Free Promissory Note Template for Florida State

In Florida, the Promissory Note serves as a crucial financial instrument that outlines the terms of a loan agreement between a borrower and a lender. This form is designed to clearly specify the amount of money being borrowed, the interest rate, and the repayment schedule. It also includes essential details such as the maturity date and any penalties for late payments, ensuring that both parties understand their obligations. The Promissory Note can be secured or unsecured, depending on whether collateral is involved. Additionally, it may contain provisions for default, allowing the lender to take specific actions if the borrower fails to meet their payment obligations. Understanding the components of this form is vital for anyone entering into a loan agreement in Florida, as it protects the rights of both the lender and the borrower while providing a clear framework for the financial transaction.

Common mistakes

-

Incorrect Borrower Information: Failing to provide the full legal name of the borrower can lead to confusion and potential legal issues. Always double-check the spelling and completeness of the name.

-

Missing Lender Details: The lender's information must also be complete. Omitting the lender's name or contact information can complicate enforcement of the note.

-

Improper Loan Amount: Entering an incorrect loan amount is a common mistake. Ensure that the amount matches what was agreed upon by both parties.

-

Failure to Specify Interest Rate: Not including an interest rate, or leaving it blank, can create ambiguity. Clearly state the agreed-upon interest rate to avoid disputes.

-

Omitting Payment Terms: The payment schedule should be clearly defined. Missing this information can lead to misunderstandings regarding when and how payments are to be made.

-

Neglecting to Include a Maturity Date: A maturity date is essential. Without it, there may be uncertainty about when the loan must be repaid in full.

-

Not Signing the Document: A promissory note is not valid unless it is signed by the borrower. Ensure that all required signatures are present.

-

Forgetting Witnesses or Notarization: Depending on the situation, having witnesses or notarization may be necessary. Check local requirements to ensure compliance.

-

Ignoring State Laws: Each state has specific laws governing promissory notes. Failing to adhere to Florida’s regulations can render the note unenforceable.

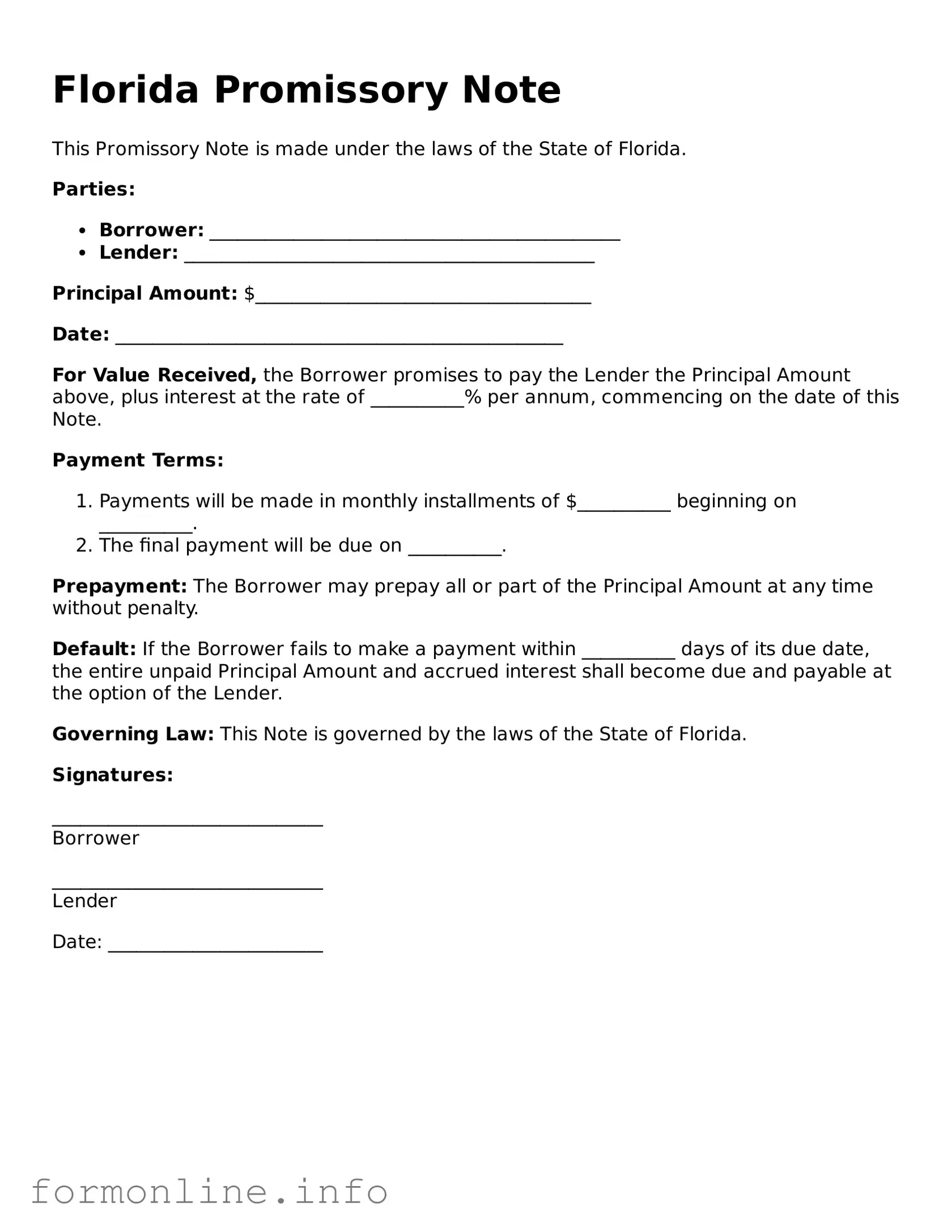

Preview - Florida Promissory Note Form

Florida Promissory Note

This Promissory Note is made under the laws of the State of Florida.

Parties:

- Borrower: ____________________________________________

- Lender: ____________________________________________

Principal Amount: $____________________________________

Date: ________________________________________________

For Value Received, the Borrower promises to pay the Lender the Principal Amount above, plus interest at the rate of __________% per annum, commencing on the date of this Note.

Payment Terms:

- Payments will be made in monthly installments of $__________ beginning on __________.

- The final payment will be due on __________.

Prepayment: The Borrower may prepay all or part of the Principal Amount at any time without penalty.

Default: If the Borrower fails to make a payment within __________ days of its due date, the entire unpaid Principal Amount and accrued interest shall become due and payable at the option of the Lender.

Governing Law: This Note is governed by the laws of the State of Florida.

Signatures:

_____________________________

Borrower

_____________________________

Lender

Date: _______________________

Popular Promissory Note State Templates

Promissory Note Form California - Some promissory notes may require notarization for added security.

Understanding the implications of a timely eviction, landlords often rely on a proper legal framework, making the essential Notice to Quit document a vital part of the process to ensure compliance and clarity in tenant relations.

Promissory Note Template Georgia - They are commonly used in private lending situations where trust between individuals is essential.

Documents used along the form

When dealing with a Florida Promissory Note, several other forms and documents may be necessary to ensure clarity and legal compliance. Below is a list of common documents that are often used in conjunction with the Promissory Note.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any conditions attached to the loan.

- Security Agreement: If the loan is secured by collateral, this agreement details the assets pledged as security and the rights of the lender in case of default.

- Personal Guarantee: A personal guarantee may be required from a third party, ensuring that they will repay the loan if the borrower defaults.

- Disclosure Statement: This document provides important information about the loan, including fees, payment schedules, and the total cost of borrowing, ensuring the borrower understands their obligations.

- Amortization Schedule: This schedule outlines each payment over the life of the loan, showing how much of each payment goes toward interest and principal.

- Default Notice: In the event of non-payment, this notice informs the borrower of their default status and the potential consequences, including legal action.

- Mobile Home Bill of Sale: This document is essential for transferring ownership of a mobile home, detailing information such as the buyer's and seller's identities and the sale price. For more information, visit the Mobile Home Bill of Sale.

- Release of Liability: Once the loan is fully repaid, this document releases the borrower from any further obligations under the Promissory Note.

These documents help clarify the terms of the loan and protect the interests of both parties involved. It is essential to ensure that all forms are completed accurately and stored securely.

Similar forms

A mortgage agreement is a document that outlines the terms of a loan secured by real property. Like a promissory note, it details the borrower's promise to repay the loan. However, a mortgage agreement also includes information about the property being used as collateral. It establishes the lender's right to take possession of the property if the borrower defaults. Both documents serve as legal evidence of the borrower's obligation to repay a debt, but the mortgage agreement adds an additional layer of security for the lender by tying the loan to a specific asset.

A loan agreement is similar to a promissory note in that it specifies the terms under which money is borrowed. This document includes details such as the loan amount, interest rate, and repayment schedule. While a promissory note focuses primarily on the borrower's promise to repay, a loan agreement may also cover additional terms like late fees and default consequences. Both documents are essential for ensuring that both parties understand their rights and responsibilities regarding the loan.

A personal guarantee is a document that provides a lender with assurance that a third party will be responsible for repaying a loan if the primary borrower defaults. This is similar to a promissory note, as it involves a promise to pay. However, a personal guarantee often involves an individual who is not the primary borrower, adding another layer of accountability. Both documents help lenders mitigate risk, but a personal guarantee extends the obligation beyond the original borrower.

An installment agreement outlines a plan for repaying a debt in regular payments over time. Like a promissory note, it specifies the amount owed and the repayment schedule. However, installment agreements often involve more detailed terms regarding the payment structure and may include provisions for interest rates and penalties for late payments. Both documents aim to clarify the repayment expectations for the borrower.

A security agreement is a document that grants a lender a security interest in specific collateral to secure a loan. Similar to a promissory note, it represents a promise to repay. However, the security agreement also identifies the collateral that the lender can claim if the borrower defaults. This added detail provides the lender with more protection, while the promissory note remains a straightforward acknowledgment of the debt.

A lease agreement can be similar to a promissory note in cases where a lease involves payments for renting property. Both documents outline the financial obligations of one party to another. A lease agreement typically includes terms related to the duration of the lease, rental payments, and responsibilities for maintenance. While a promissory note is focused solely on repayment, a lease agreement incorporates additional details about the use of the property.

For entrepreneurs looking to understand the foundational steps in setting up a business, the necessary legal framework is outlined in the important Articles of Incorporation guidelines. This document is pivotal in defining the structure and operational directives of a corporation.

A deed of trust functions similarly to a promissory note in that it secures a loan with real estate. It involves three parties: the borrower, the lender, and a trustee. The borrower promises to repay the loan, while the deed of trust allows the trustee to hold the title to the property until the loan is repaid. Both documents serve as legal instruments that protect the lender's interests, but the deed of trust also provides a mechanism for foreclosure if the borrower defaults.

An acknowledgment of debt is a document in which a borrower formally recognizes the existence of a debt owed to a lender. This is similar to a promissory note because it confirms the borrower's obligation to repay. However, an acknowledgment of debt may not include specific repayment terms, making it less comprehensive than a promissory note. Both documents serve to establish the borrower's responsibility, but the promissory note provides a clearer framework for repayment.

Dos and Don'ts

When filling out the Florida Promissory Note form, it's essential to follow specific guidelines to ensure accuracy and legality. Below is a list of things you should and shouldn't do.

- Do read the entire form carefully before starting.

- Do include all necessary information, such as the borrower's name, lender's name, and loan amount.

- Do specify the interest rate clearly, if applicable.

- Do outline the repayment schedule, including due dates.

- Do sign and date the document in the appropriate places.

- Don't leave any blank spaces; fill in all required fields.

- Don't use vague language; be specific about terms and conditions.

- Don't forget to include any fees or penalties for late payments.

- Don't sign the document without fully understanding its terms.

- Don't overlook the importance of having a witness or notary, if required.

Key takeaways

- Understand the Purpose: A Florida Promissory Note is a legal document that outlines a borrower's promise to repay a loan to a lender under specified terms.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender to avoid any confusion.

- Specify the Loan Amount: Clearly indicate the total amount of money being borrowed. This figure is crucial for both parties.

- Detail the Interest Rate: Include the interest rate applicable to the loan. This can be fixed or variable, but it must be clearly defined.

- Outline Payment Terms: Specify how and when payments will be made. This includes the payment schedule, due dates, and any grace periods.

- Include Default Terms: Clearly outline what constitutes a default on the loan, including any penalties or fees that may apply.

- Signatures Required: Both the borrower and lender must sign the document for it to be legally binding. Witness signatures may also be beneficial.

- Consider Notarization: While not always required, having the document notarized can add an extra layer of authenticity and may be necessary for certain transactions.

- Keep Copies: After the document is completed and signed, both parties should retain copies for their records. This ensures that both parties have access to the terms agreed upon.

How to Use Florida Promissory Note

Once you have the Florida Promissory Note form, you will need to complete it accurately to ensure its validity. Follow the steps outlined below to fill out the form correctly.

- Begin by entering the date at the top of the form. This should reflect the date on which the note is being executed.

- Identify the borrower. Write the full name and address of the individual or entity receiving the loan.

- Next, specify the lender's details. Include the full name and address of the person or organization providing the loan.

- Clearly state the principal amount of the loan. This is the total amount being borrowed, written in both numerical and written form.

- Indicate the interest rate. Specify whether it is a fixed or variable rate and include the applicable percentage.

- Outline the repayment terms. Detail the payment schedule, including the frequency of payments (e.g., monthly, quarterly) and the duration of the loan.

- Include any late fees or penalties for missed payments. Clearly define the terms under which these fees will apply.

- Provide any collateral details if applicable. Describe the assets that will secure the loan, if any.

- Sign and date the document. Both the borrower and lender must sign the note to make it legally binding.

- Consider having the document notarized. While not always required, notarization can add an extra layer of authenticity.