Free Durable Power of Attorney Template for Florida State

The Florida Durable Power of Attorney form is a critical legal document that empowers individuals to designate someone they trust to manage their financial and legal affairs in the event they become incapacitated. This form ensures that your chosen agent can act on your behalf, making decisions about your assets, managing bills, and handling other essential tasks without needing court intervention. One of the key features of this document is its durability; it remains effective even if you become mentally incapacitated, providing peace of mind for both you and your loved ones. Additionally, the form can be tailored to meet specific needs, allowing you to grant broad or limited powers to your agent. It’s important to understand the responsibilities of the appointed agent and the implications of the powers granted. As you navigate this process, knowing the ins and outs of the Florida Durable Power of Attorney can help ensure that your wishes are respected and that your financial matters are handled smoothly in challenging times.

Common mistakes

-

Not Specifying Powers Clearly: One common mistake is failing to clearly outline the specific powers granted to the agent. The form allows for a range of financial and legal decisions. If these powers are vague or not explicitly stated, it can lead to confusion or disputes later on.

-

Choosing the Wrong Agent: Selecting an agent who is not trustworthy or lacks the necessary skills can be detrimental. It's essential to choose someone who understands your wishes and can handle the responsibilities effectively. Family members or close friends may not always be the best choice.

-

Not Signing or Dating the Document: A Durable Power of Attorney must be signed and dated to be valid. Many people overlook this crucial step. Without a signature, the document may not hold up in legal situations, rendering it ineffective.

-

Failing to Update the Document: Life circumstances change. Failing to update the Durable Power of Attorney after significant life events, such as divorce or the death of an agent, can create problems. Regularly reviewing and revising the document ensures it reflects current wishes and conditions.

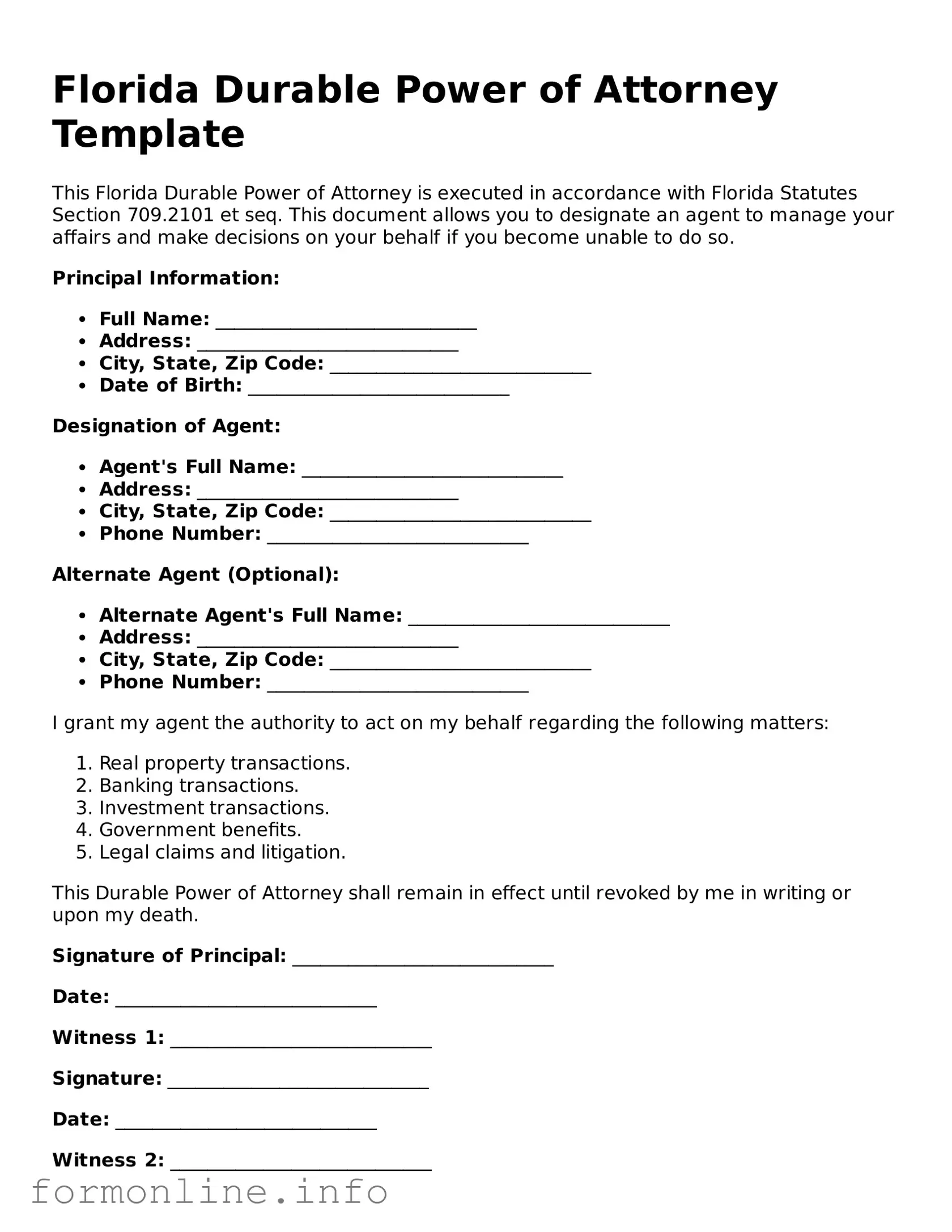

Preview - Florida Durable Power of Attorney Form

Florida Durable Power of Attorney Template

This Florida Durable Power of Attorney is executed in accordance with Florida Statutes Section 709.2101 et seq. This document allows you to designate an agent to manage your affairs and make decisions on your behalf if you become unable to do so.

Principal Information:

- Full Name: ____________________________

- Address: ____________________________

- City, State, Zip Code: ____________________________

- Date of Birth: ____________________________

Designation of Agent:

- Agent's Full Name: ____________________________

- Address: ____________________________

- City, State, Zip Code: ____________________________

- Phone Number: ____________________________

Alternate Agent (Optional):

- Alternate Agent's Full Name: ____________________________

- Address: ____________________________

- City, State, Zip Code: ____________________________

- Phone Number: ____________________________

I grant my agent the authority to act on my behalf regarding the following matters:

- Real property transactions.

- Banking transactions.

- Investment transactions.

- Government benefits.

- Legal claims and litigation.

This Durable Power of Attorney shall remain in effect until revoked by me in writing or upon my death.

Signature of Principal: ____________________________

Date: ____________________________

Witness 1: ____________________________

Signature: ____________________________

Date: ____________________________

Witness 2: ____________________________

Signature: ____________________________

Date: ____________________________

This document should be notarized to enhance its validity.

Popular Durable Power of Attorney State Templates

Durable Power of Attorney Form California - Choose an agent who understands your values and wishes to ensure alignment in decision-making.

For those in Florida, understanding the implications of a well-drafted Residential Lease Agreement is vital. It helps clarify the obligations of both the landlord and tenant, ensuring a smoother rental process. You can find more information on this critical document at the following resource: essential insights on the Residential Lease Agreement.

Documents used along the form

A Florida Durable Power of Attorney form allows an individual to appoint someone else to manage their financial and legal affairs. This document is crucial for ensuring that your wishes are honored in the event that you become incapacitated. Alongside this form, several other documents are often used to create a comprehensive estate plan. Below is a list of additional forms and documents that complement the Durable Power of Attorney.

- Living Will: This document outlines an individual's preferences regarding medical treatment in situations where they are unable to communicate their wishes. It specifies the types of medical interventions one does or does not want.

- Health Care Proxy: This form allows a person to designate someone to make medical decisions on their behalf if they become unable to do so. It is essential for ensuring that medical care aligns with personal values and desires.

- Last Will and Testament: This legal document specifies how a person's assets and property will be distributed upon their death. It can also appoint guardians for minor children and fulfill other personal wishes.

- Revocable Living Trust: This trust holds an individual’s assets during their lifetime and specifies how those assets will be managed and distributed after death. It can help avoid probate and maintain privacy.

- Beneficiary Designations: Certain assets, such as life insurance policies and retirement accounts, allow individuals to name beneficiaries directly. These designations supersede wills and trusts, making them vital for estate planning.

- Financial Power of Attorney: Similar to the Durable Power of Attorney, this document grants someone the authority to handle financial matters. However, it may not remain effective if the principal becomes incapacitated unless it is durable.

- Mobile Home Bill of Sale: This legal document is crucial for the transfer of ownership of a mobile home, ensuring that buyer and seller details are properly recorded. It serves as proof of the transaction and includes essential information such as the mobile home's description and sale price. Understanding this form is vital, especially when considering related documents like the Mobile Home Bill of Sale.

- Asset Inventory List: This is a comprehensive list of an individual's assets, including real estate, bank accounts, and personal property. It helps ensure that nothing is overlooked during estate planning and distribution.

Utilizing these documents in conjunction with the Florida Durable Power of Attorney form creates a robust plan for managing health care and financial decisions. Each document serves a unique purpose, ensuring that an individual’s wishes are respected and followed during their lifetime and after their passing.

Similar forms

The Florida Durable Power of Attorney (DPOA) form shares similarities with the General Power of Attorney. Both documents allow an individual, known as the principal, to designate another person, called the agent, to make decisions on their behalf. However, the DPOA remains effective even if the principal becomes incapacitated, whereas a General Power of Attorney typically becomes void under such circumstances. This distinction is crucial for individuals seeking to ensure their affairs are managed during periods of incapacity.

For those looking to establish a comprehensive plan for healthcare and financial decision-making, understanding the differences and similarities between various legal documents is crucial. One important option to consider is the General Power of Attorney form, which empowers an agent to act on behalf of the principal in a wide range of matters when they are unable to do so themselves.

The Medical Power of Attorney, also known as a Healthcare Proxy, is another document akin to the DPOA. This form specifically grants an agent the authority to make healthcare decisions for the principal if they are unable to do so. Like the DPOA, it empowers someone to act on behalf of the principal, but it focuses exclusively on medical matters. This ensures that health-related choices align with the principal’s wishes when they cannot voice them themselves.

Dos and Don'ts

When filling out the Florida Durable Power of Attorney form, there are important steps to take and common pitfalls to avoid. Here’s a helpful list to guide you.

- Do choose a trusted individual as your agent. This person will have significant authority over your financial and legal matters.

- Do clearly specify the powers you are granting. Be precise about what your agent can and cannot do.

- Do sign the form in front of a notary public. This adds a layer of authenticity to the document.

- Do keep a copy of the signed form for your records. This ensures you have access to it when needed.

- Don't leave any sections blank. Incomplete forms can lead to confusion or rejection.

- Don't choose someone who may not act in your best interest. Trust is essential in this role.

Key takeaways

Filling out and using the Florida Durable Power of Attorney form is an important step in ensuring that your financial and legal matters are handled according to your wishes. Here are some key takeaways to keep in mind:

- Understand the Scope: The Durable Power of Attorney allows you to grant authority to someone else to make decisions on your behalf. Be clear about what powers you are giving, whether they are financial, medical, or both.

- Choose Your Agent Wisely: Select someone you trust to act in your best interest. This person will have significant control over your affairs, so it’s crucial that they are reliable and responsible.

- Consider Specificity: You can tailor the document to specify which powers your agent will have. This can include managing bank accounts, selling property, or making healthcare decisions. Being specific helps avoid confusion later.

- Review and Update Regularly: Life changes, and so might your needs. Regularly review your Durable Power of Attorney to ensure it still reflects your wishes and that your chosen agent is still appropriate for the role.

How to Use Florida Durable Power of Attorney

Filling out the Florida Durable Power of Attorney form is an important step in designating someone to manage your financial affairs if you become unable to do so. By completing this form, you empower a trusted individual to act on your behalf. Follow these steps carefully to ensure that the document is filled out correctly.

- Obtain the Form: Start by downloading the Florida Durable Power of Attorney form from a reliable source or visit a local legal office to get a physical copy.

- Read the Instructions: Before filling out the form, read all instructions provided to understand what information is required.

- Identify Yourself: In the designated area, write your full name, address, and contact information. This identifies you as the principal.

- Choose Your Agent: Provide the name and contact information of the person you are appointing as your agent. Make sure this person is trustworthy and understands your wishes.

- Specify Powers: Clearly outline the powers you wish to grant to your agent. This may include managing bank accounts, paying bills, or making investment decisions.

- Include Successor Agents: If desired, name one or more successor agents who can act if your primary agent is unable to do so.

- Sign the Document: Sign the form in the presence of a notary public. Your signature must be witnessed to ensure validity.

- Notarization: Have the notary public sign and stamp the document. This step is crucial for the form to be legally binding.

- Distribute Copies: Make copies of the signed and notarized document. Provide copies to your agent, any successor agents, and keep one for your records.

After completing these steps, your Durable Power of Attorney will be ready for use. Ensure that you communicate your wishes clearly with your appointed agent and any relevant family members. This proactive measure can provide peace of mind knowing your affairs are in capable hands.