Free General Power of Attorney Template for Florida State

The Florida General Power of Attorney form serves as a crucial legal document that allows one person, known as the principal, to appoint another individual, referred to as the agent or attorney-in-fact, to make decisions on their behalf. This form grants broad powers, enabling the agent to handle various financial and legal matters, such as managing bank accounts, selling property, or filing taxes. It is essential for anyone who wants to ensure that their affairs are managed according to their wishes, especially in situations where they may become incapacitated or unable to make decisions themselves. The form must be signed by the principal and witnessed or notarized to be legally valid. Additionally, it is important to note that the powers granted can be limited or extensive, depending on the principal’s preferences. Understanding the specifics of this form can help individuals make informed choices about their future and the management of their assets.

Common mistakes

-

Not Specifying Powers Clearly: One common mistake is failing to clearly outline the specific powers granted to the agent. It's essential to list the exact authorities, such as handling financial matters or making healthcare decisions, to avoid confusion later.

-

Not Signing in the Presence of a Notary: Many individuals overlook the requirement for a notary public. Without a notarized signature, the document may not be considered valid, which can lead to complications when the agent attempts to act on your behalf.

-

Ignoring State-Specific Requirements: Each state has its own rules regarding power of attorney forms. Failing to adhere to Florida's specific requirements can render the document ineffective. Always ensure compliance with local laws.

-

Not Updating the Document: Life circumstances change, and so should your power of attorney. Failing to update the document after significant life events, like marriage or divorce, can create legal challenges and confusion for your agent.

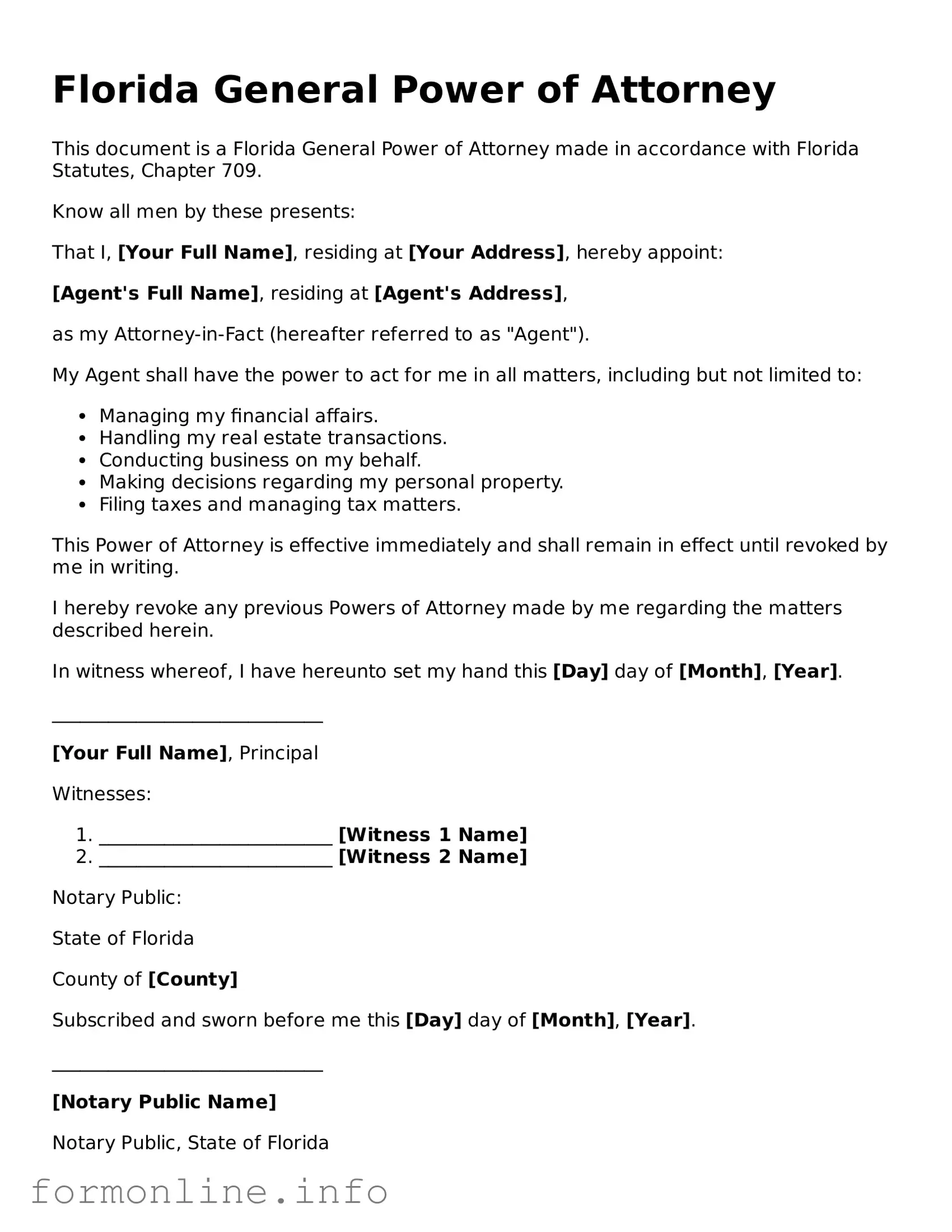

Preview - Florida General Power of Attorney Form

Florida General Power of Attorney

This document is a Florida General Power of Attorney made in accordance with Florida Statutes, Chapter 709.

Know all men by these presents:

That I, [Your Full Name], residing at [Your Address], hereby appoint:

[Agent's Full Name], residing at [Agent's Address],

as my Attorney-in-Fact (hereafter referred to as "Agent").

My Agent shall have the power to act for me in all matters, including but not limited to:

- Managing my financial affairs.

- Handling my real estate transactions.

- Conducting business on my behalf.

- Making decisions regarding my personal property.

- Filing taxes and managing tax matters.

This Power of Attorney is effective immediately and shall remain in effect until revoked by me in writing.

I hereby revoke any previous Powers of Attorney made by me regarding the matters described herein.

In witness whereof, I have hereunto set my hand this [Day] day of [Month], [Year].

_____________________________

[Your Full Name], Principal

Witnesses:

- _________________________ [Witness 1 Name]

- _________________________ [Witness 2 Name]

Notary Public:

State of Florida

County of [County]

Subscribed and sworn before me this [Day] day of [Month], [Year].

_____________________________

[Notary Public Name]

Notary Public, State of Florida

Commission Number: [Commission Number]

My Commission Expires: [Expiration Date]

Popular General Power of Attorney State Templates

Power of Attorney Template California - This form allows for broad power over your financial transactions.

When considering financial planning, it is crucial to understand the concept of a comprehensive Power of Attorney document and its significance in Florida. This form empowers individuals to designate someone they trust to make important decisions on their behalf, ensuring that their financial affairs are managed effectively. For more information about this vital legal tool, check out our guide on creating a Power of Attorney specifics.

Documents used along the form

The Florida General Power of Attorney form allows an individual to designate another person to act on their behalf in various financial and legal matters. However, several other documents may complement this form, providing additional clarity and authority in different situations. Below is a list of commonly used forms and documents that often accompany the General Power of Attorney.

- Durable Power of Attorney: This document remains effective even if the principal becomes incapacitated. It ensures that the designated agent can continue to make decisions on behalf of the principal without interruption.

- Healthcare Proxy: Also known as a medical power of attorney, this form allows an individual to appoint someone to make healthcare decisions if they are unable to do so themselves.

- Arizona University Application form: Essential for students aiming for admissions in Arizona institutions, this document includes a request for a waiver of the application fee for eligible Arizona residents facing financial hardship. For more information, visit AZ Forms Online.

- Living Will: This document outlines an individual's wishes regarding medical treatment and end-of-life care. It works in conjunction with a healthcare proxy to ensure that personal preferences are honored.

- Financial Power of Attorney: Similar to the General Power of Attorney, this form specifically grants authority to manage financial matters, such as banking, investments, and real estate transactions.

- Trust Agreement: This document establishes a trust, allowing a trustee to manage assets for the benefit of the beneficiaries. It can provide more control over how assets are distributed compared to a power of attorney.

- Affidavit of Identity: This form may be required to verify the identity of the principal or agent when executing documents related to the power of attorney.

- Notice of Revocation: If the principal decides to revoke the power of attorney, this document formally notifies the agent and any relevant institutions of the change.

- Asset Inventory: This document lists all assets owned by the principal, providing a clear picture of what the agent will manage under the power of attorney.

These documents can enhance the effectiveness of the Florida General Power of Attorney by ensuring that all aspects of an individual’s legal and financial needs are addressed comprehensively. It is important to consider each document's purpose and how it fits into your overall planning strategy.

Similar forms

A Durable Power of Attorney is similar to a General Power of Attorney but with a crucial difference. A Durable Power of Attorney remains effective even if the principal becomes incapacitated. This means that the agent can continue to make decisions on behalf of the principal during times when they cannot manage their affairs. This added protection ensures that there is always someone to handle financial matters, medical decisions, or other important tasks if the principal is unable to do so themselves.

A Healthcare Power of Attorney is another document that shares similarities with the General Power of Attorney. While the General Power of Attorney can cover a wide range of financial and legal matters, a Healthcare Power of Attorney specifically focuses on medical decisions. This document allows the designated agent to make healthcare choices for the principal if they are unable to communicate their wishes. It is essential for ensuring that medical care aligns with the principal's values and preferences.

Understanding the significance of a Mobile Home Bill of Sale is essential when transferring ownership of property. This document not only clarifies the roles of the buyer and seller but also outlines relevant details regarding the mobile home itself, thereby facilitating a smooth and legal transition of ownership.

A Living Will is closely related to the Healthcare Power of Attorney. While the latter designates someone to make decisions, a Living Will outlines the principal's wishes regarding medical treatment in specific situations, particularly at the end of life. It provides guidance to healthcare providers and loved ones about the principal’s preferences for life-sustaining treatments. Together, these documents create a comprehensive plan for medical care and decision-making.

A Revocable Trust is another important document that can work alongside a General Power of Attorney. A Revocable Trust allows individuals to manage their assets during their lifetime and specify how those assets should be distributed after their death. Unlike a General Power of Attorney, which grants authority to an agent, a Revocable Trust allows the individual to retain control over their assets while still providing a plan for management in the event of incapacity.

A Financial Power of Attorney is similar to a General Power of Attorney but is specifically focused on financial matters. This document allows the agent to handle banking, investments, and other financial transactions on behalf of the principal. It is particularly useful for individuals who want to ensure that their financial affairs are managed by a trusted person if they become unable to do so themselves.

A Limited Power of Attorney is a more specific version of the General Power of Attorney. This document grants the agent authority to act on behalf of the principal for a limited purpose or for a specific period. For example, someone might use a Limited Power of Attorney to allow another person to sell a property while they are out of the country. It provides flexibility while still maintaining control over the scope of authority granted.

Finally, a Springing Power of Attorney is similar to a General Power of Attorney but with a conditional aspect. This type of power of attorney only takes effect under certain circumstances, typically when the principal becomes incapacitated. It provides a way to ensure that the agent can step in and manage affairs only when needed, which can be a comforting option for those who want to retain control until a specific event occurs.

Dos and Don'ts

When filling out the Florida General Power of Attorney form, it is crucial to approach the process with care. This document grants someone the authority to act on your behalf in various matters. To ensure that your intentions are clear and legally sound, consider the following do's and don'ts:

- Do clearly identify the person you are appointing as your agent. Include their full name and contact information.

- Do specify the powers you wish to grant. Be precise about the decisions your agent can make on your behalf.

- Do sign the form in the presence of a notary public. This adds a layer of legitimacy to your document.

- Do keep a copy of the signed document for your records. This will help you track the authority you have granted.

- Don't use vague language. Ambiguities can lead to misunderstandings and disputes down the line.

- Don't forget to discuss your wishes with your agent before finalizing the document. They should be fully aware of your expectations.

Taking these steps can help ensure that your General Power of Attorney accurately reflects your wishes and provides the necessary authority to your chosen agent.

Key takeaways

When filling out and using the Florida General Power of Attorney form, keep these key points in mind:

- Understand the Purpose: A General Power of Attorney allows someone to act on your behalf in financial matters.

- Choose Your Agent Wisely: Pick someone you trust completely. This person will have significant control over your finances.

- Be Specific: Clearly outline the powers you are granting. General powers can be broad, but specific instructions help avoid confusion.

- Consider Duration: Decide if the power should be effective immediately or only if you become incapacitated.

- Sign in Front of Witnesses: Florida law requires you to sign the form in front of two witnesses and a notary public.

- Review Regularly: Your needs may change over time. Regularly review and update the document as necessary.

- Notify Your Agent: Make sure your agent knows they have been appointed and understands their responsibilities.

- Keep Copies: Store copies of the signed document in a safe place and provide copies to your agent and any relevant financial institutions.

- Know the Limits: A General Power of Attorney does not cover healthcare decisions; consider a separate document for that.

How to Use Florida General Power of Attorney

Filling out the Florida General Power of Attorney form requires careful attention to detail. Once completed, the form must be signed and notarized to ensure its validity. Follow these steps to accurately fill out the form.

- Obtain the form: Download the Florida General Power of Attorney form from a reliable source or visit a local legal office to acquire a physical copy.

- Fill in your information: Enter your full name, address, and contact information at the top of the form. This identifies you as the principal.

- Designate your agent: Provide the name, address, and contact information of the person you are appointing as your agent. This person will act on your behalf.

- Specify powers: Clearly outline the specific powers you wish to grant to your agent. Be as detailed as possible to avoid any confusion.

- Include any limitations: If there are any limitations on the powers granted, list them clearly in the designated section of the form.

- Sign the form: As the principal, sign and date the form in the presence of a notary public.

- Notarization: Have the notary public complete their section, which includes their signature and seal, to validate the document.

- Distribute copies: Provide copies of the completed and notarized form to your agent and any relevant financial institutions or healthcare providers.