Free Last Will and Testament Template for Florida State

In Florida, the Last Will and Testament form serves as a critical legal document that outlines an individual’s wishes regarding the distribution of their assets upon death. This form is essential for ensuring that personal property, real estate, and financial accounts are allocated according to the testator's intentions. A valid will can help avoid potential disputes among heirs and streamline the probate process. Key components of the form include the identification of the testator, the appointment of an executor to manage the estate, and specific bequests to beneficiaries. Additionally, the will must adhere to Florida's statutory requirements, such as being signed in the presence of witnesses, to ensure its enforceability. Understanding these aspects is vital for anyone considering drafting a will in Florida, as they establish the framework for how one’s legacy will be honored and managed after their passing.

Common mistakes

-

Not being specific about beneficiaries. It is crucial to clearly identify who will inherit your assets. Using vague terms or nicknames can lead to confusion and disputes among family members.

-

Failing to sign the document properly. In Florida, a will must be signed by the testator in the presence of two witnesses. If this step is overlooked, the will may not be considered valid.

-

Neglecting to update the will. Life changes such as marriage, divorce, or the birth of a child can affect your wishes. Regularly reviewing and updating your will ensures it reflects your current intentions.

-

Not including a self-proving affidavit. This affidavit can simplify the probate process by allowing witnesses to affirm the validity of the will without needing to appear in court.

-

Overlooking debts and taxes. Failing to account for outstanding debts or taxes may lead to complications in settling your estate. It is important to address these obligations in your will.

-

Using outdated forms. Laws can change, and using an old version of the will form may not comply with current legal requirements. Always ensure you are using the most up-to-date version.

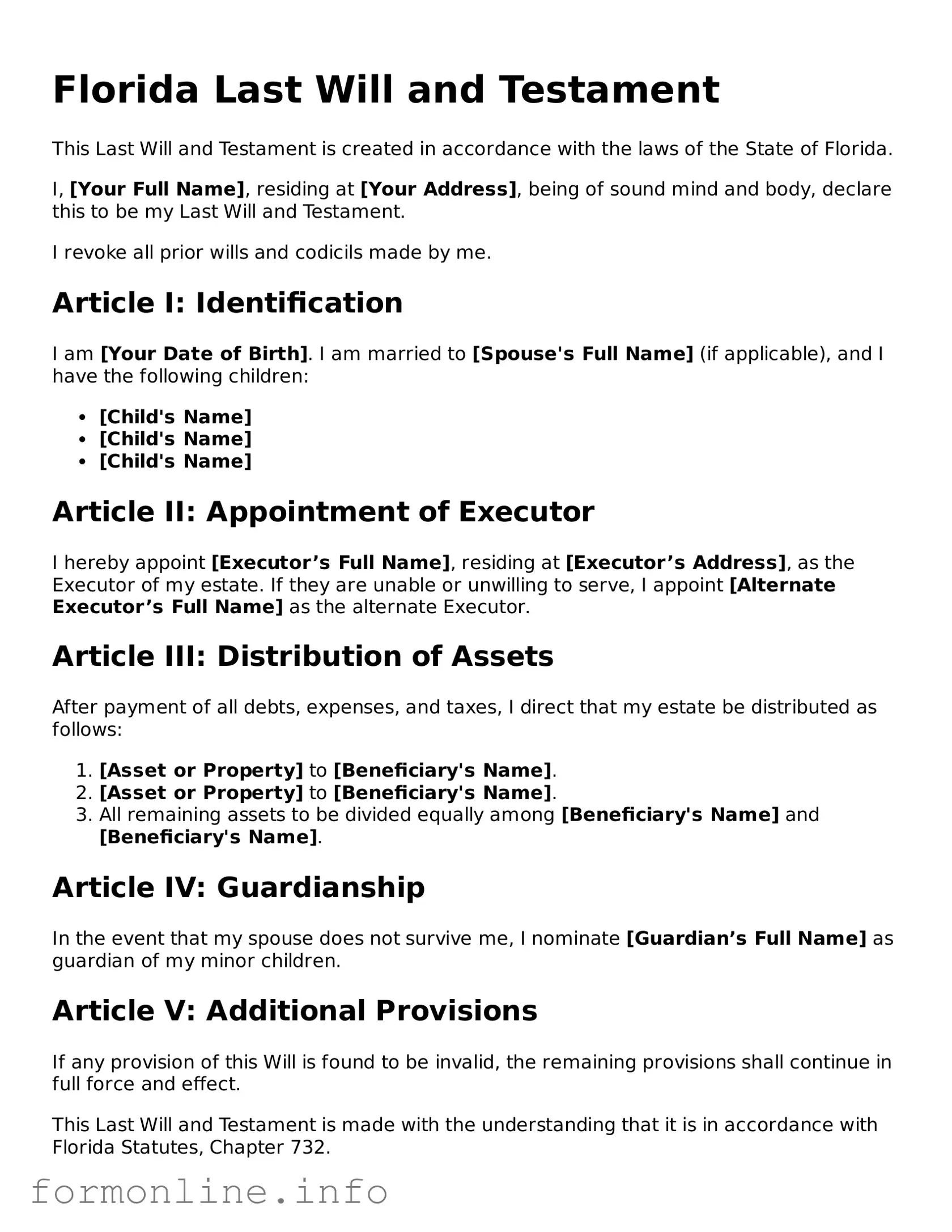

Preview - Florida Last Will and Testament Form

Florida Last Will and Testament

This Last Will and Testament is created in accordance with the laws of the State of Florida.

I, [Your Full Name], residing at [Your Address], being of sound mind and body, declare this to be my Last Will and Testament.

I revoke all prior wills and codicils made by me.

Article I: Identification

I am [Your Date of Birth]. I am married to [Spouse's Full Name] (if applicable), and I have the following children:

- [Child's Name]

- [Child's Name]

- [Child's Name]

Article II: Appointment of Executor

I hereby appoint [Executor’s Full Name], residing at [Executor’s Address], as the Executor of my estate. If they are unable or unwilling to serve, I appoint [Alternate Executor’s Full Name] as the alternate Executor.

Article III: Distribution of Assets

After payment of all debts, expenses, and taxes, I direct that my estate be distributed as follows:

- [Asset or Property] to [Beneficiary's Name].

- [Asset or Property] to [Beneficiary's Name].

- All remaining assets to be divided equally among [Beneficiary's Name] and [Beneficiary's Name].

Article IV: Guardianship

In the event that my spouse does not survive me, I nominate [Guardian’s Full Name] as guardian of my minor children.

Article V: Additional Provisions

If any provision of this Will is found to be invalid, the remaining provisions shall continue in full force and effect.

This Last Will and Testament is made with the understanding that it is in accordance with Florida Statutes, Chapter 732.

Signatures

In witness whereof, I have hereunto set my hand this [Day] day of [Month], [Year].

_________________________

[Your Full Name], Testator

Witnesses

We, the undersigned witnesses, declare that the above-named Testator signed this Last Will and Testament in our presence and that we are not beneficiaries under this Will:

- _________________________

[Witness 1 Name] - _________________________

[Witness 2 Name]

_________________________

Date

Popular Last Will and Testament State Templates

Online Will Georgia - Allows you to express any specific funeral or burial wishes.

To ensure a seamless transfer of ownership, it is crucial to utilize the appropriate documentation, such as the Mobile Home Bill of Sale, which provides clarity on the transaction and protects the rights of both buyer and seller.

Handwritten Will California - Can include specific bequests, such as gifts to individuals or charities.

Documents used along the form

When creating a Florida Last Will and Testament, several other forms and documents may be useful to ensure that your wishes are clearly communicated and legally recognized. Here are some common documents that often accompany a will:

- Durable Power of Attorney: This document allows someone to make financial decisions on your behalf if you become unable to do so. It grants authority to manage your assets and handle bills.

- Healthcare Surrogate Designation: This form designates a person to make medical decisions for you if you are incapacitated. It ensures that someone you trust can advocate for your health care preferences.

- Living Will: A living will outlines your wishes regarding medical treatment in situations where you cannot communicate. It specifies what types of life-sustaining treatments you do or do not want.

- Revocable Trust: This document allows you to place your assets in a trust during your lifetime. It can help avoid probate and allows for easier management of your estate after death.

- Beneficiary Designations: These forms specify who will receive certain assets, like life insurance policies or retirement accounts, directly upon your death, bypassing the will process.

- Affidavit of Correction: For correcting recorded documents, the Texas affidavit of correction form guide helps clarify inaccuracies and ensure public records remain reliable.

- Codicil: A codicil is an amendment to an existing will. It allows you to make changes without creating an entirely new document, such as updating beneficiaries or altering specific bequests.

Using these documents alongside your Florida Last Will and Testament can help ensure that your wishes are honored and that your loved ones are taken care of. Each document serves a unique purpose, making it important to consider which ones best fit your situation.

Similar forms

The Florida Last Will and Testament is a legal document that outlines an individual's wishes regarding the distribution of their assets after death. It shares similarities with a Living Will, which specifies an individual's preferences for medical treatment in situations where they may be unable to communicate their wishes. Both documents serve to express personal decisions, although the Last Will focuses on asset distribution while the Living Will addresses healthcare choices. Each document requires the individual’s clear intent and often necessitates witnesses to validate the person's decisions.

A Trust Agreement is another document akin to the Last Will and Testament. A Trust allows for the management of assets during a person's lifetime and specifies how those assets should be distributed after death. While a Last Will typically goes through probate, a Trust can help avoid this process, providing a more streamlined way to transfer assets. Both documents aim to ensure that a person's wishes are honored, but they operate under different legal frameworks and timelines.

The Durable Power of Attorney is similar in that it allows individuals to designate someone to make financial decisions on their behalf if they become incapacitated. While the Last Will and Testament takes effect after death, the Durable Power of Attorney is active during a person’s lifetime. Both documents require careful consideration and often involve the appointment of trusted individuals to act in the best interest of the document creator.

An Advance Healthcare Directive combines elements of a Living Will and a Durable Power of Attorney for healthcare. This document outlines an individual’s healthcare preferences and appoints a healthcare proxy to make decisions on their behalf if they are unable to do so. Like the Last Will, it reflects personal wishes and is legally binding, although it pertains specifically to medical decisions rather than asset distribution.

The Codicil serves as an amendment to an existing Last Will and Testament. It allows individuals to make changes to their will without creating an entirely new document. This is particularly useful for minor updates, such as changing beneficiaries or adjusting specific bequests. Both documents must adhere to similar legal standards, including the need for witnesses, to ensure the individual’s intentions are honored.

A Living Trust is another estate planning tool that operates similarly to a Last Will. It allows individuals to place their assets into a trust during their lifetime, which can then be managed by a trustee. Upon the individual's death, the assets in the Living Trust are distributed according to the terms set forth in the trust document. While both a Last Will and a Living Trust serve to manage the distribution of assets, a Living Trust can provide greater privacy and can help avoid probate.

If you are in New York and need to formalize the sale of an all-terrain vehicle, consider using a reliable document like the essential ATV Bill of Sale form. This will help you ensure that all transaction details are captured correctly, thus protecting both the buyer's and seller's interests in the process. For more information, visit essential ATV Bill of Sale form.

A Bill of Sale is a document that transfers ownership of personal property from one party to another. Although it does not pertain to the distribution of assets after death, it shares a commonality with the Last Will in that both documents formalize the transfer of ownership. Each document requires clear identification of the parties involved and the assets being transferred, ensuring that the intentions of the parties are documented and legally recognized.

Dos and Don'ts

When filling out the Florida Last Will and Testament form, it is essential to follow certain guidelines to ensure that your wishes are clearly expressed and legally valid. Below are some dos and don'ts to consider.

- Do clearly identify yourself at the beginning of the document, including your full name and address.

- Do specify how you want your assets distributed among your beneficiaries.

- Do sign the document in the presence of at least two witnesses who are not beneficiaries.

- Do keep the original document in a safe place and inform your executor of its location.

- Don't use ambiguous language that could lead to misinterpretation of your wishes.

- Don't forget to date the document, as this can affect its validity.

- Don't include provisions that are illegal or contrary to public policy.

- Don't rely solely on a digital version; ensure you have a signed hard copy.

Key takeaways

When preparing to fill out and utilize the Florida Last Will and Testament form, there are several important points to consider. These takeaways can help ensure that your wishes are clearly articulated and legally recognized.

- Understand the Purpose: A Last Will and Testament outlines how your assets will be distributed after your passing. It can also designate guardians for minor children.

- Eligibility Requirements: To create a valid will in Florida, you must be at least 18 years old and of sound mind. This means you should be capable of understanding the implications of your decisions.

- Written Document: Your will must be in writing. Oral wills are not recognized in Florida, so ensure you have a physical document that can be signed.

- Signature Requirements: You must sign the will at the end. If you are unable to sign, you can direct someone else to sign on your behalf in your presence.

- Witnesses: Florida law requires at least two witnesses to sign your will. These witnesses should not be beneficiaries to avoid potential conflicts of interest.

- Revocation of Previous Wills: If you create a new will, it automatically revokes any prior wills. Be clear about your intentions to avoid confusion.

- Storing Your Will: Keep your will in a safe place where it can be easily accessed after your passing. Inform trusted individuals about its location.

- Review and Update: Life changes, such as marriage, divorce, or the birth of a child, may necessitate updates to your will. Regular reviews can ensure it reflects your current wishes.

- Seek Professional Guidance: While it is possible to create a will on your own, consulting with a legal professional can provide peace of mind and ensure compliance with Florida laws.

Taking these steps seriously can help safeguard your legacy and provide clarity for your loved ones during a difficult time.

How to Use Florida Last Will and Testament

After obtaining the Florida Last Will and Testament form, you will need to fill it out carefully. Make sure to have your personal information and any details about your assets and beneficiaries ready. Follow these steps to complete the form accurately.

- Begin by entering your full name at the top of the form.

- Provide your current address, including city, state, and ZIP code.

- State your date of birth to confirm your identity.

- Clearly list the names of your beneficiaries. Include their relationship to you and their contact information.

- Detail the specific assets you wish to leave to each beneficiary. Be clear and precise.

- Designate an executor for your will. This person will be responsible for ensuring your wishes are carried out.

- If applicable, name a guardian for any minor children you may have.

- Review the form to ensure all information is correct and complete.

- Sign and date the form in the presence of two witnesses. They must also sign the document.

- Store the completed will in a safe place, and inform your executor and beneficiaries of its location.