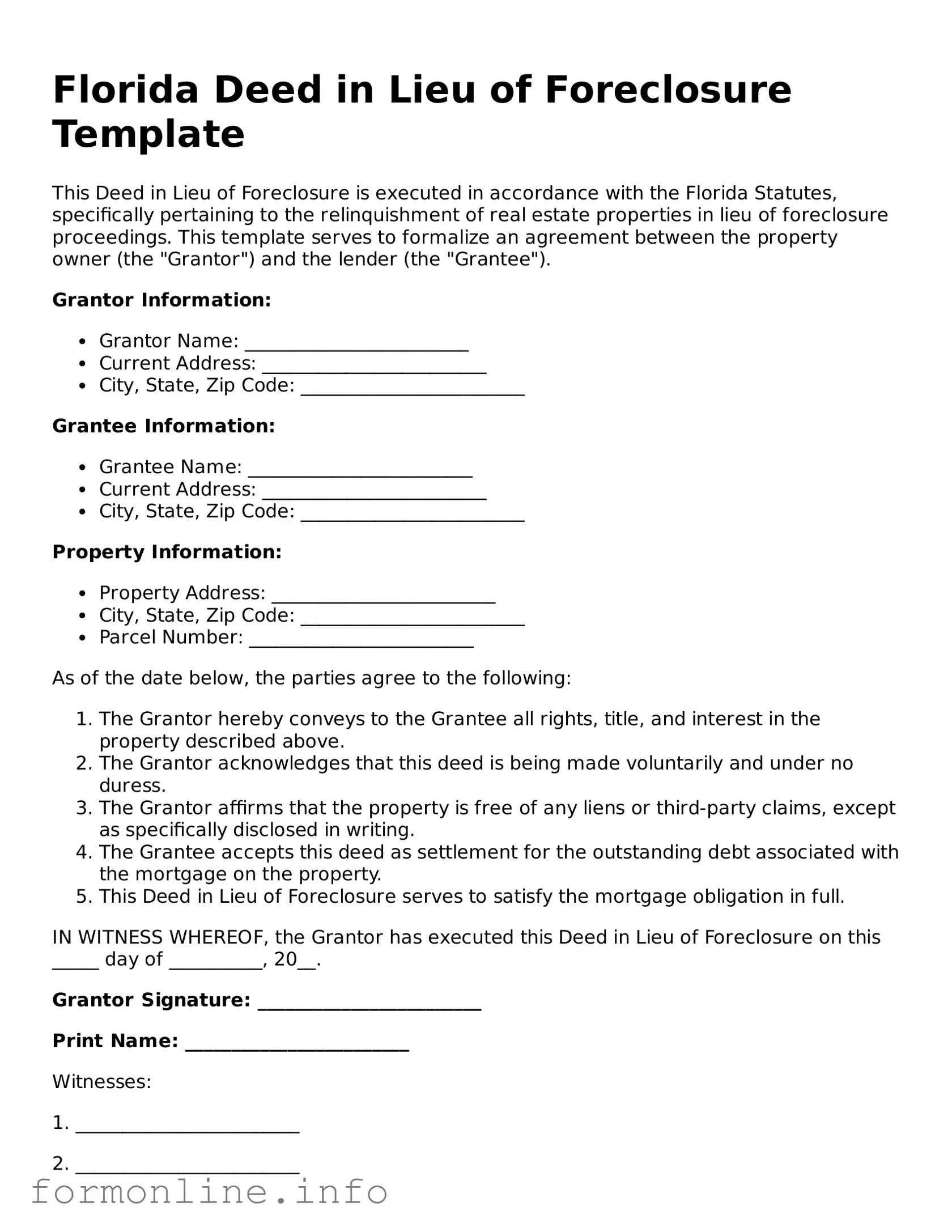

Preview - Florida Deed Form

Florida Deed Template

This deed is created in accordance with the laws of the State of Florida.

Grantor: ________________________________________

(Name of person/entity transferring property)

Grantee: ________________________________________

(Name of person/entity receiving property)

Property Address: ________________________________________

(Street Address, City, State, Zip Code)

Legal Description:

(Insert legal description of the property)

This deed conveys the following rights:

- The right to possess the property.

- The right to enjoy the property without disturbance.

- The right to sell or transfer the property.

The Grantor affirms the following:

- This property is free of any liens or encumbrances.

- The Grantor is the legal owner of the property.

- This transfer is voluntary and made without coercion.

In witness whereof, the Grantor has executed this deed on this _____ day of ___________, 20__.

Signature of Grantor: ________________________________________

Witness 1: ________________________________________

(Signature of Witness 1)

Witness 2: ________________________________________

(Signature of Witness 2)

State of Florida

County of ________________

On this _____ day of ___________, 20__, before me, a Notary Public, personally appeared ________________________________________ (Grantor), known to me to be the person(s) who executed the foregoing instrument.

Notary Public Signature: ________________________________________

My Commission Expires: ____________

Seal:

Popular Deed State Templates

Warranty Deed - Follows a structured format to ensure completeness and legal validity.

For those looking to buy or sell a horse, utilizing a thorough Horse Bill of Sale template can be instrumental in ensuring a smooth transaction. This document captures crucial details and can be accessed through this link: efficient Florida Horse Bill of Sale agreement.

How Do I Get a Copy of My House Title in California - Often reviewed by legal professionals to ensure compliance with all laws.

Documents used along the form

When dealing with property transactions in Florida, several important documents often accompany the Florida Deed form. These documents help clarify ownership, facilitate the transfer of property, and ensure compliance with state regulations. Below is a list of commonly used forms and documents.

- Title Insurance Policy: This document protects the buyer against any potential claims or issues related to the property title that may arise after the purchase.

- Property Appraisal: An appraisal assesses the market value of the property. It is often required by lenders to ensure the property's value aligns with the loan amount.

- Mobile Home Bill of Sale: This essential document facilitates the transfer of ownership for a mobile home in New York, and it's important to include accurate details about the transaction when using the Mobile Home Bill of Sale.

- Closing Statement: This document summarizes all financial transactions involved in the sale, including fees, taxes, and the final purchase price.

- Purchase Agreement: This is a contract between the buyer and seller outlining the terms of the sale, including price and contingencies.

- Affidavit of Title: This sworn statement confirms the seller's ownership of the property and that there are no liens or claims against it.

- Settlement Statement (HUD-1): Used in real estate transactions, this form details all costs associated with the closing of the property sale.

- Power of Attorney: This document allows one person to act on behalf of another in legal or financial matters, often used if the seller cannot be present at closing.

- Notice of Transfer: This document informs local authorities of the property transfer, which is necessary for updating public records.

Each of these documents plays a crucial role in ensuring a smooth property transaction. It is essential to have all necessary forms prepared and reviewed to avoid any delays or complications during the closing process.

Similar forms

The Florida Quitclaim Deed is similar to the Florida Deed form in that it transfers ownership of property from one party to another. However, unlike the Florida Deed, which provides certain guarantees about the title, the Quitclaim Deed offers no warranties. This means that the grantor does not guarantee that they own the property free and clear of any claims. It is often used between family members or in situations where the parties trust each other, as it allows for a quick transfer of property rights without extensive legal requirements.

The Florida Warranty Deed is another document closely related to the Florida Deed form. This deed provides a higher level of protection for the grantee, as it guarantees that the grantor holds clear title to the property and has the right to sell it. In contrast to the Florida Deed, which may be more straightforward and less formal, the Warranty Deed includes specific covenants that ensure the grantee is protected against any future claims on the property. This makes it a preferred choice for buyers in real estate transactions where security is a priority.

The Florida Bargain and Sale Deed shares similarities with the Florida Deed form, particularly in its function of transferring property. However, this type of deed implies that the grantor has title to the property but does not provide any warranties against encumbrances. This means that while the seller is conveying the property, the buyer assumes the risk of any existing claims. It is often used in foreclosure sales or situations where the seller is unable or unwilling to provide full assurances regarding the property’s title.

When dealing with the transfer of ownership for mobile homes, it is crucial to utilize a proper form, such as the Mobile Home Bill of Sale, which ensures that all legal requirements are met during the transaction, thus preventing any potential disputes between parties involved.

Finally, the Florida Personal Representative Deed is a document that is used in the context of estate administration. This deed allows a personal representative to transfer property from a deceased individual’s estate to heirs or beneficiaries. While it serves a similar purpose to the Florida Deed form in transferring ownership, it is specifically tied to the probate process and is used when the property is being distributed as part of an estate settlement. This ensures that the transfer is legally recognized and appropriately handled according to the decedent's wishes.

Dos and Don'ts

Filling out a Florida Deed form can be a straightforward process, but it's essential to approach it with care. Here are some key dos and don'ts to keep in mind:

- Do ensure all parties involved are correctly identified. Include full names and addresses to avoid confusion.

- Do double-check the legal description of the property. This should be accurate and match the information in public records.

- Do sign the deed in the presence of a notary. This step is crucial for the document's validity.

- Do file the deed with the appropriate county clerk's office after completing it. This makes the transfer official.

- Do keep copies of the signed deed for your records. Having documentation can save you headaches later.

- Don't rush through the form. Take your time to ensure all information is accurate and complete.

- Don't use abbreviations or nicknames. Always write out full names to prevent any legal complications.

- Don't forget to include any required disclosures or additional documents that may be necessary.

- Don't leave any sections blank. If a section does not apply, write "N/A" instead of skipping it.

- Don't overlook the importance of consulting a professional if you have questions. It's better to ask than to make a mistake.

Key takeaways

When filling out and using the Florida Deed form, it’s essential to keep several key points in mind. Here are some takeaways to guide you through the process:

- Ensure that the property description is accurate and complete. This helps avoid confusion or disputes later.

- Identify all parties involved in the transaction. This includes both the grantor (seller) and grantee (buyer).

- Sign the deed in front of a notary public. This step is crucial for the deed to be legally valid.

- Consider whether to include any special provisions or conditions. This can affect how the property is used or transferred in the future.

- File the completed deed with the county clerk in the county where the property is located. This ensures public record of the transaction.

- Keep a copy of the deed for your records. It’s important to have proof of ownership.

- Check for any local regulations or requirements that may apply. Different counties may have specific rules.

- Consult with a real estate attorney if you have any doubts or questions. Getting professional advice can save you time and trouble.

Taking these steps can help ensure a smooth process when dealing with property transactions in Florida. Be thorough and proactive to avoid potential issues down the line.

How to Use Florida Deed

Once you have obtained the Florida Deed form, you can begin the process of filling it out. Ensure that you have all necessary information at hand, as accuracy is crucial for the validity of the document. After completing the form, it will need to be signed and notarized before it can be recorded with the appropriate county office.

- Obtain the Florida Deed form from a reliable source or the local county office.

- Enter the date of the transaction at the top of the form.

- Fill in the names of the grantor(s) (the person(s) transferring the property) in the designated area.

- Provide the names of the grantee(s) (the person(s) receiving the property) following the grantor(s) information.

- Describe the property being transferred, including the legal description and address.

- Indicate the consideration (the amount paid for the property) in the appropriate section.

- Include any additional terms or conditions relevant to the transfer, if applicable.

- Sign the form in the presence of a notary public.

- Have the notary public complete their section, including their signature and seal.

- Make copies of the completed deed for your records before submitting it.

- Submit the original deed to the appropriate county office for recording.