Free Lady Bird Deed Template for Florida State

The Florida Lady Bird Deed is an important estate planning tool that allows property owners to transfer their real estate to beneficiaries while retaining certain rights during their lifetime. This unique deed enables the original owner, often referred to as the grantor, to maintain full control over the property, including the right to live in it, sell it, or even change the beneficiaries at any time. One of the most significant advantages of the Lady Bird Deed is its ability to avoid probate, which can save time and money for heirs. Additionally, this deed can provide protection from creditors and may have favorable tax implications. Understanding the nuances of the Lady Bird Deed is essential for anyone considering estate planning in Florida, as it can simplify the transfer process and ensure that your wishes are honored without unnecessary complications.

Common mistakes

-

Incorrect Property Description: Failing to provide a clear and accurate legal description of the property can lead to confusion and legal issues.

-

Not Naming All Beneficiaries: Omitting beneficiaries from the deed can create disputes among family members and lead to unintended consequences.

-

Improper Signatures: All required parties must sign the deed. Missing signatures can invalidate the document.

-

Neglecting Notarization: A Lady Bird Deed must be notarized. Without this step, the deed may not be legally recognized.

-

Filing in the Wrong County: The deed must be recorded in the correct county where the property is located. Incorrect filing can cause delays or complications.

-

Failing to Understand Tax Implications: Not considering potential tax consequences can lead to financial surprises for beneficiaries.

-

Using Outdated Forms: Utilizing an old version of the Lady Bird Deed form can result in missing important legal updates or requirements.

-

Ignoring State-Specific Laws: Each state has unique laws regarding property transfers. Ignoring Florida's specific requirements can invalidate the deed.

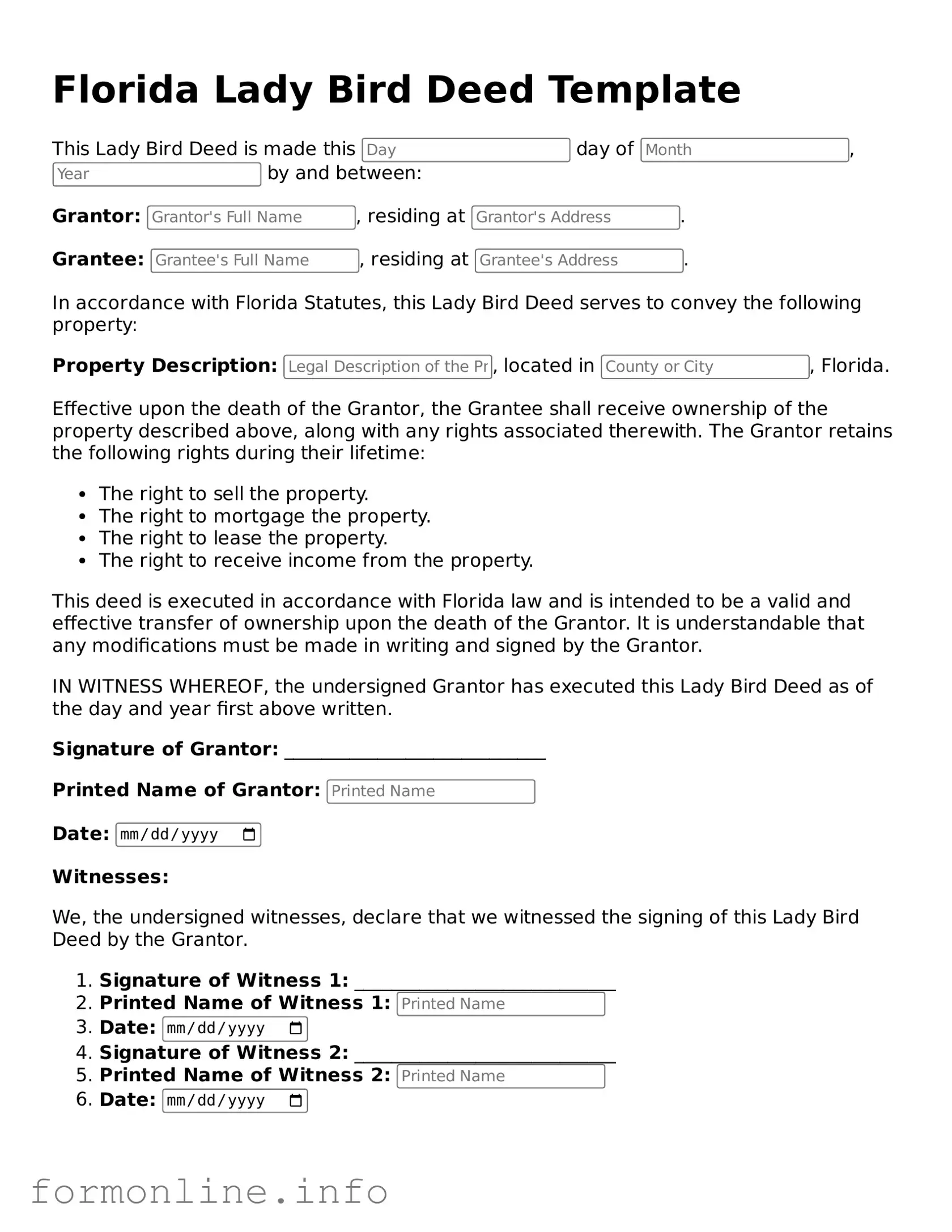

Preview - Florida Lady Bird Deed Form

Florida Lady Bird Deed Template

This Lady Bird Deed is made this day of , by and between:

Grantor: , residing at .

Grantee: , residing at .

In accordance with Florida Statutes, this Lady Bird Deed serves to convey the following property:

Property Description: , located in , Florida.

Effective upon the death of the Grantor, the Grantee shall receive ownership of the property described above, along with any rights associated therewith. The Grantor retains the following rights during their lifetime:

- The right to sell the property.

- The right to mortgage the property.

- The right to lease the property.

- The right to receive income from the property.

This deed is executed in accordance with Florida law and is intended to be a valid and effective transfer of ownership upon the death of the Grantor. It is understandable that any modifications must be made in writing and signed by the Grantor.

IN WITNESS WHEREOF, the undersigned Grantor has executed this Lady Bird Deed as of the day and year first above written.

Signature of Grantor: ____________________________

Printed Name of Grantor:

Date:

Witnesses:

We, the undersigned witnesses, declare that we witnessed the signing of this Lady Bird Deed by the Grantor.

- Signature of Witness 1: ____________________________

- Printed Name of Witness 1:

- Date:

- Signature of Witness 2: ____________________________

- Printed Name of Witness 2:

- Date:

Documents used along the form

The Florida Lady Bird Deed is a unique estate planning tool that allows property owners to transfer their property to beneficiaries while retaining certain rights during their lifetime. When preparing a Lady Bird Deed, several other forms and documents may also be needed to ensure the process is smooth and legally compliant. Below is a list of commonly used documents that accompany the Lady Bird Deed.

- Warranty Deed: This document transfers ownership of property from one party to another, guaranteeing that the title is clear of any liens or encumbrances.

- Mobile Home Bill of Sale: This legal document is essential for transferring ownership of a mobile home and includes necessary details about the buyer, seller, and mobile home description. For more information, refer to the Mobile Home Bill of Sale.

- Quitclaim Deed: Used to transfer interest in a property without any warranties. It’s often used among family members or in divorce settlements.

- Power of Attorney: A legal document that allows one person to act on behalf of another in financial or legal matters, which can be useful if the property owner becomes incapacitated.

- Last Will and Testament: This document outlines how a person's assets will be distributed after their death. It can complement a Lady Bird Deed by addressing other assets.

- Trust Agreement: Establishing a trust can help manage assets during a person’s lifetime and distribute them after death, providing an alternative to a Lady Bird Deed.

- Affidavit of Heirship: A sworn statement that identifies heirs of a deceased person, which may be necessary if the property owner passes away without a will.

- Property Tax Exemption Application: This form can be filed to claim exemptions on property taxes, which can be relevant for properties transferred through a Lady Bird Deed.

- Notice of Intent to File a Claim: This document informs interested parties of a claim against the estate, which may be relevant in certain estate planning scenarios.

- Certificate of Title: This document proves ownership of the property and may be required for the transfer of title during the Lady Bird Deed process.

- Beneficiary Designation Forms: These forms allow property owners to designate beneficiaries for various assets, ensuring clarity in asset distribution.

Each of these documents serves a specific purpose in the estate planning process. It's important to consult with a legal professional to determine which forms are necessary for your particular situation, ensuring that your wishes are properly documented and honored.

Similar forms

The Florida Lady Bird Deed, often referred to as an enhanced life estate deed, shares similarities with a traditional life estate deed. Both documents allow an individual, known as the grantor, to retain the right to use and occupy the property during their lifetime. However, the Lady Bird Deed provides additional flexibility. Upon the grantor's death, the property automatically transfers to the designated beneficiaries without the need for probate, while a traditional life estate may require more complex arrangements for transferring ownership after the grantor's death.

In the context of transferring ownership of motor vehicles, it is important to utilize the appropriate legal documentation to ensure a smooth process. A key document in this regard is the South Carolina Motor Vehicle Bill of Sale, which acts as proof of ownership transfer upon the sale of a vehicle. For individuals seeking to familiarize themselves with this essential form, more information can be found at autobillofsaleform.com/south-carolina-motor-vehicle-bill-of-sale-form, where they can access valuable resources regarding the process and requirements involved.

Dos and Don'ts

When filling out the Florida Lady Bird Deed form, it's essential to follow certain guidelines to ensure the document is completed accurately. Here are seven important dos and don'ts to keep in mind:

- Do clearly identify the property being transferred. Include the legal description, which can usually be found on the property's deed.

- Do provide the full names of all parties involved. This includes the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Do understand the implications of the Lady Bird Deed. It allows you to retain control of the property during your lifetime while facilitating an easy transfer upon your death.

- Do ensure that you sign the document in front of a notary public. This step is crucial for the deed to be legally binding.

- Don't forget to record the deed with the county clerk's office after signing. This step is necessary to make the transfer official.

- Don't leave any blank spaces on the form. All fields should be filled out completely to avoid confusion or legal issues later.

- Don't attempt to use outdated forms. Always use the most current version of the Lady Bird Deed form to ensure compliance with Florida laws.

Key takeaways

Filling out and using the Florida Lady Bird Deed form can be a straightforward process, but understanding its key aspects is essential for effective estate planning. Here are some important takeaways:

- Definition: A Lady Bird Deed allows property owners to transfer real estate to a beneficiary while retaining control during their lifetime.

- Retained Rights: The property owner retains the right to live in, sell, or mortgage the property without the beneficiary's consent.

- Avoids Probate: Properties transferred via a Lady Bird Deed typically bypass the probate process, simplifying the transfer upon the owner's death.

- Tax Implications: The property may receive a step-up in basis for tax purposes, potentially reducing capital gains taxes for the beneficiary.

- Revocable: The deed can be revoked or altered at any time by the property owner, providing flexibility in estate planning.

- Execution Requirements: The deed must be signed in the presence of two witnesses and a notary public to be valid.

- State-Specific: The Lady Bird Deed is specific to Florida, and similar deeds may not have the same legal effects in other states.

- Legal Advice: Consulting with an attorney can help ensure that the deed is filled out correctly and aligns with overall estate planning goals.

How to Use Florida Lady Bird Deed

Filling out the Florida Lady Bird Deed form is an important step for those looking to transfer property while retaining certain rights. After completing the form, it will need to be signed and notarized before being filed with the appropriate county office.

- Obtain the Lady Bird Deed form from a reliable source, such as a legal website or office supply store.

- Fill in the name of the current property owner at the top of the form.

- Provide the address of the property being transferred.

- List the name(s) of the beneficiaries who will receive the property upon the owner's passing.

- Include the current owner's date of birth and any relevant identification details.

- Clearly state that the current owner retains the right to use and benefit from the property during their lifetime.

- Sign the form in the presence of a notary public.

- Have the notary public complete their section, which includes their signature and seal.

- Make copies of the completed form for your records.

- File the original form with the county clerk's office in the county where the property is located.