Free Loan Agreement Template for Florida State

When individuals or businesses in Florida seek to borrow money, a Loan Agreement form becomes an essential document in the transaction. This form outlines the terms and conditions of the loan, ensuring that both the lender and borrower have a clear understanding of their rights and obligations. Key components of the Loan Agreement typically include the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, it may specify the consequences of default, which is crucial for protecting the lender's investment. By clearly detailing these aspects, the Loan Agreement helps to prevent misunderstandings and disputes, fostering a more transparent lending process. Both parties should take care to review the document thoroughly, as it serves not only as a legal record but also as a framework for their financial relationship.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to delays or rejection of the loan application. Every section must be addressed, even if the answer is "none" or "not applicable."

-

Incorrect Personal Details: Providing inaccurate personal information, such as misspelled names or wrong Social Security numbers, can create significant complications during the approval process.

-

Neglecting to Read Terms: Not thoroughly reviewing the loan terms and conditions can result in misunderstandings about interest rates, repayment schedules, and fees.

-

Forgetting Signatures: Omitting signatures on the form can render the agreement invalid. Each required party must sign to confirm their acceptance of the terms.

-

Ignoring Required Documentation: Failing to attach necessary documents, such as proof of income or identification, can stall the processing of the loan.

-

Overlooking Loan Purpose: Not clearly stating the purpose of the loan can lead to confusion and may affect the lender's decision.

-

Misunderstanding Repayment Terms: Miscalculating monthly payments or the total cost of the loan can lead to financial strain. It’s crucial to ensure clarity on these terms.

-

Not Keeping Copies: Failing to retain a copy of the completed Loan Agreement for personal records can create issues in the future, especially if disputes arise.

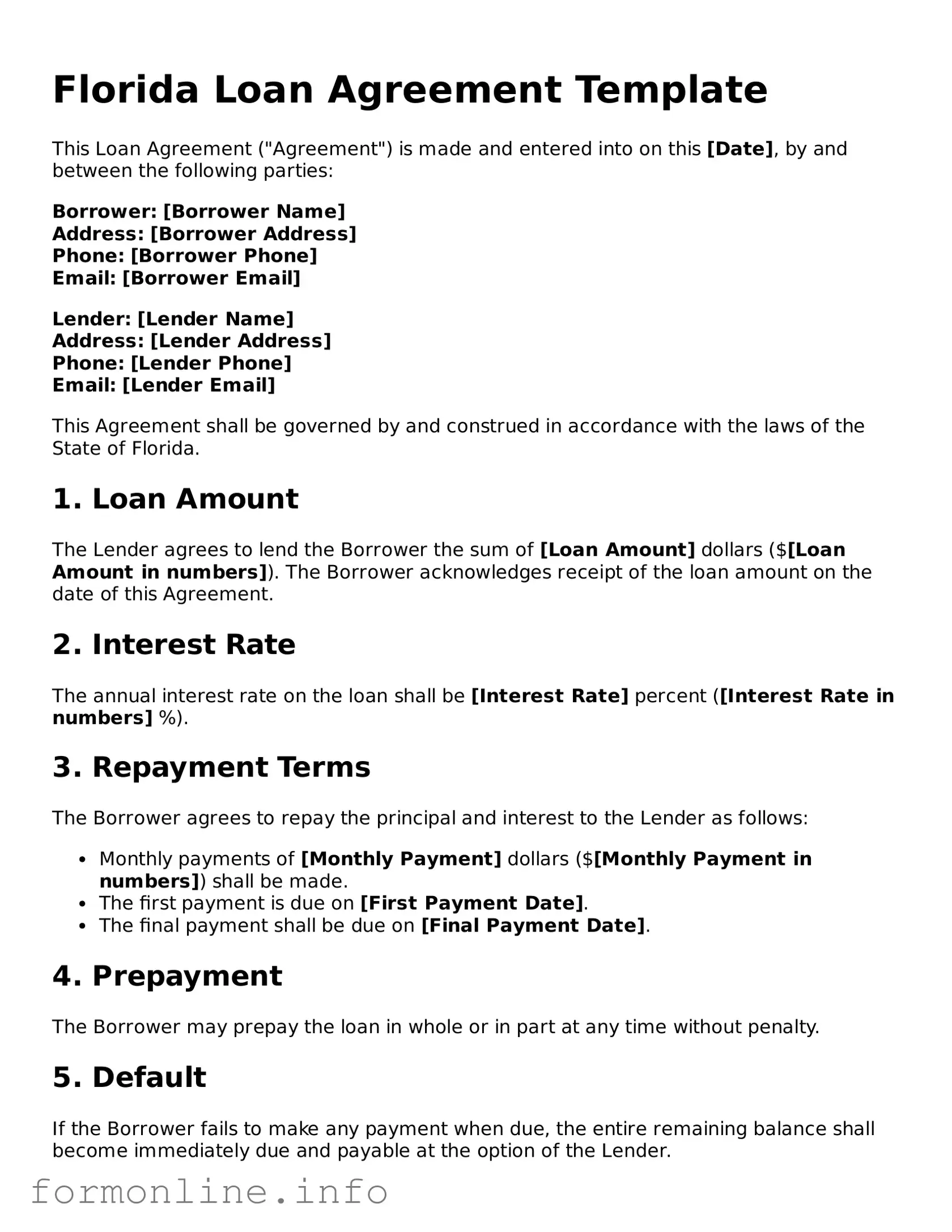

Preview - Florida Loan Agreement Form

Florida Loan Agreement Template

This Loan Agreement ("Agreement") is made and entered into on this [Date], by and between the following parties:

Borrower: [Borrower Name]

Address: [Borrower Address]

Phone: [Borrower Phone]

Email: [Borrower Email]

Lender: [Lender Name]

Address: [Lender Address]

Phone: [Lender Phone]

Email: [Lender Email]

This Agreement shall be governed by and construed in accordance with the laws of the State of Florida.

1. Loan Amount

The Lender agrees to lend the Borrower the sum of [Loan Amount] dollars ($[Loan Amount in numbers]). The Borrower acknowledges receipt of the loan amount on the date of this Agreement.

2. Interest Rate

The annual interest rate on the loan shall be [Interest Rate] percent ([Interest Rate in numbers] %).

3. Repayment Terms

The Borrower agrees to repay the principal and interest to the Lender as follows:

- Monthly payments of [Monthly Payment] dollars ($[Monthly Payment in numbers]) shall be made.

- The first payment is due on [First Payment Date].

- The final payment shall be due on [Final Payment Date].

4. Prepayment

The Borrower may prepay the loan in whole or in part at any time without penalty.

5. Default

If the Borrower fails to make any payment when due, the entire remaining balance shall become immediately due and payable at the option of the Lender.

6. Governing Law

This Agreement shall be governed by the laws of the State of Florida. Any disputes arising under this Agreement shall be resolved in the state's courts.

7. Signatures

By signing below, the parties agree to the terms and conditions outlined in this Agreement. This Agreement may be executed in counterparts, each of which shall be deemed an original.

______________________________

[Borrower Name]

______________________________

[Lender Name]

Date: [Date]

Popular Loan Agreement State Templates

Promissory Note Georgia - Establishes jurisdiction for legal disputes arising from the agreement.

When engaging in the sale of a mobile home in Virginia, it is important to utilize the proper documentation to ensure all legal aspects are covered. The Virginia Mobile Home Bill of Sale form provides a structured approach to record the transfer of ownership, ensuring clarity on critical elements such as the identities of the buyer and seller, a detailed description of the mobile home, and the sale price. For those looking to get a comprehensive understanding of this process, resources like the Mobile Home Bill of Sale can offer valuable guidance.

Documents used along the form

When entering into a loan agreement in Florida, several other forms and documents may be necessary to ensure a smooth transaction. These documents help clarify the terms of the loan and protect the interests of both the lender and the borrower. Below is a list of commonly used documents that accompany the Florida Loan Agreement.

- Promissory Note: This is a written promise from the borrower to repay the loan amount. It outlines the terms of the loan, including the interest rate, repayment schedule, and any penalties for late payments.

- Security Agreement: This document details any collateral that secures the loan. It specifies what assets the lender can claim if the borrower defaults on the loan.

- RV Bill of Sale Form: Essential for documenting the transfer of ownership of recreational vehicles in Arizona, this form is crucial for both buyers and sellers, ensuring legal protection and transparency. For more information, you can refer to https://autobillofsaleform.com/rv-bill-of-sale-form/arizona-rv-bill-of-sale-form.

- Disclosure Statement: This statement provides important information about the loan, including the total cost of borrowing, interest rates, and any fees involved. It ensures that the borrower understands the financial implications of the loan.

- Loan Application: This form collects personal and financial information from the borrower. It helps the lender assess the borrower's creditworthiness and ability to repay the loan.

Using these documents together with the Florida Loan Agreement helps create a comprehensive understanding of the loan terms. Each form plays a crucial role in protecting both parties and ensuring that the lending process is transparent and fair.

Similar forms

The Florida Loan Agreement form shares similarities with the Promissory Note. Both documents serve to outline the terms of a loan, detailing the borrower's promise to repay the borrowed amount. A Promissory Note typically includes the loan amount, interest rate, repayment schedule, and consequences of default. While the Loan Agreement may encompass more extensive terms, the core function of ensuring a written commitment to repayment is present in both documents.

Another document akin to the Florida Loan Agreement is the Mortgage Agreement. This document secures a loan with real property as collateral. Like the Loan Agreement, it specifies the amount borrowed, the interest rate, and the repayment terms. However, the Mortgage Agreement includes additional provisions regarding the rights of the lender in case of default, emphasizing the security interest in the property that backs the loan.

When engaging in vehicle transactions, understanding the necessary documentation is important. This includes the comprehensive Motor Vehicle Bill of Sale form, which serves as a vital record in the transfer of vehicle ownership. For more detailed guidance, refer to the comprehensive Motor Vehicle Bill of Sale form.

The Security Agreement is also similar to the Florida Loan Agreement, as it establishes a secured transaction. In this case, the borrower offers collateral to guarantee the loan. Both documents outline the obligations of the borrower and the rights of the lender. However, the Security Agreement focuses specifically on the collateral involved, while the Loan Agreement may cover broader terms of the loan arrangement.

A Credit Agreement is another document that resembles the Florida Loan Agreement. Credit Agreements are often used in commercial lending and can be more complex. They detail the terms under which a lender extends credit to a borrower. Like the Loan Agreement, they include interest rates, repayment schedules, and default provisions. However, Credit Agreements may also include covenants and other conditions that the borrower must adhere to throughout the life of the loan.

The Loan Disclosure Statement bears a resemblance to the Florida Loan Agreement by providing essential information about the loan. This document typically includes details such as the total cost of the loan, interest rates, and any fees associated with the loan. While it does not serve as a binding agreement, it complements the Loan Agreement by ensuring that borrowers understand the financial implications of their loan before signing the agreement.

The Installment Sale Agreement can also be compared to the Florida Loan Agreement. This document is used when a buyer agrees to purchase an item, often real estate or personal property, through installment payments. Like the Loan Agreement, it outlines payment terms, interest rates, and consequences for default. However, the Installment Sale Agreement typically transfers ownership to the buyer once the payments are completed, whereas a Loan Agreement retains ownership with the lender until the loan is fully repaid.

Lastly, the Personal Loan Agreement shares common ground with the Florida Loan Agreement. This document is often used for informal loans between individuals. It outlines the loan amount, repayment terms, and any interest charged. While it may be less formal than the Florida Loan Agreement, both serve the same fundamental purpose of documenting the terms of a loan to protect both the lender and the borrower.

Dos and Don'ts

When filling out the Florida Loan Agreement form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here are some important dos and don'ts:

- Do read the entire agreement carefully before filling it out.

- Do provide accurate personal and financial information.

- Do check for any required signatures before submitting the form.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank unless instructed to do so.

- Don't rush through the process; take your time to avoid mistakes.

Key takeaways

When filling out and using the Florida Loan Agreement form, it is essential to keep several key points in mind. These takeaways can help ensure that the process is smooth and legally sound.

- Understand the terms: Before signing, make sure you comprehend all the terms outlined in the agreement. This includes the interest rate, repayment schedule, and any fees associated with the loan.

- Complete all sections: Every part of the form should be filled out completely. Missing information can lead to misunderstandings or disputes later on.

- Include borrower and lender details: Clearly state the names and contact information of both the borrower and the lender. This identification is crucial for legal purposes.

- Review the repayment plan: Pay close attention to how and when payments are to be made. Ensure that the schedule aligns with your financial situation.

- Seek legal advice if needed: If you have any doubts or questions about the agreement, consider consulting a legal professional. They can provide clarity and help protect your interests.

How to Use Florida Loan Agreement

Once you have the Florida Loan Agreement form in front of you, it’s important to fill it out accurately to ensure that all parties understand their obligations. Follow these steps carefully to complete the form.

- Begin by entering the date at the top of the form.

- Fill in the names and addresses of the borrower and the lender in the designated sections.

- Specify the loan amount clearly. This should be written both in numbers and in words to avoid confusion.

- Indicate the interest rate, if applicable. Make sure this is accurate and reflects the agreed terms.

- Outline the repayment schedule. Include the start date, frequency of payments, and the total number of payments required.

- Detail any collateral involved in the loan. This could be property or other assets that secure the loan.

- Include any additional terms or conditions that both parties have agreed upon. This could cover late fees, prepayment penalties, or other relevant points.

- Sign and date the form. Ensure both the borrower and lender sign it to make it legally binding.

- Make copies of the completed form for both parties to keep for their records.