Free Prenuptial Agreement Template for Florida State

In the vibrant state of Florida, the prenuptial agreement serves as a vital tool for couples preparing to embark on the journey of marriage. This legal document allows partners to outline their financial rights and responsibilities, ensuring clarity and protection for both parties should the relationship end. By addressing issues such as property division, spousal support, and debt allocation, the prenuptial agreement can prevent misunderstandings and disputes in the future. It is essential for couples to consider their unique circumstances and intentions when drafting this agreement. Additionally, the form must adhere to specific legal requirements, including full disclosure of assets and voluntary consent from both parties. Engaging in open conversations about finances before tying the knot can foster trust and strengthen the relationship, making the prenuptial agreement not just a legal safeguard, but also a foundation for healthy communication.

Common mistakes

-

Failing to disclose all assets and debts: One of the most critical mistakes is not fully listing all assets and liabilities. Full transparency is essential for the agreement to be enforceable.

-

Not seeking legal advice: Many individuals attempt to fill out the form without consulting a lawyer. This can lead to misunderstandings about rights and obligations.

-

Using vague language: Ambiguous terms can create confusion later. It’s important to be specific about what each party is agreeing to.

-

Ignoring state laws: Prenuptial agreements must comply with Florida laws. Failing to consider these regulations can render the agreement invalid.

-

Not updating the agreement: Life changes such as having children or acquiring new assets should prompt a review and possible amendment of the agreement.

-

Forgetting to sign and date: An unsigned or undated document is not legally binding. Ensure both parties sign and date the agreement.

-

Pressure or coercion: If one party feels pressured to sign, the agreement may be challenged later. Both parties should enter the agreement willingly.

-

Not considering future changes: An effective prenuptial agreement anticipates future circumstances. Failing to address potential changes can lead to disputes.

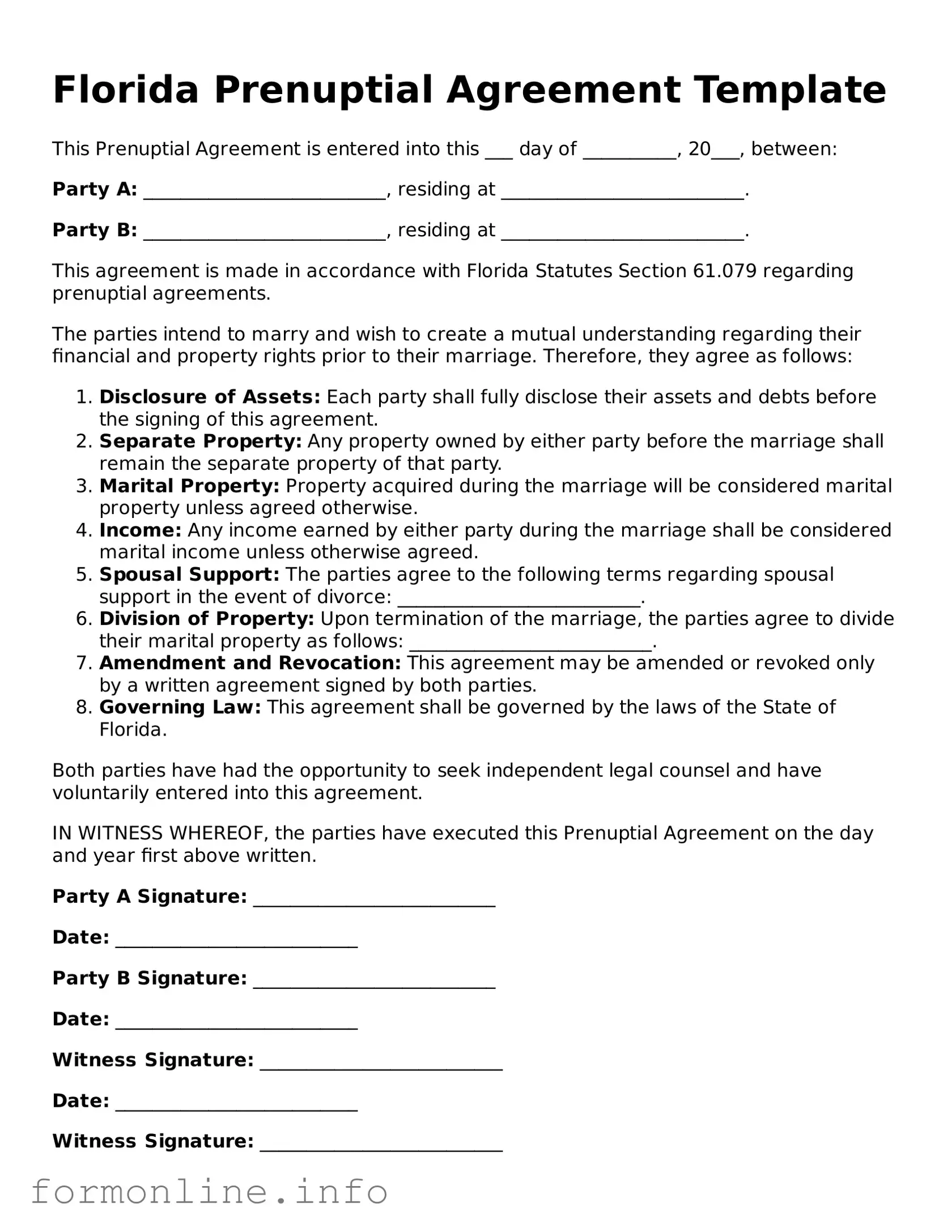

Preview - Florida Prenuptial Agreement Form

Florida Prenuptial Agreement Template

This Prenuptial Agreement is entered into this ___ day of __________, 20___, between:

Party A: __________________________, residing at __________________________.

Party B: __________________________, residing at __________________________.

This agreement is made in accordance with Florida Statutes Section 61.079 regarding prenuptial agreements.

The parties intend to marry and wish to create a mutual understanding regarding their financial and property rights prior to their marriage. Therefore, they agree as follows:

- Disclosure of Assets: Each party shall fully disclose their assets and debts before the signing of this agreement.

- Separate Property: Any property owned by either party before the marriage shall remain the separate property of that party.

- Marital Property: Property acquired during the marriage will be considered marital property unless agreed otherwise.

- Income: Any income earned by either party during the marriage shall be considered marital income unless otherwise agreed.

- Spousal Support: The parties agree to the following terms regarding spousal support in the event of divorce: __________________________.

- Division of Property: Upon termination of the marriage, the parties agree to divide their marital property as follows: __________________________.

- Amendment and Revocation: This agreement may be amended or revoked only by a written agreement signed by both parties.

- Governing Law: This agreement shall be governed by the laws of the State of Florida.

Both parties have had the opportunity to seek independent legal counsel and have voluntarily entered into this agreement.

IN WITNESS WHEREOF, the parties have executed this Prenuptial Agreement on the day and year first above written.

Party A Signature: __________________________

Date: __________________________

Party B Signature: __________________________

Date: __________________________

Witness Signature: __________________________

Date: __________________________

Witness Signature: __________________________

Date: __________________________

Popular Prenuptial Agreement State Templates

California Premarital Contract - A Prenuptial Agreement provides a framework for financial decisions.

When engaging in the sale of a trailer, it is crucial to complete the Georgia Trailer Bill of Sale accurately to avoid any future disputes. This document not only facilitates the transfer of ownership but also protects both the buyer and seller. For additional guidance on filling out the form correctly, you can visit https://georgiapdf.com.

Documents used along the form

A Florida Prenuptial Agreement is an important document that outlines the financial rights and responsibilities of each party before marriage. However, it is often accompanied by other forms and documents that can help clarify intentions and protect interests. Below is a list of related documents that may be used in conjunction with a prenuptial agreement.

- Financial Disclosure Statement: This document details each party's assets, debts, income, and expenses. It ensures transparency and helps both parties understand their financial positions before entering into the agreement.

- Arizona RV Bill of Sale Form: When purchasing an RV, it is essential to have a proper bill of sale to document the transaction. This legal form evidences the transfer of ownership and details the specifics of the sale, such as the vehicle's identification and purchase terms. For more information, visit https://autobillofsaleform.com/rv-bill-of-sale-form/arizona-rv-bill-of-sale-form.

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after marriage. It can address changes in circumstances or clarify financial arrangements that were not covered in the prenuptial agreement.

- Marital Settlement Agreement: This document is often used during divorce proceedings. It outlines how assets and debts will be divided, and it can help facilitate a smoother separation process.

- Waiver of Rights: This form allows one party to waive certain rights, such as spousal support or inheritance claims. It can be included in a prenuptial agreement to clarify what each party is giving up.

- Confidentiality Agreement: This document ensures that sensitive financial information shared during negotiations remains private. It can help protect both parties from potential breaches of trust.

- Power of Attorney: This legal document grants one party the authority to make decisions on behalf of the other in financial or legal matters. It can be particularly useful if one spouse becomes incapacitated.

These documents can play a crucial role in ensuring that both parties enter into marriage with a clear understanding of their rights and responsibilities. Properly preparing and considering these forms can lead to a more secure and harmonious relationship.

Similar forms

A Cohabitation Agreement is similar to a prenuptial agreement in that it outlines the financial and personal arrangements between two individuals who choose to live together without marrying. Both documents serve to clarify the rights and responsibilities of each party, helping to prevent misunderstandings and disputes. While a prenuptial agreement is designed for couples planning to marry, a cohabitation agreement is tailored for those who wish to establish guidelines for their relationship while living together. This can include property division, financial responsibilities, and even provisions for what happens if the relationship ends.

A Postnuptial Agreement shares many characteristics with a prenuptial agreement, but it is created after the couple has already married. Like a prenuptial agreement, it addresses asset division and financial responsibilities in the event of a divorce or separation. Couples may choose to draft a postnuptial agreement to clarify their financial arrangements as their circumstances change over time, such as after the birth of a child or a significant change in income. This document provides a way for couples to reassess their financial arrangements and protect their interests even after marriage.

A Separation Agreement is another document that resembles a prenuptial agreement, as it outlines the terms of a couple's separation. This agreement can cover child custody, support, and division of assets, similar to what a prenuptial agreement does for couples entering marriage. While a prenuptial agreement aims to prevent disputes before they arise, a separation agreement addresses issues that come up when a couple decides to live apart. It serves as a legally binding document that helps both parties understand their rights and obligations during the separation process.

The Virginia Mobile Home Bill of Sale form is a vital document for partners entering a living arrangement together, as it clearly sets out the ownership rights and responsibilities related to the mobile home. Similar to how a cohabitation agreement delineates terms for shared living, this bill of sale serves to establish the legal transfer of the mobile home from the seller to the buyer, ensuring both parties are aware of the details, including the sale price and property description. For further guidance on this matter, individuals can refer to the Mobile Home Bill of Sale.

A Marital Settlement Agreement is closely related to a prenuptial agreement in that it outlines the terms of a couple's divorce. This document details how assets, debts, and responsibilities will be divided, much like a prenuptial agreement does for couples before marriage. The key difference is that a marital settlement agreement is created after a couple has decided to divorce, while a prenuptial agreement is established before marriage. Both documents aim to provide clarity and prevent disputes, ensuring that both parties have a clear understanding of their rights.

A Living Will, while not directly related to financial matters, shares the common theme of outlining a person's wishes regarding personal circumstances. Similar to a prenuptial agreement, a living will provides clarity and guidance, ensuring that an individual's preferences are respected in specific situations, such as medical emergencies. Both documents serve to protect the interests of the individuals involved, whether in financial matters or health care decisions, and help avoid conflicts during challenging times.

A Trust Agreement can also be seen as similar to a prenuptial agreement in that it establishes how assets will be managed and distributed. While a prenuptial agreement focuses on asset division in the event of a divorce, a trust agreement outlines how assets will be handled during a person's lifetime and after their death. Both documents aim to provide clarity and protect the interests of the parties involved. By setting clear guidelines, both agreements help to minimize potential disputes and ensure that individual wishes are honored.

Dos and Don'ts

When filling out a Florida Prenuptial Agreement form, it’s essential to approach the process with care and attention to detail. Here are some key dos and don'ts to keep in mind:

- Do communicate openly with your partner about your financial expectations and goals.

- Do provide complete and accurate information regarding your assets and debts.

- Do consult with a qualified attorney who specializes in family law to ensure compliance with Florida laws.

- Do discuss the agreement well in advance of the wedding to avoid any perception of pressure.

- Don't overlook the importance of having both parties review the agreement independently.

- Don't use ambiguous language that could lead to misunderstandings in the future.

- Don't rush the process; take the necessary time to ensure all terms are clear and acceptable to both parties.

Key takeaways

When considering a prenuptial agreement in Florida, it's essential to understand its purpose and how to fill it out correctly. Here are some key takeaways to keep in mind:

- Purpose of the Agreement: A prenuptial agreement outlines how assets and debts will be divided in the event of divorce or death.

- Full Disclosure: Both parties must fully disclose their financial situations, including assets, debts, and income.

- Voluntary Signing: Both individuals should sign the agreement voluntarily, without any pressure or coercion.

- Legal Representation: It is advisable for each party to have their own attorney to ensure fair representation and understanding of the agreement.

- Written Format: The agreement must be in writing to be enforceable. Oral agreements are not valid.

- Timing: It is best to complete the agreement well in advance of the wedding to avoid any claims of duress.

- Review and Update: Consider reviewing and updating the agreement periodically, especially after significant life events like the birth of a child or changes in financial status.

- State Laws: Familiarize yourself with Florida laws regarding prenuptial agreements, as they can affect the enforceability of certain provisions.

- Not a Guarantee: A prenuptial agreement does not guarantee that all provisions will be upheld in court. Courts can invalidate certain terms if deemed unfair or unconscionable.

Understanding these key points can help ensure that a prenuptial agreement serves its intended purpose and protects both parties involved.

How to Use Florida Prenuptial Agreement

Filling out a Florida Prenuptial Agreement form is an important step for couples considering marriage. This process involves carefully detailing financial arrangements and expectations. Once completed, both parties should review the document thoroughly before signing.

- Obtain the Form: Download the Florida Prenuptial Agreement form from a reliable legal resource or consult with an attorney to get the correct version.

- Title the Document: Clearly label the document as "Prenuptial Agreement" at the top of the first page.

- Identify the Parties: Fill in the full legal names and addresses of both individuals entering the agreement.

- State the Purpose: Include a brief statement outlining the purpose of the agreement, emphasizing mutual understanding and intentions.

- Detail Assets and Liabilities: List all assets and liabilities for each party. Be thorough and honest about property, debts, and any other financial matters.

- Outline Financial Rights: Specify how assets will be managed during the marriage and how they will be divided in the event of divorce or separation.

- Include Provisions for Future Changes: Consider adding terms for how the agreement can be amended in the future, if necessary.

- Review Legal Requirements: Ensure that the agreement complies with Florida law, including any necessary disclosures and signatures.

- Consult with Legal Counsel: It’s advisable for both parties to have independent legal advice to ensure that their rights are protected.

- Sign the Agreement: Both parties should sign the document in the presence of a notary public to validate the agreement.